The fund outperformed in November, due largely to stellar performance by the insurance-sector DeemedRetractibles with an assist from BNA.PR.C. DeemedRetractibles as a group outperformed FixedResets, +68bp vs. +5bp respectively.

The fund’s Net Asset Value per Unit as of the close November 30, 2012, was 10.8469.

| Returns to November 30, 2012 |

| Period |

MAPF |

BMO-CM “50” Index |

TXPR

Total Return |

CPD

according to

Blackrock |

| One Month |

+0.83% |

+0.27% |

+0.18% |

+0.09% |

| Three Months |

+2.70% |

+1.04% |

+0.86% |

+0.67% |

| One Year |

+12.55% |

+6.09% |

+5.94% |

+5.31% |

| Two Years (annualized) |

+6.39% |

+6.14% |

+5.14% |

N/A |

| Three Years (annualized) |

+10.29% |

+8.16% |

+6.71% |

+5.93% |

| Four Years (annualized) |

+26.63% |

+14.33% |

+12.86% |

N/A |

| Five Years (annualized) |

+17.16% |

+6.20% |

+4.94% |

+4.26% |

| Six Years (annualized) |

+13.14% |

+3.96% |

|

|

| Seven Years (annualized) |

+12.18% |

+4.02% |

|

|

| Eight Years (annualized) |

+11.44% |

+4.11% |

|

|

| Nine Years (annualized) |

+11.82% |

+4.33% |

|

|

| Ten Years (annualized) |

+13.57% |

+4.66% |

|

|

| Eleven Years (annualized) |

+12.10% |

+4.47% |

|

|

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. |

| CPD Returns are for the NAV and are after all fees and expenses. |

| * CPD does not directly report its two- or four-year returns. |

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.09%, +1.10% and +5.84%, respectively, according to Morningstar after all fees & expenses. Three year performance is +6.91%; five year is +5.14% |

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are -0.02%, +0.48% and +2.65% respectively, according to Morningstar. Three Year performance is +4.02% |

| Figures for Manulife Preferred Income Fund (formerly AIC Preferred Income Fund) (which are after all fees and expenses) for 1-, 3- and 12-months are +0.17%, +0.83% & +5.27%, respectively. Three Year performance is +5.14% |

| Figures for Horizons AlphaPro Preferred Share ETF (which are after all fees and expenses) for 1-, 3- and 12-months are +0.56%, +1.86% & +7.67%, respectively. |

| Figures for Altamira Preferred Equity Fund are not yet available. |

| Figures for BMO S&P/TSX Laddered Preferred Share Index ETF are not yet available. |

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

A problem that has bedevilled the market over the past year has been the OSFI decision not to grandfather Straight Perpetuals as Tier 1 bank capital, and their continued foot-dragging regarding a decision on insurer Straight Perpetuals has segmented the market to the point where trading has become much more difficult. The fund has done well by trading between GWO issues, which have a good range of annual coupons, but is “stuck” in the MFC and SLF issues, which have a much narrower range of coupon, while the IAG DeemedRetractibles are quite illiquid. Until the market became so grossly segmented, this was not so much of a problem – but now banks are not available to swap into (because they are so expensive) and non-regulated companies are likewise deprecated (because they are not DeemedRetractibles; they should not participate in the increase in value that will follow the OSFI decision I anticipate). The fund’s portfolio is, in effect ‘locked in’ to the MFC & SLF issues due to projected gains from a future OSFI decision, to the detriment of trading gains.

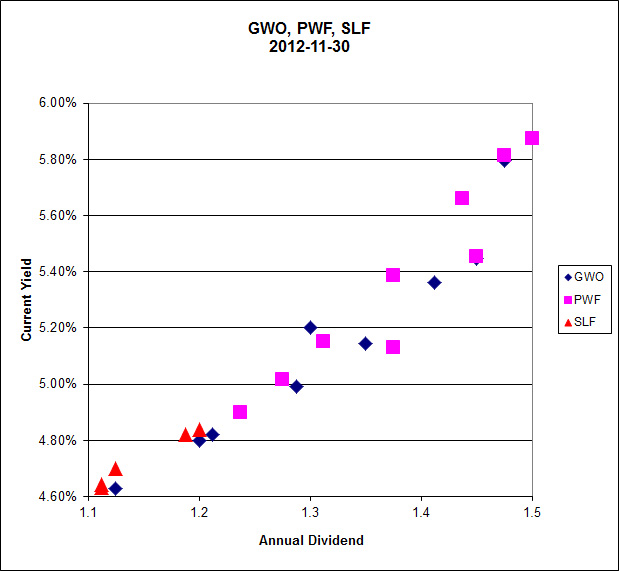

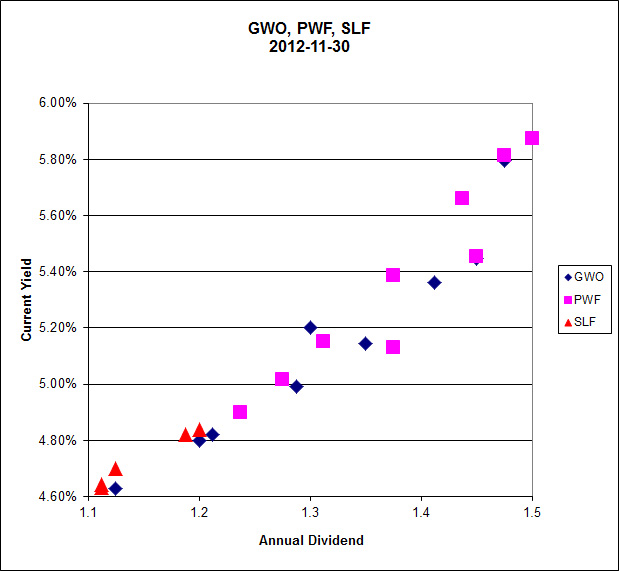

SLF DeemedRetractibles may be compared with PWF and GWO:

Click for Big

Click for BigIt is quite apparent that that the market continues to treat regulated insurance issues (SLF, GWO) no differently from unregulated issues (PWF) – despite the fact that the PWF issues are much more subject to unfavourable calls in the near term and should, logically, be deprecated on those grounds alone without any fancy-pants arguments about imposition of the NVCC rule!

Those of you who have been paying attention will remember that in a “normal” market (which we have not seen in well over a year) the slope of this line is related to the implied volatility of yields in Black-Scholes theory, as discussed in the January, 2010, edition of PrefLetter. The relationship is still far too large to be explained by Implied Volatility – the numbers still indicate an overwhelming degree of directionality in the market’s price expectations.

Sometimes everything works … sometimes it’s 50-50 … sometimes nothing works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’ – although for quite some time, noise trading has taken a distant second place to the sectoral play on insurance DeemedRetractibles. There were a lot of strongly motivated market participants during the Panic of 2007, generating a lot of noise! Unfortunately, the conditions of the Panic may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, without worrying about the level of monthly turnover.

There’s plenty of room for new money left in the fund. I have shown in recent issues of PrefLetter that market pricing for FixedResets is demonstrably stupid and I have lots of confidence – backed up by my bond portfolio management experience in the markets for Canadas and Treasuries, and equity trading on the NYSE & TSX – that there is enough demand for liquidity in any market to make the effort of providing it worthwhile (although the definition of “worthwhile” in terms of basis points of outperformance changes considerably from market to market!) I will continue to exert utmost efforts to outperform but it should be borne in mind that there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit |

| Month |

NAVPU |

Portfolio

Average

YTW |

Leverage

Divisor |

Securities

Average

YTW |

Capital

Gains

Multiplier |

Sustainable

Income

per

current

Unit |

| June, 2007 |

9.3114 |

5.16% |

1.03 |

5.01% |

1.3240 |

0.3524 |

| September |

9.1489 |

5.35% |

0.98 |

5.46% |

1.3240 |

0.3773 |

| December, 2007 |

9.0070 |

5.53% |

0.942 |

5.87% |

1.3240 |

0.3993 |

| March, 2008 |

8.8512 |

6.17% |

1.047 |

5.89% |

1.3240 |

0.3938 |

| June |

8.3419 |

6.034% |

0.952 |

6.338% |

1.3240 |

$0.3993 |

| September |

8.1886 |

7.108% |

0.969 |

7.335% |

1.3240 |

$0.4537 |

| December, 2008 |

8.0464 |

9.24% |

1.008 |

9.166% |

1.3240 |

$0.5571 |

| March 2009 |

$8.8317 |

8.60% |

0.995 |

8.802% |

1.3240 |

$0.5872 |

| June |

10.9846 |

7.05% |

0.999 |

7.057% |

1.3240 |

$0.5855 |

| September |

12.3462 |

6.03% |

0.998 |

6.042% |

1.3240 |

$0.5634 |

| December 2009 |

10.5662 |

5.74% |

0.981 |

5.851% |

1.1141 |

$0.5549 |

| March 2010 |

10.2497 |

6.03% |

0.992 |

6.079% |

1.1141 |

$0.5593 |

| June |

10.5770 |

5.96% |

0.996 |

5.984% |

1.1141 |

$0.5681 |

| September |

11.3901 |

5.43% |

0.980 |

5.540% |

1.1141 |

$0.5664 |

| December 2010 |

10.7659 |

5.37% |

0.993 |

5.408% |

1.0298 |

$0.5654 |

| March, 2011 |

11.0560 |

6.00% |

0.994 |

5.964% |

1.0298 |

$0.6403 |

| June |

11.1194 |

5.87% |

1.018 |

5.976% |

1.0298 |

$0.6453 |

| September |

10.2709 |

6.10%

Note |

1.001 |

6.106% |

1.0298 |

$0.6090 |

| December, 2011 |

10.0793 |

5.63%

Note |

1.031 |

5.805% |

1.0000 |

$0.5851 |

| March, 2012 |

10.3944 |

5.13%

Note |

0.996 |

5.109% |

1.0000 |

$0.5310 |

| June |

10.2151 |

5.32%

Note |

1.012 |

5.384% |

1.0000 |

$0.5500 |

| September |

10.6703 |

4.61%

Note |

0.997 |

4.624% |

1.0000 |

$0.4934 |

| November, 2012 |

10.8469 |

4.40% |

0.994 |

4.426% |

1.0000 |

$0.4801 |

NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains.

Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00%

The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99

Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings.

The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested.

Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company (definition refined in May, 2011). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. |

| Yields for September, 2011, to January, 2012, were calculated by imposing a cap of 10% on the yields of YLO issues held, in order to avoid their extremely high calculated yields distorting the calculation and to reflect the uncertainty in the marketplace that these yields will be realized. From February to September 2012, yields on these issues have been set to zero. All YLO issues held were sold in October 2012. |

Significant positions were held in DeemedRetractible and FixedReset issues on November 30; all of these currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31. This presents another complication in the calculation of sustainable yield. The fund also holds a position various SplitShare issues which also have their yields calculated with the expectation of a maturity at par.

I will no longer show calculations that assume the conversion of the entire portfolio into PerpetualDiscounts, as there are currently only four such issues of investment grade, from only two issuer groups. Additionally, the fund has no holdings of these issues.

It should be noted that the concept of this Sustainable Income calculation was developed when the fund’s holdings were overwhelmingly PerpetualDiscounts – see, for instance, the bottom of the market in November 2008. It is easy to understand that for a PerpetualDiscount, the technique of multiplying yield by price will indeed result in the coupon – a PerpetualDiscount paying $1 annually will show a Sustainable Income of $1, regardless of whether the price is $24 or $17.

Things are not quite so neat when maturity dates and maturity prices that are different from the current price are thrown into the mix. If we take a notional Straight Perpetual paying $5 annually, the price is $100 when the yield is 5% (all this ignores option effects). As the yield increases to 6%, the price declines to 83.33; and 83.33 x 6% is the same $5. Good enough.

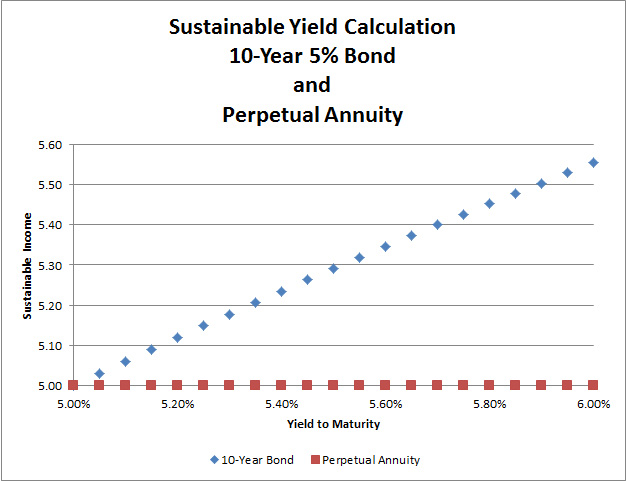

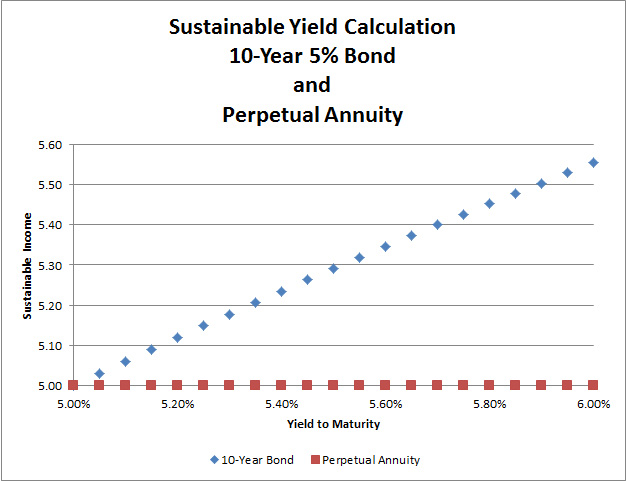

But a ten year bond, priced at 100 when the yield is equal to its coupon of 5%, will decline in price to 92.56; and 92.56 x 6% is 5.55; thus, the calculated Sustainable Income has increased as the price has declined as shown in the graph:

Click for Big

Click for BigThe difference is because the bond’s yield calculation includes the amortization of the discount; therefore, so does the Sustainable Income estimate.

Thus, the decline in the MAPF Sustainable Income from $0.5500 per unit in June to $0.4801 per unit in October should be looked at as a simple consequence of the fund’s holdings; virtually all of which have their yields calculated in a manner closer to bonds than to Perpetual Annuities.

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the long-term results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.