Andrew Allentuck was kind enough to both me and Malachite Aggressive Preferred Fund in his Financial Post article today, Desperately Seeking Value:

Some managers add value to market returns. James Hymas’s Toronto-based Malachite Aggressive Preferred Fund, for example, produced a 14.8% average annual gain for the five years ended Jan. 31, 2012 vs. the 4.15% average annual gain of its benchmark, the BMO Capital Markets 50 Index.

His fees, which start at 1.34% of net asset value and drop as amounts invested grow, are below average.

.His style is the rigorous fundamental analysis used for fixed income assets – balance sheets, study of corporate capital structure, and a good deal of what one might call iconoclastic beliefs in the market. His territory, preferred shares, is usually ignored by other managers. But his returns show that a maverick manager who does not follow the market can perform well for clients.

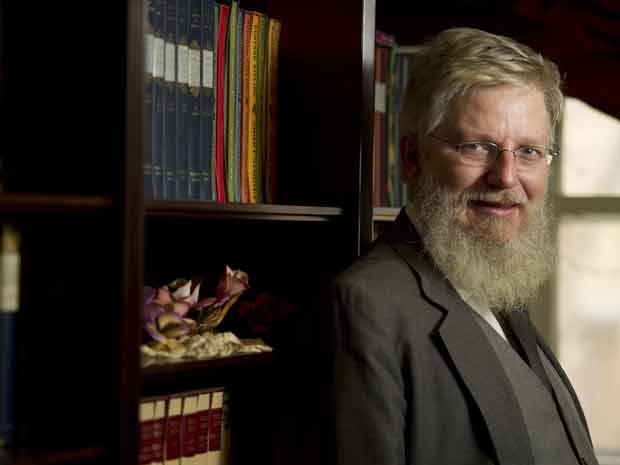

There’s a rather good picture of me with the article:

Those who are fixated on the phrase produced a 14.8% average annual gain for the five years ended Jan. 31, 2012 vs. the 4.15% average annual gain of its benchmark are reminded that the five year period to 2012-1-31 included the Credit Crunch, when market conditions were perfect for my investment style. While I certainly hope to continue delivering performance that earns my fee, I do not expect to see such ideal conditions ever again. See Annualized Performance to Fourth Quarter for a good historical overview.

Update: The on-line version posted on canada.com has the picture that was printed in the paper:

This nice decor is worthy of the filmmaking of an Agatha Christie novel.

Hopefully with fewer corpses! I mean, gee whiz!