A post today in Econbrowswer (which in turn was tipped by Calculated Risk) alerted me to a new Fed study: Understanding the Securitization of Subprime Mortgage Credit, which on first examination looks excellent.

I will admit that I have not thoroughly read the paper – I dare say it probably also took the authors more than an afternoon to research and write it – but I have had a look at some of the things that matter to me.

The authors identify seven frictions involved in the securitization process; number six – and a suggestion for mitigation – is:

Frictions between the asset manager and investor: Principal-agent [2.1.6]

- The investor provides the funding for the MBS purchase but is typically not financially sophisticated enough to formulate an investment strategy, conduct due diligence on potential investments, and find the best price for trades. This service is provided by an asset manager (agent) who may not invest sufficient effort on behalf of the investor (principal).

- Resolution: investment mandates and the evaluation of manager performance relative to a peer group or benchmark

This is one of the five that they highlight as causing the subprime crisis; they note:

Friction #6: Existing investment mandates do not adequately distinguish between structured and corporate ratings. Asset managers had an incentive to reach for yield by purchasing structured debt issues with the same credit rating but higher coupons as corporate debt issues.

[footnote] The fact that the market demands a higher yield for similarly rated structured products than for straight corporate bonds ought to provide a clue to the potential of higher risk.

I’m a bit confused by their footnote. Yes, there is an incentive to reach for yield; but the fact that “the market demands a higher yield for similarly rated structured products” implies that there are some managers who do not reach for yield – for one reason or another. If there weren’t, then yields for instruments of the same rating and term would be identical.

It is very tempting to think of the markets as being homogeneous – the market says this and the market says that. While there is some reason to believe that “the market” is a good predictor – whether of investment returns or election results (except in the New Hampshire primary!) – one must always remember that the market is heterogeneous and some players are better than others.

I will also note an eighth friction that is not mentioned by the authors; this is index-inclusion friction. I do not believe that this was a factor in the subprime fiasco; as the authors note:

Note that the Lehman Aggregate Index has a weight of less than one percent on non-agency MBS.

However, this kind of thing is indeed an issue. Canadian bond indices, for instance, include the banks’ Innovative Tier 1 Capital – and these things simply aren’t bonds! However – they’re included in the index. So, to the extent that a manager exercises his discretion and does not include them in a bond portfolio, he is mis-matching his portfolio. I noted early last year that quality spreads between tiers of bank paper were awfully skinny … but there are still spreads!

If I’m matched against the index and do not hold Tier 1 paper, I’m giving up yield due to my fear and – in 99 years out of 100 – I will underperform the average idiot who sees the chance to buy Royal Bank paper at a spread to other Royal Bank paper and buys the Tier 1 crap to pick up and extra 15bp. This is something James Hamilton of Econbrowser continually – and with good reason – harps on:

But who would be so foolish to have invested hundreds of billions of dollars in extra risky assets with negative expected returns? The logical answer would appear to be– someone who did not understand that they were accepting this risk.

Which brings us to the highly interesting Table 34 in section 6.1 of the report, which shows that:

the share of non-agency MBS in the total fixed-income portfolio increased from 12% (245/2022) in 2005 to 34% (740/2179) in 2006. In other words, the pension fund almost tripled its exposure to non-agency MBS. Further, note that this increase in exposure to risky MBS was at the expense of exposure to MBS backed by full faith and credit of the United States government, or an agency or instrumentality thereof, which dropped from $489.6 million to $58.9 million.

I’ll note that I don’t understand this “full faith and credit” stuff. Agency MBS are not explicitly guaranteed by the US treasury – which, again, James Hamilton has harped on:

Frame and Scott (2007) report that U.S. depository institutions face a 4% capital-to-assets requirement for mortgages held outright but only a 1.6% requirement for AA-rated mortgage-backed securities, which seems to me to reflect the (in my opinion mistaken) assumption that cross-sectional heterogeneity is currently the principal source of risk for mortgage repayment. Perhaps it’s also awkward for the Fed to declare that agency debt is riskier than Treasury debt and yet treat the two as equivalent for so many purposes.

Technically, I suppose, the authors may justify their “full faith and credit” stance with an insistence that they are talking about the full faith and credit of the GSEs … but somehow, I have the feeling that IF Fannie and Freddie go bust and IF they are not bailed out by Congress and IF large losses are experienced by investors in this paper, then the I-told-ya-so crowd will be the first to cast aspersions at portfolio managers who paid treasury prices for agency paper.

The portfolio managers discussed by Ashcraft & Schuermann made a decision that non-agency MBS were better, on a risk-reward basis, than agency MBS. It is very easy to say that the fact that this has not turned out very well so far proves that the portfolio managers were naive – but this is the sort of assessment that active portfolio managers are called upon to make as a matter of routine. Rather than focussing on this particular instance where … er … things don’t seem to have turned out so well, it would be much better to examine the portfolio management performance over a long history of such decisions and determine the manager’s skill from these data.

In fact, the authors do look at managers, fees and performance:

In 2006, the fund’s assets were 100% managed by external investment managers. The fixed income group is comprised of eight asset managers who collectively have over $2.2 trillion in assets under management (AUM). They are (with AUM in parentheses):

- JPMorgan Investment Advisors, Inc. ($1.1 trillion, 2006)

- Lehman Brothers Asset Management ($225 billion, 2006)

- Bridgewater Associates ($165 billion, 2006)

- Loomis Sayles & Company, LP ($115 billion, 2006)

- MacKay Shields LLC ($40 billion, 2006)

- Prima Capital Advisors, LLC ($1.8 billion, 2006)

- Quadrant Real Estate Advisors LLC ($2.7 billion, 2006)

- Western Asset Management ($598 billion, 2007)

The 2005 performance audit of this fund suggested that investment managers in the core fixed income portfolio are compensated 16.3 basis points. The fund paid these investment managers approximately $1.304 million in 2006 in order to manage an $800 million portfolio of investment-grade fixed-income securities. While the 2006 financial statement reports that these managers out-performed the benchmark index by 26 basis points (= 459 – 433), this was accomplished in part through a significant reallocation of the portfolio from relatively safe to relatively risk non-agency mortgage-backed securities. One might note that after adjusting for the compensation of asset managers, this aggressive strategy netted the pension fund only 10 basis points of extra yield relative to the benchmark index, for about $2.1 million.

Look at all those name-brand asset managers with 12-figure AUMs! One wonders what the long-term performance of these managers is; and particularly, how this performance was achieved. I should also point out that I know for a fact that working for a name-brand company is not particularly well correlated with investment management skill – quite the opposite, in my experience.

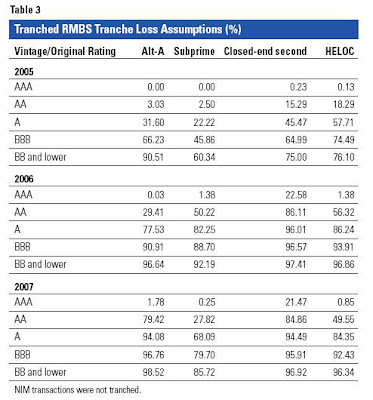

Update: Oh, and another thing! The researchers gleefully imply the portfolio managers in question are dumb yumps who ignorantly reached for yield, but do not provide a lot of details. According to Table 34, all – every single dollar’s worth – of the non-agency MBS was rated A- or better; no further details are given. Given the nature of the market, the nature of the managers and the nature of the investor, I will bet a nickel that the lion’s share (if not all) of this paper is comprised of AAA tranches.

These have taken a price thumping in the past year, but credit quality – as far as I can tell – of the AAA tranches remains pretty good. Maybe not AAA, but not junk, either. It will be most interesting to learn what the ultimate return on this paper is, if held to maturity.

I’ll tell you a little story, for instance. I’m involved with a real-money account that holds about $750,000 worth of paper issued by a subsidiary of, and ultimately guaranteed by, a major US-based financial firm. I tried to sell it … couldn’t get a bid.

Couldn’t. Even. Get. A. Damned. Bid.

So … for now, anyway, the client’s going to hold it. It’s still good quality paper. More liquid paper with the same guarantor trades around 6%.

What price should this paper be marked at? Am I an idiot for recommending its purchase last year? If it matures at par, do I then become a genius?

Update, 2008-01-12: Out of the kindness of my heart, I’m going to suggest another topic for a Master’s thesis. Here’s what I want you to do … get bond prices for an enormous variety of corporates (the index prepararers would be a good place to get these data) and slice it up into tranches based on yield and term. So now you’ve got a variety of market-based yield groups … say number 1 is “4.5-5.5 year term, 5.00% to 5.25% yield” and so on.

Now what I want you to do is follow each tranche to maturity and determine its total return over the period.

The questions are: (i) Do ex-ante yields predict ex-post returns?

(ii) Do these results tie in with other work that seeks to analyze bond yields in terms of risk-free rate, liquidity and default risk? The Bank of England has published some of the results of such work, but (a) they’re more interested in junk credits, and (b) I haven’t seen their source data, or (I am ashamed to admit) thoroughly read their source documents.

(iii) How risky is liquidity risk? This is the interesting part. I contend that most investors, particularly pension funds, are way more liquid than they have to be, in large part due to the way in which actuarial work is done, with all the liabilities being discounted at the long bond yield. To move the critical point to an extreme, consider a bond with a thirty-year term that cannot be sold (don’t laugh! The Canada Pension Plan used to be invested in these things!). Isn’t such a bond simply an equity with a poor return?

(iv) If investment mandates call for a given proportion of bonds, should there be elaboration of the liquidity requirement? Let us make some assumptions about the portfolio discussed above: (a) the non-agency paper, due to credit enhancements, is perfectly good from a credit standpoint, and (b) the ex-ante liquidity premium will be captured, 100% on maturity, and (c) the paper, ex-post, is way less liquid than the ex-ante assumption. In such a case, the investment returns of the portfolio will exceed the benchmark for the period of the investment. However, there will have been more interim risk. Is there a good way to describe this?

Update, 2008-2-7: Discussion with a reader has clarified a better way of expressing part of the above (2008-1-12 Update) idea: use the Moody’s Implied Ratings to compute GINI coefficients at industry-standard time-horizons. Also, check the volatility of the these ratings. Moody’s may have already done this … I really don’t know.

Anyway, I’ll bet a nickel that Moody’s assigned ratings are better than Moody’s implied ratings under these two metrics.

Update, 2008-2-8: Further discussion and thought! The idea that yield spreads are well-correlated with credit risk has been examined by the Cleveland Fed, with the idea that bank supervision would be improved if every bank had at least one sub-debt issue that would trade in the market, providing information to the Fed. According to the Cleveland Fed, this is not yet a reliable measure.

On the other hand, one would (well … could!) expect faster and more predictable refinancing for subprime-ARMs relative to “normal” prime mortgages, with everybody trying to refinance as soon as the teaser rate expired. This would lead to more predictable cash flows and less negative convexity for these instruments, which should imply a lower required yield, which would be REALLY hard to pick apart from the credit risk.