Assiduous Reader prefQC gently reminds me that DC.PR.D, the FloatingReset recently converted from DC.PR.B has commenced trading – and I forgot all about it!

At any rate, it has started on a strong note, closing at 24.91-15 today vs. DC.PR.B’s 24.56-68, a very nice premium for the exchange. Vital statistics are:

| DC.PR.D | FloatingReset | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-09-30 Maturity Price : 25.00 Evaluated at bid price : 24.91 Bid-YTW : 4.86 % |

Assiduous Readers might be a little upset that they missed this, particularly since I said:

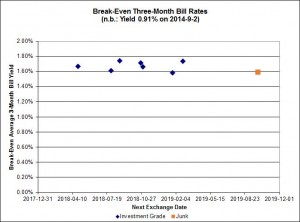

It is difficult to formulate a recommendation regarding whether holders of DC.PR.B should convert. The two issues resulting after partial conversion will, of course, form a Strong Pair and may be analyzed with the Pairs Equivalency Calculator. Performing an analysis of all current FixedReset/FloatingReset pairs results in the following chart:

This chart was created with the assumed price of the new DC FloatingReset set to 25.22, the same as the price of DC.PR.B. According to this, the DC FloatingReset looks a little bit cheap … but not much. To get to the average Breakeven 3-Month Bill Yield of 1.67%, the price would only need to increase by $0.08, to 25.30.

Mind you, I also said:

Those with a taste for speculation, however, will find the conversion to the FloatingReset attractive, since there’s not much downside and potentially quite a bit of upside.

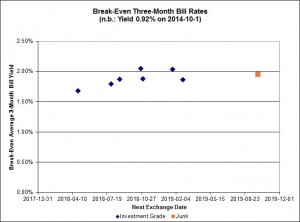

However, look at the current chart of break-even T-bill yields:

That’s the implied rate for the DC.PR.B / DC.PR.D pair way over on the right, the only member so far of the “Junk” group – I remain very interested regarding whether the implied rates for junk and investment-grade will diverge. They shouldn’t … but you never know!

Anyway, the implied break-even three-month T-bill rate until the next exchange in September 2019 for this pair is 1.95%, just a hair over the 1.88% average for investment-grade and clearly inside the range. The interesting part of this, however, is what has happened to the average break-even rate since my recommendation as of September 2: the investment-grade average has increased from 1.67% to 1.88%. That’s a big move and has resulted in the big gap between the prices of DC.PR.B and DC.PR.D. What has happened, more or less, is that FixedResets have moved down in price, while FloatingResets are largely unchanged.

I will note that, assuming the three-month bill rate increases uniformly over the five years until the next exchange, this is predicting a yield in September 2019 of about 3%. Fancier expectations should be higher, since most pundits expect policy rates to be kept on hold for the next year, maybe two.

DC.PR.D will be tracked by HIMIPref™, but relegated to the Scraps index on credit concerns.