Richard Morrison of the Financial Post wrote a piece titled Preferred shares an attractive alternative to bonds, stocks that featured a number of quotes from me. It was published in Saturday’s Financial Post with the title “Gentlemen prefer preferreds”.

Archive for the ‘Press Clippings’ Category

Preferred shares an attractive alternative to bonds, stocks

Monday, October 29th, 2012Press: A New Direction for Fixed-Income Investing

Thursday, October 11th, 2012Noreen Rasbach of the Globe and Mail was kind enough to quote me yesterday in a story titled A new direction for fixed-income investing:

The huge benefit to investing in preferred shares is their tax advantage, according to James Hymas, president of Toronto-based Hymas Investment Management Inc. and a preferred-shares expert.

“The great distinction between preferred shares and long-term corporate bonds is that preferred shares give you entitlement to the dividend tax credit – which for most people has the effect of multiplying your return by a factor of about 1.3.”

Investors who want to take advantage of the dividend tax credit need to hold their preferred shares in a taxable account, not an RRSP.

Preferred shares provide holders with a dividend and a stated dollar value per share when it is redeemed by the company. The prices of the shares trade up and down.

Often, Mr. Hymas said, investors are attracted by a high yield and buy preferred shares, and a short time later the issue is called for redemption at a far lower price than they paid for it – “and they end up with a very poor return or even losing money.”

PrefInfo.com Attracts Praise

Friday, September 14th, 2012I am pleased to report that PrefInfo.com has been included in Rob Carrick’s list of 13 websites that can make you a better investor:

PrefInfo.com

Clearly, preferred shares have some appeal right now because of their comparatively high yields. Problem is, they can be a trap for investors who aren’t wise to their many terms and conditions. PrefInfo, maintained by the preferred share specialist James Hymas, is like an online catalogue of preferred share issues that contains pertinent details like the annual dividend amount, maturity and retraction dates, and more.

Some of the entries include hyperlinks to posts from Mr. Hyman’s PrefBlog, where he keeps a running commentary on the preferred share market.

Financial Post Best Pictures of February 2012

Saturday, March 10th, 2012

Sat at the window and sewed.

She cried, “Look! who’s that handsome man?”

They answered, “Mr. Toad.”

Desperately Seeking Value

Wednesday, February 22nd, 2012Andrew Allentuck was kind enough to both me and Malachite Aggressive Preferred Fund in his Financial Post article today, Desperately Seeking Value:

Some managers add value to market returns. James Hymas’s Toronto-based Malachite Aggressive Preferred Fund, for example, produced a 14.8% average annual gain for the five years ended Jan. 31, 2012 vs. the 4.15% average annual gain of its benchmark, the BMO Capital Markets 50 Index.

His fees, which start at 1.34% of net asset value and drop as amounts invested grow, are below average.

.His style is the rigorous fundamental analysis used for fixed income assets – balance sheets, study of corporate capital structure, and a good deal of what one might call iconoclastic beliefs in the market. His territory, preferred shares, is usually ignored by other managers. But his returns show that a maverick manager who does not follow the market can perform well for clients.

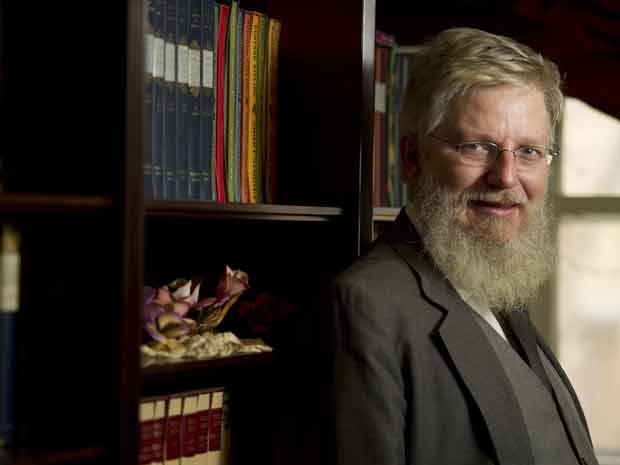

There’s a rather good picture of me with the article:

Those who are fixated on the phrase produced a 14.8% average annual gain for the five years ended Jan. 31, 2012 vs. the 4.15% average annual gain of its benchmark are reminded that the five year period to 2012-1-31 included the Credit Crunch, when market conditions were perfect for my investment style. While I certainly hope to continue delivering performance that earns my fee, I do not expect to see such ideal conditions ever again. See Annualized Performance to Fourth Quarter for a good historical overview.

Update: The on-line version posted on canada.com has the picture that was printed in the paper:

An Investment that Never Stops Paying You

Friday, January 20th, 2012Rob Carrick was kind enough to quote me in his piece An Investment that Never Stops Paying You:

Think of a perpetual preferred like a corporate bond with no fixed maturity date. Other types of preferred shares have set dates when the issuing company will redeem them at the issue price, usually $25. “Perpetuals could be paying out that dividend as long as you live,” said James Hymas president of Hymas Investment Management and an expert on preferred shares.

One reason why Mr. Hymas likes insurance company perpetuals right now is that they offer a high-yielding and relatively secure flow of dividend income. Preferred shares issued by Sun Life, Manulife and Great-West Lifeco are investment grade, although Standard & Poor’s has Sun Life on negative credit watch. Investment grade means a low probability of default.

Mr. Hymas also sees an opportunity to buy insurance company perpetual preferreds now and benefit from possible rule changes by regulators concerning the financial structure of this sector. Banks have already been subjected to these changes, which largely eliminate the attractiveness for them of raising money by issuing preferred shares. As a result, it’s widely expected banks will gradually redeem their preferred shares over the next decade, including perpetuals.

…

As far as Sun Life goes, there’s also the worry of a reduction in the common share dividend. Truth is, cutting the amount of cash paid out to common shareholders helps ensure there’s enough money to pay preferred shareholders. But Mr. Hymas said holders of the preferred shares should still expect some turbulence.“People see a dividend cut and they instantly assume the preferred shares will be affected,” he said. “Typically, what will happen is that there will be a period – six months to a year – where the preferreds are depressed.”

Are Preferred Shares A Good Buy?

Friday, November 11th, 2011David Aston was kind enough to quote me in his Moneysense piece Are preferred shares a good buy?:

Third, before taxes, the yields on preferred shares tend to be pretty similar to those of long-term bonds for the same company, says preferred shares expert James Hymas, president of Hymas Investment Management in Toronto. Even though they’re not as reliable as the company’s bonds, they give you about the same before-tax yield. So if you’re investing inside a TFSA or RRSP where taxes don’t matter, go with the bonds.

Fourth—and this is their key advantage—the dividends on Canadian preferred shares get the same highly advantageous tax treatment as dividends on Canadian common shares. So they generally beat bonds hands-down when held in non-registered accounts, where taxes matter. In fact, as a rule of thumb, a bond has to generate about 1.3 times the before-tax yield in order to end up with the same after-tax income compared to a preferred share, says Hymas.

[This post was written 2012-2-6, but backdated to the Moneysense publication date, 2011-11-25)

The Brightest Spots in the Market Gloom

Saturday, October 8th, 2011Rob Carrick was kind enough to quote me in his piece The Brightest Spots in the Market Gloom:

“In 2008, there was widespread fear that the global financial system was breaking down,” said James Hymas, president of Hymas Investment Management and an expert on preferred shares. As much as there’s reason to worry about a global economic slowdown and the debt problems of some countries, “we’re very definitely not in the state of panic we were three years ago.”

…

High yields are also a factor in the strength of the preferred share market lately. The dividend yield on the S&P/TSX preferred share index as of late this week was 5.3 per cent. Mr. Hymas, the preferred share specialist, said that’s substantially more than you can get from corporate bonds, which themselves are a step up in yield from government bonds. “There’s a great number of investors whose portfolio could use a few preferreds in them,” Mr. Hymas said.The big difference in the preferred share market between today and 2008? Mr. Hymas said it’s that investors aren’t questioning the stability of the banking system this time around. The preferred share market in Canada is 80-per-cent exposed to banks and insurance companies, all of which were treated as toxic in the 2008-09 crash.

James Hymas Quoted in Winnipeg Free Press

Saturday, August 27th, 2011Joel Schlesinger of the Winnipeg Free Press was kind enough to quote me in a piece titled Roller-coaster times, published 2011-8-20:

Surprisingly, the rating agencies still have enough authority to give markets a good shake as S&P demonstrated, recently downgrading U.S. debt from AAA, its highest rating, to AA+, the second highest credit rating.

The downgrade really means nothing in terms of default risk, says James Hymas, president of Hymas Investment Management, Inc., a Toronto-based fixed income investment firm.

“The chance of default has increased from 0.01 per cent to 0.015 per cent,” he says. “The difference between AAA and AA+ is something that’s more a matter of perception than something that can actually be measured.”

Call it a shot across the bow of U.S. lawmakers.

…

The U.S. debt downgrade was only a side dish to the main course of financial worries that have driven markets over the past few weeks, Hymas says.“The real story was the debt crisis in Europe with the European Central Bank starting purchases of Spanish and Italian bonds,” he says. “That had the effect of forcing people to focus their attention on the bond portfolios and to a large extent they decided that Europe was getting too risky for them and they wanted to hold the U.S. debt.”

…

At the moment, the market is selling these bonds, not buying them. European banks and other large investors have these bonds on their books and want to unload them. The ECB is stepping in to buy up the unwanted bonds to help stabilize the European banks because just the prospect of default on Spanish and Italian bonds affects their ability to do business, Hymas says.“A big piece of the puzzle is liquidity because a bank keeps a liquid reserve of investments and in the course of its business it might need to borrow $100 million for a short term and it might want those bonds as collateral to get a loan from another institution,” he says.

“The trouble is, what if you own Greek bonds, for instance, and your usual counterparties aren’t accepting those as collateral?”

And liquidity is important to banks. Greek bond defaults are one thing, but default worries about Italy and Spain’s bonds — much larger fish — are another. If financial institutions become worried enough about one another’s investment books, liquidity in markets can dry up — as we saw in 2008.

But Hymas says while the problems are real, they don’t necessarily lead to a major calamity until there’s a major shift in perception all at once. It’s a ‘Wile E. Coyote moment’ — to quote New York Times financial columnist and economist Paul Krugman.

“You’ll remember from the cartoons that Wile E. Coyote is always running off cliffs, but he doesn’t start falling until he looks down,” he says. “The way crises finally come to light is when investors as a group suddenly look down.”

Arguably, we have been having those moments every other day in the markets of late, Hymas says. This has led to volatility in both the bond and stock markets.

“We have this daily risk on and risk off in the marketplace,” Graham says.

Stock indices can be up 500 points one day — the risk is on — and down 400 points the next — the risk is off.

Why only millionaires should invest in bonds directly

Wednesday, July 6th, 2011John Heinzl was kind enough to quote me in his Investors’ Clinic column titled Why only millionaires should invest in bonds directly:

Now, it’s true that bond ETFs typically roll over holdings one year before they mature, because at this point these securities are considered money-market instruments. But in an environment of rising interest rates, a bond ETF that follows a sell-before-maturity policy would buy new, higher-coupon bonds sooner than an identical portfolio of bonds that held to maturity, and the higher income would make up for any capital loss incurred as a result of selling early, said James Hymas, a fixed-income expert and president of Hymas Investment Management.

Bond ETFs have several advantages, he points out. Because ETFs buy in volume, they get much better pricing than retail investors could obtain through their broker, and this pricing advantage for most ETFs will outweigh the management expense ratio. Bond ETFs also provide instant diversification. The notion that bond ETFs don’t mature and should therefore be avoided makes no sense, he said.

“Anybody investing less than $1-million in bonds should do it through ETFs,” Mr. Hymas said. “If you have more than $1-million, then you can talk about buying individual issues, but if you have less than $1-million you’re either going to have poor diversification or poor pricing, perhaps both.”

The Globe’s website shows one comment worth addressing:

I disagree entirely. A bond costs $5K to buy and nothing to hold. For 70K you can set up a 7 year ladder with one bond maturing every 6 months. You hold every bond until it matures, reinvesting each matured bond with all the accumulated interest in the account in a new 7 year bond. When you retire you can use the interest payments as income if you like. You will earn the same as a second OAP, without the clawback.

If you don’t have 70K yet, you buy one $5K 7 year bond every 6 months for the next 7 years to set up.

It is not rocket science, I have been doing it for 15 years. The pros like Hymas hate it because, apart from the small fee when you buy a bond, you pay no fees at all.

A Bond ETF will have a management expense ratio of 25-35bp. The bid-offer spread on seven year bonds purchased in amount of $5,000 will almost certainly exceed this. Additionally, there will be costs associated with further trading, unless you spend amounts exactly equal to your coupon income.

Another commenter suggested:

It is certainly possible to create your own bond ladder as you describe, and there are benefits to that. But the costs are also hidden by the lack of transparency and liquidity in the smaller denominations. Perhaps $1M is overkill, but probably $25,000 is a practical trade-off between price/cost and yield.

I just checked a broker screen and spreads on medium-term corporates are about 35bp for quantities of $1,000. Sorry – I don’t know precisely where the price breaks are, or how much better pricing is at the 25,000 level.

I suggested $1-million because then you can buy 20 bonds in lots of $50,000. The ETF also has the advantage of greater liquidity, as well as freeing you from the tender mercies of your custodial broker’s bond desk should you need to sell, which are often not very tender.

Additionally, note that most retail bond desks will make only a very limited number of names available to investors – proper diversification of a bond portfolio will always be very difficult for retail, even those who do have $1-million.

For more on this theme – which addresses in more detail the ladder / ETF decision – see my March 2010 publication from the Advisors’ Edge Report.

Update, 2011-7-8: One commenter made an excellent point:

And have you ever tried to sell a bond? Sure, if you’ve laddered everything nicely you shouldn’t need to. But sometimes $hit happens and you need money unexpectedly. I’ve tried twice, once through W’house, once through e-trade. It took them days to get back to me with a (horrible) price, by which time I’d raised cash elsewhere. If you’re buying bonds directly, be really, really sure you’ll hold them to maturity.

One common theme in the comment is the view that holding bonds directly is better because “Transaction fees and the spread are a one time cost whereas the MER is forever.” In fact, transaction fees and the spread are a recurring cost, paid anew every time you roll a rung of the ladder. And, as stated in my post above, the spread for medium term corporates in small quantities at one broker is about 35bp per annum – when you express the spread as a difference in yield.

Update, 2011-7-7: See also discussion at Financial Webring Forum.