I continue to be fascinated by negative yields:

Want proof we’re still living in abnormal times? The bond market is telling us that many advanced economies won’t see much in the way of nominal growth over the next decade.

In the wake of the Swiss National Bank’s decision to ditch its currency floor and move deposit rates further into negative territory, investors actually lined up to pay the government for the privilege of holding on to their money for a period of 10 years.

According to Bank of America Merrill Lynch, there is now $7.3-trillion (U.S.) in debt that has a minus sign in front of the yield, courtesy of the euro zone, Japan and Switzerland.

…

While the Swiss move got all the headlines last week, India’s central bank governor Raghuram Rajan also surprised with a rate cut. Although this was cast as a response to sliding inflation in light of the slump in oil prices, the governor’s op-ed published prior to this announcement told a different tale. In fact, his reasons were very similar to those of his counterpart in Switzerland: A desire to prevent a wave of inflows into the nation.“If not properly managed, these flows can precipitate a credit and asset-price boom and drive up exchange rates,” he wrote. “When developed-country monetary policies are eventually tightened, some of the capital is likely to depart.”

The Economist provides a little colour:

Some banks and institutions are also forced to hold government bonds, regardless of their yield, because of regulations and liquidity requirements.

The final possibility, and the most obvious explanation in the short term, is that investors have been anticipating the introduction of quantitative easing by the European Central Bank. If experience in America and Britain is any guide, purchases by the ECB will eventually drive prices up and yields down. Why worry about the theoretical loss involved in holding a bond till maturity if the investor knows he can offload the bond to his friendly neighbourhood central bank?

There are risks involved, of course. If the global economy returns to normal, then losses on government bonds will be substantial. The same would be true if inflation ever reappears. M&G says that if German bond yields merely rose back to the levels that prevailed at their previous trough, in 2012, when it was feared the euro might break up, investors would suffer a capital loss of 7%. Whatever else European government bonds may be, they are not risk-free.

Canadian inflation is lower than expectations:

Canadian inflation slowed to 1.5 percent in December as cheaper gasoline countered accelerating prices on most other items, reinforcing Bank of Canada Governor Stephen Poloz’s argument the economy needs lower interest rates.

The core inflation rate, which excludes eight volatile products such as energy, quickened to 2.2 percent from November’s 2.1 percent pace, Statistics Canada said today from Ottawa. Economists in a Bloomberg News survey forecast the total rate would slow to 1.6 percent from 2.0 percent and core prices would rise 2.3 percent.

Valener Inc., proud issuer of VNR.PR.A, was confirmed at Pfd-2(low) by DBRS:

DBRS Limited (DBRS) has today confirmed Valener Inc.’s (Valener or the Company) Cumulative Rate Reset Preferred Shares, Series A rating at Pfd-2 (low) with a Stable trend. The rating is based on the stability of dividends distributed to the Company from its 29% interest in Gaz Métro Limited Partnership (GMLP), which guarantees the First Mortgage Bonds and Senior Secured Notes (rated “A”) of Gaz Métro inc. (GMi). The rating also reflects Valener’s low non-consolidated leverage. GMi owns the remaining 71% of GMLP.

It was another violently mixed day for the Canadian preferred share market, with PerpetualDiscounts up 41bp, FixedResets down 14bp and DeemedRetractibles off 7bp. Yet another lengthy Performance Highlights table was dominated by losing FixedResets and winning Straight Perpetuals. Volume was below average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

- based on Implied Volatility Theory only

- are relative only to other FixedResets from the same issuer

- assume constant GOC-5 yield

- assume constant Implied Volatility

- assume constant spread

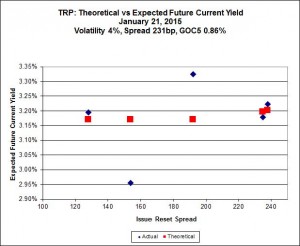

Here’s TRP:

So according to this, TRP.PR.A, bid at 20.99, is $0.71 cheap, but it has already reset (at +192). TRP.PR.C, bid at 19.47 and resetting at +154bp on 2016-1-30 is $0.82 rich.

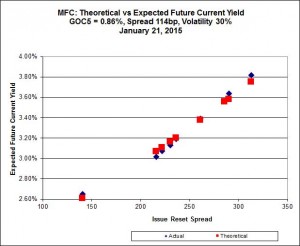

MFC.PR.F continues to be near the line defined by its peers despite its very poor performance today, as Implied Volatility declined again from 24% yesterday to 20% today.

Implied Volatility for MFC continues to be a conundrum. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

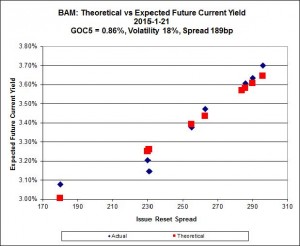

There continues to be cheapness in the lowest-spread issue, BAM.PR.X, resetting at +180bp on 2017-6-30, which is bid at 21.62 and appears to be $0.35 cheap, while BAM.PR.T, resetting at +231bp 2017-3-31 is bid at 24.91 and appears to be $0.67 rich.

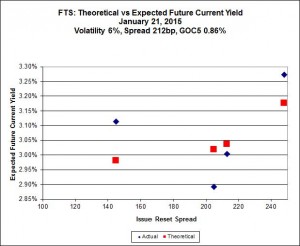

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 18.28, looks $0.88 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp, and bid at 25.15, looks $1.12 expensive and resets 2019-3-1.

Pairs equivalence is all over the map, but the investment grade pairs (which are presumably more closely watched and easier to trade) do show a rising trend with increasing time to interconversio which, qualitatively speaking, is entirely reasonable. The average break-even rate is way down from recent levels again today, reinforcing yesterday’s move. And it’s kinda neat to see that the DC.PR.B / DC.PR.D pair is now priced for a negative three-month bill rate over the next four and a half years-odd.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4586 % | 2,453.7 |

| FixedFloater | 4.45 % | 3.63 % | 19,270 | 18.23 | 1 | -0.2800 % | 3,975.8 |

| Floater | 3.09 % | 3.24 % | 54,724 | 19.14 | 4 | 0.4586 % | 2,608.4 |

| OpRet | 4.04 % | 1.52 % | 95,989 | 0.40 | 1 | 0.0000 % | 2,755.3 |

| SplitShare | 4.29 % | 4.09 % | 32,700 | 3.60 | 5 | -0.1954 % | 3,188.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 2,519.4 |

| Perpetual-Premium | 5.42 % | -9.67 % | 55,637 | 0.09 | 19 | -0.2132 % | 2,512.1 |

| Perpetual-Discount | 5.01 % | 4.85 % | 107,872 | 15.30 | 16 | 0.4146 % | 2,769.1 |

| FixedReset | 4.24 % | 3.22 % | 208,685 | 17.26 | 77 | -0.1364 % | 2,524.9 |

| Deemed-Retractible | 4.92 % | 0.23 % | 101,362 | 0.09 | 39 | -0.0716 % | 2,641.8 |

| FloatingReset | 2.46 % | 2.49 % | 67,147 | 6.46 | 7 | 0.2435 % | 2,413.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| IFC.PR.C | FixedReset | -2.86 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.78 Bid-YTW : 3.78 % |

| TRP.PR.C | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 19.47 Evaluated at bid price : 19.47 Bid-YTW : 3.19 % |

| ENB.PF.G | FixedReset | -2.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.68 Evaluated at bid price : 23.86 Bid-YTW : 3.92 % |

| MFC.PR.F | FixedReset | -1.90 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.65 Bid-YTW : 4.83 % |

| HSE.PR.A | FixedReset | -1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 20.05 Evaluated at bid price : 20.05 Bid-YTW : 3.37 % |

| BMO.PR.L | Deemed-Retractible | -1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-25 Maturity Price : 25.50 Evaluated at bid price : 26.00 Bid-YTW : 2.52 % |

| CGI.PR.D | SplitShare | -1.22 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2023-06-14 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : 3.71 % |

| ENB.PF.E | FixedReset | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.71 Evaluated at bid price : 23.89 Bid-YTW : 3.89 % |

| POW.PR.G | Perpetual-Premium | -1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-04-15 Maturity Price : 26.00 Evaluated at bid price : 26.71 Bid-YTW : 4.17 % |

| BNS.PR.C | FloatingReset | 1.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.77 Bid-YTW : 2.53 % |

| CU.PR.E | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-09-01 Maturity Price : 25.00 Evaluated at bid price : 25.45 Bid-YTW : 4.74 % |

| BAM.PR.Z | FixedReset | 1.16 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-12-31 Maturity Price : 25.00 Evaluated at bid price : 26.06 Bid-YTW : 3.40 % |

| CU.PR.D | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-09-01 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 4.70 % |

| CU.PR.F | Perpetual-Discount | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 23.35 Evaluated at bid price : 23.70 Bid-YTW : 4.80 % |

| BAM.PR.N | Perpetual-Discount | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.88 Evaluated at bid price : 23.29 Bid-YTW : 5.13 % |

| BAM.PR.M | Perpetual-Discount | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.90 Evaluated at bid price : 23.20 Bid-YTW : 5.15 % |

| GWO.PR.P | Deemed-Retractible | 2.35 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-03-31 Maturity Price : 26.00 Evaluated at bid price : 26.57 Bid-YTW : 4.31 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.P | FixedReset | 686,000 | Called for Redemption 2015-2-25. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-25 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 1.76 % |

| ENB.PF.E | FixedReset | 287,930 | RBCC crossed 70,200 at 24.25 and 50,000 at 24.22. TD crossed 50,000 at 24.22; Nesbitt crossed 95,400 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.71 Evaluated at bid price : 23.89 Bid-YTW : 3.89 % |

| ENB.PF.G | FixedReset | 83,200 | Nesbitt crossed 75,000 at 24.22. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 22.68 Evaluated at bid price : 23.86 Bid-YTW : 3.92 % |

| RY.PR.Z | FixedReset | 60,855 | Desjardins crossed 50,000 at 25.65. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 23.42 Evaluated at bid price : 25.65 Bid-YTW : 2.98 % |

| TD.PF.C | FixedReset | 56,796 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-23 Maturity Price : 23.22 Evaluated at bid price : 25.17 Bid-YTW : 3.11 % |

| PWF.PR.F | Perpetual-Premium | 52,927 | Desjardins crossed 47,400 at 25.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-22 Maturity Price : 25.00 Evaluated at bid price : 25.40 Bid-YTW : -15.06 % |

| There were 26 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| ENB.PF.G | FixedReset | Quote: 23.86 – 24.40 Spot Rate : 0.5400 Average : 0.3123 YTW SCENARIO |

| IFC.PR.C | FixedReset | Quote: 24.78 – 25.20 Spot Rate : 0.4200 Average : 0.2489 YTW SCENARIO |

| BMO.PR.L | Deemed-Retractible | Quote: 26.00 – 26.45 Spot Rate : 0.4500 Average : 0.2794 YTW SCENARIO |

| NEW.PR.D | SplitShare | Quote: 32.33 – 33.33 Spot Rate : 1.0000 Average : 0.8586 YTW SCENARIO |

| ENB.PF.E | FixedReset | Quote: 23.89 – 24.25 Spot Rate : 0.3600 Average : 0.2370 YTW SCENARIO |

| MFC.PR.B | Deemed-Retractible | Quote: 24.46 – 24.92 Spot Rate : 0.4600 Average : 0.3545 YTW SCENARIO |