This post is really late, I know. But I’m catching up slowly!

The Bank of Canada has released the Bank of Canada Review: Summer 2012 with the articles:

- Measurement Bias in the Canadian Consumer Price Index: An Update

- Global Risk Premiums and the Transmission of Monetary Policy

- An Analysis of Indicators of Balance-Sheet Risks at Canadian Financial Institutions

The first article, by Patrick Sabourin, makes the point:

Commodity-substitution bias reflects the fact that, while the weights of items in the CPI basket are held constant for a period of time, a change in relative prices may cause patterns in consumer spending to change. If, for example, the price of chicken were to increase considerably following supply constraints, consumers would likely purchase less chicken and increase their consumption of beef, since the two meats may be perceived as substitutes for each other. The CPI, however, assumes that consumers would continue to purchase the same quantity of chicken following a price change. This means that the measured change in the CPI will overstate the increase in the minimum cost of reaching a given standard of living (i.e., there is a positive bias).

I’ve always had trouble with this concept. I love beef. I despise chicken. As far as I am concerned, there is a separate quality adjustment that must be made that would mitigate, if not completely offset, the substitution adjustment when beef becomes too expensive and I have to eat chicken.

And, I am sure, this occurs for every other possible substitution. Although I might try explaining to my girlfriend that Coach handbags have become too expensive and I will follow theoretically approved procedure and get her, say, a plastic shopping bag for Christmas instead.

The second article, by Gregory H. Bauer and Antonio Diez de los Rios examines the relationship between long- and short-term interest rates:

- An important channel in the transmission of monetary policy is the relationship between the short-term policy rate and long-term interest rates.

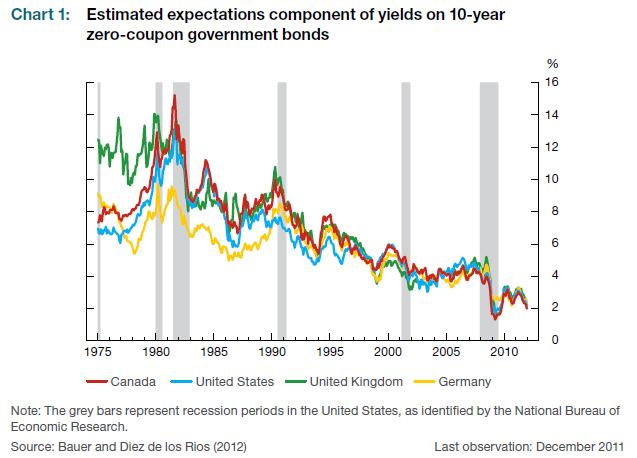

- Using a new term-structure model, we show that the variation in long-term interest rates over time consists of two components: one representing investor expectations of future policy rates, and another reflecting a term-structure risk premium that compensates investors for

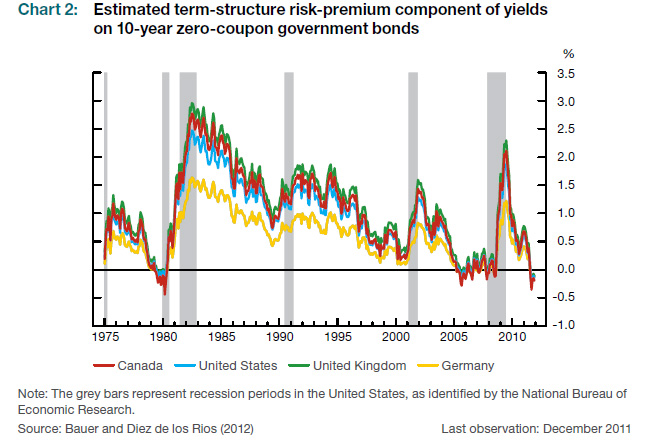

holding a risky asset.- The time variation in the term-structure risk premium is countercyclical and largely determined by global macroeconomic conditions. As a result, long-term rates are pushed up during recessions and down during times of expansion. This is an important phenomenon that central banks need to take into account when using short-term rates as a policy tool.

- We illustrate this phenomenon by showing that the “conundrum” observed in the behaviour of long-term interest rates when U.S. monetary policy was tightened during the 2004–05 period was actually part of a global phenomenon.

In their model:

The long-term rate is decomposed into two terms in the following equation:

…

The first term involves market expectations, that is, the average expected 1-year interest rate over the next 10 years. In our model, we use the 1-year interest rate in country j as a proxy for that country’s policy rate. Observed yields will, on average, equal the expectations component only under the “expectations hypothesis,” which has been statistically rejected in many studies.The rejection of the expectations hypothesis is typically attributed to the existence of the second term in equation (1), a time-varying term-structure risk premium. The risk premium represents the extra compensation that investors require for holding a 10-year bond. In our model, agents hold portfolios for one year, and the prices of long-term bonds may change considerably over that period, necessitating a higher expected rate of return. Several studies have focused on the properties of the term-structure risk premium (see Cochrane and Piazzesi (2005) and their references).

…

The second real-world aspect of the model consists of the constraints placed

on the time-varying risk premium, the second component of equation (1). Previous work has shown that imposing restrictions on the term-structure risk premium makes the forecast values of interest rates more realistic than those in unrestricted models.7 Our model restricts risk premiums on bonds through its assumption of global asset pricing; i.e., in integrated international markets, only global risks carry significant risk premiums. As a result, the term-structure risk premium on any bond is driven by the bond’s exposure to the global level and slope factors only. The local factors, while helping to explain prices at a point in time, do not affect expected returns (i.e., changes in prices), since investors can eliminate their effects by diversifying with a global portfolio.

This effect is evident during the financial crisis of 2007–09. While short-term U.S. rates fell by 263 basis points, long-term U.S. rates decreased by a mere 23 basis points. This occurred because, although the Fed succeeded in lowering expectations of future policy moves by 224 basis points (Table 2), the term-structure risk premium rose by 190 basis points.

…

The analysis in this article demonstrates the extent to which the global term-structure risk premium as well as monetary policy actions influence long-term interest rates. The risk premium is countercyclical to the global business cycle and thus may affect long-term interest rates in the opposite direction to that related to central bank policy actions. As a result, central banks need to take these forces into account in appropriately calibrating their policy response. Indeed, given the current low level of long-term rates, understanding movements in the global risk premium is important for the monetary policy decision-making process.Since monetary policy may affect expectations and the term-structure risk premium differently, the levels of these two components may, in turn, affect the macroeconomy in various ways. For these reasons, understanding the effects on growth and inflation of movements in market expectations and the global term-structure risk premium is an important aim for future research.

The third article, by David Xiao Chen, H. Evren Damar, Hani Soubra and Yaz Terajima, will be of interest to students of Canadian banking and regulation thereof:

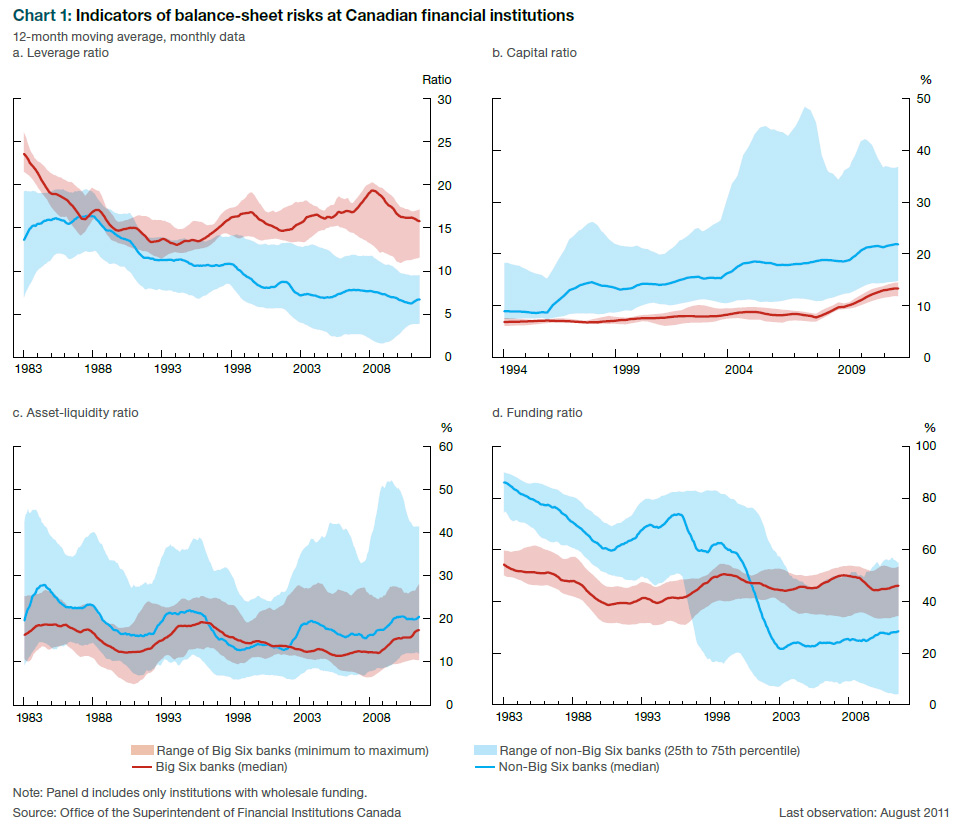

- This article compares different types of Canadian financial institutions by examining over time ratios that are indicators of four balance-sheet risks—leverage, capital, asset liquidity and funding.

- The various risk indicators have decreased during the past three decades for most of the non-Big Six financial institutions in our sample and have remained relatively unchanged for the Big Six banks, resulting in increasing heterogeneity in these indicators of balance-sheet risks.

- The observed overall decline and increased heterogeneity in the risk indicators follow certain regulatory changes, such as the introduction of liquidity guidelines on funding in 1995 and the implementation of bank specific leverage requirements in 2000. This suggests that regulatory changes have had significant and heterogeneous effects on the management of balance sheets by financial institutions and, given that these regulations required more balance-sheet risk management, they contributed to the increased resilience of the banking sector.

Of particular interest is the funding ratio, defined as:

we define a funding ratio as the proportion of a bank’s total assets that are funded by wholesale funding (a relatively less stable funding source than retail (personal) deposits, for example):

Funding ratio (%) = 100 x (Non-personal deposits + repos)/Total assets.

A higher funding ratio indicates that a bank relies on greater market-based funding and is therefore more exposed to adverse shocks in the market that could disrupt continuous funding of its assets.

The Funding Ratio is of great interest due to Moody’s recent highlighting of:

the large Canadian banks’ noteworthy reliance on confidence-sensitive wholesale funding, which is obscured by limited public disclosure, increases their vulnerability to financial markets turmoil.

The BoC paper also highlights the eagerness of the politicians to inflate the housing bubble:

In addition, the growing popularity of mortgage-loan securitization in the late 1990s, following the introduction of the Canada Mortgage Bonds Program, raised the percentage of mortgage loans on bank balance sheets, especially among large and medium-sized financial institutions.(note)

Note reads: Increasing demand for mortgage loans caused by demographic shifts and lower down-payment

requirements has also played a role. See Chen et al. (forthcoming) for more details.

The authors conclude:

This article analyzes the balance-sheet ratios of Canadian financial institutions. Overall, various measures of risk have decreased over the past three decades for most non-Big Six institutions and have remained relatively unchanged for the Big Six banks. We find that smaller institutions, particularly trust and loan companies, generally have lower leverage and higher capital ratios than other types of financial institutions, including the Big Six banks. They also have larger holdings of liquid assets and face lower funding risk compared with other financial institutions. The observed overall decline and increased heterogeneity in risk (as measured by divergent trends in the leverage, capital and asset-liquidity ratios) followed certain regulatory changes, such as the introduction of liquidity guidelines on funding in 1995 (which preceded a sharp decline in, and more dispersion of, funding ratios among non-Big Six institutions) and the implementation of bankspecific leverage requirements in 2000 (which preceded a divergence in leverage ratios between the Big Six and non-Big Six institutions). This suggests that regulatory changes had significant and heterogeneous impacts on the management of balance sheets by financial institutions, resulting in the increased resilience of the banking system. While market discipline may have also played a role, more research is needed to identify changes in the degree of market discipline in the Canadian banking sector.

Given the observed variation in behaviour among Canadian financial institutions, continued analysis of different types of institutions can enable a more comprehensive assessment of financial stability. Understanding the different risks faced by various types of financial institutions improves the framework that the Bank of Canada uses to monitor developments of potential risks in the banking sector.

The statement that “This suggests that regulatory changes had significant and heterogeneous impacts on the management of balance sheets by financial institutions, resulting in the increased resilience of the banking system.” strikes me as being a little bit fishy. Regulatory change did indeed have “significant and heterogeneous impacts on the management of balance sheets by financial institutions”, but whether this resulted “in the increased resilience of the banking system.” has not been addressed in the paper. That was the intention, certainly, and may well be true, but a cause and effect relationship has not been demonstrated.