The Office of the Chief Actuary (part of OSFI) has released its eighth actuarial study, titled Technical Aspects of the Financing of the Canada Pension Plan, complete with OSFI’s usual dollop of patronizing paternalistic Panglossian pablum:

The review panel expressed concern that most readers would be unduly distressed that the Canada Pension Plan (CPP or the “Plan”) is not expected to ever be even one-third funded. As such, the panel recommended minimizing or removing “point-in-time” funded status indicators from the actuarial report and to focus instead on the fact that the adequacy and stability of the steady-state contribution rate is the critical tool for judging the sustainability of the CPP, and that the funded ratio (ratio of assets to liabilities), if kept in the report, is at most an indicator of the projected mprovement in the funded level. This paper was thus written with the purpose of analyzing and comparing the financing of the CPP using different measures, in particular, the unfunded obligations (liabilities less assets) and funded ratios of the Plan under various closed and open group methodologies, including a methodology more consistent with that used for occupational defined benefit pension plans.

Let’s donate the Chief Actuary to Europe – he can help advise them on what to do about those CDS-trading terrorists, who caused the Greek crisis all by themselves.

Speaking of the Greek crisis:

Europe’s stalemate over possible aid for debt-encumbered Greece deepened as European Central Bank President Jean-Claude Trichet spoke out against offering low- interest loans for which the Greek government has pressed.

Trichet’s demand for stringent terms and German Chancellor Angela Merkel’s push for sanctions against nations that breach deficit limits heightened the chance that Greece will leave a March 25-26 summit empty-handed. That could force Prime Minister George Papandreou to decide whether he’s ready to fulfill his threat and turn instead to the International Monetary Fund.

Looks like there might finally be some action on the Fannie & Freddie front:

U.S. Treasury Secretary Timothy F. Geithner said the government should end the “ambiguity” over the government’s involvement in mortgage finance companies Fannie Mae and Freddie Mac.

“Private gains can no longer be supported by the umbrella of public protection, capital standards must be higher and excessive risk-taking must be appropriately restrained,” Geithner said in testimony prepared for the House Financial Services Committee that was obtained today by Bloomberg News. The hearing is scheduled for tomorrow at 10 a.m. in Washington.

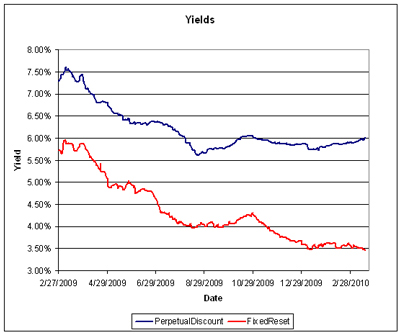

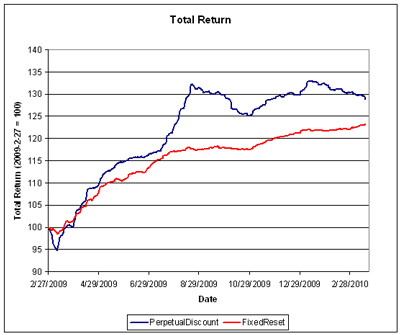

Volume jumped up as PerpetualDiscounts got hammered again, losing 36bp, while FixedResets continued to show strength, gaining 3bp which took yields on the latter down to 3.42%. Volatility was also pretty good.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.69 % | 2.77 % | 56,523 | 20.62 | 1 | -0.0476 % | 2,054.7 |

| FixedFloater | 5.09 % | 3.21 % | 45,194 | 19.92 | 1 | -0.6047 % | 3,106.8 |

| Floater | 1.95 % | 1.74 % | 47,415 | 23.19 | 4 | 0.1982 % | 2,370.0 |

| OpRet | 4.90 % | 2.84 % | 96,061 | 0.19 | 13 | -0.0328 % | 2,309.2 |

| SplitShare | 6.40 % | 6.41 % | 125,527 | 3.67 | 2 | 0.1769 % | 2,131.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0328 % | 2,111.5 |

| Perpetual-Premium | 5.93 % | 6.02 % | 120,049 | 13.78 | 7 | -0.4554 % | 1,875.9 |

| Perpetual-Discount | 5.96 % | 6.00 % | 181,177 | 13.88 | 71 | -0.3649 % | 1,772.8 |

| FixedReset | 5.35 % | 3.42 % | 346,549 | 3.68 | 43 | 0.0339 % | 2,206.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.D | Perpetual-Discount | -2.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 20.35 Evaluated at bid price : 20.35 Bid-YTW : 6.18 % |

| TD.PR.O | Perpetual-Discount | -1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 5.79 % |

| SLF.PR.A | Perpetual-Discount | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 6.16 % |

| BNS.PR.K | Perpetual-Discount | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 20.55 Evaluated at bid price : 20.55 Bid-YTW : 5.94 % |

| GWO.PR.H | Perpetual-Discount | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 6.17 % |

| GWL.PR.O | Perpetual-Premium | -1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 24.87 Evaluated at bid price : 25.20 Bid-YTW : 4.79 % |

| TD.PR.P | Perpetual-Discount | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 22.89 Evaluated at bid price : 23.05 Bid-YTW : 5.78 % |

| SLF.PR.B | Perpetual-Discount | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 19.45 Evaluated at bid price : 19.45 Bid-YTW : 6.20 % |

| IAG.PR.E | Perpetual-Premium | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 24.69 Evaluated at bid price : 24.91 Bid-YTW : 6.04 % |

| MFC.PR.C | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 18.90 Evaluated at bid price : 18.90 Bid-YTW : 6.00 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BAM.PR.N | Perpetual-Discount | 72,991 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-22 Maturity Price : 17.43 Evaluated at bid price : 17.43 Bid-YTW : 6.86 % |

| RY.PR.R | FixedReset | 71,140 | National crossed 49,500 at 28.05. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 27.97 Bid-YTW : 3.26 % |

| RY.PR.X | FixedReset | 67,137 | RBC crossed 28,000 at 28.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 28.10 Bid-YTW : 3.44 % |

| CM.PR.L | FixedReset | 65,521 | National crossed 49,300 at 28.43. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 28.46 Bid-YTW : 3.24 % |

| TD.PR.K | FixedReset | 44,670 | National crossed blocks of 19,400 and 10,000, both at 28.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 28.36 Bid-YTW : 3.25 % |

| NA.PR.N | FixedReset | 40,300 | HSBC sold 10,000 to RBC at 26.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-14 Maturity Price : 25.00 Evaluated at bid price : 26.51 Bid-YTW : 3.65 % |

| There were 62 other index-included issues trading in excess of 10,000 shares. | |||