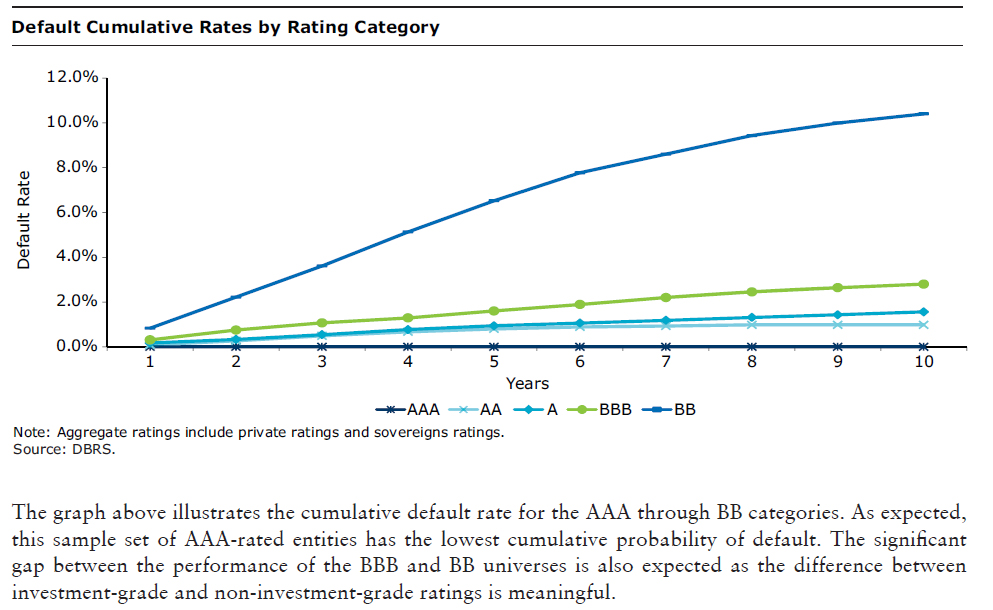

DBRS has published its 2012 DBRS Corporate Rating Transition and Default Study:

The Boston Fed has released a paper by Oz Shy titled Window Shopping:

The terms “window shopping” and “showrooming” refer to the activity in which potential buyers visit a brick-and-mortar store to examine a product but end up either not buying it or buying the product from an online retailer. This paper analyzes potential buyers who differ in their preference for after-sale service that is not offered by online retailers. For some buyers, making a trip to the brick-and-mortar store is costly; however, going to the store to examine the product has the advantage of mitigating the uncertainty as to whether the product will suit the buyer’s needs. The model shows that the number of buyers engaged in window shopping behavior exceeds the optimal number, both under duopoly and under joint ownership of the online and walk-in store outlets.

…

Second, the retail industry environment is evolving in many ways. Fearing a loss of customers to online retailers, many large brick-and-mortar retailers now offer online shopping with either home delivery or store pickups. In addition, many online retailers offer easy returns, some offer “free returns,” and some provide links to webpages where customers can find aftermarket service providers in their area. In addition, online sellers keep introducing more and more products, such as eyeglasses, that until recently were available only in walk-in stores. This is accomplished by offering significant price reductions that are possible because online merchants learn how to bypass the middlemen and shorten the supply chain.

I believe that at some point it will become attractive to the manufacturers to pay retailers explicitly for showrooming their product and cut out the on-line retailer middleman.

I had an interesting conversation with my furnace repairman (*sigh*) a few weeks ago. He complained that the distributors were cutting back on staff, staff experience and staff training, so it wasn’t enough for him any more to say he needed a pilot light detector for a Heat-Yer-House Model 71; he had to say he needed part number HYH-71-ABC45D. They would then supply him with the part.

I suggested that if the distributors were not providing all that great service, it would be to the manufacturers’ advantage to sell the parts directly (you could get really fancy with a website for this. Cutaway photos or diagrams of the appliance, for instance – click on the area, pop up an order form with all the information). He responded that that’s already starting to happen.

We live in a world of change!

Scandal in LatteLand! Timmy’s is under Review-Negative:

DBRS has today placed the A (low) ratings of Tim Hortons Inc. (THI or the Company) Under Review with Negative Implications following the Company’s announcement that it is actively evaluating possible changes to its capital structure (i.e., optimal debt level within the context of maintaining an investment grade credit rating).

The Under Review with Negative Implications status reflects DBRS’s concerns that an increase in financial leverage – potentially triggered by the Company’s review of its optimal capital structure, including consideration of potential share repurchase activity and other uses of leverage – could result in a credit risk profile that would no longer be consistent with the A (low) rating category.

The priorities of the world have become so skewed that there is now handwringing that some scholarships are based on merit:

To increase their standing on college rankings, more private colleges are giving “merit aid” to top students, who are often affluent, while charging unaffordable prices to the needy, according to the report. The percentage of students receiving merit aid jumped to 44 percent in 2007-2008 from 24 percent in 1995-1996, the report found. To a lesser extent, public universities are using some of the same practices,[report writer Stephen] Burd said.

…

Colleges use merit aid for talented middle- and upper-income students because it is less costly than pursuing similar prospects from poor families, said Catharine Hill, Vassar’s president. Enrolling low-income students costs schools money because they are giving up a spot for those who can pay full freight — or close to it.

If American universities want to fix the problem they should address the problem:

University spending is driven by the need to compete in university league tables that tend to rank almost everything about a university except the (hard-to-measure) quality of the graduates it produces. Roger Geiger of Pennsylvania State University and Donald Heller of Michigan State University say that since 1990, in both public and private colleges, expenditures on instruction have risen more slowly than in any other category of spending, even as student numbers have risen. Universities are, however, spending plenty more on administration and support services (see chart 2).

Another problem is tuition discounting:

The practice of tuition discounting, in which a college awards financial aid from its own funds, is responsible for 27% to 32% of the increase in college tuition. On an absolute scale, tuition discounting accounts for 2 to 3 percentage points of the college tuition inflation rate. Tuition charges would be 22% to 25% lower without tuition discounting, but lower income families would be unable to afford to pay for a college education.

I think the basic problem is that there are simply too many people going to university.

It was a modestly positive day for the Canadian preferred share market, with PerpetualPremiums and DeemedRetractibles both up 5bp and FixedResets gaining 2bp. Volatility was minimal. Volume continued to be high – but not as ridiculously high as yesterday.

PerpetualDiscounts now yield 4.88%, equivalent to 6.34% interest at the standard equivalency factor of 1.3x. Long Corporates now yield about 4.1%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 225bp, a slight – and perhaps spurious – narrowing from the 230bp reported May 1.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.4312 % | 2,601.7 |

| FixedFloater | 3.92 % | 3.14 % | 33,988 | 18.80 | 1 | -0.2058 % | 4,193.9 |

| Floater | 2.67 % | 2.89 % | 84,137 | 19.99 | 4 | -0.4312 % | 2,809.1 |

| OpRet | 4.80 % | 0.14 % | 65,019 | 0.14 | 5 | -0.0772 % | 2,611.6 |

| SplitShare | 4.78 % | 4.12 % | 108,989 | 4.08 | 5 | 0.2511 % | 2,970.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0772 % | 2,388.1 |

| Perpetual-Premium | 5.21 % | 2.27 % | 93,245 | 0.43 | 31 | 0.0456 % | 2,382.3 |

| Perpetual-Discount | 4.85 % | 4.88 % | 195,229 | 15.64 | 4 | -0.1722 % | 2,685.1 |

| FixedReset | 4.86 % | 2.66 % | 255,937 | 3.33 | 81 | 0.0165 % | 2,522.8 |

| Deemed-Retractible | 4.87 % | 3.21 % | 139,604 | 0.47 | 44 | 0.0555 % | 2,461.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TRP.PR.B | FixedReset | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-08 Maturity Price : 23.35 Evaluated at bid price : 24.50 Bid-YTW : 2.60 % |

| FTS.PR.H | FixedReset | 1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-08 Maturity Price : 23.83 Evaluated at bid price : 25.82 Bid-YTW : 2.58 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| IAG.PR.G | FixedReset | 57,990 | National crossed 50,000 at 26.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.44 Bid-YTW : 2.95 % |

| BAM.PF.C | Perpetual-Discount | 56,977 | Scotia crossed 49,500 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-08 Maturity Price : 24.50 Evaluated at bid price : 24.89 Bid-YTW : 4.91 % |

| GWO.PR.G | Deemed-Retractible | 50,836 | National crossed 40,600 at 25.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-07 Maturity Price : 25.25 Evaluated at bid price : 25.75 Bid-YTW : -11.73 % |

| W.PR.H | Perpetual-Premium | 50,050 | Nesbitt crossed 40,000 at 25.68. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-07 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : -18.30 % |

| PWF.PR.H | Perpetual-Premium | 48,415 | Nesbitt crossed 12,600 at 25.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-07 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : -22.61 % |

| GWO.PR.H | Deemed-Retractible | 46,108 | National crossed 41,100 at 25.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-30 Maturity Price : 25.25 Evaluated at bid price : 25.48 Bid-YTW : 3.78 % |

| There were 44 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| MFC.PR.J | FixedReset | Quote: 26.37 – 26.80 Spot Rate : 0.4300 Average : 0.2519 YTW SCENARIO |

| TRP.PR.B | FixedReset | Quote: 24.50 – 24.88 Spot Rate : 0.3800 Average : 0.2509 YTW SCENARIO |

| BMO.PR.K | Deemed-Retractible | Quote: 26.16 – 26.48 Spot Rate : 0.3200 Average : 0.2076 YTW SCENARIO |

| GWO.PR.N | FixedReset | Quote: 24.49 – 24.90 Spot Rate : 0.4100 Average : 0.2987 YTW SCENARIO |

| MFC.PR.H | FixedReset | Quote: 26.76 – 27.13 Spot Rate : 0.3700 Average : 0.2657 YTW SCENARIO |

| PWF.PR.P | FixedReset | Quote: 26.02 – 26.35 Spot Rate : 0.3300 Average : 0.2373 YTW SCENARIO |