The Bank of England has released Working Paper #358, “Understanding the real rate conundrum: an application of no-arbitrage finance models to the UK real yield curve”, by Michael Joyce, Iryna Kaminska and Peter Lildholdt, with the abstract:

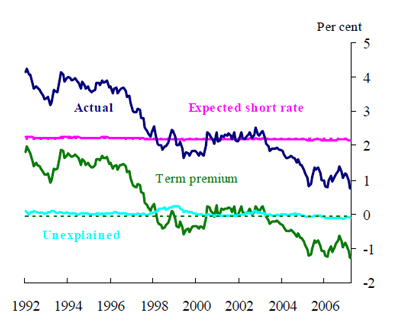

Long-horizon interest rates in the major international bond markets fell sharply during 2004 and 2005, at the same time as US policy rates were rising; a phenomenon famously described as a ‘conundrum’ by Alan Greenspan the Federal Reserve Chairman. But it was arguably the decline in international long real rates over this period which was more unusual and, by the end of 2007, long real rates in the United Kingdom remained at recent historical lows. In this paper, we try to shed light on the recent behaviour of long real rates, by estimating several empirical models of the term structure of real interest rates, derived from UK index-linked bonds. We adopt a standard ‘finance’ approach to modelling the real term structure, using an essentially affine framework. While being empirically tractable, these models impose the important theoretical restriction of no arbitrage, which enables us to decompose forward real rates into expectations of future short (ie risk-free) real rates and forward real term premia. One general finding that emerges across all the models estimated is that time-varying term premia appear to be extremely important in explaining movements in long real forward rates. Although there is some evidence that long-horizon expected short real rates declined over the conundrum period, our results suggest lower term premia played the dominant role in accounting for the fall in long real rates. This evidence could be consistent with the so-called ‘search for yield’ and excess liquidity explanations for the conundrum, but it might also partly reflect strong demand for index-linked bonds by institutional investors and foreign central banks.

From the discussion:

One clear finding of our results across all the models we estimate is the importance of movements in estimated real term premia in explaining movements in real rates. This is contrary to what appears to be the conventional wisdom that real term premia are small and negligible. Indeed, many papers simply ignore the presence of real term premia altogether (for a recent example, see Ang, Bekaert and Wei (2007)).

…

Negative term premia are of course quite consistent with finance theory and may indicate that for some investors long-maturity index-linked bonds are seen as providing a form of ‘insurance’. However, the emergence of negative term premia in the late 1990s seems likely to have reflected the impact of various accounting and regulatory changes that have caused pension funds to match their assets more closely to their liabilities by switching into long-maturity conventional and index-linked bonds (see McGrath and Windle (2006)). Indeed, the timing of the move to negative term premia suggested by the model decompositions seems to broadly match the introduction of the MFR in 1997, which market commentary suggests had a significant impact on UK pension fund asset allocation.Footnote: More recently, the Pensions Act 2004, which became effective in December 2005, introduced a new Pensions Regulator with powers to require pension fund trustees and sponsors to address issues of underfunding. Another factor that may also have influenced pension fund behaviour has been the ‘FRS 17’ accounting standard, which became effective from the start of 2005, and has meant that pension scheme deficits/surpluses need to be measured at market value and included on company balance sheets. Both these factors are thought to have increased pension fund demand for longer-duration nominal and real gilts, as assets which provide a better match for their liabilities. See discussion in the ‘Markets and Operations’ article of the Bank of England Quarterly Bulletin, Spring 2006.

With conclusions:

Another important finding, common to all the estimated model specifications, is that our term premia estimates appear to have been negative over much of the sample period since the late 1990s. We have argued that this is likely to reflect the impact of various accounting and regulatory changes in the United Kingdom that have encouraged pension funds to match their assets more closely to their liabilities, by switching into long-maturity conventional and index-linked bonds. The importance of this Category 3 explanation for the behaviour of term premia after the 1990s needs to be borne in mind when interpreting more recent downward moves in term premia.

…

In terms of understanding the fall in long rates over the conundrum period during 2004 and 2005, all the estimated models suggest that falls in UK long real rates have to a significant degree reflected reductions in real term premia, though the extent to which this is true varies with the precise model specification used. The importance of the reduction in term premia might indicate the influence of changing institutional investor behaviour, but the fact that the decline in long rates was a global phenomenon suggests to us that this is unlikely to have been the primary cause. This leads us to the conclusion that excess liquidity and search for yield were more important in explaining the compression of real term premia. But since our models also suggest that there is some evidence that perceptions of the neutral rate of interest may have fallen, we cannot rule out the possibility that changes in the balance of investment and saving may also have had an impact. In terms of the recent conjuncture, all our model specifications would suggest that there is a risk real rates may rise in the future, since in all of the models forward premia or expected future short rates are below their long-run expected levels.

Chart 6: Decomposition of the ten-year real forward rate from the survey model:

[…] notion that issuance of 5-Year TIPS might be halted has been discussed on PrefBlog, as has a BoE Working Paper on the term-structure of inflation indexed […]

[…] The paper by Ang, Bekaert & Wei has not been reviewed here, but it has been referenced in Term Premia on Real-Return Bonds in the UK. […]