National Bank of Canada has announced:

that it has entered into an agreement with a group of underwriters led by National Bank Financial Inc. for the issuance on a bought deal basis of 8 million non-cumulative 5-year rate reset first preferred shares series 40 (non-viability contingent capital (NVCC)) (the “Series 40 Preferred Shares”) at a price of $25.00 per share, to raise gross proceeds of $200 million.

National Bank has granted the underwriters an option to purchase, on the same terms, up to an additional 4 million Series 40 Preferred Shares. This option is exercisable in whole or in part by the underwriters at any time up to two business days prior to closing. The gross proceeds raised under the offering will be $300 million should this option be exercised in full.

The Series 40 Preferred Shares will yield 4.60% annually, payable quarterly, as and when declared by the Board of Directors of National Bank, for the initial period ending May 15, 2023. The first of such dividends, if declared, shall be payable on May 15, 2018. Thereafter, the dividend rate will reset every five years at a level of 258 basis points over the then 5-year Government of Canada bond yield. Subject to regulatory approval, National Bank may redeem the Series 40 Preferred Shares in whole or in part at par on May 15, 2023 and on May 15 every five years thereafter.

Holders of the Series 40 Preferred Shares will have the right to convert their shares into an equal number of non-cumulative floating rate first preferred shares series 41 (non-viability contingent capital (NVCC)) (the “Series 41 Preferred Shares”), subject to certain conditions, on May 15, 2023, and on May 15 every five years thereafter. Holders of the Series 41 Preferred Shares will be entitled to receive quarterly floating dividends, as and when declared by the Board of Directors of National Bank, equal to the 90-day Government of Canada Treasury Bill rate plus 258 basis points.

The net proceeds of the offering will be used for general corporate purposes and added to National Bank’s capital base. The expected closing date is on or about January 22, 2018. National Bank intends to file in Canada a prospectus supplement to its November 21, 2016 base shelf prospectus in respect of this issue.

They later announced:

that as a result of strong investor demand for its previously announced domestic public offering of non-cumulative 5-year rate reset first preferred shares series 40 (non-viability contingent capital (NVCC)) (the “Series 40 Preferred Shares”), the underwriters have exercised their option to purchase an additional 4,000,000 Series 40 Preferred Shares. The size of the offering has been increased to 12 million shares for gross proceeds of $300 million. The offering will be underwritten by a syndicate led by National Bank Financial Inc. The expected closing date is on or about January 22, 2018.

The net proceeds of the offering will be used for general corporate purposes and added to National Bank’s capital base.

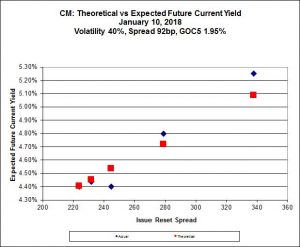

This issue looks quite expensive to me, according to Implied Volatility Analysis:

We see in this chart many of the same features we saw when reviewing the recent BPO new issue and Tuesday’s BEP issue and yesterday’s CM issue:

- The curve is very steep, with Implied Volatility equal to 40% (a ridiculously large figure), and

- The extant issues are trading relatively near to, or well above par

The ludicrously high figure of Implied Volatility is something I take to mean that the underlying assumption of the Black-Scholes model, that of no directionality of prices, is not accepted by the market; the market seems to be taking the view that since things seem rosy now, they will always be rosy and everything will trade near par in the future.

I balk at ascribing a 100% probability to this outcome. There may still be a few old geezers amongst the Assiduous Readers of this blog who can still (faintly) remember the Great Bear Market of 2014-16, in which quite a few similar assumptions made earlier turned out to be slightly inaccurate.

For the long term, I suggest that any change in the slope of the curve will be a flattening, with a very high degree of confidence. This will imply that the higher-spread issues will outperform the lower-spread issues.

All told, though, I have no hesitation in slapping an ‘Expensive’ label on this issue – according to the Implied Volatility analysis shown above, the theoretical price of the new issue is 24.01.