It seems that some of the communications received by shareholders on the conversion are not particularly enlightening – I received the following complaint earlier this week:

Just to let you know that the conversion of series C to D is based on the 90 day Tbill rate not the 5 year GOC rate as noted on your prefinfo.com listing. I wish I would have checked this before as shares are now converting Dec 31. I do not understand notice from FFH that I would be getting $1.1445 per share which works out to 4.578 % share. I assume the 90 day rate is 0.90 + 3.15 % works out to 4.05 %.

I answered him:

Yes, if you convert to D, you will receive the 90-day bill rate plus 315bp, reset quarterly, with the first quarter’s dividend having been set at $0.25212 per share, payable on March 31, 2015.

However, if you retain your C, you will receive the 5 Year GOC Rate plus 315bp, which on December 2 was equal to a total of 4.578%, or $1.14450 per share per year, which is what the prefinfo.com description is referring to. This rate will not be reset until the next exchange date, 2019-12-31.

It is your choice as to whether you retain your C or convert to D. It’s a difficult question which I will address on PrefBlog.com on Thursday night. The first link in the next paragraph has some preliminary advice on the matter.

For more information on the reset, see http://prefblog.com/?p=26994, http://prefblog.com/?p=26996 and http://prefblog.com/?p=27036

…

If you have any ideas on how the prefinfo.com description can be made more clear, please let me know!

So the resets for the three captioned issues have been set, but the question remains – should they be converted into the FixedResets, which will pay a spread over three-month bills, reset quarterly, or not?

First, we will construct a table:

| Imminent Resets | |||

| Issue | Resets To | Convertible to Bills +X bp |

Company Deadline for Conversion Instruction |

| TRP.PR.A | 3.266% | +192bp | 2014-12-16-5pm |

| FFH.PR.C | 4.578% | +315bp | 2014-12-16-5pm |

| AZP.PR.B | 5.570% | +418bp | 2014-12-16-5pm |

| Note that the deadline given is the one given for receipt of instructions by the company. Your broker’s deadline will be earlier so don’t waste any time if you want to convert | |||

Next, we will take a look at similar pairs currently trading:

| Fixed Reset | Fixed Rate | Floating Reset | Spread over Bills | Bid Price Fixed Reset |

Bid Price Floating Reset |

Break-Even 3-Month Bill Rate |

| BNS.PR.P | 3.35% | BNS.PR.A | 205 | 25.16 | 25.70 | 2.01% |

| TD.PR.S | 3.371% | TD.PR.T | 160 | 25.23 | 25.31 | 1.87% |

| BMO.PR.M | 3.39% | BMO.PR.R | 165 | 24.65 | 25.45 | 2.71% |

| BNS.PR.Q | 3.61% | BNS.PR.B | 170 | 25.38 | 25.39 | 1.92% |

| TD.PR.Y | 3.5595% | TD.PR.Z | 168 | 25.32 | 25.27 | 1.82% |

| BNS.PR.R | 3.83% | BNS.PR.C | 188 | 25.39 | 25.45 | 2.02% |

| RY.PR.I | 3.52% | RY.PR.K | 193 | 25.41 | 25.66 | 1.86% |

| DC.PR.B | 5.688% | DC.PR.D | 410 | 25.07 | 25.00 | 1.51% |

For further details of how the Break-Even Bill Rate is calculated, see the posts Pairs Equivalency Calculator and Strong Pairs. Basically, the idea is that the next time you have to make a choice, you won’t care which one of the pairs you are holding, because you’ll be able to convert. Therefore, the break-even bill rate is the rate at which the difference in total expected dividends equals the current difference in price.

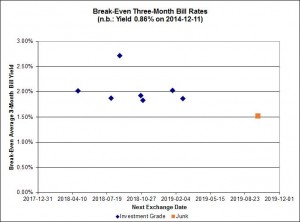

The above table provides the material for the following chart:

At some point in the future, there might be a sufficient spread of future exchange dates, sufficient data points and sufficient knowledge by the market that there will be slope to the curve drawn, whence it will be possible to calculate the predicted future course of 3-month bill rates … but we’re not there yet!

The average for the investment grade issues is 2.03%, but this is distorted by the high figure of 2.71% for the BMO.PR.M / BMO.PR.R pair. The lowest reasonable expectation for break-even rates on the three issues of interest is about 1.80% and the high is about 2.00%. So let’s plug in those numbers and see what we get.

| Estimation of FloatingReset Trading Prices | |||

| Estimated Price of FloatingReset |

|||

| FixedReset | Price of FixedReset 2014-12-11 |

if breakeven 1.80% | if breakeven 2.00% |

| TRP.PR.A | 20.40 | 20.88 | 21.09 |

| FFH.PR.C | 23.83 | 24.21 | 24.41 |

| AZP.PR.B | 11.80 | 12.12 | 12.28 |

Given these data, I recommend that all the FixedResets be converted to FloatingResets, on the grounds that a worth-while capital gain may result from conversion if these new pairs trade comparably to current pairs; but I will note that in the conversion of DC.PR.B / DC.PR.D the average break-even rate traded by the market changed substantially between the decision date and the first trading date of the FloatingReset and made a mockery of my calculations. All you can do is play the odds … and cross your fingers!

As stated above, the company deadline for receipt of instructions is 2014-12-16-5pm for each of these issues, but brokerage deadlines will be earlier, so don’t waste any time instructing your broker to instruct the company to convert your shares if you wish to convert.