The Treasury Market Practices Group has released a new closing-time convention that should help the Treasury fails situation – at least to some extent:

Some buy-side market participants expressed dissatisfaction with the existing market convention under which dealers can deliver securities to customers until 3:15 p.m., but customers can usually only deliver securities to dealers until 3:00 p.m.6 This convention can sometimes leave a customer who had, at 3:00 p.m., an uncompleted obligation to receive securities and a matching uncompleted obligation to deliver the same securities in the position of taking in the securities after 3:00 p.m. without being able to turn the securities around and redeliver them on the same day. Instead of a pair of matched fails, the customer is left with an unmatched fail to deliver, resulting in higher interest expenses and/or an overdraft charge. Some buy-side market participants expressed the view that closing times should treat all market participants the same, regardless of whether they are real money investors, leveraged investors, or dealers.

It will now be 3:00pm for everybody and 3:15pm for sophisticated participants (who will mostly be dealers).

It is unusual, but not unheard of, for “real money” accounts to buy and sell the same issue on the same day; but it would be more of a problem for hot money accounts like hedge funds.

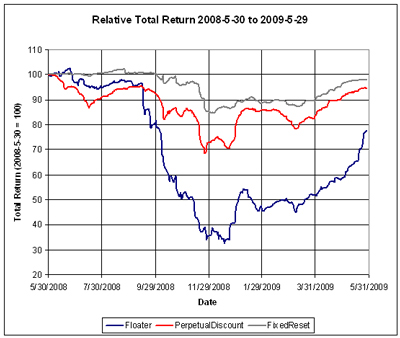

Not much price volatility today, as the market eased off a little bit on continued good volume. I forgot to do the spreads-to-corporates yesterday … today PerpetualDiscounts closed to yield 6.42%, equivalent to 8.99% at the standard 1.4x equivalency factor. Long Corporates currently yield about 7.0%, so the pre-tax interest-equivalent spread is now about 199bp – in line with what may be considered Credit-Crunch-but-not-Credit-Terror levels.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1983 % |

1,282.0 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1983 % |

2,073.2 |

| Floater |

2.93 % |

3.44 % |

83,607 |

18.60 |

3 |

-0.1983 % |

1,601.5 |

| OpRet |

5.04 % |

3.71 % |

128,089 |

0.98 |

15 |

-0.0450 % |

2,157.7 |

| SplitShare |

5.95 % |

5.87 % |

53,574 |

4.28 |

3 |

-0.2179 % |

1,830.0 |

| Interest-Bearing |

6.04 % |

8.53 % |

27,841 |

0.57 |

1 |

0.5061 % |

1,973.3 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1548 % |

1,715.0 |

| Perpetual-Discount |

6.38 % |

6.42 % |

160,615 |

13.32 |

71 |

-0.1548 % |

1,579.5 |

| FixedReset |

5.75 % |

4.98 % |

487,269 |

4.47 |

37 |

-0.0897 % |

1,975.1 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| MFC.PR.C |

Perpetual-Discount |

-2.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 17.46

Evaluated at bid price : 17.46

Bid-YTW : 6.47 % |

| BAM.PR.M |

Perpetual-Discount |

-2.00 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 14.70

Evaluated at bid price : 14.70

Bid-YTW : 8.28 % |

| MFC.PR.B |

Perpetual-Discount |

-1.48 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 18.60

Evaluated at bid price : 18.60

Bid-YTW : 6.27 % |

| BAM.PR.B |

Floater |

-1.20 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 11.50

Evaluated at bid price : 11.50

Bid-YTW : 3.46 % |

| PWF.PR.L |

Perpetual-Discount |

-1.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 19.12

Evaluated at bid price : 19.12

Bid-YTW : 6.76 % |

| BAM.PR.N |

Perpetual-Discount |

-1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 14.83

Evaluated at bid price : 14.83

Bid-YTW : 8.20 % |

| RY.PR.I |

FixedReset |

-1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 24.42

Evaluated at bid price : 24.47

Bid-YTW : 4.33 % |

| BNS.PR.M |

Perpetual-Discount |

-1.12 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 18.54

Evaluated at bid price : 18.54

Bid-YTW : 6.15 % |

| POW.PR.C |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 21.63

Evaluated at bid price : 21.63

Bid-YTW : 6.82 % |

| CM.PR.P |

Perpetual-Discount |

1.20 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 21.65

Evaluated at bid price : 21.91

Bid-YTW : 6.35 % |

| POW.PR.A |

Perpetual-Discount |

1.44 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 21.20

Evaluated at bid price : 21.20

Bid-YTW : 6.72 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BMO.PR.O |

FixedReset |

218,122 |

National Bank crossed 200,000 at 27.00.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-06-24

Maturity Price : 25.00

Evaluated at bid price : 26.90

Bid-YTW : 5.10 % |

| TD.PR.E |

FixedReset |

111,941 |

National Bank bought 10,000 from HSBC at 26.48. Nesbit crossed 40,000 at 26.60 and bought 36,100 from RBC at the same price.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 26.41

Bid-YTW : 5.11 % |

| BNS.PR.J |

Perpetual-Discount |

110,699 |

National Bank crossed 100,000 at 21.78.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 21.48

Evaluated at bid price : 21.76

Bid-YTW : 6.10 % |

| BNS.PR.R |

FixedReset |

60,642 |

Nesbitt crossed 50,000 at 24.36.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 24.40

Evaluated at bid price : 24.45

Bid-YTW : 4.30 % |

| RY.PR.C |

Perpetual-Discount |

47,210 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-28

Maturity Price : 18.57

Evaluated at bid price : 18.57

Bid-YTW : 6.25 % |

| RY.PR.Y |

FixedReset |

47,059 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-12-24

Maturity Price : 25.00

Evaluated at bid price : 26.08

Bid-YTW : 5.34 % |

| There were 47 other index-included issues trading in excess of 10,000 shares. |