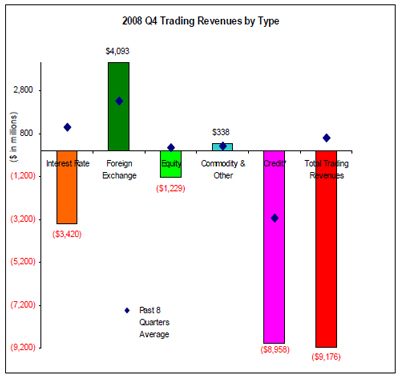

The Office of the Comptroller of the Currency has released its Quarterly Report on Bank Trading and Derivatives Activities. Credit trading has been a disaster:

A commercial banks was reasonably strong in the fourth quarter, the quarter was particularly difficult for number of reasons, and banks reported a sizable trading loss of $9.2 billion. Market liquidity suffered in the fourth quarter of 2008 and general economic conditions worsened, resulting in escalated write-downs in legacy credit positions, including CDOs, leveraged loans and mortgage-related exposures. These write-downs flowed through trading revenues and dwarfed the underlying strength in trade profitability from wide bid-ask spreads.

Trading results in the fourth quarter also suffered due to an unfavorable combination of rising overall corporate credit spreads and declining credit spreads for the bank dealers themselves. Rising counterparty credit spreads increase the risk of derivatives receivables. Banks account for this increased risk by lowering the fair value of those receivables. Banks report the rising credit costs associated with a write-down of receivables values as trading losses. While these higher credit costs are a part of operating a derivatives business, they can (and in the fourth quarter did) mask otherwise profitable trading operations. Typically, when credit spreads increase, much of the negative impact on bank trading results from write-downs of receivables can be offset by writedowns of derivatives payables. However, in the fourth quarter, government support for the banking industry resulted in lower bank credit spreads. As a result, the fair value of bank derivatives payables increased, and therefore banks reported additional trading losses.

This “net” current credit exposure is the primary metric used by the OCC to evaluate credit risk in bank derivatives activities. A more risk sensitive measure of credit exposure would also consider the value of collateral held against counterparty exposures. While banks are not required to report collateral held against their derivatives positions in their Call Reports, they do report collateral in their published financial statements. Notably, large trading banks tend to have collateral coverage of 30-40% of their net current credit exposures from derivatives contracts.

Continued turmoil in credit markets has led to deterioration in derivatives-related and loan credit metrics. The fair value of derivatives contracts past due 30 days or more totaled $363 million, up $302 million from the third quarter. Past due contracts were 0.05% of net current credit exposure in Q4, up from 0.01% in the third quarter. During the fourth quarter of 2008, U.S. commercial banks charged-off a record $847 million in derivatives receivables, or 0.10% of the net current credit exposure from derivative contracts, up from the 0.02% in the prior quarter. [See Graph 5c.] For comparison purposes, Commercial and Industrial (C&I) loan net charge-offs rose to $5.5 billion from $3.0 billion and were 0.4% of total C&I loans for the quarter, nearly double the ratio of the third quarter.

The report has many fascinating graphs.