Performance of the HIMIPref™ Indices for August, 2010, was:

| Total Return | ||

| Index | Performance August 2010 |

Three Months to August 31, 2010 |

| Ratchet | -2.04% *** | -1.99% *** |

| FixFloat | -2.04% ** | +0.05% ** |

| Floater | -2.04% | -2.23% |

| OpRet | +0.42% | +2.11% |

| SplitShare | +3.65% | +7.48% |

| Interest | +0.42%**** | +2.11%**** |

| PerpetualPremium | +1.68%* | +8.25%* |

| PerpetualDiscount | +2.40% | +10.72% |

| FixedReset | +1.13% | +4.57% |

| * The last member of the PerpetualPremium index was transferred to PerpetualDiscount at the May, 2010, rebalancing; the June performance is set equal to the PerpetualDiscount index; the index was repopulated (from the PerpetualDiscount index) at the June rebalancing. | ||

| ** The last member of the FixedFloater index was transferred to Scraps at the June, 2010, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| *** The last member of the RatchetRate index was transferred to Scraps at the July, 2010, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| **** The last member of the InterestBearing index was transferred to Scraps at the June, 2009, rebalancing; subsequent performance figures are set equal to the OperatingRetractible index | ||

| Passive Funds (see below for calculations) | ||

| CPD | +1.12% | +5.36% |

| DPS.UN | +1.29% | +6.90% |

| Index | ||

| BMO-CM 50 | +1.31% | +6.16% |

| TXPR Total Return | +1.29% | +5.74% |

There was another month of significant tracking error for CPD, as it implemented the July 2010 TXPR Rebalancing.

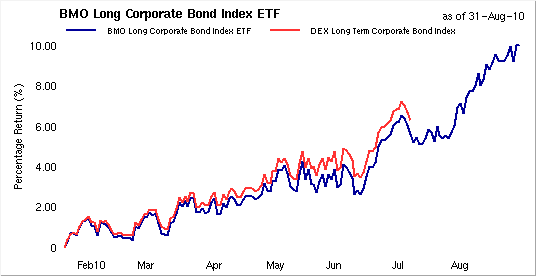

The pre-tax interest equivalent spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the month at 265bp, a significant decline from the 275bp recorded at July month-end. Long corporate yields declined to 5.3% from 5.5% during the period while PerpetualDiscounts had the same decline in dividend terms, from 5.89% to 5.69%, which became a larger move in interest-equivalent terms, from 8.25% to 7.97%. I would be happier with long corporates in the 6.00-6.25% range, but what do I know? The market has never shown any particular interest in my happiness.

Long Corporates have simply been on wheels:

Charts related to the Seniority Spread and the Bozo Spread (PerpetualDiscount Current Yield less FixedReset Current Yield) are published in PrefLetter.

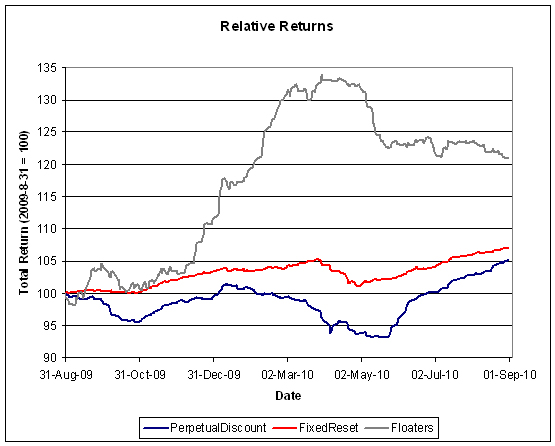

The trailing year returns are starting to look a bit more normal.

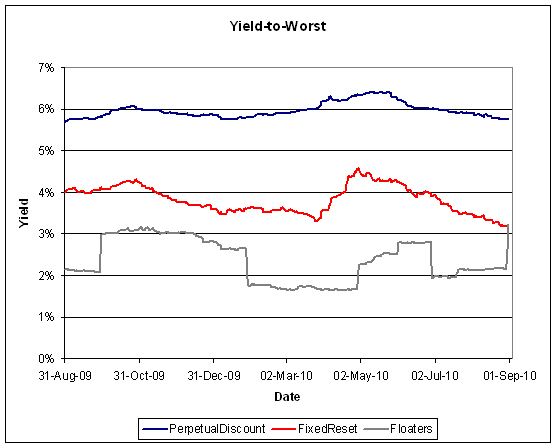

But I suggest that eventually yields will make a difference:

FixedResets set an all time low in median weighted average yield-to-worst during the month … this is going to end in tears.

And look, I know the index yield for Floaters shows discontinuities – it’s a result of index rebalancings due to volume shifting the mid point back and forth between the two BAM issues and either one of the PWF or the TRI issues. Give me better data and I’ll give you a better graph!

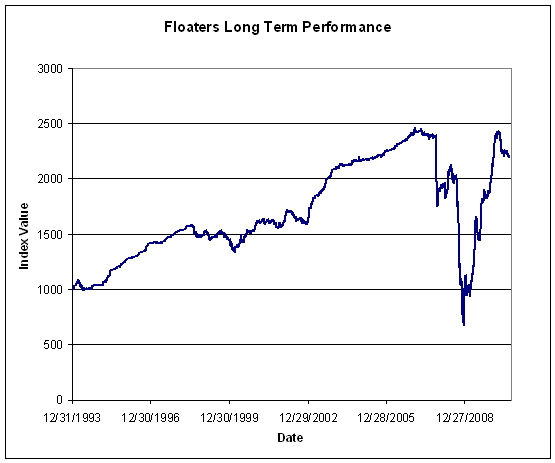

Floaters have had a wild ride; the latest decline is presumably due to the idea that the BoC will be slower rather than faster in hiking the overnight rate:

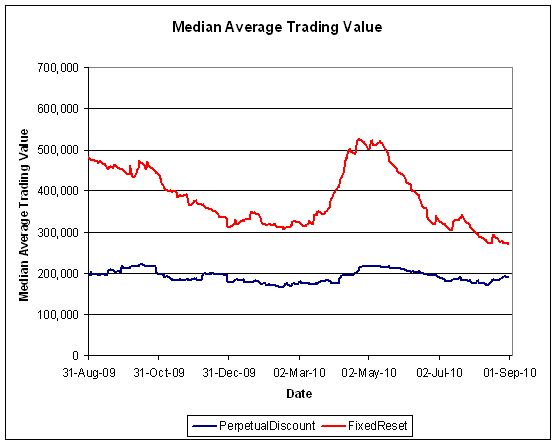

FixedReset volume declined during the month after their burst of activity in April when they performed poorly. Volume may be under-reported due to the influence of Alternative Trading Systems (as discussed in the November PrefLetter), but I am biding my time before incorporating ATS volumes into the calculations, to see if the effect is transient or not.

Compositions of the passive funds were discussed in the September, 2009, edition of PrefLetter.

Claymore has published NAV and distribution data (problems with the page in IE8 can be kludged by using compatibility view) for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to August 31, 2010 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| May 31, 2010 | 16.26 | |||

| June 25 | 16.47 | 0.21 | +2.58% | +2.58% |

| June 30 | 16.47 | 0.00 | 0.00% | |

| July 27 | 16.62 | 0.069 | +1.33% | +1.57% |

| July 30 | 16.66 | 0.00 | +0.24% | |

| August 26 | 16.76 | 0.069 | +1.01% | +1.12% |

| August 31, 2010 | 16.78 | +0.11% | ||

| Quarterly Return | +5.36% | |||

Claymore currently holds $486,846,162 (advisor & common combined) in CPD assets, up about $24-million from the $462,433,680 reported last month and up about $113-million from the $373,729,364 reported at year-end. The monthly increase in AUM of about 5% is larger than the total return of +0.72%, implying that the ETF experienced significant net subscriptions in August.

The DPS.UN NAV for September 1 has been published so we may calculate the approximate August returns.

| DPS.UN NAV Return, August-ish 2010 | ||||

| Date | NAV | Distribution | Return for sub-period | Return for period |

| July 28, 2010 | 20.21 | |||

| September 1, 2010 | 20.57 | +1.78% | ||

| Estimated July Ending Stub | -0.24% ** | |||

| Estimated September Beginning Stub | -0.24% * | |||

| Estimated August Return | +1.29% *** | |||

| *CPD had a NAVPU of 16.82 on September 1 and 16.78 on August 31, hence the total return for the period for CPD was +0.24%. The return for DPS.UN in this period is presumed to be equal. | ||||

| **CPD had a NAVPU of 16.62 on July 28 and 16.66 on July 30, hence the total return for the period for CPD was +0.24%. The return for DPS.UN in this period is presumed to be equal. | ||||

| *** The estimated August return for DPS.UN’s NAV is therefore the product of three period returns, +1.78%, -0.24% and -0.24% to arrive at an estimate for the calendar month of +1.29% | ||||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for June and July:

| DPS.UN NAV Returns, three-month-ish to end-August-ish, 2010 | |

| June-ish | +3.42% |

| July-ish | +2.05% |

| Augusts-ish | +1.29% |

| Three-months-ish | +6.90% |

Sentry Select is now publishing performance data for DPS.UN, but this appears to be price-based, rather than NAV-based. I will continue to report NAV-based figures.