A bit of good news on the regulatory extortion front – a US judge is questioning the SEC / SAC Capital settlement:

SAC Capital Advisors LP will have to wait to learn if its $602 million insider trading settlement with the Securities and Exchange Commission can go forward, after a Manhattan judge raised questions over a provision that allows SAC to avoid admitting it did anything wrong.

SAC and the agency asked Marrero today to approve the agreement, which is the SEC’s biggest insider trading settlement in history. It would resolve SEC claims that SAC and its CR Intrinsic Investors LLC unit profited from illegal tips about an Alzheimer’s drug received by a former portfolio manager, Mathew Martoma.

U.S. District Judge Victor Marrero today expressed concern about the SEC’s use of the provision, which was questioned by a different judge who rejected an SEC settlement with Citigroup Inc. (C) in 2011. Marrero said today he may condition approval of the SAC deal on a ruling in the Citigroup case by the U.S. appeals court in New York. Marrero also asked what would happen if Martoma, who has pleaded not guilty to related criminal charges, is convicted.

There’s some new progress on atmospheric carbon dioxide extraction:

“What this discovery means is that we can remove plants as the middleman,” said Adams, who is co-author of the study detailing their results published March 25 in the early online edition of the Proceedings of the National Academies of Sciences. “We can take carbon dioxide directly from the atmosphere and turn it into useful products like fuels and chemicals without having to go through the inefficient process of growing plants and extracting sugars from biomass.”

The process is made possible by a unique microorganism called Pyrococcus furiosus, or “rushing fireball,” which thrives by feeding on carbohydrates in the super-heated ocean waters near geothermal vents. By manipulating the organism’s genetic material, Adams and his colleagues created a kind of P. furiosus that is capable of feeding at much lower temperatures on carbon dioxide.

The research team then used hydrogen gas to create a chemical reaction in the microorganism that incorporates carbon dioxide into 3-hydroxypropionic acid, a common industrial chemical used to make acrylics and many other products.

It’s tough to get ahead in the investment business. Talent isn’t enough. Hard work isn’t enough. You’ve got to have that little extra something:

Wells Fargo & Co. (WFC), the most valuable U.S. bank, paid a board member’s son about $1.4 million last year for his work in a unit responsible for investing deposits.

Scott P. Quigley, 44, received the compensation as a manager in the principal investments group, according to the San Francisco-based lender’s most recent proxy filing. His father, Philip J. Quigley, a Wells Fargo director since 1994, is retiring from the board in April. Scott Quigley declined to comment, and his father didn’t respond to messages seeking comment. The bank declined to make them available.

Canadian inflation remains low:

The country’s consumer price index rose 1.2 per cent in February from a year earlier, quickening from a 0.5-per-cent increase in January, Statistics Canada said Wednesday. It also climbed 1.2 per cent from a month earlier, the fastest monthly pace of inflation since 1991.

…

Transportation costs led the annual increase, advancing 2 per cent, spurred by higher costs at the pump, and as rebates disappeared at car dealerships. Food prices accelerated to 1.9 per cent after a 1.1-per-cent gain in January as consumers paid more for meat and fresh fruit. The cost of fuel oil also rose.

OSFI has come out with another Planning Report Produced Because It’s Expected Of Us Because Of Some Kind Of Governance Thingy. Of great interest is their targetted depositor recovery on default:

| Program Expected Results |

Performance Indicators |

Targets |

| Protect depositors and policy holders while recognizing that all failures cannot be prevented. |

Percentage of estimated recoveries on failed institutions. (amount recovered per dollar of claim) |

90% |

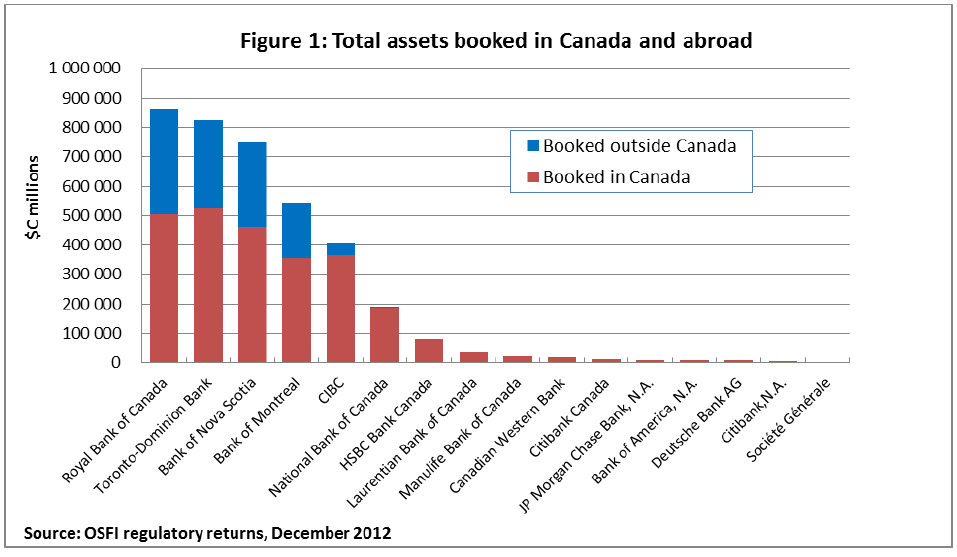

I wonder if anybody’s told the CDIC that OSFI will give itself a pat on the back if depositor recoveries in the event of the failure of a major bank exceed 90%? Hmm … CDIC has about 2.4-billion in cash and investments on the books … the smallest of the Big Six Banks, National Bank, has about 93-billion in deposits on its books … well, let’s just hope that none of the big six fail, that’s all!

Regulatory lawyers are continuing their campaign to destroy the corporate bond market:

Are there steps that can or should be taken to facilitate exchange trading of corporate bonds and other fixed income securities? Were ATSs required to disseminate pre-trade pricing information, would there be an impact on exchange trading of corporate bonds? If so, what would be the impact?

Should the Commission consider regulatory initiatives that would encourage the use of transparent execution venues, such as exchanges or ATSs that publicly disseminate trading interest on their systems? For example, what would be the benefits and drawbacks of requiring brokers to affirmatively offer retail customers the option of exposing their orders on one or more of these transparent execution venues? Are there better ways to foster price transparency in these markets?

…

Better Investor Information

Should investors be provided more information about the compensation of broker-dealers trading in a principal capacity? What would be the benefits and burdens of requiring the disclosure of dealer markups to customers? Are certain types of transactions more suited for markup disclosure, such as riskless principal transactions? How should a riskless principal transaction be defined for corporate bond or other fixed income transactions? What would be the most effective way to provide markup disclosures to customers?

Do steps need to be taken to help assure that investors know about the various execution options available to them and the potential advantages and disadvantages of each? What would be the relative merits of requiring broker disclosure of those options at the time of the transaction, as compared with periodic disclosure (e.g., at account opening and annually thereafter), or general investor education efforts?

Do steps need to be taken to help assure that investors have pricing information relevant to their fixed income security transaction?

All the questions assume that corporate bond financing exists in some kind of bubble world, unaffected by competition from other venues and private placements.

Lauren Lambie-Hanson at the Boston Fed asks the question When Does Delinquency Result in Neglect? Mortgage Delinquency and Property Maintenance:

Studies of foreclosure externalities have overwhelmingly focused on the impact of forced sales on the value of nearby properties, typically finding modest evidence of foreclosure spillovers. However, many quality-of-life issues posed by foreclosures may not be reflected in nearby sale prices. This paper uses new data from Boston on constituent complaints and requests for public services made to City government departments, matched with loan-level data, to examine the timing of foreclosure externalities. I find evidence that property conditions suffer most while homes are bank owned, although reduced maintenance is also common earlier in the foreclosure process. Since short sales prevent bank ownership, they should result in fewer neighborhood disamenities than foreclosures.

“Disamenities”?

Nice perspective on Cyprus:

For Cypriot banks, particularly Laiki Bank, at the center of the current storm, however, these conclusions foretold a disaster: Altogether, they lost more than 4-billion euros, a huge amount in a country with a gross domestic product of just 18-billion euros. Laiki, also known as Cyprus Popular Bank, alone took a hit of 2.3 billion euros, according to its 2011 annual report.

[Kikis] Kazamias, the finance minister at the time of the Greek bond write-down, said he had little idea of just how badly the move would hurt his country’s banks.

“We worried but we never received any information that this was a red line” that should not have been crossed, he said. The Cypriot government, he added, initially calculated that “we were in a position to cover the losses,” and it was only later, after depositors began to flee and the Cyprus economy stalled, that “we found out that this was impossible.”

Spend-Every-Penny’s going to start choosing his new lap-dog next week:

Finance Minister Jim Flaherty should receive a short list of candidates to replace Bank of Canada Governor Mark Carney after a meeting of the central bank’s board of directors next week, said two people familiar with the plans.

Flaherty will get the list after the two-day meeting in Ottawa, said the people, who asked not to be identified because the discussions are private. Flaherty, who has said that the announcement could be made in April, will then interview the people on the short list, with the appointment to be approved by Prime Minister Stephen Harper and his cabinet.

The bank’s outside directors have been reviewing candidates after posting the job Jan. 7, following Carney’s surprise November announcement he would leave his job June 1 to take over the Bank of England. Analysts at JPMorgan Chase & Co. have said the most likely replacements are Senior Deputy Governor Tiff Macklem and Export Development Canada Chief Executive Officer Stephen Poloz.

Want the job, boys? Roll over! Beg! Copy the highlights from my next speech into your next speech!

It was a modestly positive day for the Canadian preferred share market, with PerpetualPremiums winning 6bp, FixedResets gaining 2bp and DeemedRetractibles up 5bp. Volatility was reasonably good. Volume was heavy.

And that’s it for another month! Malachite Aggressive Preferred Fund is now 12 years old – Happy Birthday!

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.3849 % |

2,634.8 |

| FixedFloater |

4.10 % |

3.45 % |

28,537 |

18.36 |

1 |

0.4338 % |

3,963.1 |

| Floater |

2.54 % |

2.83 % |

80,468 |

20.16 |

5 |

-0.3849 % |

2,844.9 |

| OpRet |

4.80 % |

0.96 % |

55,746 |

0.18 |

5 |

0.2635 % |

2,609.0 |

| SplitShare |

4.26 % |

4.32 % |

138,933 |

4.18 |

4 |

0.2584 % |

2,954.9 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2635 % |

2,385.7 |

| Perpetual-Premium |

5.21 % |

-0.90 % |

92,241 |

0.10 |

31 |

0.0649 % |

2,372.3 |

| Perpetual-Discount |

4.75 % |

4.82 % |

164,620 |

15.72 |

5 |

-0.0081 % |

2,677.4 |

| FixedReset |

4.88 % |

2.51 % |

292,054 |

3.28 |

80 |

0.0192 % |

2,522.7 |

| Deemed-Retractible |

4.85 % |

2.19 % |

126,019 |

0.16 |

44 |

0.0517 % |

2,456.8 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BNS.PR.Z |

FixedReset |

-1.01 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.15

Bid-YTW : 2.85 % |

| BNS.PR.P |

FixedReset |

1.00 % |

Will not be called. Yields 3.15% to Hard Maturity 2022-01-31

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 25.19

Bid-YTW : -2.60 % |

| VNR.PR.A |

FixedReset |

1.08 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-10-15

Maturity Price : 25.00

Evaluated at bid price : 27.20

Bid-YTW : 2.51 % |

| MFC.PR.A |

OpRet |

1.09 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-27

Maturity Price : 25.75

Evaluated at bid price : 25.96

Bid-YTW : -4.67 % |

| HSB.PR.D |

Deemed-Retractible |

1.23 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-27

Maturity Price : 25.50

Evaluated at bid price : 25.56

Bid-YTW : 1.38 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.P |

FixedReset |

424,325 |

Recent extension announcement. Yields 3.15% to Hard Maturity 2022-01-31

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 25.19

Bid-YTW : -2.60 % |

| TRP.PR.D |

FixedReset |

130,159 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2019-04-30

Maturity Price : 25.00

Evaluated at bid price : 25.96

Bid-YTW : 3.36 % |

| BNS.PR.Z |

FixedReset |

76,223 |

Scotia sold 10,900 to RBC at 25.17.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.15

Bid-YTW : 2.85 % |

| BNS.PR.R |

FixedReset |

74,836 |

Nesbitt bought blocks of 10,000 and 12,300 from Scotia, both at 25.35.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-26

Maturity Price : 25.00

Evaluated at bid price : 25.40

Bid-YTW : 2.51 % |

| SLF.PR.G |

FixedReset |

64,969 |

Nesbitt crossed 25,000 at 25.65.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.55

Bid-YTW : 2.80 % |

| TRP.PR.A |

FixedReset |

63,394 |

National crossed two blocks of 20,000 each, the first at 25.57, the second at 25.61.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-28

Maturity Price : 23.87

Evaluated at bid price : 25.64

Bid-YTW : 3.05 % |

| There were 58 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| MFC.PR.H |

FixedReset |

Quote: 27.15 – 27.49

Spot Rate : 0.3400

Average : 0.1949

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-03-19

Maturity Price : 25.00

Evaluated at bid price : 27.15

Bid-YTW : 2.36 % |

| ENB.PR.F |

FixedReset |

Quote: 26.14 – 26.49

Spot Rate : 0.3500

Average : 0.2120

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2018-06-01

Maturity Price : 25.00

Evaluated at bid price : 26.14

Bid-YTW : 3.12 % |

| MFC.PR.F |

FixedReset |

Quote: 25.65 – 25.90

Spot Rate : 0.2500

Average : 0.1419

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.65

Bid-YTW : 2.92 % |

| TRI.PR.B |

Floater |

Quote: 24.09 – 24.44

Spot Rate : 0.3500

Average : 0.2669

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-28

Maturity Price : 23.84

Evaluated at bid price : 24.09

Bid-YTW : 2.15 % |

| PWF.PR.R |

Perpetual-Premium |

Quote: 26.96 – 27.25

Spot Rate : 0.2900

Average : 0.2080

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2020-04-30

Maturity Price : 25.25

Evaluated at bid price : 26.96

Bid-YTW : 4.49 % |

| W.PR.H |

Perpetual-Premium |

Quote: 25.65 – 26.00

Spot Rate : 0.3500

Average : 0.2742

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-27

Maturity Price : 25.00

Evaluated at bid price : 25.65

Bid-YTW : -27.04 % |