TD.PF.C is a FixedReset, 3.75%+225, announced December 5, which TD did not honour with an announcement of the closing. The issue will be tracked by HIMIPref™ and has been assigned to the FixedReset subindex.

The issue traded a very respectable 1,005,216 shares today in a range of 24.80-96 before closing at 24.87-88.

Vital statistics are:

| TD.PF.C | FixedReset | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-16 Maturity Price : 23.11 Evaluated at bid price : 24.87 Bid-YTW : 3.51 % |

Implied Volatility is:

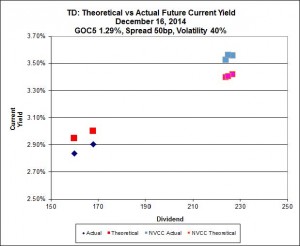

TD.PF.C has been trading below $25.00 since it was issued. The dividend is $0.9375 per share per year and it rests at 5 Yr. GOC plus 2.25%. TD.PF.A and TD.PF.B are issues with the same Pfd-2 Stable Trend rating, 2.24% reset adjustment and a dividend slightly higher at $0.975 per share per year but they trade around $25.50.

The small dividend differential does not seem to justify the price difference. Any ideas why TD.PF.C is trading below par?

One reason is accumulated dividend: TD.PF.A and TD.PF.B have been accumulating dividends since their last pay date, 2014-10-31, while TD.PF.C has only been accumulating since issue date, 2014-12-16. That’s about one and a half months’ worth, or about $0.15.

As of the close today, TD.PF.A was bid at 25.26, TD.PF.B at 25.39 and TD.PF.C at 24.92. These prices imply yields to perpetuity of 3.56%, 3.54% and 3.58%, respectively; so TD.PF.C is a little cheap, to be sure, but this is within the normal bounds of market efficiency.

[…] is a FixedReset, 3.75%+225, that commenced trading 2014-12-16 after being announced 2014-12-5. Notice of extension was reported in December, 2019. TD.PF.C will […]

[…] is a FixedReset, 3.75%+225, that commenced trading 2014-12-16 after being announced 2014-12-5. It is tracked by HIMIPref™ and is assigned to the […]