The Investment Industry Association of Canada has released its 3Q08 Debt Trading and Issuance Report, noting:

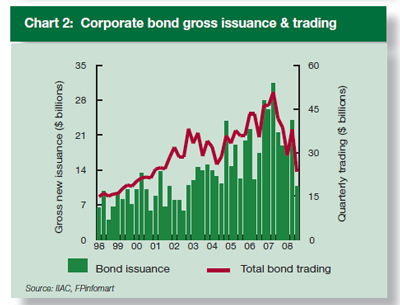

Long-term borrowing costs for corporations also increased and, as a result, corporate bond issuance recorded its lowest financing totals in 6 years – $10.8 billion – down $13.2 billion or 55% from the previous quarter (Chart 2).

The third quarter saw only one lonely Maple bond issued, worth a mere $200-million … but that represents an increase from the second quarter!

Hooray!

Notch one up (we hope) for rational regulation and managing investor expectations.

It is good to see that not every regulatory change is all about more “forbearance” designed to further hide or fudge things or make them worse (e.g. pension and insurance changes in Canada).

I only hope the political changes coming down the pipe can have some sanity mixed in with nuttiness, too, but I am not holding my breath as politicians don’t seem to realize the economy is 85% services.

I can’t be sure, of course, but I believe that Assiduous Reader prefhound meant to comment on the post Volker to Regulate Money Market Funds as Banks?.

Oops, seems I spun up the page too far or something….please relocate