A New Year’s update from Assiduous Reader RAV4guy!

Category: Index Construction / Reporting

CPD Portfolio Analysis : February, 2021

With all the tumult of the past year, I thought it was high time to show a new portfolio analysis of CPD. Holdings were recovered from the CPD information page as of February 25 and converted into HIMIPref™ format. Cash was not included in the HIMIPref™ transcription – these analyses are for the securities only.

Sectoral distribution of the CPD portfolio on February 26 was as follows:

| CPD Sectoral Analysis 2021-2-26 | ||||

| HIMI Indices Sector | Weighting | YTW | ModDur | |

| Ratchet | 0% | N/A | N/A | |

| FixFloat | 0% | N/A | N/A | |

| Floater | 0% | N/A | N/A | |

| OpRet | 0% | N/A | N/A | |

| SplitShare | 0% | N/A | N/A | |

| Interest Rearing | 0% | N/A | N/A | |

| PerpetualPremium | 4.9% | 1.44% | 3.39 | |

| PerpetualDiscount | 3.4% | 4.96% | 15.52 | |

| Fixed-Reset Discount | 25.9% | 4.01% | 17.19 | |

| Insurance – Straight | 7.8% | 3.91 | 12.11 | |

| FloatingReset | 0% | N/A | N/A | |

| FixedReset Premium | 20.0% | 3.16% | 3.42 | |

| FixedReset Bank non-NVCC | 0.4% | 1.92% | 0.49 | |

| FixedReset Insurance non-NVCC | 7.4% | 3.57% | 13.52 | |

| Scraps – Ratchet | 1.2% | 4.95% | 18.36 | |

| Scraps – FixedFloater | 0.9% | 4.84% | 17.61 | |

| Scraps – Floater | 0% | N/A | N/A | |

| Scraps – OpRet | 0% | N/A | N/A | |

| Scraps – SplitShare | 0% | N/A | N/A | |

| Scraps – PerpPrem | 1.5% | -1.06% | 7.50 | |

| Scraps – PerpDisc | 1.4% | 5.00% | 15.48 | |

| Scraps – FR Discount | 18.9% | 5.29% | 14.88 | |

| Scraps – Insurance Straight | 0% | N/A | N/A | |

| Scraps – FloatingReset | 0% | N/A | N/A | |

| Scraps – FR Premium | 6.3% | 4.68% | 3.65 | |

| Scraps – Bank non-NVCC | 0% | N/A | N/A | |

| Scraps – Ins non-NVCC | 0% | N/A | N/A | |

| Cash | 0% | N/A | N/A | |

| Total | 100% | 3.94% | 11.53 | |

| Totals and changes will not add precisely due to rounding. | ||||

| The various “Scraps” indices include issues with a DBRS rating of Pfd-3(high) or lower and issues with an Average Trading Value (calculated with HIMIPref™ methodology, which is relatively complex) of less than $25,000. The issues considered “Scraps” are subdivided into indices which reflect those of the main indices. | ||||

| DeemedRetractibles were comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company or the regulator. These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31 in the case of banks or normally in the case of insurers and insurance holding companies, in addition to the call schedule explicitly defined. See the Deemed Retractible Review: September 2016 for the rationale behind this analysis and IAIS Says No To DeemedRetractions for the recent change in policy with respect to insurers.

Note that the estimate for the time this will become effective for insurers and insurance holding companies was extended by three years in April 2013, due to the delays in OSFI’s providing clarity on the issue and by a further five years in December, 2018; the estimate was eliminated in November. However, the distinctions are being kept because it is useful to distinguish insurance issues from others. The name of this subindex has been changed to "Insurance Straight" as of November, 2020 |

||||

| Calculations of resettable instruments are performed assuming a constant GOC-5 rate of 0.86%, a constant 3-Month Bill rate of 0.11% and a constant Canada Prime Rate of 2.45% | ||||

The calculation of overall yield may be criticized, since it is merely a weighted average of the yield for each issue. Thus, when considering WN.PR.A, the average will reflect the calculated YTW of -17.44% as if it was in effect for as long as every other calculated yield, which is simply wrong. A proper overall yield calculation would take the cashflows of each instrument in the portfolio and calculate the yield based on all these cashflows together, but I don’t know anybody who does that. HIMIPref™ can prepare a table of these cashflows, but I see no point in doing so.

The weighted average is 3.94%, as indicated on the table. The weighted average if all the negative YTWs (there are eight of them) are set to zero is 4.11%. The weighted average if all the issues with a negative YTW are ignored completely is 4.23%. So take your pick.

A wrinkle to the division into sub-indices is the fact that some issues are classed here as FixedResets, even though for analytical purposes they are classified as Straights – this is due to the fact that these particular issues reset with a floor rate which is (given the current level of the GOC 5-Year bond) currently expected to be effective.

For CPD the total portfolio is 68.5% “Floating”, which means the rates will reset periodically based upon the GOC-5, T-Bill or Canada Prime levels.

Credit distribution is:

| CPD Credit Analysis 2021-2-26 | ||

| DBRS Rating | CPD Weighting | |

| Pfd-1 | 0 | |

| Pfd-1(low) | 0 | |

| Pfd-2(high) | 36.2% | |

| Pfd-2 | 16.7% | |

| Pfd-2(low) | 15.0% | |

| Pfd-3(high) | 14.8% | |

| Pfd-3 | 12.6% | |

| Pfd-3(low) | 1.6% | |

| Pfd-4(high) | 0% | |

| Pfd-4 | 0% | |

| Pfd-4(low) | 0% | |

| Pfd-5(high) | 0% | |

| Pfd-5 | 0% | |

| Cash | 0% | |

| Totals will not add precisely due to rounding. | ||

| 3% of the portfolio is not rated by DBRS and I have not used S&P ratings as a substitute. | ||

Liquidity Distribution is:

| CPD Liquidity Analysis 2021-2-26 | ||

| Average Daily Trading | CPD Weighting | |

| <$50,000 | 2.6% | |

| $50,000 – $100,000 | 16.4% | |

| $100,000 – $200,000 | 39.2% | |

| $200,000 – $300,000 | 24.5% | |

| >$300,000 | 17.3% | |

| Cash | 0% | |

| Totals will not add precisely due to rounding. | ||

The distribution of Issue Reset Spreads is:

| Range | CPD Weight |

| <100bp | 0% |

| 100-149bp | 0.4% |

| 150-199bp | 1.8% |

| 200-249bp | 17.9% |

| 250-299bp | 18.1% |

| 300-349bp | 11.7% |

| 350-399bp | 9.9% |

| 400-449bp | 6.5% |

| 450-499bp | 10.8% |

| 500-549bp | 1.8% |

| 550-599bp | 0% |

| >= 600bp | 0% |

| Undefined | 21.0% |

Distribution of Floating Rate Start Dates is shown in the table below. This is the date of the next adjustment to the dividend rate, if the issue is currently paying a fixed rate for a limited time; which in practice is successive terms of 5 years. Issues that adjust quarterly are considered “Currently Floating”.

| Range | CPD Weight |

| Currently Floating | 1.2% |

| 0-1 Year | 19.0% |

| 1-2 Years | 18.6% |

| 2-3 Years | 13.4% |

| 3-4 Years | 20.8% |

| 4-5 Years | 8.1% |

| 5-6 Years | 0% |

| >6 Years | 0% |

| Not Floating Rate | 19.0% |

16Q2 TXPR Revision

S&P Dow Jones Indices Canadian Index Operations has announced:

the following index changes as a result of the quarterly S&P/TSX Preferred Share Index Review. These changes will be effective at the open on Monday, April 18, 2016.

| S&P/TSX PREFERRED SHARE INDEX – ADDITIONS | ||

| Symbol | Issue Name | CUSIP |

| BNS.PR.G | BANK OF NOVA SCOTIA PR SER 36 | 064151 20 2 |

| BIP.PR.B | BROOKFIELD INFRASTRUCTURE PARTNR LP A PR SR 3 | G16252 14 3 |

| BPO.PR.H | BROOKFIELD OFFICE PROP INC. CL AAA PR SER ‘H’ | 112900 80 8 |

| BPO.PR.K | BROOKFIELD OFFICE PROP INC. CL AAA PR SER ‘K’ | 112900 86 5 |

| EML.PR.A | EMPIRE LIFE INSURANCE COMPANY (THE) SER 1 PR | 291839 20 7 |

| LB.PR.J | LAURENTIAN BANK OF CANADA CL’A’ PR SER 15 | 51925D 79 1 |

| MFC.PR.O | MANULIFE FINANCIAL CORP NN-CM CL 1 PR SER 21 | 56501R 65 0 |

| NA.PR.X | NATIONAL BANK OF CANADA 5-YR 1ST PR SER ’34’ | 633067 26 9 |

| PPL.PR.K | PEMBINA PIPELINE CORPORATION CL ‘A’ PR SER 11 | 706327 87 1 |

| RY.PR.R | ROYAL BANK OF CANADA 1ST PR SER BM | 78013N 27 4 |

| TD.PF.G | TORONTO-DOMINION BANK(THE)CL ‘A’1ST PR SER 12 | 891145 57 5 |

| W.PR.K | WESTCOAST ENERGY INC. 5-YR 1ST PR SER ’10’ | 95751D 84 7 |

| S&P/TSX PREFERRED SHARE INDEX – DELETIONS | ||

| Symbol | Issue Name | CUSIP |

| AQN.PR.D | ALGONQUIN POWER & UTILITIES CORP. SER ‘D’ PR | 015857 50 1 |

| BCE.PR.A | BCE INC. 1ST PR SERIES ‘AA’ | 05534B 79 4 |

| CU.PR.F | CANADIAN UTILITIES LIMITED 2ND PR SER ‘CC’ | 136717 65 9 |

| POW.PR.D | POWER CORPORATION OF CANADA 5.00% SER ‘D’ PR | 739239 86 1 |

| SLF.PR.G | SUN LIFE FINANCIAL INC. CLASS ‘A’ PR SER 8R | 866796 88 1 |

| TD.PR.Z | TORONTO-DOMINION BANK(THE) FLTG RT PR SER Z | 891145 71 6 |

TXPR / TXPL Quarterly Rebalancing: April 2015

S&P Dow Jones Indices Canadian Index Operations has announced:

the following index changes as a result of the quarterly S&P/TSX Preferred Share Index and S&P/TSX Preferred Share Laddered Index Reviews. These changes will be effective at the open on Monday, April 20, 2015.

| S&P/TSX Preferred Share Index | ||

| ADDITIONS | ||

| Symbol | Issue Name | CUSIP |

| BIP.PR.A | BROOKFIELD INFRASTRUCTURE 4.50% CL A PR SERIES 1 | G16252 12 7 |

| CM.PR.Q | CIBC 3.60% CLASS A PR SERIES 43 | 136069 39 0 |

| FFH.PR.M | FAIRFAX FINANCIAL HLDG 4.75% PR SERIES M | 303901 79 7 |

| HSB.PR.C | HSBC BANK CANADA CL 1 NON-CUMULATIVE SER C PR | 40427H 50 9 |

| HSE.PR.E | HUSKY ENERGY INC 4.50% PR SERIES 5 | 448055 60 8 |

| LB.PR.F | LAURENTIAN BANK OF CANADA PR’A’ SERIES 11 | 51925D 84 1 |

| RY.PR.J | ROYAL BANK OF CANADA 1ST PR NVCC SER ‘BD’ | 78012Q 11 2 |

| RY.PR.M | ROYAL BANK OF CANADA 1ST PR NVCC SER ‘BF’ | 78012T 47 0 |

| TD.PF.D | TORONTO-DOMINION BANK CLASS A 1ST PR SER 7 | 891145 63 3 |

| TRP.PR.F | TRANSCANADA CORPORATION 1ST PR SERIES ‘2’ | 89353D 30 5 |

| TRP.PR.G | TRANSCANADA CORPORATION 1ST PR SERIES ’11’ | 89353D 84 2 |

| DELETIONS | ||

| Symbol | Issue Name | CUSIP |

| CU.PR.E | CANADIAN UTILITIES LIMITED 2ND PR SER ‘BB’ | 136717 66 7 |

| FTS.PR.F | FORTIS INC. 1ST PR SERIES ‘F’ | 349553 86 7 |

| POW.PR.A | POWER CORPORATION OF CANADA 5.60% SER ‘A’ PR | 739239 88 7 |

| PWF.PR.L | POWER FINANCIAL CORP. 5.10% SERIES ‘L’ 1ST PR | 73927C 82 9 |

| S&P/TSX Preferred Share Laddered Index | ||

| ADDITIONS | ||

| Symbol | Issue Name | CUSIP |

| BIP.PR.A | BROOKFIELD INFRASTRUCTURE 4.50% CL A PR SERIES 1 | G16252 12 7 |

| CM.PR.Q | CIBC 3.60% CLASS A PR SERIES 43 | 136069 39 0 |

| FFH.PR.M | FAIRFAX FINANCIAL HLDG 4.75% PR SERIES M | 303901 79 7 |

| HSE.PR.E | HUSKY ENERGY INC 4.50% PR SERIES 5 | 448055 60 8 |

| RY.PR.J | ROYAL BANK OF CANADA 1ST PR NVCC SER ‘BD’ | 78012Q 11 2 |

| RY.PR.M | ROYAL BANK OF CANADA 1ST PR NVCC SER ‘BF’ | 78012T 47 0 |

| TD.PF.D | TORONTO-DOMINION BANK CLASS A 1ST PR SER 7 | 891145 63 3 |

| TRP.PR.G | TRANSCANADA CORPORATION 1ST PR SERIES ’11’ | 89353D 84 2 |

| DELETIONS | ||

| Symbol | Issue Name | CUSIP |

| GMP.PR.B | GMP CAPITAL INC. 5-YR RST SER ‘B’ PR | 380134 20 5 |

TXPR / TXPL Quarterly Rebalancing: January 2015

S&P Dow Jones Indices Canadian Index Operations has announcedthe following index changes as a result of the quarterly S&P/TSX Preferred Share Index and S&P/TSX Preferred Share Laddered Index Reviews. These changes will be effective at the open on Monday, January 19, 2015.

|

S&P/TSX Preferred Share Index |

||

|

ADDITIONS |

||

|

Symbol |

Issue Name |

CUSIP |

|

BAM.PF.G |

BROOKFIELD ASSET MANAGEMENT INC CL A PR SR 42 |

112585 51 8 |

|

BPO.PR.A |

BROOKFIELD OFFICE PROP INC CL AAA PR SER ‘AA’ |

112900 68 3 |

|

CM.PR.P |

CIBC 3.75% CLASS A PREFERRED SERIES 41 |

136069 42 4 |

|

HSE.PR.C |

HUSKY ENERGY INC 4.50% PREFERRED SERIES 3 |

448055 40 0 |

|

MFC.PR.N |

MANULIFE FINANCIAL 3.80% CLASS 1 PREFERRED SERIES 19 |

56501R 67 6 |

|

NA.PR.W |

NATIONAL BANK OF CANADA 1ST PR SERIES ’32’ |

633067 28 5 |

|

TD.PF.C |

TD BANK CLASS A 1ST PREFERRED SERIES 5 |

891145 65 8 |

|

DELETIONS |

||

|

Symbol |

Issue Name |

CUSIP |

|

BMO.PR.R |

BANK OF MONTREAL FLTG RATE CL ‘B’ PR SER 17 |

063671 77 0 |

|

BNS.PR.A |

BANK OF NOVA SCOTIA (THE) PR SERIES ’19’ |

064149 73 5 |

|

BNS.PR.R |

BANK OF NOVA SCOTIA (THE)5-YR RESET PR SER 22 |

064149 69 3 |

|

GWO.PR.M |

GREAT-WEST LIFECO INC. 5.80% 1ST PR SERIES M |

39138C 81 7 |

|

L.PR.A |

LOBLAW COMPANIES LIMITED 2ND PR SERIES ‘A’ |

539481 60 6 |

|

PWF.PR.I |

POWER FINANCIAL CORP. 6% SERIES ‘I’ 1ST PR |

73927C 84 5 |

|

RY.PR.C |

ROYAL BANK OF CANADA 1ST PR SERIES ‘AC’ |

780102 60 4 |

|

TRI.PR.B |

THOMSON REUTERS CORPORATION FLTG RATE PR II |

884903 30 3 |

|

TD.PR.T |

TORONTO-DOMINION BANK(THE) FLTG RT PR SER T |

891145 72 4 |

|

W.PR.H |

WESTCOAST ENERGY INC. 5.50% 1ST PR SERIES ‘7’ |

95751D 88 8 |

|

S&P/TSX Preferred Share Laddered Index |

||

|

ADDITIONS |

||

|

Symbol |

Issue Name |

CUSIP |

|

BAM.PF.G |

BROOKFIELD ASSET MANAGEMENT INC CL A PR SR 42 |

112585 51 8 |

|

BAM.PF.E |

BROOKFIELD ASSET MANAGEMNT INC CL A PR SER 38 |

112585 55 9 |

|

BPO.PR.A |

BROOKFIELD OFFICE PROP INC CL AAA PR SER ‘AA’ |

112900 68 3 |

|

CM.PR.P |

CIBC 3.75% CLASS A PREFERRED SERIES 41 |

136069 42 4 |

|

EMA.PR.F |

EMERA INCORPORATED PR SERIES ‘F’ |

290876 80 4 |

|

ENB.PF.C |

ENBRIDGE INC. PR SER ’11’ |

29250N 59 2 |

|

ENB.PF.E |

ENBRIDGE INC. PR SER ’13’ |

29250N 57 6 |

|

ENB.PF.G |

ENBRIDGE INC. PR SER ’15’ |

29250N 55 0 |

|

HSE.PR.C |

HUSKY ENERGY INC. 4.50% PREFERRED SERIES 3 |

448055 40 0 |

|

MFC.PR.N |

MANULIFE FINANCIAL 3.80% CLASS 1 PREFERRED SERIES 19 |

56501R 67 6 |

|

NA.PR.W |

NATIONAL BANK OF CANADA 1ST PR SERIES ’32’ |

633067 28 5 |

|

TD.PF.C |

TD BANK CLASS A 1ST PREFERRED SERIES 5 |

891145 65 8 |

TXPR / TXPL 14Q2 Rebalancing Changes Announced

S&P Dow Jones Indices Canadian Index Operations has announced:

the following index changes as a result of the quarterly S&P/TSX Preferred Share Index and S&P/TSX Preferred Share Laddered Index Reviews. These changes will be effective at the open on Monday, April 21, 2014.

S&P/TSX Preferred Share Index

| ADDITIONS | ||

|

Symbol |

Issue Name | CUSIP |

| AIM.PR.C | AIMIA INC. CUMULATIVE RESET SERIES ‘3’ PR | 00900Q 40 0 |

| BAM.PF.E | BROOKFIELD ASSET MANAGEMNT INC CL A PR SER 38 | 112585 55 9 |

| CWB.PR.B | CANADIAN WESTERN BANK 5-YR RESET PR SER ‘5’ | 136765 50 0 |

| ENB.PF.A | ENBRIDGE INC. PR SER ‘9’ | 29250N 62 6 |

| IAG.PR.F | INDUSTRIAL ALLIANCE INS & FIN SERV 5.90% PR F | 455871 50 9 |

| MFC.PR.L | MANULIFE FINANCIAL CORP. CL 1 PR SER ’15’ | 56501R 72 6 |

| NA.PR.L | NATIONAL BANK OF CANADA 1ST PR SERIES ’16’ | 633067 51 7 |

| NA.PR.S | NATIONAL BANK OF CANADA 5-YR 1ST PR SER ’30’ | 633067 31 9 |

| PPL.PR.E | PEMBINA PIPELINE CORPORATION CL ‘A’ PR SER 5 | 706327 11 1 |

| RY.PR.Z | ROYAL BANK OF CANADA 1ST PR NON-CUM SER ‘AZ’ | 78012G 41 1 |

| TRP.PR.E | TRANSCANADA CORPORATION 1ST PR SERIES ‘9’ | 89353D 86 7 |

| DELETIONS | ||

|

Symbol |

Issue Name | CUSIP |

| ELF.PR.H | E-L FINANCIAL CORP. 5.50% 1ST PR SERIES ‘3’ | 26857Q 50 7 |

| FTS.PR.E | FORTIS INC. 1ST PR SERIES ‘E’ | 349553 80 0 |

| TCL.PR.D | TRANSCONTINENTAL INC. 1ST PR SERIES ‘D’ | 893578 30 2 |

| VNR.PR.A | VALENER INC. SERIES ‘A’ PR | 91912H 20 7 |

S&P/TSX Preferred Share Laddered Index

| ADDITIONS | ||

|

Symbol |

Issue Name | CUSIP |

| AIM.PR.C | AIMIA INC. CUMULATIVE RESET SERIES ‘3’ PR | 00900Q 40 0 |

| CWB.PR.B | CANADIAN WESTERN BANK 5-YR RESET PR SER ‘5’ | 136765 50 0 |

| ENB.PF.A | ENBRIDGE INC. PR SER ‘9’ | 29250N 62 6 |

| MFC.PR.L | MANULIFE FINANCIAL CORP. CL 1 PR SER ’15’ | 56501R 72 6 |

| NA.PR.S | NATIONAL BANK OF CANADA 5-YR 1ST PR SER ’30’ | 633067 31 9 |

| PPL.PR.E | PEMBINA PIPELINE CORPORATION CL ‘A’ PR SER 5 | 706327 11 1 |

| RY.PR.Z | ROYAL BANK OF CANADA 1ST PR NON-CUM SER ‘AZ’ | 78012G 41 1 |

| TRP.PR.E | TRANSCANADA CORPORATION 1ST PR SERIES ‘9’ | 89353D 86 7 |

TXPR / TXPL 14Q1 Rebalancing Changes Announced

S&P Dow Jones Indices Canadian Index Operations has announced:

the following index changes as a result of the quarterly S&P/TSX Preferred Share Index and S&P/TSX Venture Select Index Reviews. These changes will be effective at the open on Monday, January 20, 2014.

| TXPR |

| Additions |

| ALA.PR.E |

| BMO.PR.N |

| BNS.PR.B |

| ENB.PR.J |

| PPL.PR.C |

| PWF.PR.T |

| TD.PR.Z |

| VSN.PR.C |

| Deletion |

| IGM.PR.B |

| TXPL |

| Additions |

| ALA.PR.E |

| BAM.PF.B |

| BRF.PR.C |

| ENB.PR.J |

| ENB.PR.P |

| ENB.PR.T |

| ENB.PR.Y |

| FTS.PR.K |

| PPL.PR.C |

| PWF.PR.T |

| TRP.PR.D |

| VSN.PR.C |

| Deletions |

| None |

HIMIPref™ Index Performance: January 2011

This is grossly abbreviated. My apologies, but since the OSFI announcement on extant Tier 1 Capital, time has been at a premium.

Performance of the HIMIPref™ Indices for January, 2011, was:

| Total Return | ||

| Index | Performance January 2011 |

Three Months to January 31, 2011 |

| Ratchet | +4.03% *** | +9.80% *** |

| FixFloat | +3.76% ** | +9.24% ** |

| Floater | +4.03% | +9.80% |

| OpRet | -0.35% | +0.62% |

| SplitShare | +0.78% | +2.91% |

| Interest | -0.35%**** | +0.62%**** |

| PerpetualPremium | +0.81% | +0.99% |

| PerpetualDiscount | +2.96% | +3.21% |

| FixedReset | -0.11% | -0.32% |

| ** The last member of the FixedFloater index was transferred to Scraps at the June, 2010, rebalancing; subsequent performance figures are set equal to the Floater index. The index was repopulated at the October, 2010, rebalancing | ||

| *** The last member of the RatchetRate index was transferred to Scraps at the July, 2010, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| **** The last member of the InterestBearing index was transferred to Scraps at the June, 2009, rebalancing; subsequent performance figures are set equal to the OperatingRetractible index | ||

| Passive Funds (see below for calculations) | ||

| CPD | +0.87% | +1.09% |

| DPS.UN | +1.21% | +2.24% |

| Index | ||

| BMO-CM 50 | +1.62% | +2.24% |

| TXPR Total Return | +0.87% | +1.17% |

The pre-tax interest equivalent spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the month at 190bp, a significant decline from the 225bp reported at year-end. The decline may be attribute with a fair level of confidence to speculation (ultimately proved correct) that OSFI would not grandfather extant Tier 1 Capital.

Claymore has published NAV and distribution data (problems with the page in IE8 can be kludged by using compatibility view) for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to January 31, 2011 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| October 29, 2010 | 17.24 | |||

| November 25 | 17.25 | 0.069 | +0.46% | +0.23% |

| November 30 | 17.21 | -0.23% | ||

| December 24 | 17.09 | 0.069 | -0.30% | -0.01% |

| December 31, 2010 | 17.14 | +0.29% | ||

| January 26, 2011 | 17.20 | 0.069 | +0.75% | +0.87% |

| January 31, 2011 | 17.22 | +0.12% | Quarterly Return | +1.20% |

Claymore currently holds $623,497,812 (advisor & common combined) in CPD assets, up about $27-million (4.50%) from the $596,621,272 reported at December month-end.

The DPS.UN NAV for February 2 has been published so we may calculate the approximate January returns.

| DPS.UN NAV Return, January-ish 2011 | ||||

| Date | NAV | Distribution | Return for sub-period | Return for period |

| December 29 | 21.01 | |||

| February 2 | 21.352 | +1.63% | ||

| Estimated December Ending Stub | -0.29% ***** | |||

| Estimated February Beginning Stub | -0.12% * | |||

| Estimated January Return | +1.21% ****** | |||

| *CPD had a NAVPU of 17.22 on January 31 and 17.24 on February 2, therefore the return for the period was +0.12%. The return for DPS.UN in this period is presumed to be equal. | ||||

| *****CPD had a NAVPU of 17.09 on December 29 and 17.14 on December 31, hence the total return for the period for CPD was +0.29%. The return for DPS.UN in this period is presumed to be equal. | ||||

| **** The estimated January return for DPS.UN’s NAV is therefore the product of three period returns, +1.63%, -0.29%, -0.12%, to arrive at an estimate for the calendar month of +1.21% | ||||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for November and December:

| DPS.UN NAV Returns, three-month-ish to end-December-ish, 2010 | |

| November-ish | +0.88% |

| December-ish | +0.14% |

| January-ish | +1.21% |

| Three-months-ish | +2.24% |

Sentry Select is now publishing performance data for DPS.UN, but this appears to be price-based, rather than NAV-based. I will continue to report NAV-based figures.

HIMIPref™ Rebalancing: January 2011

| HIMI Index Changes, January 31, 2011 | |||

| Issue | From | To | Because |

| TD.PR.P | PerpetualPremium | PerpetualDiscount | Price |

| PWF.PR.H | PerpetualPremium | PerpetualDiscount | Price |

| TCA.PR.Y | PerpetualDiscount | PerpetualPremium | Price |

| TCA.PR.X | PerpetualDiscount | PerpetualPremium | Price |

| GWO.PR.M | PerpetualDiscount | PerpetualPremium | Price |

| CM.PR.P | PerpetualDiscount | PerpetualPremium | Price |

| CM.PR.E | PerpetualDiscount | PerpetualPremium | Price |

| GWO.PR.L | PerpetualDiscount | PerpetualPremium | Price |

| IGM.PR.B | PerpetualDiscount | PerpetualPremium | Price |

| BNS.PR.N | PerpetualDiscount | PerpetualPremium | Price |

There were the following intra-month changes:

| HIMI Index Changes during January 2011 | |||

| Issue | Action | Index | Because |

| CL.PR.B | Delete | PerpetualDiscount | Redeemed |

| FN.PR.A | Add | Scraps | New Issue |

| REI.PR.A | Add | Scraps | New Issue |

| NPP.PR.A | Delete | Scraps | Ticker Change |

| NPI.PR.A | Add | Scraps | Ticker Change |

HIMIPref™ Index Performance: December 2010

Performance of the HIMIPref™ Indices for December, 2010, was:

| Total Return | ||

| Index | Performance December 2010 |

Three Months to December 30, 2010 |

| Ratchet | +2.00% *** | +7.46% *** |

| FixFloat | -0.35% ** | +7.19% ** |

| Floater | +2.00% | +7.46% |

| OpRet | +0.68% | +1.10% |

| SplitShare | -0.84% | +3.65% |

| Interest | +0.68%**** | +1.10%**** |

| PerpetualPremium | +0.50% | +1.25% |

| PerpetualDiscount | -0.47% | +2.55% |

| FixedReset | +0.03% | +0.49% |

| ** The last member of the FixedFloater index was transferred to Scraps at the June, 2010, rebalancing; subsequent performance figures are set equal to the Floater index. The index was repopulated at the October, 2010, rebalancing | ||

| *** The last member of the RatchetRate index was transferred to Scraps at the July, 2010, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| **** The last member of the InterestBearing index was transferred to Scraps at the June, 2009, rebalancing; subsequent performance figures are set equal to the OperatingRetractible index | ||

| Passive Funds (see below for calculations) | ||

| CPD | -0.01% | +1.44% |

| DPS.UN | +0.14% | +1.19% |

| Index | ||

| BMO-CM 50 | -0.04% | +2.64% |

| TXPR Total Return | 0.00% | +1.86% |

The pre-tax interest equivalent spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the year at 225bp, a slight increase from the 220bp reported at November month end. Long corporate yields remained constant 5.4% during the period (albeit with interesting things happening in the interim) while PerpetualDiscounts increased slightly to 5.48% from 5.41% dividend yield. I would be happier with long corporates in the 6.00-6.25% range with a seniority spread in the range of 100-150bp, but what do I know? The market has never shown any particular interest in my happiness.

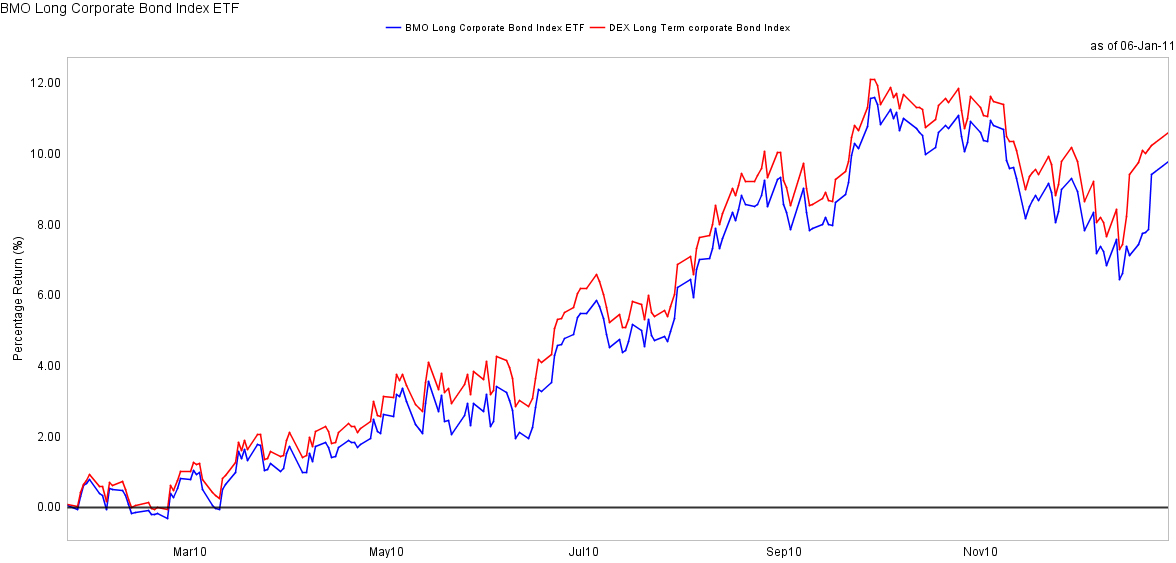

The wild ride of long corporates during the month is illustrated by the BMO Long Corporate Bond Index ETF tracking error chart:

Charts related to the Seniority Spread and the Bozo Spread (PerpetualDiscount Current Yield less FixedReset Current Yield) are published in PrefLetter.

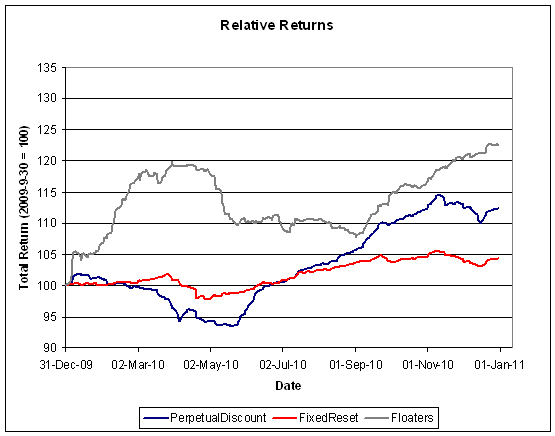

The trailing year returns are starting to look a bit more normal.

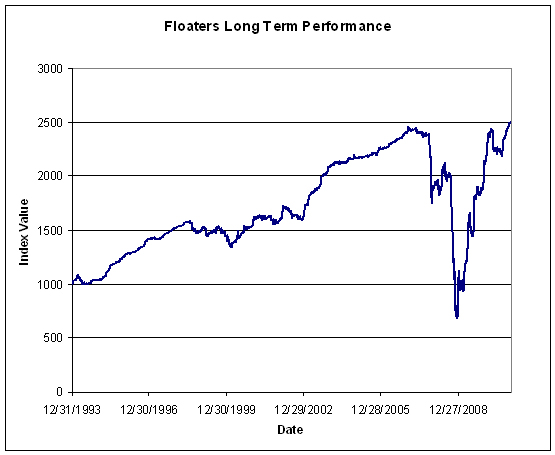

Floaters have had a wild ride; the latest decline is presumably due to the idea that the BoC will be slower rather than faster in hiking the overnight rate. I’m going to keep publishing updates of this graph until the one-year trailing return for the sector no longer looks so gigantic:

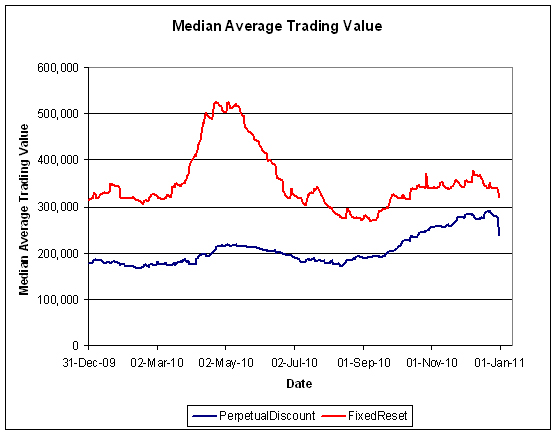

Volumes are on their way back up Volume may be under-reported due to the influence of Alternative Trading Systems (as discussed in the November PrefLetter), but I am biding my time before incorporating ATS volumes into the calculations, to see if the effect is transient or not. The droop at year end is quite pronounced.

Compositions of the passive funds were discussed in the September, 2010, edition of PrefLetter.

Claymore has published NAV and distribution data (problems with the page in IE8 can be kludged by using compatibility view) for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to December 30, 2010 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| September 30 | 17.07 | |||

| October 26 | 17.21 | 0.069 | +1.22% | +1.40% |

| October 29, 2010 | 17.24 | +0.17% | ||

| November 25 | 17.25 | 0.069 | +0.46% | +0.23% |

| November 30 | 17.21 | -0.23% | ||

| December 24 | 17.09 | 0.069 | -0.30% | -0.01% |

| December 31 | 17.14 | +0.29% | Quarterly Return | +1.44% |

Claymore currently holds $596,621,272 (advisor & common combined) in CPD assets, up about $14-million (2.47%) from the $582,195,003 reported at November month-end and up about $223-million (+59.64%) from the $373,729,364 reported at year-end 2009. Their tracking error does not seem to be affecting their ability to gather assets!

The DPS.UN NAV for December 29 has been published so we may calculate the approximate December returns.

| DPS.UN NAV Return, December-ish 2010 | ||||

| Date | NAV | Distribution | Return for sub-period | Return for period |

| December 1 | 21.33 | |||

| December 29 | 21.01 | 0.30 | -0.09% | Estimated December Beginning Stub | * |

| Estimated December Ending Stub | +0.29% ***** | |||

| Estimated December Return | +0.14% ****** | |||

| **CPD had a NAVPU of 17.21 on November 30 and 17.20 on December 1, therefore the return for the day was -0.06%. The return for DPS.UN in this period is presumed to be equal. | ||||

| *****CPD had a NAVPU of 17.09 on December 29 and 17.14 on December 31, hence the total return for the period for CPD was +0.29%. The return for DPS.UN in this period is presumed to be equal. | ||||

| **** The estimated December return for DPS.UN’s NAV is therefore the product of three period returns, -0.06%, -0.09%, +0.29% to arrive at an estimate for the calendar month of +0.14% | ||||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for October and November:

| DPS.UN NAV Returns, three-month-ish to end-December-ish, 2010 | |

| October-ish | +0.17% |

| November-ish | +0.88% |

| December-ish | +0.14% |

| Three-months-ish | +1.19% |

Sentry Select is now publishing performance data for DPS.UN, but this appears to be price-based, rather than NAV-based. I will continue to report NAV-based figures.