Our Government Motors investment has a long way to go:

But for the U.S. to break even through sales of the rest of its stake, the share price may need to rise more than 60% from its initial level, to about $50.

The initial public offering plan envisions the shares would be priced at $26 to $29 each, these people said. The actual price of the stock to be sold in the IPO would be set about Nov. 17, and the sale would take place the following day.

More subsidies urgently required!

Merkel is stepping up calls for an EU default mechanism:

Measures being drafted by the European Union will result in rules with “more bite” to protect the euro, Merkel said in a speech today in Bruges, Belgium. Along with steps to prevent EU members running up excessive debt, a crisis mechanism enshrined in EU treaties is necessary for the longer term, she said.

“We will set it up in such a way that European taxpayers will no longer be on the hook for possible new mistakes and turmoil on the financial markets,” Merkel said. “Private investors must also make a contribution.”

European officials including Spanish Prime Minister Jose Luis Rodriguez Zapatero are concerned that announcing bond investors will have to shoulder a greater part of any future bailout will spook traders at a time when Ireland and Portugal are struggling to cut their budget deficits.

European Central Bank President Jean-Claude Trichet told EU leaders last week he’s concerned that talk of a debt restructuring mechanism from 2013 would hurt the bonds of the euro-region’s so-called periphery nations, according to an EU official familiar with the talks.

Irish bonds fell for a sixth day, sending the 10-year yield to a record, and Greek bonds dropped for a seventh day, the longest losing streak since April.

Rules, schmules. They’re only as effective as the political will to enforce them – Germany and France both demanded exemptions from the 3% deficit cap; turned a willful blind eye to the Greek crisis as it was developing; and participated in the Greek bail-out contrary to the EU’s no-bailout rules.

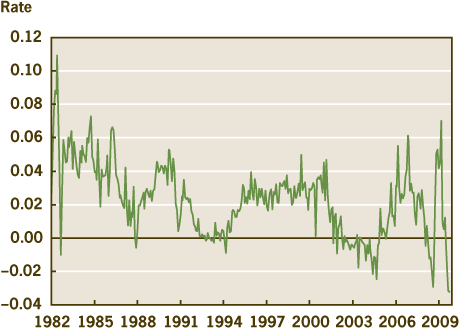

The Depositary Trust Company is now publishing average daily General Collateral repo rates. The Treasury Market Practices Group applauds the move:

The Treasury Market Practices Group (“TMPG”) today applauded the announcement by the Depository Trust and Clearing Corporation (“DTCC”) to introduce the publication of three overnight general collateral repo rate indices and corresponding transaction volumes.

These new data, which will be published daily, reflect activity on DTCC’s GCF Repo dealer-to-dealer trading platform for the three most active collateral categories traded: Treasury securities, agency debt securities, and agency mortgage-backed securities. Publication of these data, made at the request of the TMPG, provides useful information in a form that has not been available to market participants until now.

“The publication of these indices by DTCC is a major step on the critical path of enhanced transparency in the secured funding markets,” said Tom Wipf, the chairman of the TMPG. “This collaboration demonstrates the shared commitment of TMPG and DTCC in support of the integrity and efficiency of the Treasury, agency debt, and mortgage-backed securities markets.”

God knows why. Greater transparency leads to fairer markets for the little guys, which leads to less profit for the well capitalized big guys, which leads to … surprise! a withdrawal of capital from the market. We’ve seen this countless times and every single time the market in question becomes a little thinner and a little more brittle. If that’s what we want, fine … but not once have I seen a regulatory decision take explicit account of the trade-off.

It will soon be easier to confine people who look at you funny, given all the complaints that private citizens can get in trouble for shooting people who are running away. While worried, I am also entertained by the slow oscillations of the pendulum … how long will it be before some looney-tune exercises his new citizen’s arrest rights in a manner that is unpopular?

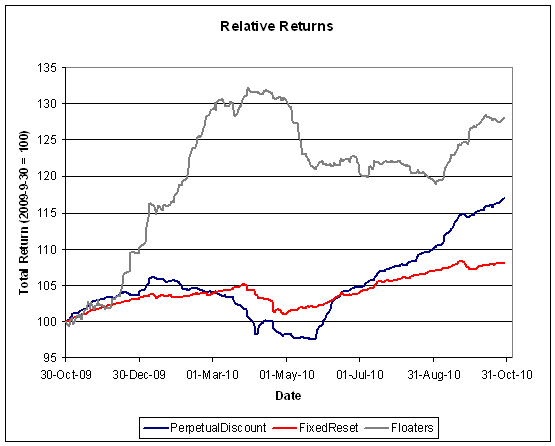

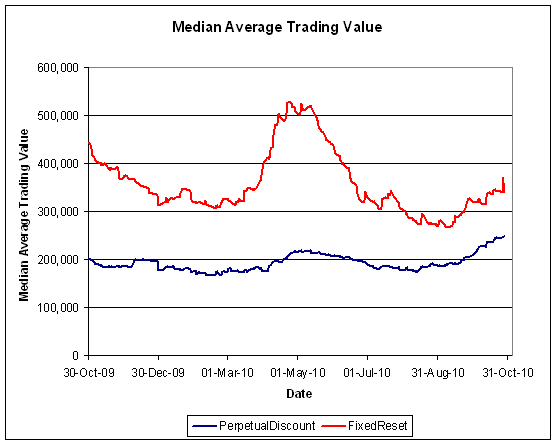

It was yet another good day for the Canadian preferred share market, with PerpetualDiscounts up 28bp and FixedResets gaining 19bp, taking the median weighted average yield on the latter index back down to 2.93%. The all-time low yield for this index was 2.89%, set on September 23; today’s level ranks #3 all-time. Volume returned to very strong levels.

And how about that BMO.PR.N, eh? Now with a pre-tax bid-YTW of 2.23%, based on a bid of 28.34 and a call 2014-3-27 at 25.00. I note that the BMO Capital Trust BOATS Series D, 5.474%, (prospectus on SEDAR dated September 23, 2004) are indicated at 108.97 to yield 3.15% to a presumed call December 31, 2014. Note that given current market conditions the call would not be in the economic best interests of BMO; but there is also the thought that OSFI will demand redemption due to concerns over the loss-absorption potential of the issue (this issue can convert into 5% preferred shares, but only if Very Bad Things happen). One way or another, BMO.PR.N is yielding at an interest-equivalent rate of 3.12% at the standard conversion factor of 1.4x.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1162 % | 2,198.9 |

| FixedFloater | 5.00 % | 3.58 % | 27,170 | 19.12 | 1 | 1.1628 % | 3,364.2 |

| Floater | 2.71 % | 2.38 % | 55,298 | 21.28 | 4 | 0.1162 % | 2,374.2 |

| OpRet | 4.79 % | 3.15 % | 77,780 | 1.89 | 9 | 0.4351 % | 2,388.8 |

| SplitShare | 5.88 % | -16.37 % | 66,542 | 0.09 | 2 | -0.1013 % | 2,393.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4351 % | 2,184.4 |

| Perpetual-Premium | 5.64 % | 5.03 % | 160,524 | 3.09 | 24 | 0.3199 % | 2,020.2 |

| Perpetual-Discount | 5.36 % | 5.40 % | 253,396 | 14.79 | 53 | 0.2784 % | 2,034.9 |

| FixedReset | 5.21 % | 2.93 % | 338,152 | 3.23 | 50 | 0.1926 % | 2,284.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.J | OpRet | 1.01 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 26.88 Bid-YTW : 4.31 % |

| SLF.PR.B | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 21.79 Evaluated at bid price : 22.14 Bid-YTW : 5.47 % |

| BAM.PR.G | FixedFloater | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 25.00 Evaluated at bid price : 21.75 Bid-YTW : 3.58 % |

| BAM.PR.R | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.61 Bid-YTW : 4.19 % |

| RY.PR.H | Perpetual-Premium | 1.24 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-23 Maturity Price : 25.00 Evaluated at bid price : 26.12 Bid-YTW : 4.83 % |

| GWO.PR.G | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 23.86 Evaluated at bid price : 24.15 Bid-YTW : 5.44 % |

| PWF.PR.K | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 23.08 Evaluated at bid price : 23.30 Bid-YTW : 5.33 % |

| MFC.PR.B | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 20.96 Evaluated at bid price : 20.96 Bid-YTW : 5.63 % |

| SLF.PR.G | FixedReset | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 23.45 Evaluated at bid price : 25.91 Bid-YTW : 3.22 % |

| BAM.PR.I | OpRet | 1.63 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-12-02 Maturity Price : 25.50 Evaluated at bid price : 26.86 Bid-YTW : -45.78 % |

| IAG.PR.E | Perpetual-Premium | 2.70 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.20 Bid-YTW : 5.39 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.S | FixedReset | 163,605 | TD crossed block of 100,000 and 52,500, both at 26.57. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.61 Bid-YTW : 2.52 % |

| BMO.PR.J | Perpetual-Discount | 123,855 | RBC crossed blocks of 74,500 and 30,000, both at 22.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 22.72 Evaluated at bid price : 22.89 Bid-YTW : 4.91 % |

| BNS.PR.P | FixedReset | 115,424 | RBC crossed 100,000 at 26.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-25 Maturity Price : 25.00 Evaluated at bid price : 26.59 Bid-YTW : 2.36 % |

| BAM.PR.T | FixedReset | 109,183 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 23.01 Evaluated at bid price : 24.76 Bid-YTW : 4.22 % |

| RY.PR.X | FixedReset | 108,850 | Desjardins crossed blocks of 12,900 and 83,000, both at 27.90. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.87 Bid-YTW : 3.03 % |

| CM.PR.I | Perpetual-Discount | 63,477 | RBC crossed blocks of 39,000 and 11,000, both at 22.56. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-02 Maturity Price : 22.43 Evaluated at bid price : 22.58 Bid-YTW : 5.23 % |

| There were 52 other index-included issues trading in excess of 10,000 shares. | |||