I have had occasion to review asset class correlation – among the things I have read was: Li, Lingfeng, Macroeconomic Factors and the Correlation of Stock and Bond Returns(November 2002). Yale ICF Working Paper No. 02-46; AFA 2004 San Diego Meetings. Available at SSRN: http://ssrn.com/abstract=363641:

This paper examines the correlation between stock and bond returns. It first documents that the major trends in stock-bond correlation for G7 countries follow a similar reverting pattern in the past forty years. Next, an asset pricing model is employed to show that the correlation of stock and bond returns can be explained by their common exposure to macroeconomic factors. The link between the stock-bond correlation and macroeconomic factors is examined using three successively more realistic formulations of asset return dynamics. Empirical results indicate that the major trends in stock-bond correlation are determined primarily by uncertainty about expected inflation. Unexpected inflation and the real interest rate are significant to a lesser degree. Forecasting this stock-bond correlation using macroeconomic factors also helps improve investors’ asset allocation decisions. One implication of this link between trends in stock-bond correlation and inflation risk is the Murphy’s Law of Diversification: diversification opportunities are least available when they are most needed.

In light of the widely held view that Benjamin Graham is so famous his pronouncements should not be questioned, it is amusing to read the first footnote:

In the first version of The Intelligent Investor, published in the 1950s, the author, then investment guru Benjamin Graham, claims that the correlation between stock and bond returns is negative. His argument provides the basis for the asset allocation advice of 50-50 split in stocks and bonds. However, in the second version of this book published in the 1970s, the correlation structure has changed and the argument is dropped. Today, one can randomly search the term “stock and bond correlation” on the internet, and easily find sharply contradictory opinions among market participants. When it comes to story-telling, one man’s story is just as good as others. Most of these opinions are based on causal observations and lack the support of concrete evidence.

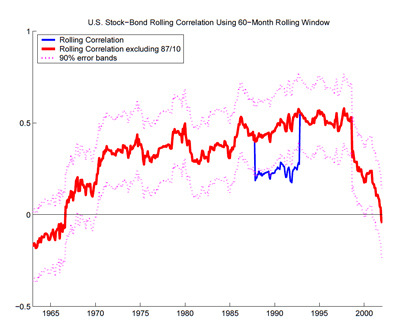

Figure 1: U.S. Rolling Stock-Bond Correlations, 1961-2001 This figure shows U.S. rolling stock-bond correlations using 60-month rolling window. The thick line is the rolling correlation excluding October 1987. The two dashed lines are the 90% upper and lower error bands. The thin line includes October 1987. Stock returns are calculated using the broad market total return indices. Bond returns are calculated using the long-term government bond total return indices. All returns are monthly, from January 1958 to December 2001.

Our analysis sheds light on the reverting trend observed in G7 stock-bond correlations. The 1970s saw an oil crisis and a subsequent economic stagflation in major industrial countries, which caused high and persistent inflation expectations for over a decade. Investors’ concern for inflation strongly affected the valuation of financial assets during this period and resulted in high comovement between stock and bond returns. The sharp decline in stock-bond correlations in the 1990s can be partially attributed to the lower inflation risk during this period.

Stocks and bonds are two major asset classes for ordinary investors. A lower stock-bond correlation indicates better diversification opportunities. The fact that stock-bond correlation is positively related to inflation risk is a disturbing message for investors. During the periods when inflation risk is high, asset returns tend to be more volatile. This gives investors a stronger incentive to diversify the investment risk. Unfortunately, these are also the periods when stock-bond correlations are high and diversification opportunities are meager. This observation leads to the Murphy’s Law of Diversification: diversification opportunities are least available when they are most needed.

[…] See original here: PrefBlog » Blog Archive » Correlation of Stock and Bond Returns […]

This is nice, but in using only government bonds, misses the important corporate bond sector (which now has fat juicy yields and is the most directly comparable to pref shares). Intuitively we might expect correlation between stocks and corporate bonds to be higher than between stocks and government bonds, and might be higher for longer term corporate bonds. That would be nice to know as ultimately, we pref and fixed income investors need to know how correlated we are with stocks, and especially, inflation.