My attention was drawn to the latest efforts of the Treasury Borrowing Advisory Committee by a Bloomberg story:

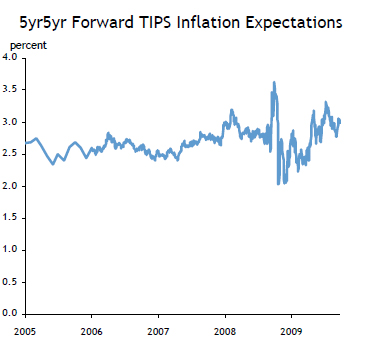

The 13-member committee of bond dealers and investors that Treasury Secretary Timothy Geithner depends on for advice, and includes officials of Pacific Investment Management Co. and Goldman Sachs Group Inc., highlighted the surge on page 36 of a 67-page report on Nov. 3. On the same page, they showed inflation expectations are subdued based on gauges watched by the Federal Reserve. In their discussions, the group noted that a second year of government debt sales approaching $2 trillion may weigh on investors as the Fed stops buying notes and bonds.

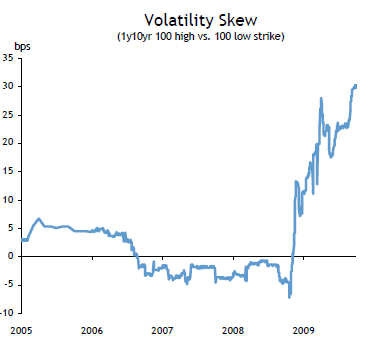

The presentation is on-line. Lots of fascinating charts, including the two highlighted ones:

…and forward inflation…

This looks like good stuff – and I believe I’ve highlighted some of their work before, in the context of five-year TIPS elimination – that I want to chew on for a while … but I’m knee-deep in PrefLetter at the moment … and then there’s some urgent programming … then a couple of letters …

How might an investor exploit a high-real-rate-low-inflation scenario? Answer that, win a kewpie doll.

Update: The report to the Treasury Secretary is online:

With regard to TIPS, the Committee recommends increasing TIPS issuance from $58 billion in 2009 to $70-$80 billion in 2010. The auction schedules for both 5 and 10-year TIPS would be maintained, although sizes would increase. However, 20-year TIPS issuance would be replaced with 30-year TIPS, on the same auction schedule, with larger sizes. The Committee felt that this would both lengthen the average maturity of Treasury’s debt, while attracting investors interested in longer duration inflation protection. In the medium term, the Committee felt that the market could support increases in both auction sizes and frequency, growing gross TIPS issuance to $100-$130 billion per annum. These actions maintain, if not increase, the proportion of TIPS to total marketable debt outstanding.