It will not have escaped notice that equities got crushed today:

Canadian stocks tumbled the most in almost eight years, led by a record drop in raw-material shares, as tighter credit, rising unemployment and lower home prices threatened to tip the U.S. into a recession.

Potash Corp. of Saskatchewan Inc. fell the most since 1989 after rival Mosaic Co. posted profit that missed analysts’ estimates and cut its sales forecast. Barrick Gold Corp. plunged the most in two decades as bullion declined on speculation the U.S. will approve a $700 billion plan to revive credit markets, reducing the metal’s appeal.

Suncor Energy Inc. touched the lowest in 15 years, leading oil and gas producers lower as crude fell below $95 a barrel and Merrill Lynch & Co. said it may drop to $50. The Standard & Poor’s/TSX Composite Index fell 7 percent to 10,900.54 in Toronto, the most since Oct. 25, 2000.

Preferreds were not immune, although the TXPR’s loss of 1.02% looks a whole better than ‘first-loss’ equities!

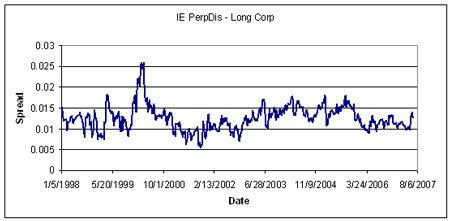

But the really illuminating thing about the action is just how SLOPPY this market is. I mean, look … if you want to tell me that the proper yield for preferreds in this environment is X, I’ll listen! For a while, anyway. That sort of speculation is simply market timing and I don’t put much credence in it.

But surely similar securities from the same issuer should trade somewhere around each other! But that’s not the case today … the yield curve has been getting sloppier and sloppier over the past couple of weeks and today … well, I haven’t checked, but it must be some kind of record!

| Internal Spreads on Perpetual Discount Issues |

|||

| Issuer | High Bid Yield | Low Bid Yield | High/Low Series ID |

| BMO | 6.62% | 6.26% | H, L |

| BNS | 5.89% | 5.70% | N, K |

| CM | 7.07% | 6.93% | E, I |

| GWO | 6.70% | 5.97% | H, F |

| NA | 6.39% | 6.23% | K, L |

| POW | 6.78% | 6.38% | (B & D), A |

| PWF | 6.54% | 6.06% | L, E |

| RY | 6.29% | 6.11% | W, H |

| SLF | 6.34% | 6.24% | D, B |

| TD | 6.15% | 5.84% | O, (Q & R) |

| Issuers included in list if they have at least three issues listed in the “PerpetualDiscount” index | |||

Speaking very generally, there appears to be some positive correlation between Average Daily Trading Value and Yield – that is, the higher the average volume, the higher the yield, which is to say: the liquidity premium is negative … which really shouldn’t happen.

This behavior is consistent with people simply reducing exposure by selling whatever’s easiest to sell, regardless of price.

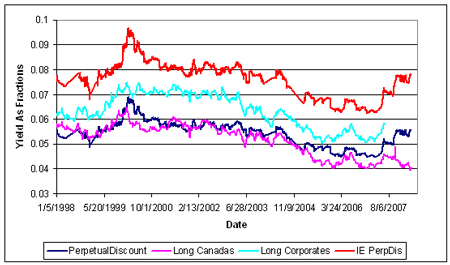

The weighted mean average pre-tax bid-YTW of the PerpetualDiscount index is now 6.37%, which is about where it was on July 11 (going up) and July 28 (going down). This is equivalent to 8.92% interest at the standard conversion factor of 1.4x. Long corporates now yield about 6.7%, so the PTIE spread is now about 220bp.