The Bank of Canada has released a working paper by Jean-Sébastien Fontaine and René Garcia titled Bond Liquidity Premia:

Recent asset pricing models of limits to arbitrage emphasize the role of funding conditions faced by financial intermediaries. In the US, the repo market is the key funding market. Then, the premium of on-the-run U.S. Treasury bonds should share a common component with risk premia in other markets. This observation leads to the following identification strategy. We measure the value of funding liquidity from the cross-section of on-the-run premia by adding a liquidity factor to an arbitrage-free term structure model. As predicted, we find that funding liquidity explains the cross-section of risk premia. An increase in the value of liquidity predicts lower risk premia for on-the run and off-the-run bonds but higher risk premia on LIBOR loans, swap contracts and corporate bonds. Moreover, the impact is large and pervasive through crisis and normal times. We check the interpretation of the liquidity factor. It varies with transaction costs, S&P500 valuation ratios and aggregate uncertainty. More importantly, the liquidity factor varies with narrow measures of monetary aggregates and measures of bank reserves. Overall, the results suggest that different securities serve, in part, and to varying degrees, to fulfill investors’ uncertain future needs for cash depending on the ability of intermediaries to provide immediacy.

As far as corporates are concerned, they suggest:

Finally, we consider a sample of corporate bond spreads from the NAIC. We find that the impact of liquidity is significant and follows a flight-to-quality pattern across ratings. For bonds of the highest credit quality, spreads decrease, on average, following a shock to the funding liquidity factor. In contrast, spreads of bonds with lower ratings increase. We also compute excess returns on AAA, AA, A, BBB and High Yield Merrill Lynch corporate bond indices (see Figure 3) and reach similar conclusions. Bonds with high credit ratings were perceived to be liquid substitutes to government securities and offered lower risk premium following increases of the liquidity factor. This corresponds to an average effect through our sample, the recent events suggests that this is not always the case.

Corporate spreads are dealt with in more detail:

The impact of funding liquidity extends to the corporate bond market. This section measures the impact of the liquidity factor on the risk premium offered by corporate bonds. Empirically, we find that the impact of liquidity has a flight-to-quality” pattern across credit ratings. Following an increase of the liquidity factor, excess returns decrease for the higher ratings but increase for the lower ratings. Our results are consistent with the evidence that default risk cannot rationalize corporate spreads. Collin-Dufresne et al. (2001) find that most of the variations of non-default corporate spreads are driven by a single latent factor. We formally link this factor with funding risk. Our evidence is also consistent with the differential impact of liquidity across ratings found by Ericsson and Renault (2006). However, while they relate bond spreads to bond-specific measures of liquidity, we document the impact of an aggregate factor in the compensation for illiquidity.

…

First, as expected, average excess returns are higher for lower ratings. Next, estimates of the liquidity coefficients show that the impact of a rising liquidity factor is negative for the higher ratings and becomes positive for lower ratings. A one-standard deviation shock to the liquidity factor leads to decreases in excess returns for AAA, AA and A ratings but to increases in excess returns for BBB and HY ratings. Excess returns decrease by 2.27% for AAA index but increase by 2.38% for the HY index. For comparison, the impact on Treasury bonds with 7 and 10 years to maturity was -4.52% and -5.42%. Thus, on average, high quality bonds were considered substitutes, albeit imperfect, to U.S. Treasuries as a hedge against variations in funding conditions. On the other hand, lower-rated bonds were exposed to funding market shocks.

However, in extreme cases the sign of the relationship for hiqh quality bonds changes:

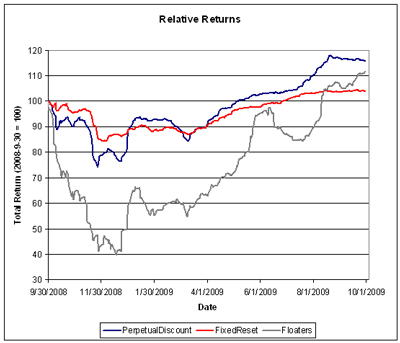

Adding 2008 only increases the measured impact of the common funding liquidity factor on bond risk premia. Each of the regression above leads to higher estimate for the liquidity coefficient. An interesting case, though, is the behavior of corporate bond spreads. Clearly corporate bond spreads increased sharply over that period, indicating an increase in expected returns. What is interesting is that this was the case for any ratings. Figure 8 compares the liquidity factor with the spread of the AAA and BBB Merrill Lynch index. In the sample excluding 2008, the estimated average impact a shock to funding liquidity was negative for AAA bonds and positive for BBB. The large and positively correlated shock in 2008 reverses this conclusion for AAA bonds. But note that AAA spreads and the liquidity factor were also positively correlated in 1998. This confirms our conjecture that the behavior of high-rating bonds is not stable and depends on the nature or the size of the shock to funding liquidity. Note that this does not affect our conclusion that corporate bond liquidity premium shares a component with other risk premium due to funding risk. Instead, it suggests that the relationship exhibits regimes through time.