James Hamilton of Econbrowser writes another marvellous review of the Fed’s Balance sheet, updating his prior commentary which was also reviewed on PrefBlog.

One thing I had been unclear about was the precise nature of the “Supplementary Financing Program Account” of Treasury at the Fed, which is financing all the special programmes. While the assertion has been made that the Fed’s intervention is sterilized (meaning that it is causing no increase in monetary aggregates) … I wasn’t sure. However, the Monthly Treasury Statement referenced by Dr. Hamilton shows clearly (Table 6 on page 20) that Treasury has issued about $630-odd billion in Treasury Securities in fiscal 2009 to date, of which $588-billion has been from the public. This more than covers the $134-billion increase in the Supplementary Account, while still leaving $402-billion to finance the deficit … which is the total deficit for F2009 reported in Table 5 on page 18.

OK, so that’s cleared up!

Dr. Hamilton concludes:

For the record, let me reiterate my personal position on all this.

(1) I am doubtful of the Fed’s ability to alter interest rate spreads through the kinds of compositional changes in its balance sheet implemented over the last two years. Whatever your prior ideas were about this, surely it’s time to revise those in light of incoming data– if the first trillion dollars didn’t do the job, how much do you think it would take to accomplish the task?

(2) I think the Fed’s goal should be a 3% inflation rate. Paying interest on reserves and encouraging banks to hoard them is inconsistent with that objective, as would be a new trillion dollars in money creation.

I would therefore urge the Fed to eliminate the payment of interest on reserves and begin the process of replacing the exotic colors in the first graph above with holdings such as inflation-indexed Treasury securities and the short-term government debt of our major trading partners.

I’m not sure that point 1 is phrased in a useful manner. As I see it, the objective is not so much to maintain spreads as it is to ensure that the market exists at all. It has been observed that securitization has declined, which has had essentially forced banks to intermediate between borrowers and lenders, as opposed to simply engaging in the disintermediation inherent in packaging their loans and taking the spreads and servicing fees.

John Kiff, Paul Mills & Carolyne Spackman wrote a piece for VoxEU, European securitisation and the possible revival of financial innovation:

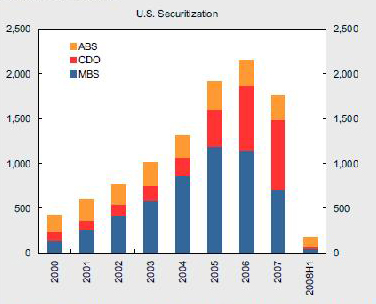

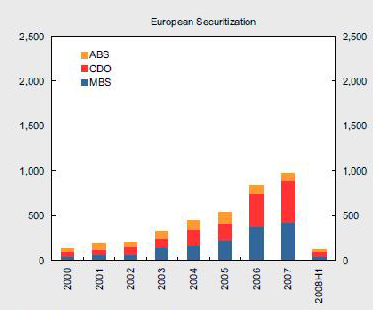

Collapsing global securitisation volumes in the wake of the subprime crisis have raised fundamental questions over the viability of the originate-to-distribute business model.1 Issuance has dropped precipitously in both Europe and the US, with banks keeping more loans on their balance sheets and tightening lending standards as a result (Figure 1). The decline has been particularly sharp for mortgage-backed securities and mortgage-backed-securities-backed collateralised debt obligations. The originate-to-distribute model was thought to have made the financial system more resilient by dispersing credit risk to a broad range of investors. Ironically, however, it became the source of financial instability.

…

The risk transfer and capital saving benefits of securitisation, combined with underlying investor demand for securities, should eventually revive issuance. But the products are likely to be simpler, more transparent, and trade at significantly wider spreads.

All that lost securitization issuance is staying on banks’ balance sheets and there are only a few possibilities:

- let the market collapse: in this case, banks will simply cease to make new loans; their balance sheets won’t take the strain and they can’t really issue new equity while the markets are so awfully depressed without really sticking it to their existing shareholders, or

- let the markets adjust.

An adjustment in the market can take place in several different ways:

- banks can re-intermediate: this will require balance sheet expansion, which can’t happen until they can sell equity at reasonable prices, or

- securitization markets can get restarted

I suggest that it is a Public Good for securitization markets to restart and agree with Kiff et al. that this will likely be accompanied by greater transparency and wider spreads. Trouble is, nobody knows what those spreads will be like.

What should the spread of mortgages over governments be? Agency spreads in the US were minimal prior to the current crisis and it seems clear to me that they should be wider. I’ve tried to find an easy graph for mortgage spreads in Canada – where securitization is nowhere near as important – but the best I’ve been able to come up with is a chart from 1999:

Mortgages are not, perhaps, the best example to choose because as I have repeatedly noted, there is a lot more that’s wrong with the American mortgage market than mere sub-prime:

Americans should also be taking a hard look at the ultimate consumer friendliness of their financial expectations. They take as a matter of course mortgages that are:

- 30 years in term

- refinancable at little or no charge (usually; this may apply only to GSE mortgages; I don’t know all the rules)

- non-recourse to borrower (there may be exceptions in some states)

- guaranteed by institutions that simply could not operate as a private enterprise without considerably more financing

- Added 2008-3-8: How could I forget? Tax Deductible

Clearly, in the particular case of US mortgages, the underlying pools must not just trade at wider spread, but they must be more investor friendly.

However, I do recognize Dr. Hamilton’s desire to put a limit on the amount of reintermediation that is being done by the Fed, but must disagree with the prescription of keeping the balance sheet grossed up with government bonds of any description.

I suggest that a schedule be put into place whereby, for instance, the Commercial Paper Funding Facility have its spreads gradually widened. Rates are now 2.19% for unsecured commercial paper and is scheduled to cease purchasing new paper on April 30, 2009. The current rate paid on excess & required reserve balances is now 0.25%. Thus, it is apparent that in the current environment, a spread of 194bp is not enough to get the banks to move into commercial paper in a big way. The same applies to the general public.

I suggest that this is a distress-level spread, being paid for CP of perfectly good quality; indicating a flight to safety. Eventually the climate of blind fear will dissapate, but until that happens the Fed should continue to apply the implicit Bagehot prescription of making credit freely available at punitive rates. And, perhaps, announce that the programme will be extended past April, but at spreads on CP of 110+110 (for the duration of the extension), rather than the current 100+100. Eventually, one of several things will happen:

- Greed will overcome fear, and banks (et al.) will cease lending to the Fed at 0.25% and start lending to solid companies at 2.25%, or

- Companies will refinance with longer term paper, or

- Companies will go bust.

If we want securitization to pick up again after the business model broke because banks made loans they would never keep on their own books — then the solution is simple: Make the originating bank keep 10-20% of the securitized assets on their books.

This doesn’t need to be a regulation — it seems to me that the market should demand it, with the fraction kept written into the contract and presumably variable with circumstances for different contracts over time.

I’m not sure whether this could make much difference during the current period of risk aversion, but it does address the critical issue of trust in underwriting standards and brings in fresh capital from sources who don’t want the leverage of investing directly in banks.

From the essay by Kiff et al.:

The ultimate in keeping assets on the books is “covered bonds”, but issuance of these has virtually halted as well.

[…] way or another, watching the Fed’s balance sheet has been a lot more interesting than normal […]

[…] Good news indeed, although I want do do a little work attempting to estimate the proportions of total debt that the Fed is financing. The last post in this series of notes was Financing the Fed’s Balance Sheet. […]

[…] of the Fed’s balance sheet; and if the Fed keeps spreads where they are – or follows my recommendation to slowly increase them – then at some point greed will overcome […]