This one will cause some angst for the bubble-gum crowd:

Warren Buffett, the Wall Street critic who invested $5 billion in Goldman Sachs Group Inc., said he supports the bank’s Chief Executive Officer Lloyd Blankfein “100 percent” after the firm was sued by regulators for fraud.

…

Buffett said he will discuss the trade at the center of the regulator’s suit later today at the meeting and “I will bet that of the 40,000 people in there, 39,900 of them have a misconception.”

God endorses Satan! Of course, Buffett achieved his status by a very rare process known technically as “thinking about what he was doing”.

He went further later on:

“I can’t see what difference it makes if it were Paulson on the other side of the deal or Goldman Sachs or Berkshire Hathaway,” Buffett said today at his company’s annual meeting in Omaha, Nebraska. Buffett said it “wasn’t so obvious” when the investments were sold in 2007 that the housing market would collapse.

Gracious heavens, the bubble-gum crowd is going to have a collective nervous breakdown!

Buffett said today that Berkshire has four decades of experience with Goldman Sachs and no expectation that the bank would offer investment advice or disclose its own stance on trades.

“We are in the business of making our own decisions,” Buffett said. “They do not owe us a divulgence of their position.”

A grown-up! An actual grown-up! Quick, call the nannies! It occurs to me that one reason Buffett has done so well is that he’s an adult in a world of kiddies.

Suprisingly, I don’t see his comments highlighted in one of the sacred places where the acolytes proselytize and interpret the Holy Word. I guess Buffett can only be considered wise when he recites platitudes that people want to hear … but that’s the marketting biz!

Blankfein has learned that lesson and is attempting to distance himself and the firm from some headlined eMails:

Lloyd Blankfein, chief executive officer of Goldman Sachs Group Inc., said a “callousness” toward clients demonstrated in some e-mails released to the public this week is unacceptable and doesn’t represent the firm.

“There were some e-mails where some people were projecting I would say, at best indifference, and at worst a callousness,” Blankfein, 55, said in an interview on the “Charlie Rose” television show last night, according to a transcript. While he said those e-mails aren’t representative of the firm, “it’s inexcusable if 10 people think that way or thought that way.”

But, of course, you don’t get to be head of a big (public) firm by telling people what they don’t want to hear. I’ve had a look, but unfortunately have been unable to find a link to the actual transcript.

Never let it be said that PrefBlog doesn’t report both sides of the story: Suna Reyent writes a post on Seeking Alpha titled Why SEC has a Strong Case Against Goldman, Part 1. She states, for instance:

SEC alleges that Goldman not only hid Paulson’s role from all long parties via making it appear like a third long party (ACA) picked the portfolio, which is a material misrepresentation on its own, but it also made one investor (ACA) believe that Paulson was interested in the long side of the deal.

That’s where I stopped reading. ACA was the Selection Agent; they were paid to be the Selection Agent; they had fiduciary responsibility as the Selection Agent. The idea that Goldman made one investor (ACA) believe that Paulson was interested in the long side of the deal. is:

- contested by Goldman & Tourre

- completely non-material and irrelevent even if true.

Some light reading with a moral… Never Kick Your Chief Regulator in the Nuts. Or, to put it another way, never disclose that the emperor has no clothes. The light reading is best accompanied by SEC Fraud Allegations against MBIA. Of course, since this was settled without admission of guilt, we’ll never know whether they were really guilty, or whether not paying up would have constituted kicking the Chief Regulator in the Nuts.

Ackman, by the way, agrees with PrefBlog and Buffet about Goldman Sachs:

Ackman also staunchly defends Goldman Sachs. He says that the media misrepresents the charges against Goldman Sachs. He states that it would have been unethical had Goldman disclosed who the counter party(John Paulson) was on the trade. Ackman states that SEC laws require client confidentiality. Paulson himself did not know who was the long on the trade nor did he care.

I’ll go further, actually. Any fiduciary who cared about the identity of the seller, or who would have allowed the identity of the seller to influence his decision on the investment in any way whatsoever should be in jeopardy of losing his license. Investing is not a kiddie game of follow the leader … or shouldn’t be.

Trichet gave a speech decrying the propensity of investment managers to act in (what they believe to be) their clients’ best interest:

Gradually, the focus of finance shifted in the recent past. From its traditional role of helping the real economy to cope with economic risk, finance became a self-referential activity. The notion of “financial engineering” is a striking illustration of the shift of attitudes that spearheaded the changing focus of finance.

The ABACUS transaction is a good illustration of the point. ACA & IKB beleived that sub-prime borrowers were getting a deal favourable to the lenders. Paulson thought they were getting way too rich a deal. Goldman got between them, as brokers do, and created a security referencing the deals. Had this deal not gone forward, Paulson would not have been able to take a view on the market (it’s hard to short houses with mortgages!); the ACA/IKB money would have eventually have flowed into the sub-prime market, thus distorting the real economy even further. By creating a vehicle to interupt the inefficient allocation of capital to an overheated sector of the market, Goldman did the world financial system a great service, and deserves our thanks … but I suppose that profits on the books and expectations of future profits from similar deals will satisfy them.

James Hamilton of Econbrowser writes a post on the evolution of investment strategy at Reserve Primary Fund, which has attracted (so far) some very good comments. That post bulds on a very good post he wrote previously in which he traced the flow of funds into the US housing market.

The Greek bail-out conditions have been released. The effect on the total economy is fearsome:

*Economic contraction of 4 percent this year and 2.6 percent in 2011. Growth will return in 2012 at 1.1 percent and 2.1 percent in 2013 and 2014.

*Debt will rise from 133.3 percent of GDP this year to 145.1 percent in 2011, 148.6 in 2012 and peak at 149.1 percent in 2013. It is projected to fall to 144.3 percent in 2014.

*Budget deficit will shrink to 8.1 percent this year, 7.6 percent next year, 6.5 percent in 2012, 4.9 percent in 2013 and below the 3 percent demanded by the European Union in 2014.

There is some speculation that regulatory uncertainty is affecting the real economy:

Bank are increasing purchases of U.S. government securities to pump up profits while lending to businesses languishes near the lowest levels since credit markets started to freeze almost three years ago.

Holdings of Treasuries rose each of the past five weeks, an increase of $63.2 billion to $1.5 trillion, according to Federal Reserve data. At the same time, commercial and industrial loans climbed less than 1 percent to $1.27 trillion and are down 23 percent from the record high level in October 2008.

…

“The risk of owning Treasures is lower than creating loans,” said Anthony Crescenzi, a market strategist and money manager at Newport Beach, California-based Pacific Investment Management Co., the world’s largest bond-fund manager. “There is no clarity on what the capital climates will be domestically or on a global scale with regulation coming down the pipes, which means banks will be banking their money in safer assets.”

Jerome Kerviel, the SocGen trader last discussed on PrefBlog on July 28, 2009, has written a book:

The five-billion-Euro rogue trader Jerome Kerviel will claim in a book this week that he was merely a “prostitute” in the “great banking orgy” and should be treated leniently in his trial next month.

Kerviel, 33, has broken a long silence with an autobiography and two newspaper interviews in which he says that his €4.9bn losses in rogue trades in 2006-07 should be blamed on a world banking industry “disconnected from reality”.

One reason not to ban shorting is that it’s a risky business:

Hedge funds that profit from falling shares have seen 34 percent of their value evaporate since February 2009, according to Chicago-based Hedge Fund Research Inc. Zions Bancorp., Sears Holdings Corp. and Wynn Resorts Ltd., among the favorites of so- called short-sellers, caused the biggest losses as their shares more than tripled.

…

The combination of record-low interest rates, first-quarter economic growth of 3.2 percent and analyst estimates for the fastest profit gains in 14 years erased 94 percent of the HFRI EH Short Bias Index’s advance from June 2007 to February 2009. The better news for bulls is that the percentage of New York Stock Exchange shares that remain shorted is higher than any time before 2008, providing more grist for gains should speculators be forced to retreat.

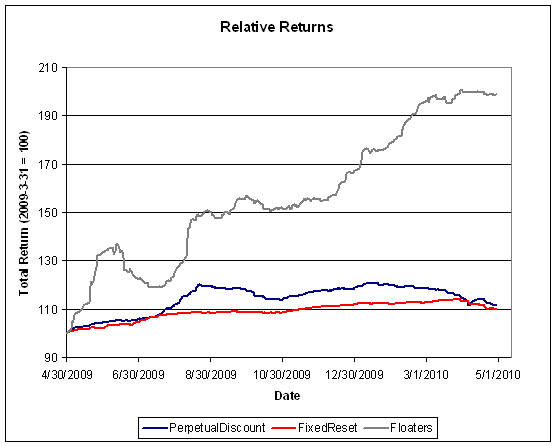

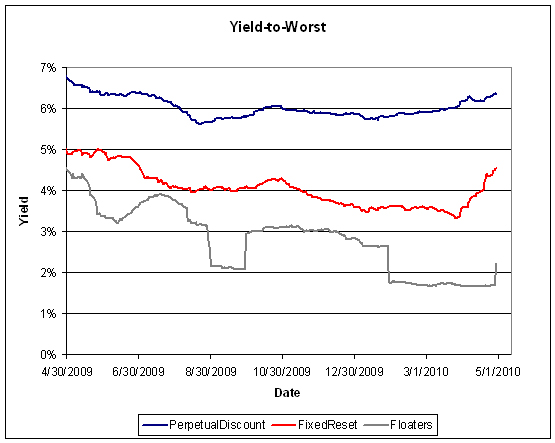

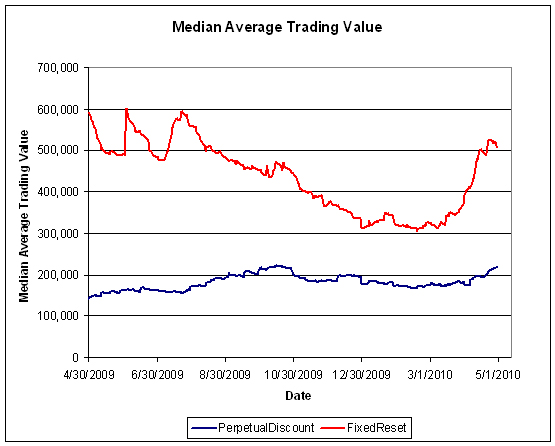

Some recovery in the Canadian preferred share market today on continued heavy volume, with PerpetualDiscounts squeaking out a win of 5bp, while FixedResets were up 36bp.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.54 % |

2.58 % |

50,829 |

21.02 |

1 |

1.7415 % |

2,181.4 |

| FixedFloater |

4.94 % |

3.00 % |

45,733 |

20.35 |

1 |

0.0000 % |

3,237.9 |

| Floater |

2.03 % |

2.26 % |

105,337 |

21.72 |

3 |

-0.7000 % |

2,391.4 |

| OpRet |

4.90 % |

3.87 % |

99,302 |

1.19 |

11 |

0.0000 % |

2,303.4 |

| SplitShare |

6.40 % |

6.57 % |

134,863 |

3.56 |

2 |

-0.0662 % |

2,131.9 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0000 % |

2,106.3 |

| Perpetual-Premium |

5.53 % |

4.77 % |

25,032 |

15.84 |

1 |

0.0000 % |

1,822.8 |

| Perpetual-Discount |

6.28 % |

6.36 % |

218,625 |

13.39 |

77 |

0.0462 % |

1,700.9 |

| FixedReset |

5.54 % |

4.41 % |

502,788 |

3.59 |

44 |

0.3642 % |

2,135.8 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| CU.PR.B |

Perpetual-Discount |

-8.72 % |

This one is courtesy of a lazy market-maker. Three transactions late in the day comprised the entire day’s volume of 1,300 shares; all were executed at 24.65. That took out the bid, though, and the closing quote was 22.50-24.99 (!!), 5×20.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 22.21

Evaluated at bid price : 22.50

Bid-YTW : 6.80 % |

| BAM.PR.K |

Floater |

-1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 17.50

Evaluated at bid price : 17.50

Bid-YTW : 2.26 % |

| POW.PR.C |

Perpetual-Discount |

1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 21.95

Evaluated at bid price : 22.45

Bid-YTW : 6.51 % |

| BNS.PR.Y |

FixedReset |

1.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 23.96

Evaluated at bid price : 24.00

Bid-YTW : 4.01 % |

| PWF.PR.G |

Perpetual-Discount |

1.69 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 22.60

Evaluated at bid price : 22.86

Bid-YTW : 6.50 % |

| BAM.PR.E |

Ratchet |

1.74 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 22.51

Evaluated at bid price : 22.20

Bid-YTW : 2.58 % |

| BMO.PR.P |

FixedReset |

1.75 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-03-27

Maturity Price : 25.00

Evaluated at bid price : 26.15

Bid-YTW : 4.29 % |

| BNS.PR.T |

FixedReset |

2.06 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.80

Bid-YTW : 4.39 % |

| ELF.PR.F |

Perpetual-Discount |

4.49 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-03

Maturity Price : 19.10

Evaluated at bid price : 19.10

Bid-YTW : 7.02 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.X |

FixedReset |

93,927 |

Desjardins crossed two blocks of 20,000 each at 26.60. RBC crossed 40,000 at 26.80.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.62

Bid-YTW : 4.60 % |

| CM.PR.L |

FixedReset |

89,410 |

RBC crossed 20,000 at 26.62; Desjardins crossed 12,300 at 26.68. RBC crossed 35,000 at 26.67.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 26.70

Bid-YTW : 4.74 % |

| TD.PR.K |

FixedReset |

71,127 |

Nesbitt crossed 65,000 at 26.70.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 26.70

Bid-YTW : 4.55 % |

| CM.PR.M |

FixedReset |

62,570 |

RBC crossed 29,200 at 26.69 and 30,000 at 26.70.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 26.83

Bid-YTW : 4.66 % |

| TD.PR.C |

FixedReset |

53,776 |

RBC crossed 50,000 at 26.10.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-02

Maturity Price : 25.00

Evaluated at bid price : 26.17

Bid-YTW : 4.30 % |

| TD.PR.I |

FixedReset |

45,411 |

RBC crossed 25,000 at 26.70.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 26.70

Bid-YTW : 4.55 % |

| There were 50 other index-included issues trading in excess of 10,000 shares. |