Assiduous Readers will recall the post on the Assets to Capital Multiple and my correspondence with Royal Bank’s Investor Relations department:

Well! This is interesting! According to these very, very rough calculations, RBC has an Assets-to-Capital multiple of 23.3:1, which is both over the limit and well above its competitors. This may be a transient thing … there was a jump in assets in the first quarter:

RBC: Change in Assets

From 4Q07 to 1Q08 |

| Item |

Change ($-billion) |

| Securities |

+6 |

| Repos |

+12 |

| Loans |

+8 |

| Derivatives |

+7 |

| Total |

+33 |

I have sent the following message to RBC via their Investor Relations Page:

I would appreciate learning your Assets-to-Capital multiple (as defined by OSFI) as of the end of the first quarter, 2008, and any detail you can provide regarding its calculation.

I have derived a very rough estimate of 23.3:1, based on total assets of 632,761 and total regulatory capital of 27,113

Update, 2008-04-17: RBC has responded:

Thank you for your question about our assets to capital multiple (ACM). In keeping with prior quarter-end practice, we did not disclose our ACM in Q1/08 but were well within the OSFI minimum requirement. Our ACM is disclosed on a quarterly basis (with a 6-7 week lag) on OSFI’s website. We understand this should be available over the next few days. Below is an excerpt from the OSFI guidelines outlining the calculation of the ACM. We hope this helps.

The supplied excerpt from the guidelines was:

From OSFI Capital Adequacy Requirements (No. A-1)

1.2. The assets to capital multiple

Institutions are expected to meet an assets to capital multiple test. The assets to capital multiple is calculated by dividing the institution’s total assets, including specified off-balance sheet items, by the sum of its adjusted net tier 1 capital and adjusted tier 2 capital as defined in section 2.5 of this guideline. All items that are deducted from capital are excluded from total assets. Tier 3 capital is excluded from the test.

Off-balance sheet items for this test are direct credit substitutes1, including letters of credit and guarantees, transaction-related contingencies, trade-related contingencies and sale and repurchase agreements, as described in chapter 3. These are included at their notional principal amount. In the case of derivative contracts, where institutions have legally binding netting agreements (meeting the criteria established in chapter 3, Netting of Forwards, Swaps, Purchased Options and Other Similar Derivatives) the resulting on-balance sheet amounts can be netted for the purpose of calculating the assets to capital multiple.

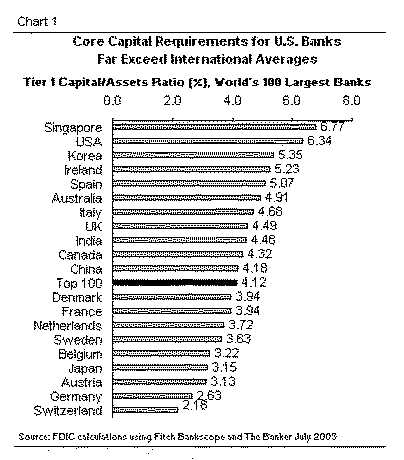

Under this test, total assets should be no greater than 20 times capital, although this multiple can be exceeded with the Superintendent’s prior approval to an amount no greater than 23 times. Alternatively, the Superintendent may prescribe a lower multiple. In setting the assets to capital multiple for individual institutions, the Superintendent will consider such factors as operating and management experience, strength of parent, earnings, diversification of assets, type of assets and appetite for risk.

1. When an institution, acting as an agent in a securities lending transaction, provides a guarantee to its client, the guarantee does not have to be included as a direct credit substitute for the assets to capital multiple if the agent complies with the collateral requirements of Guideline B-4, Securities Lending.

I’ve been checking the OSFI disclosures page fairly regularly and today was rewarded with the actual data. As of 1Q08, Royal Bank had:

| RY Capital Adequacy, 1Q08 |

| Tier 1 Ratio |

9.77% |

| Total Ratio |

11.24% |

| Assets to Capital Multiple |

22.05 |

Well! Here’s a howdy-do! I’ve been puzzling for some time as to how my approximate calculation could be so different from the sub-20 multiple that I assumed was actually reported! I’m glad to see that backs of envelopes still serve some purpose.

I have sent the following query to Royal’s Investor Relations department:

Sirs,

I am most interested to learn that your ACM was 22.05 as of 1Q08.

When did you seek approval from OSFI to exceed 20.0, and what was the rationale for exceeding the normal guideline?

Sincerely,

Incidentally … PrefBlog’s Scary Number Department recommends a glance at the “BCAR Derivative Components” figure. RY has nearly 3.4-trillion in interest-rate swaps outstanding and nearly 414-billion in credit swaps. The total notional for all derivatives is about 5.3-trillion.

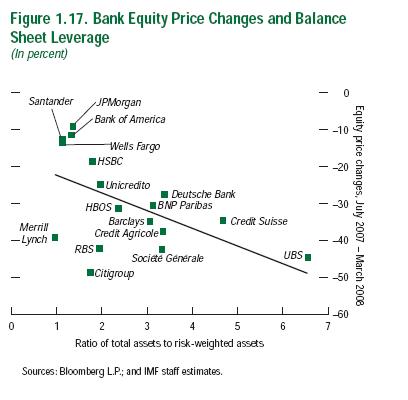

Given that RY’s Total Capital Ratio (based on Risk Weighted Assets) is close to that of the other banks, the implication is that RY has greater total exposure with a small average risk weight. I’ll try to have a look at this shortly.

Update: I have also sent an inquiry to OSFI:

I was most interested to learn that Royal Bank had an Assets-to-Capital ratio of 22.05 as of the 1Q08 filing.

It is my understanding that the general maximum allowed by OSFI for this ratio is 20.0, which may be increased to 23.0 upon prior application to the Superintendant.

Is this correct? If so, then:

(a) When did Royal Bank apply to have the maximum increased?

(b) On what grounds did the Superintendant allow the increase?

(c) Were any terms, conditions, or time limits attached to the approval?

Sincerely,

Update, 2008-6-5: I have not received a response from RY Investor Relations. I have received a reply from OSFI:

Thank you for your e-mail of May 26, 2008, concerning the assets to capital ratio for banks.

You are correct that under the assets to capital test, total assets should be no greater than 20 times capital, although this multiple can be exceeded with the Superintendent’s prior approval to an amount no greater than 23 times. Further information on this ratio can be found in Section 1.2 of the Capital Adequacy Guideline (http://www.osfi-bsif.gc.ca/app/DocRepository/1/eng/guidelines/

capital/guidelines/CAR_A_e.pdf).

In response to the second part of your enquiry, you may wish to note that pursuant to section 22 of the Office of the Superintendent of Financial Institutions Act, any information that is obtained by the Superintendent regarding the business or affairs of a federally regulated financial institution (FRFI), or regarding persons dealing with the FRFI, or any person acting under the direction of the Superintendent, is to be treated as confidential and may not be disclosed to a third party.

Thank you for taking the time to write to this Office with your questions.