Via Dealbreaker comes news that CME and Citadel will be starting a CDS exchange. The follows reports yesterday that the Fed was pushing the principals of a proposed clearinghouse to get moving; the report noted:

CNBC reported earlier that the Fed was meeting with officials from Chicago-based futures exchange operator CME Group and the Intercontinental Exchange Inc., the second-largest U.S. futures market, to create a marketplace for credit-default swaps.

Kelly Loeffler, a spokeswoman for Intercontinental Exchange, and CME spokeswoman Mary Haffenberg declined to comment on the meeting. Both companies have announced plans to offer clearing services for the market and ICE earlier this year bought credit swap broker Creditex Group Inc., which is one of the owners of Clearing Corp.

CME last year started offering futures contracts that were similar to credit-default swaps in an effort to tap into the over-the-counter market, which had swelled more than 100-fold the past seven years.

For background, see the post Exchange Traded CDSs and Accrued Interest.

I’ve updated the post SEC and BSC with some juicy de-redactions.

There is a cheery note from Bloomberg:

The Standard & Poor’s 500 Index lost 18 percent since the start of 2000 after sinking 11 percent this month, total return data compiled by Bloomberg show. The decline would be the first for a decade in 70 years and exceeds the 8.9 percent plunge in the 1930s, following the stock market crash of 1929, data compiled by New York University’s Stern School of Business show.

Econbrowser‘s Menzie Chinn paraphrases an IMF report on historical experience with finance-led recessions and provides a cheery chart:

The risk weight of Fannie/Freddie debt is being cut to 10%:

The Federal Deposit Insurance Corp. today tentatively approved a rule, proposed by all four federal bank regulators, that eases capital requirements for federally insured depository institutions that hold large amounts of Fannie and Freddie corporate debt, subordinated debt, mortgage guarantees and derivatives. The so-called risk weighting for banks on Fannie and Freddie’s credit claims was cut to 10 percent from 20 percent.

Sub-debt, too? Let’s hope they’ve got some really good signatures on the government guarantee!

At the same time, the banks are putting the screws to any borrower who breaches covenants. It’s every man for himself!

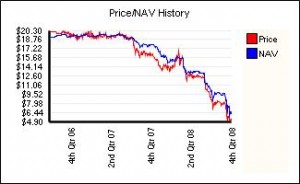

Brookfield issues were killed today. Annihilated. There has been a significant increase in options activity but the most recent actual news I can find is that Brookfield Residential Property Services has bought GMAC Home Services LLC. GMAC Home Services Mortgage and GMAC Real Estate were also included in the deal. But that was September 23. Are there any options mavens out there (you know who you are!) who want to take a stab at estimating default probabilities and times for the BAM retractibles, perps and BNA split-shares?

As at October 6, BMO-CM calls Brookfield a market-performer; it was down significantly today, but given that it outperformed slightly yesterday that’s not all too much surprising. If anybody can explain this, let me know!

What can I say? At 6.63%, PerpetualDiscount yields are now equal to their July 16 peak. This time around, though, long corporates are at about 6.70, so the interest-equivalent yield of 9.28% is a spread of “only” 258bp. Hell, we were there in June.

What gets me, though, and what has people who know me crossing the street so I won’t complain to them about it again, is just how sloppy the market is. It’s outrageous! If it keeps up, you won’t need any fancy software to outperform the market … just the ability to calculate current yields for similar issues with the same ex-Date.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 5.07% | 5.26% | 78,171 | 15.23 | 6 | -3.2842% | 1,016.10 |

| Floater | 6.23% | 6.29% | 49,274 | 13.51 | 2 | -10.1215% | 646.5 |

| Op. Retract | 5.28% | 5.98% | 124,524 | 3.82 | 14 | -1.7919% | 995.2 |

| Split-Share | 6.14% | 9.81% | 57,458 | 4.06 | 12 | -1.3550% | 919.8 |

| Interest Bearing | 6.82% | 8.83% | 42,864 | 3.64 | 3 | -0.8202% | 1,013.7 |

| Perpetual-Premium | 6.36% | 6.41% | 54,973 | 13.30 | 1 | +1.1537% | 975.1 |

| Perpetual-Discount | 6.56% | 6.63% | 176,835 | 13.06 | 70 | -0.9966% | 819.2 |

| Fixed-Reset | 5.21% | 5.07% | 1,082.323 | 15.26 | 10 | +0.6686% | 1,096.7 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -12.9565% (!!!) | Unbelievable. Now with a pre-tax bid-YTW of 10.67% based on a bid of 20.02 and a softMaturity 2013-12-30 at 25.00. Compare with BAM.PR.H (9.22% to 2012-3-30), BAM.PR.J (10.68% to 2018-3-30) and BAM.PR.O (10.27% to 2013-6-30); and with the perpetuals at 8.58% and 9.03%. |

| BNA.PR.A | SplitShare | -12.2414% | Asset coverage of 3.2+:1 as of August 31 according to the company. Coverage now of 2.3+:1 based on BAM.A at 24.05 and 2.4 BAM.A held per preferred. Now with a pre-tax bid-YTW of 18.31% (!) based on a bid of 20.36 and a hardMaturity 2010-9-30 at 25.00. Compare with BNA.PR.B (11.33% to 2016-3-25) and BNA.PR.C (12.07% to 2019-1-10). Unlike yesterday and the BNA.PR.B, the closing quote of 20.36-21.60, 2×2, is actually realistic on the bid side. After a trade at 21.04 at 1:14pm, some guy sold 1900 shares at 20.03 at 1:40pm, and the closing trade at 3:45pm was at 20.15. Incredible. I thought – still! even after all the horrors of 2008 – that you had to be on the brink of bankruptcy, with high leverage funded by short-term paper, to trade like this. |

| BAM.PR.B | Floater | -12.2000% | Well, the floaters have to get in on the action too, don’t they? |

| W.PR.H | PerpetualDiscount | -8.8557% | Commodities are going out of style! Now with a pre-tax bid-YTW of 7.56% based on a bid of 18.32 and a limitMaturity. Several smallish trades below the closing bid in the last two hours of trading. |

| BAM.PR.K | Floater | -8.0952% | |

| BAM.PR.J | OpRet | -8.0423% | See BAM.PR.I, above. |

| BAM.PR.N | PerpetualDiscount | -7.9530% | Now with a pre-tax bid-YTW of 9.04% based on a bid of 13.31 and a limitMaturity. |

| BCE.PR.I | FixFloat | -7.7021% | |

| GWO.PR.G | PerpetualDiscount | -6.6421% | Now with a pre-tax bid-YTW of 7.42% based on a bid of 17.71 and a limitMaturity. |

| LBS.PR.A | SplitShare | -6.0674% | Asset coverage of just under 2.0:1 as of October 2, according to Brompton Group. Now with a pre-tax bid-YTW of 9.37% based on a bid of 8.36 and a hardMaturity 2013-11-29. The capital units are at a premium, making a monthly retraction a speculative proposition, but the annual retraction is at the end of November. |

| BCE.PR.Z | FixFloat | -5.4759% | |

| FIG.PR.A | InterestBearing | -5.4054% | Asset coverage of 1.6+:1 as of October 3, according to Faircourt. Now with a pre-tax bid-YTW of 9.01% based on a bid of 8.75 and a hardMaturity 2014-12-31 at 10.00. |

| BAM.PR.M | PerpetualDiscount | -5.0169% | Now with a pre-tax bid-YTW of 8.58% based on a bid of 14.01 and a limitMaturity. |

| BMO.PR.H | PerpetualDiscount | -4.6190% | Now with a pre-tax bid-YTW of 6.73% based on a bid of 20.03 and a limitMaturity. |

| BAM.PR.H | OpRet | -4.4492% | See BAM.PR.I, above. |

| POW.PR.B | PerpetualDiscount | -4.0701% | Now with a pre-tax bid-YTW of 7.23% based on a bid of 18.62 and a limitMaturity. |

| BAM.PR.O | OpRet | -3.5714% | Now with a pre-tax bid-YTW of 10.2660% based on a bid of 20.25 and a limitMaturity. |

| CU.PR.A | PerpetualDiscount | -3.4869% | Now with a pre-tax bid-YTW of 6.32% based on a bid of 23.25 and a limitMaturity. |

| BCE.PR.C | FixFloat | -3.2609% | |

| PWF.PR.F | PerpetualDiscount | -3.2379% | Now with a pre-tax bid-YTW of 6.51% based on a bid of 20.62 and a limitMaturity. |

| BCE.PR.A | FixFloat | -3.1250% | |

| CM.PR.J | PerpetualDiscount | -3.1250% | Now with a pre-tax bid-YTW of 7.29% based on a bid of 15.50 and a limitMaturity. |

| CM.PR.P | PerpetualDiscount | -3.1008% | Now with a pre-tax bid-YTW of 7.36% based on a bid of 18.75 and a limitMaturity. |

| POW.PR.A | PerpetualDiscount | -2.9907% | Now with a pre-tax bid-YTW of 6.79% based on a bid of 20.76 and a limitMaturity. |

| CM.PR.I | PerpetualDiscount | -2.9500% | Now with a pre-tax bid-YTW of 7.32% based on a bid of 16.12 and a limitMaturity. |

| NA.PR.L | PerpetualDiscount | -2.9255% | Now with a pre-tax bid-YTW of 6.77% based on a bid of 18.25 and a limitMaturity. |

| BNS.PR.L | PerpetualDiscount | -2.8571% | Now with a pre-tax bid-YTW of 6.14% based on a bid of 18.36 and a limitMaturity. |

| W.PR.J | PerpetualDiscount | -2.7490% | Now with a pre-tax bid-YTW of 7.52% based on a bid of 18.75 and a limitMaturity. |

| BNS.PR.K | PerpetualDiscount | -2.6290% | Now with a pre-tax bid-YTW of 6.02% based on a bid of 20.00 and a limitMaturity. |

| HSB.PR.C | PerpetualDiscount | -2.5974% | Now with a pre-tax bid-YTW of 6.87% based on a bid of 18.75 and a limitMaturity. |

| FBS.PR.B | SplitShare | -2.2198% | Asset coverage of 1.5+:1 as of October 2, according to TD Securities. Now with a pre-tax bid-YTW of 9.31% based on a bid of 8.81 and a hardMaturity 2011-12-15 at 10.00. Perhaps in an effort to halt the carnage, the fund announced a dividend increase for the capital units today; let’s see … FBS.B closed at 4.90; FBS.PR.B closed at 8.80; NAV $15.07 as of October 2; Special Annual Retraction in December …. hmmm …. |

| TD.PR.R | PerpetualDiscount | -2.1268% | Now with a pre-tax bid-YTW of 6.09% based on a bid of 23.01 and a limitMaturity. |

| POW.PR.D | PerpetualDiscount | -2.0219% | Now with a pre-tax bid-YTW of 7.02% based on a bid of 17.93 and a limitMaturity. |

| NA.PR.K | PerpetualDiscount | -1.9956% | Now with a pre-tax bid-YTW of 6.73% based on a bid of 22.10 and a limitMaturity. |

| GWO.PR.I | PerpetualDiscount | -1.8282% | Now with a pre-tax bid-YTW of 7.06% based on a bid of 16.11 and a limitMaturity. |

| DFN.PR.A | SplitShare | -1.7281% | Asset coverage of just under 2.2:1 as of September 30, according to the company. Now with a pre-tax bid-YTW of 8.45% based on a bid of 8.53 and a hardMaturity 2014-12-1 at 10.00. |

| CM.PR.H | PerpetualDiscount | -1.7178% | Now with a pre-tax bid-YTW of 7.52% based on a bid of 16.02 and a limitMaturity. |

| PWF.PR.E | PerpetualDiscount | -1.5549% | Now with a pre-tax bid-YTW of 6.32% based on a bid of 22.16 and a limitMaturity. |

| BNS.PR.O | PerpetualDiscount | -1.4799% | Now with a pre-tax bid-YTW of 6.02% based on a bid of 23.30 and a limitMaturity. |

| RY.PR.F | PerpetualDiscount | -1.3514% | Now with a pre-tax bid-YTW of 6.46% based on a bid of 17.25 and a limitMaturity. |

| PWF.PR.K | PerpetualDiscount | -1.2880% | Now with a pre-tax bid-YTW of 6.60% based on a bid of 19.16 and a limitMaturity. |

| CM.PR.D | PerpetualDiscount | -1.2500% | Now with a pre-tax bid-YTW of 7.31% based on a bid of 19.75 and a limitMaturity. |

| BNS.PR.N | PerpetualDiscount | -1.1807% | Now with a pre-tax bid-YTW of 6.04% based on a bid of 21.76 and a limitMaturity. |

| BNS.PR.J | PerpetualDiscount | -1.1358% | Now with a pre-tax bid-YTW of 6.03% based on a bid of 21.76 and a limitMaturity. |

| BCE.PR.R | FixFloat | -1.0753% | |

| BNS.PR.Q | FixedReset | -1.0717% | |

| BCE.PR.Y | FixFloat | -1.0638% | |

| PWF.PR.L | PerpetualDiscount | +1.0842% | Now with a pre-tax bid-YTW of 6.66% based on a bid of 19.58 and a limitMaturity. |

| CL.PR.B | PerpetualPremium (for now!) | +1.1537% | Now with a pre-tax bid-YTW of 6.41% based on a bid of 24.55 and a limitMaturity. |

| CM.PR.E | PerpetualDiscount | +1.1873% | Now with a pre-tax bid-YTW of 7.50% based on a bid of 18.75 and a limitMaturity. |

| BSD.PR.A | InterestBearing | +1.2346% | Asset coverage of just under 1.3:1 as of October 3, according to Brookfield Funds. The asset coverage implies no more distributions to capital units. Now with a pre-tax bid-YTW of 10.00% based on a bid of 8.20 and a hardMaturity 2015-3-31 at 10.00. |

| PWF.PR.G | PerpetualDiscount | +1.3130% | Now with a pre-tax bid-YTW of 6.28% based on a bid of 23.92 and a limitMaturity. |

| SLF.PR.D | PerpetualDiscount | +1.3629% | Now with a pre-tax bid-YTW of 6.29% based on a bid of 17.85 and a limitMaturity. |

| ELF.PR.F | PerpetualDiscount | +1.4320% | Now with a pre-tax bid-YTW of 7.85% based on a bid of 17.00 and a limitMaturity. |

| BNA.PR.C | SplitShare | +1.4493% | See BNA.PR.A, above. |

| ELF.PR.G | PerpetualDiscount | +1.5303% | Now with a pre-tax bid-YTW of 7.83% based on a bid of 15.26 and a limitMaturity. |

| STW.PR.A | InterestBearing | +1.5544% | Asset coverage of just under 1.7:1 as of September 25, according to Middlefield. Now with a pre-tax bid-YTW of 7.68% (mostly as interest) based on a bid of 9.80 and a hardMaturity 2009-12-31. |

| MFC.PR.C | PerpetualDiscount | +1.6375% | Now with a pre-tax bid-YTW of 6.32% based on a bid of 18.00 and a limitMaturity. |

| CIU.PR.A | PerpetualDiscount | +1.9553% | Now with a pre-tax bid-YTW of 6.40% based on a bid of 18.25 and a limitMaturity. |

| PWF.PR.H | PerpetualDiscount | +2.0316% | Now with a pre-tax bid-YTW of 6.49% based on a bid of 22.60 and a limitMaturity. |

| CM.PR.R | OpRet | +2.0408% | Now with a pre-tax bid-YTW of 5.03% based on a bid of 25.00 and a softMaturity 2013-4-29 at 25.00. |

| PWF.PR.I | PerpetualDiscount | +2.4086% | Now with a pre-tax bid-YTW of 6.43% based on a bid of 23.81 and a limitMaturity. |

| IAG.PR.A | PerpetualDiscount | +2.8807% | Now with a pre-tax bid-YTW of 6.64% based on a bid of 17.50 and a limitMaturity. |

| BNA.PR.B | SplitShare | +4.6582% | See BNA.PR.A, above. |

| NA.PR.N | FixedReset | +8.8405% | Mostly reverses yesterday’s nonsense. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| GWO.PR.F | PerpetualDiscount | 72,155 | Anonymous crossed 67,300 at 25.00 … unless they were different anonymice! Now with a pre-tax bid-YTW of 6.00% based on a bid of 24.76 and a limitMaturity. |

| CM.PR.A | OpRet | 39,090 | Nesbitt crossed 36,000 at 25.25. Now with a pre-tax bid-YTW of 5.22% based on a bid of 25.00 and a softMaturity 2011-7-30 at 25.00. |

| CM.PR.E | PerpetualDiscount | 34,500 | TD crossed 25,000 at 18.95. Now with a pre-tax bid-YTW of 7.50% based on a bid of 18.75 and a limitMaturity. |

| BNS.PR.R | FixedReset | 34,325 | RBC bought 10,000 at 24.45 from Scotia. |

| CM.PR.H | PerpetualDiscount | 29,735 | Now with a pre-tax bid-YTW of 7.52% based on a bid of 16.02 and a limitMaturity. |

There were twenty-four other index-included $25-pv-equivalent issues trading over 10,000 shares today