I’m very annoyed with DBRS. I had been hoping they would come to some resolution of their mass reviews of Split Corporations (two of them: October and December), but here we are at month-end and … nothing.

So we’ll go through February with, for instance, FBS.PR.B sporting an asset coverage just a hair over 1.0:1 and still rated Pfd-2(low). As a portfolio manager, of course, I couldn’t be happier – such a grossly mis-rated issue in the universe increases my chance to outperform – but as an index calculator, it’s very annoying. It will be in the Split-Share sub-index for at least another month.

The concept of incentive is under continued attack:

NYSE Euronext Chief Executive Officer Duncan Niederauer said today in Davos that “some compensation models need to be completely overhauled.” He added that this would be difficult to legislate and companies will have to take the lead.

“While a number of people clearly do create wealth by brain power, by use of the company’s balance sheet and by other resources, other people have been receiving incentives for basically turning up,” Barclays Plc Chairman Marcus Agius said at the World Economic Forum. “That I don’t think is very smart. An incentive system properly designed and fairly calibrated is absolutely fundamental.”

Interesting charge/countercharge in the Money Market Fund world:

James “Jes” Staley, head of JPMorgan Chase & Co.’s investment unit, said the $4 trillion money-market fund industry is the “greatest systemic risk” to the financial system that hasn’t been adequately addressed.

…

JPMorgan’s Staley blamed money funds for Lehman’s collapse and the near bankruptcy of Bear Stearns Cos. last year. The funds, which typically hold highly rated, short-term debt instruments, were forced to pull their money from the firms when they saw signs of trouble, he said.“The people who brought down Lehman and almost Bear Stearns weren’t the banks, they were the money funds,” Staley said.

David Glocke, head of taxable money-market investments at Valley Forge, Pennsylvania-based Vanguard Group defended the industry.

“I’m aware there are those who want to blame the money- market industry for taking away the punch bowl,” he said. “But issuers need to maintain diverse sources of funding.”

The G-30 report on MMFs has been discussed on PrefBlog. The interesting thing about Mr. Glocke’s remark is that – taken at face value – it appears to accept that MMFs are a portfolio management monoculture; it would be highly surprising is the same thing were to be said, for instance, about an equity issue … but, of course, equities only go down due to short selling, so the short-seller can get one of them bonus thingies, right?

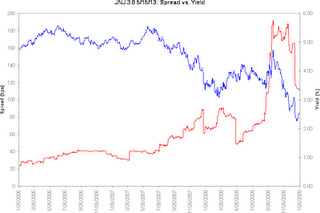

PerpetualDiscounts closed the month with a marginal loss, closing to yield 6.85%, equivalent to 9.59% at the standard 1.4x equivalency factor. Long corporates now yield about 7.6%, so the pre-tax interest-equivalent spread is now at about 200bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.81 % | 7.58 % | 21,648 | 13.63 | 2 | 0.3929 % | 851.8 |

| FixedFloater | 7.47 % | 6.96 % | 158,550 | 13.86 | 8 | -0.7003 % | 1,384.7 |

| Floater | 5.57 % | 4.75 % | 32,615 | 15.98 | 4 | -4.1413 % | 944.4 |

| OpRet | 5.31 % | 4.92 % | 163,621 | 4.03 | 15 | 0.0279 % | 2,023.7 |

| SplitShare | 6.23 % | 9.05 % | 76,364 | 4.10 | 15 | -0.7373 % | 1,789.8 |

| Interest-Bearing | 7.06 % | 8.21 % | 35,974 | 0.88 | 2 | 0.4049 % | 2,004.7 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0185 % | 1,559.9 |

| Perpetual-Discount | 6.87 % | 6.85 % | 223,347 | 12.72 | 71 | -0.0185 % | 1,436.7 |

| FixedReset | 6.10 % | 5.44 % | 761,417 | 14.33 | 26 | 0.2212 % | 1,789.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -7.91 % | Five hundred shares trading in the last 15 minutes took out the bid and the closing quote was 11.06-14.98 (!) 1×1, trading a total of 4,910 shares in a range of 11.06-12.06. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 11.06 Evaluated at bid price : 11.06 Bid-YTW : 4.75 % |

| BAM.PR.B | Floater | -5.03 % | Closed at 7.36-79, 3×9 after trading 10,221 shares in a range of 7.75-79. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 7.36 Evaluated at bid price : 7.36 Bid-YTW : 7.24 % |

| DF.PR.A | SplitShare | -3.72 % | Asset coverage of 1.4-:1 as of January 15, according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.79 Bid-YTW : 7.94 % |

| BAM.PR.K | Floater | -3.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 7.56 Evaluated at bid price : 7.56 Bid-YTW : 7.05 % |

| BNS.PR.K | Perpetual-Discount | -3.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 18.36 Evaluated at bid price : 18.36 Bid-YTW : 6.59 % |

| LFE.PR.A | SplitShare | -3.19 % | Asset coverage of 1.5-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.11 Bid-YTW : 8.04 % |

| PPL.PR.A | SplitShare | -2.75 % | Asset coverage of 1.4+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.85 Bid-YTW : 8.56 % |

| BCE.PR.A | FixedFloater | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 25.00 Evaluated at bid price : 16.48 Bid-YTW : 6.72 % |

| RY.PR.H | Perpetual-Discount | -2.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 21.00 Evaluated at bid price : 21.00 Bid-YTW : 6.75 % |

| PWF.PR.L | Perpetual-Discount | -2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 17.74 Evaluated at bid price : 17.74 Bid-YTW : 7.25 % |

| BCE.PR.G | FixedFloater | -1.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 25.00 Evaluated at bid price : 15.21 Bid-YTW : 7.14 % |

| GWO.PR.G | Perpetual-Discount | -1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 18.31 Evaluated at bid price : 18.31 Bid-YTW : 7.21 % |

| BCE.PR.R | FixedFloater | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 25.00 Evaluated at bid price : 15.51 Bid-YTW : 6.96 % |

| RY.PR.C | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 17.65 Evaluated at bid price : 17.65 Bid-YTW : 6.54 % |

| BAM.PR.J | OpRet | -1.01 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.60 Bid-YTW : 10.70 % |

| PWF.PR.I | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 21.92 Evaluated at bid price : 22.26 Bid-YTW : 6.78 % |

| POW.PR.A | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 21.02 Evaluated at bid price : 21.02 Bid-YTW : 6.74 % |

| FIG.PR.A | Interest-Bearing | 1.21 % | Asset coverage of 1.1-:1 as of January 19, based on Capital Units NAV of 1.46 as of January 29 and 0.53 Capital Units per preferred. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-31 Maturity Price : 10.00 Evaluated at bid price : 7.52 Bid-YTW : 12.53 % |

| SLF.PR.D | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 15.58 Evaluated at bid price : 15.58 Bid-YTW : 7.25 % |

| PWF.PR.E | Perpetual-Discount | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.85 % |

| BAM.PR.G | FixedFloater | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 25.00 Evaluated at bid price : 11.31 Bid-YTW : 9.63 % |

| MFC.PR.C | Perpetual-Discount | 1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 16.96 Evaluated at bid price : 16.96 Bid-YTW : 6.75 % |

| BNS.PR.Q | FixedReset | 2.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 21.71 Evaluated at bid price : 21.75 Bid-YTW : 4.49 % |

| TD.PR.Y | FixedReset | 3.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 22.17 Evaluated at bid price : 22.21 Bid-YTW : 4.41 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.G | FixedReset | 611,420 | New issue settled today. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 24.80 Evaluated at bid price : 24.85 Bid-YTW : 6.30 % |

| BNS.PR.X | FixedReset | 496,219 | New issue settled today. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 24.85 Evaluated at bid price : 24.90 Bid-YTW : 6.34 % |

| RY.PR.R | FixedReset | 214,946 | New issue settled yesterday. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 24.96 Bid-YTW : 6.34 % |

| NA.PR.P | FixedReset | 172,668 | New issue settled today. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 24.86 Evaluated at bid price : 24.91 Bid-YTW : 6.68 % |

| TD.PR.N | OpRet | 120,800 | Scotia crossed 120,000 at 25.65. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.61 Bid-YTW : 4.08 % |

| BNS.PR.T | FixedReset | 94,731 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 24.75 Evaluated at bid price : 24.80 Bid-YTW : 6.15 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. | |||