Monday’s Globe & Mail had a book review by Adriana Barton (on page 3, no less!), Gorillas that we missed: The deceptive powers of perception regarding a new book by Christopher Chabris and Daniel Simons, The Invisible Gorilla: And Other Ways Our Intuitions Deceive Us.

The centerpiece of the book is an experiment in psychology:

It’s not a joke – it’s psychology’s famous “gorilla experiment,” used in schools, corporations and anti-terrorism units to show how blind we can be when we’re paying attention.

In the test, observers are asked to count basketball passes between two teams – half of them don’t see a woman in a gorilla suit walking into the action and thumping her chest.

It illustrates the phenomenon of “inattentional blindness”- how people can miss events occurring directly in front of them.

So why am a highlighting it on PrefBlog? Three of the six “distorted beliefs about our brains” are directly related to the investment business:

- Confidence: We equate self-assurance with competence, in ourselves and others.

- Knowledge: We mistake familiarity with subject matter for knowledge.

- Cause:We draw conclusions about a root cause based on the order and relationship of events.

Most successful brokers – and money managers, for that matter – exude confidence and spend a great deal of time “staying abreast of the market”, which in general has little, if any, effect on actual returns earned by actual dollars. The third point will be familiar to anybody who has ever watched a talking head confidently recapitulating the day’s market action in terms of the Knowledge he has so arduously gained.

I’ve ordered the book and look forward to reading it: it provides an academic sheen to my beliefs. I’m no more immune to perceptual bias than the next guy! I can only hope it reinforces my prejudices by as much as The Fortune Sellers did.

Additional reviews may be found in The Washington Post and National Public Radio, inter alia.

So – what’s happening with Fannie & Freddie? Nothing:

Fannie Mae and Freddie Mac, the mortgage-finance giants that are now wards of the government, are on their way to becoming the single-biggest cost to taxpayers from the financial crisis—ahead of the banks, auto makers, or even insurer American International Group.

But while Washington is on the cusp of enacting a broad revamp of the financial regulatory infrastructure, it’s in no hurry to touch Fannie and Freddie.

“The administration has put it on the ‘too hard’ pile,” says David Felt, a former senior lawyer at the companies’ federal regulator who presided over the government takeover of the companies in 2008.

Why address a problem when you can score cheap political points by vilifying bit players like Goldman Sachs?

Even when …:

Fannie Mae and Freddie Mac, the mortgage companies operating under U.S. conservatorship, will require additional government aid amid losses stemming from the 2008 credit crisis, the nation’s top housing regulator said in its annual report to Congress.

“While critical to supporting the ongoing functioning of the nation’s housing finance system, the enterprises would be unable to serve the mortgage market in the absence of the ongoing financial support,” said Edward DeMarco, acting director of the Federal Housing Finance Agency, said in the report released today.

Corporate debt is getting less liquid:

The gap between the cost to buy and sell corporate credit reached the widest in nine months in another sign that investors are increasingly wary of all but the safest government securities amid Europe’s sovereign debt crisis.

The bid-ask spread for credit-default swaps on U.S. investment-grade bonds surged to an average 8.86 basis points as of May 21 from 5.42 basis points a month ago, according to CMA DataVision prices. The difference jumped to a one-year high of 10.57 on May 7, from as low as 3.1 in 2007.

…

Global corporate bond sales are poised for the worst month in a decade, with companies issuing $48.4 billion of debt this month, down from $183 billion in April, according to data compiled by Bloomberg.

Undeterred by the political and market reaction to the partial short-sale ban, Germany is pressing ahead with a complete ban on short-sales:

Germany’s Finance Ministry proposed legislation extending a partial ban on naked short selling adopted last week to all German stocks and certain euro-currency derivatives.

The plan would ban naked short selling in stocks of all German companies listed on a domestic exchange and would also outlaw naked credit-default swaps on some euro-region bonds as well as certain euro currency derivatives, the ministry said in what it termed a “discussion paper,” distributed to banks and industry groups.

“The financial crisis has curbed confidence in the financial markets and has revealed the need for further substantial improvement of oversight rules,” according to the document. “The crisis has reached a new dimension with turbulence increasing on the European Union member countries’ bond markets and the volatility of the euro.”

They’d be better off if they paid attention to their own rules and committments:

With Greece’s debt crisis now exposing the weakness of fiscal oversight in the 16-nation economy, governments missed one or both of the European Union’s two budget requirements 57 percent of the time since they adopted the euro. Those rules limit debt to 60 percent of gross domestic product and budget deficits to 3 percent of GDP, as set out in the 1997 Stability and Growth Pact.

…

Of the economies that have been in the euro since it started trading in 1999, Belgium and Italy missed one or both of the targets in all 11 years. Greece failed in all nine years in which it used the euro. Finland and Luxembourg satisfied both goals every year.

There is an increasing amount of retail option trading:

Volume in the U.S. has tripled since 2004 to a record 3.61 billion contracts in 2009, while trading by individual investors in the same period has increased fivefold at Fidelity Investments, the world’s largest mutual-fund firm. Sophisticated online software and the growth in training offered by industry groups and brokerages, such as Charles Schwab Corp. and TD Ameritrade Holding Corp., are enabling individuals to execute advanced techniques on home computers that had been the province of professionals.

…

The number of contracts traded at Schwab, the largest independent brokerage by client assets, rose 9 percent in 2009 from 2008, according to Randy Frederick, the San Francisco-based company’s director of trading and derivatives. TD Ameritrade, based in Omaha, Nebraska, had a 3 percent growth rate in clients trading options from October 2009 to March 2010, according to spokeswoman Fran Del Valle.

But at least the ban is creating jobs!

Germany’s unilateral move to curb speculative trading of government bonds and some naked short selling last week forced lawyers to work long hours to interpret rules enacted with less than a day’s notice.

The nation’s financial regulator, BaFin, has been posting guidance about the rules online, while lawyers toiled over what countries the rules apply in, what constitutes a “naked” deal and whether the ban covers derivatives.

“The situation has been tough for all of us, lawyers and regulators alike,” said Jochen Kindermann, a capital markets lawyer at Simmons & Simmons in Frankfurt. “The step was dropped on us like a bomb and no one really had any time to prepare.”

Woes in Europe coule lead to a new bank crisis:

European leaders must now address debt sold by nations such as Greece and Spain to avoid a costlier bank bailout later, said JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon.

“If they don’t fix the problem now, they’re still going to have to fix it later by bailing out their banks,” Dimon said at the Japan Society’s annual awards dinner in New York last night. “If they have to bail out their banks, it will be far worse than making that sovereign debt good.”

…

“A lot of that sovereign debt is owned by European banks, so when these countries have problems, so will their banks,” Dimon said, answering a question from former Federal Reserve Chairman Paul Volcker, who is now an economic adviser to President Barack Obama.

Europe’s looming debt crisis shouldn’t come as a surprise, Dimon said, because European Union nations have failed to live up to promises to keep their deficits and outstanding debt within target levels.

I have crossed SEC Commissioner Luis A. Aguilar off my Christmas card list. He is using very inflammatory language:

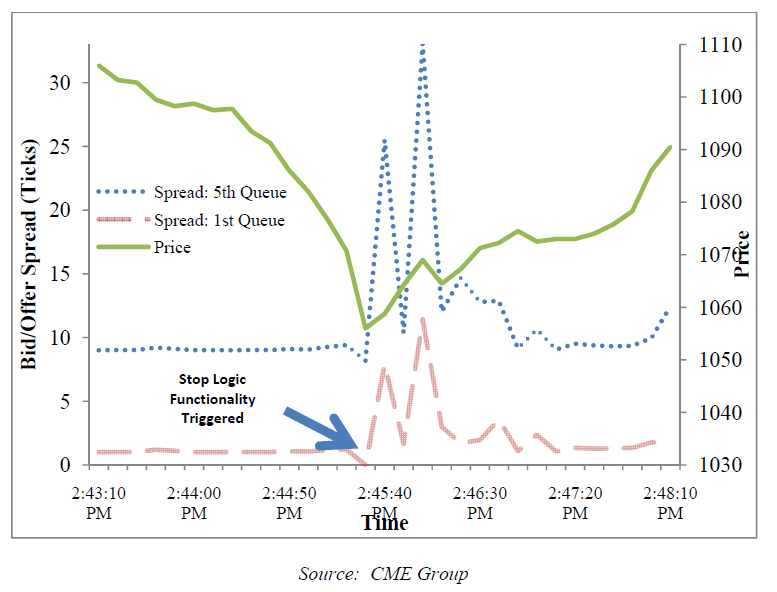

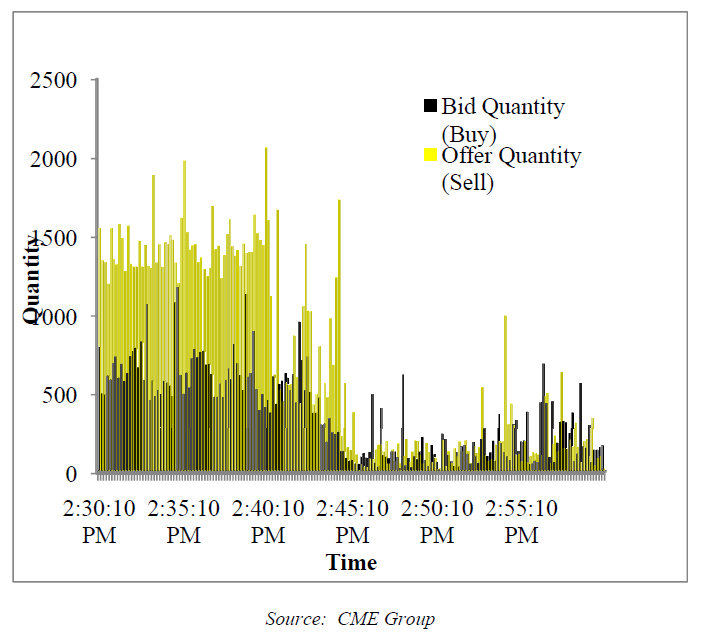

The financial crisis and its enormous costs to society were the direct result of years of deregulation, and they have sounded the alarm for change. The perils of fragmented regulation may also be seen in the May 6th market break — the so-called “flash crash.” This market breakdown and the difficulty in determining how and why it occurred are yet further stark reminders of the dangers of weak oversight of our tightly interconnected financial markets.

“Direct result”? I haven’t seen any proof of that. “[D]ifficulty in determining” the cause of the flash crash? It’s been three weeks, buddy. Note, however, that I will agree that we might never know The Reason. Even as we may never know The Reason why Greek bonds are so cheap when all the politicians have already said everything’s OK.

It is clear that the public is clamoring for significant reform and expects Washington to deliver.(5) Against this backdrop of deregulation and confusion, it is apparent that Wall Street and Main Street are in a tug-of-war to see who wins the legislative debate. This struggle will continue as the House and Senate financial reform bills are reconciled in conference. Throughout this debate, the voices of Main Street investors have been few.

Setting up the debate as Main Street vs. Wall Street is a cheap rhetorical trick – not something I would expect to hear from an SEC Commissioner. His footnote justifying his word “clamoring” is a poll with the question “Do you support or oppose stricter federal regulations on the way [banks and other financial institutions] / [Wall Street firms] conduct their business?” Does he really consider such a poll to be justifiable as a driver of public policy? And I must say, I find it surprising that the public is clamouring for stricter regulation, while at the same time the “voices of Main Street investors have been few”. Which is it?

By contrast, the voices from Wall Street are active, well-organized, well-financed, and extremely well-connected. And they are quick to argue that one proposed reform or another would certainly lead to undesirable effects.6 They argue this even though their powers of foresight failed utterly to anticipate the severity of the financial crisis before they were swept up in it.

More cheap rhetoric. Note that he is claiming that the Credit Crunch proves the financial sector knows nothing about anything, despite the fact that regulators and central banks are heavily implicated.

As with penalties, I think that the SEC has been too often willing to compromise on remedial sanctions because they can be a sticking point in settlement negotiations. Defendants and respondents fight hardest against accepting these sanctions is because they are, in many ways, the most meaningful measures we have to protect investors.

So, Luis? All that means is: Stop Regulatory Extortion. Now. If you think somebody’s done wrong – don’t settle without an admission of guilt.

In the meantime, I consider it a disgrace that such a senior regulator be using such inflammatory language and indulging in such public advocacy. New directions, whatever they might be, are the responsibility of politicians to decide, advised in a judicious and neutral manner of what the effects – and unintended consequences – of proposed changes might be.

I am saddened to see that Queers against Israeli Apartheid has been excluded from the Pride parade:

Pride Toronto’s Board of Directors voted Friday to ban the term from all Pride-related events, Councillor Kyle Rae confirmed.

No one from Pride Toronto would comment Friday, although they said a news conference will be held Tuesday.

The group Queers Against Israeli Apartheid, which has marched in Toronto’s annual Pride parade for the past several years, has angered people who feel the name is discriminatory, anti-Semitic and anti-Israeli.

Discriminatory? Anti-Israeli? So what? Anti-Semitic? Those who feel that criticizing Israel – however wildly, inaccurately or vehemently – is equivalent to anti-Semitism have feelings that simply don’t matter. However, there’s a loop-hole:

“the Pride committee has voted to ban the use of the term Israeli apartheid at all Pride-related events.”

They’ll probably rename themselves “Queers against Israeli Genocide”, or something equally inflammatory.

The disgrace is that this has happened as the result of a bureacratic decision (on the part of city bureaucrats to threaten funding) – there has been no legislative, judicial or quasi-judicial involvement whatsoever. But then, city bureacrats are running amok, about to ban soda pop at arenas and community centers.

All this is going to backfire, the same way official disapproval of pornography fueled the growth of the Internet. You know why Harry Potter (and, to a lesser extent, Twilight) was such a sensational success? It’s because, after a steady diet of politically correct bilge, somebody sat down a wrote a story (and wrote it well, which is the hard part) with villains and conflict. Most kids, I am sure, embarked on the voyage with a suspicion that somewhere along the line Voldemort and Potter would discuss their differences, resolve them, hug and become best friends. And if they had, JK Rowling might well have done well – but not great.

Want to make community centres irrelevant? Simply make them irrelevant to people’s lives and ban soda.

On another day of relatively light volume, PerpetualDiscounts gained 10bp and FixedResets lost 6bp.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.68 % |

2.77 % |

46,156 |

20.62 |

1 |

2.4390 % |

2,063.4 |

| FixedFloater |

5.24 % |

3.31 % |

35,261 |

19.95 |

1 |

0.0000 % |

3,054.0 |

| Floater |

2.18 % |

2.52 % |

101,132 |

20.96 |

3 |

-0.6421 % |

2,226.9 |

| OpRet |

4.89 % |

3.90 % |

98,564 |

1.13 |

11 |

0.3093 % |

2,307.7 |

| SplitShare |

6.43 % |

1.61 % |

113,640 |

0.08 |

2 |

0.1110 % |

2,156.7 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.3093 % |

2,110.2 |

| Perpetual-Premium |

5.54 % |

4.79 % |

23,008 |

15.77 |

1 |

0.0000 % |

1,821.3 |

| Perpetual-Discount |

6.33 % |

6.41 % |

210,664 |

13.34 |

77 |

0.1046 % |

1,690.0 |

| FixedReset |

5.49 % |

4.28 % |

457,044 |

3.66 |

45 |

-0.0629 % |

2,147.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| GWO.PR.M |

Perpetual-Discount |

-1.88 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 22.78

Evaluated at bid price : 22.91

Bid-YTW : 6.48 % |

| TRI.PR.B |

Floater |

-1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 22.45

Evaluated at bid price : 22.71

Bid-YTW : 1.71 % |

| BNS.PR.Y |

FixedReset |

-1.28 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 23.86

Evaluated at bid price : 23.90

Bid-YTW : 3.64 % |

| IGM.PR.B |

Perpetual-Discount |

-1.27 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 22.46

Evaluated at bid price : 22.57

Bid-YTW : 6.62 % |

| BAM.PR.R |

FixedReset |

1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 23.08

Evaluated at bid price : 24.92

Bid-YTW : 4.86 % |

| PWF.PR.K |

Perpetual-Discount |

1.06 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 19.10

Evaluated at bid price : 19.10

Bid-YTW : 6.57 % |

| GWO.PR.I |

Perpetual-Discount |

1.15 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 17.59

Evaluated at bid price : 17.59

Bid-YTW : 6.52 % |

| IAG.PR.F |

Perpetual-Discount |

1.28 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 22.87

Evaluated at bid price : 23.00

Bid-YTW : 6.58 % |

| CM.PR.R |

OpRet |

2.00 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-06-24

Maturity Price : 25.45

Evaluated at bid price : 25.99

Bid-YTW : -16.00 % |

| BAM.PR.E |

Ratchet |

2.44 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 21.67

Evaluated at bid price : 21.00

Bid-YTW : 2.77 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| SLF.PR.G |

FixedReset |

452,345 |

New issue settled today.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 24.18

Evaluated at bid price : 24.22

Bid-YTW : 4.03 % |

| BMO.PR.P |

FixedReset |

113,615 |

Desjardins crossed 100,000 at 26.30.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-03-27

Maturity Price : 25.00

Evaluated at bid price : 26.20

Bid-YTW : 4.28 % |

| RY.PR.X |

FixedReset |

105,972 |

RBC crossed 100,000 at 27.00.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 26.91

Bid-YTW : 4.36 % |

| PWF.PR.D |

OpRet |

65,400 |

RBC crossed 31,700 at 25.66 and another 20,000 at 25.67.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-11-30

Maturity Price : 25.40

Evaluated at bid price : 25.64

Bid-YTW : 3.96 % |

| RY.PR.A |

Perpetual-Discount |

39,389 |

Nesbitt crossed 17,000 at 18.67.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 18.60

Evaluated at bid price : 18.60

Bid-YTW : 6.03 % |

| CM.PR.H |

Perpetual-Discount |

37,362 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-25

Maturity Price : 18.79

Evaluated at bid price : 18.79

Bid-YTW : 6.47 % |

| There were 27 other index-included issues trading in excess of 10,000 shares. |