There was a very good essay (which means: “one that I agree with”) in The Economist of July 24 titled Too many laws, too many prisoners that included the information:

For bringing some prescription sleeping pills into prison, he was put in solitary confinement for 71 days. The prison was so crowded, however, that even in solitary he had two room-mates.

Comrade Peace Prize is touting the automaker bail-out (far more expensive than the banking bail-out, but probably cheaper than the Fannie/Freddie bail-out):

Heading into a congressional election season in which polls show the public skeptical about the $84.8 billion rescue and anxious about economy, Obama is using the backdrop of Detroit- area plants owned by GM and Chrysler to promote what he says is an industry revival that has saved more than a million jobs.

…

“We are going to get all the money back that we invested in those car companies,” Obama said on ABC’s “The View” program.

For sure the money will be paid back! All GM needs is more subsidies:

The price tag? About $41,000. Luxury car prices for a car that is much more about what is under the hood than between the doors. Comfort and feature-wise, the volt is more like a Focus than a Lexus. For that kind of sticker-price you can get a BMW convertible, a Cadillac CTS or a number of well-known luxury cars. This creates a problem in making the desired electric vehicle commercially viable.

In order to compensate for the high cost and the desire to have a more ‘green’ economy, the Federal government implemented a $7,500 tax credit for electric vehicles, reducing the overall price of the Volt to $33,500. That’s right, much like the abomination that was the “Cash for Clunkers” program, our federal government is spending other people’s tax dollars to subsidize the purchase of cars by people who might otherwise choose to buy something else. By doing so they hope that the price tag will be more acceptable to potential buyers.

At least with Cash for Clunkers this taxpayer money was spread around the industry. In this case, however, the qualifying candidates for the program are narrow indeed, although it has provided a boon to the golf cart industry by allowing this subsidy to be given to purchasers of road-worthy golf carts, if equipped with side mirrors and seat belts (wittily referred to by the Wall Street Journal as a “Cash for Clubbers” program).

Still, even after the tax break, the Volt remains a pricey alternative to the typical gasoline-only cars.

Why do we subsidize the auto industry? Because they’re good jobs. Why are they good jobs? Because they’re subsidized.

Moody’s is increasingly dubious regarding whether Iceland is investment grade:

Moody’s is “taking it too far,” Economy MinisterGylfi Magnusson said in an interview yesterday, after the rating service cut the outlook on Iceland’s Baa3 foreign currency debt to negative. Moody’s said it will lower the rating to junk if a June court ruling banning some foreign loans hurts the recovery or forces the government to raise debt levels by bailing out the banks.

…

Iceland’s financial crisis was exacerbated by banks that borrowed in currencies such as Japanese yen and Swiss francs to take advantage of lower interest rates, then repackaged them as kronur loans for clients. The krona has lost 38 percent against the yen and 30 percent against the franc since Sept. 15, 2008. The government is struggling to pay down a gross debt burden that will swell to 150 percent of economic output this year, Moody’s estimates.

The prospect that Iceland’s economy will return to growth next year is “subject to significant downside risks,” Moody’s said. The economy contracted 6.5 percent in 2009 and will probably shrink a further 2.6 percent this year, the central bank estimates. Output will expand 3.4 percent in 2011, the bank said in its latest forecast in May.

CIBC has reopened some USD covered bond deals:

DBRS has today assigned ratings of AAA to the Series CB5 (Tranche 2) and Series CB7 (Tranche 2) covered bonds issued under the Canadian Imperial Bank of Commerce (CIBC) Global Public Sector Covered Bond Programme (the Programme). The USD 400 million Series CB5 (Tranche 2) covered bonds are a re-opening of the existing Series CB5 (Tranche 1) covered bonds and have the same coupon rate (2.00%) and maturity date (February 4, 2013). Similarly, the USD 600 million Series CB7 (Tranche 2) covered bonds are a re-opening of the existing Series CB7 (Tranche 1) covered bonds and have the same coupon rate (2.60%) and maturity date (July 2, 2015). All covered bonds issued under the Programme (the Covered Bonds) rank pari passu with each other.

I wasn’t able to learn the price at which these went out the door, but was able to learn that they were issued as Rule 144a private placements: so retail can go suck eggs, the regulators have destroyed the market.

And now Toronto hosts Caribana again – complete with its perennial funding problems, despite the fact that it brings a tidal wave of cash into the city. Meanwhile, the totally synthetic Luminato is awash in cash (like its cousin, Nuit Blanche) despite having an economic impact, as near as I can figure, of half a dozen extra coffees being sold so the ribbon cutters can stay awake during each others’ speeches. But synthetic events are just so much easier to control than grass-roots ones, don’t you agree? And provide employment for the right sort of people. But anyway, have fun at Caribana, everyone – and if you’re under thirty, kiss a girl for me!

The month ended on a somnolent note, with very quiet trading in the Canadian preferred share market. PerpetualDiscounts gained 4bp and FixedResets were up 10bp, taking the median weighted average yield to worst on the latter class down to 3.46% – the eighth-lowest on record. All seen lower market yiels were at the end of March, 2010.

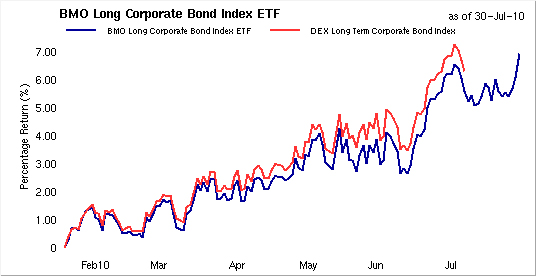

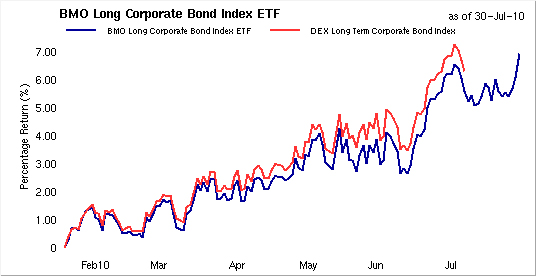

PerpetualDiscounts now yield 5.89%, equivalent to 8.25% interest at the standard 1.4x conversion factor. Long Corporates now yield about 5.5%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) is now 275bp, a surprising increase from the 265bp recorded on July 28. Corporates have been on wheels!

Click for Big

Click for Big

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.89 % |

2.96 % |

23,089 |

20.14 |

1 |

0.0000 % |

2,078.3 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0262 % |

3,149.2 |

| Floater |

2.52 % |

2.14 % |

38,827 |

22.00 |

4 |

0.0262 % |

2,244.6 |

| OpRet |

4.88 % |

3.59 % |

92,059 |

0.33 |

11 |

0.1416 % |

2,342.3 |

| SplitShare |

6.22 % |

2.87 % |

73,865 |

0.08 |

2 |

0.0000 % |

2,229.4 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1416 % |

2,141.8 |

| Perpetual-Premium |

5.94 % |

5.75 % |

105,684 |

1.79 |

4 |

-0.1085 % |

1,937.2 |

| Perpetual-Discount |

5.82 % |

5.89 % |

178,057 |

14.03 |

73 |

0.0406 % |

1,862.5 |

| FixedReset |

5.32 % |

3.46 % |

307,644 |

3.43 |

47 |

0.1013 % |

2,227.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| PWF.PR.O |

Perpetual-Discount |

1.40 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-07-30

Maturity Price : 24.39

Evaluated at bid price : 24.60

Bid-YTW : 5.93 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| SLF.PR.A |

Perpetual-Discount |

30,873 |

RBC crossed 25,000 at 20.06.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-07-30

Maturity Price : 19.98

Evaluated at bid price : 19.98

Bid-YTW : 6.02 % |

| BAM.PR.J |

OpRet |

25,985 |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 26.08

Bid-YTW : 4.82 % |

| TRP.PR.A |

FixedReset |

23,651 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.91

Bid-YTW : 3.83 % |

| TD.PR.O |

Perpetual-Discount |

23,400 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-07-30

Maturity Price : 21.65

Evaluated at bid price : 21.65

Bid-YTW : 5.64 % |

| RY.PR.A |

Perpetual-Discount |

19,947 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-07-30

Maturity Price : 20.08

Evaluated at bid price : 20.08

Bid-YTW : 5.55 % |

| TD.PR.Q |

Perpetual-Discount |

16,570 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-07-30

Maturity Price : 24.65

Evaluated at bid price : 24.88

Bid-YTW : 5.65 % |

| There were 11 other index-included issues trading in excess of 10,000 shares. |