RBC is defending its capital markets exposure:

Frustrated with a recent ratings downgrade and worried by the imminent possibility of another, Royal Bank of Canada is intent on proving that its capital markets arm poses no real threat to its future.

…

Facing another blow, RBC lashed out, arguing that its inclusion in a review of too-big-to-fail firms was “unwarranted,” in part because its capital markets business represented less than 25 per cent of the bank’s bottom line.Building on this argument, RBC put together a special presentation for analysts and investors on Friday that focused solely on its capital markets business. The bank did not come out and say that the presentation was designed to prove Moody’s wrong, but the potential downgrade was hinted at many times.

…

RBC also devoted a lot of time to risk management practices, another of Moody’s concerns. In February, the rating agency noted that “rapidly changing risk positions expose these firms to unexpected losses that can overwhelm the resources of even the largest, most diversified groups.” RBC noted that of the roughly 1,000 people added since 2008, the majority have been in the back office, where divisions such as risk management are housed.

Divisions such as compliance are also housed in the back office. The RBC Presentation proudly states that the Capital Market division is:

Strategically extending our loan book to deepen client relationships

- Modest sized loan book representing 13% of RBC’s total outstanding loans and acceptances

- Since 2009, increased the number of lending clients by 30% to over 1,200

… but I’m not sure if that’s a good thing for either the bank or society, despite all their protestations regarding diversification, exposure limits and profitability. The lending makes it difficult, if not impossible, for non-bank dealers to compete; and the dual purpose of the lending (to make a lending profit and to make a trading profit) makes these loans somewhat more suceptible to jiggery-pokery at approval time.

The OSC has a new policy:

Staff of the Compliance and Registrant Regulation Branch of the Ontario Securities Commission (the OSC) is sending this email to firms that are registered under the Securities Act (Ontario) (the Act) in the categories of exempt market dealer, scholarship plan dealer, or portfolio manager, to advise such firms of a new approach OSC staff will be adopting when performing compliance reviews under section 20 of the Act. Specifically, OSC staff will now contact clients of registered firms as a routine part of its compliance review process.

While OSC staff have historically not contacted clients of a registered firm as part of the compliance review process, we have done so in a number of exceptional cases and have found that client contact is a valuable method of assessing the firm’s compliance with Ontario securities law. Accordingly, we will be expanding our use of this important tool and will be contacting clients in the normal course of compliance reviews. Clients may be asked a variety of questions regarding their experience with their registered firm and representative, including such things as the accuracy of know-your-client information the firm has about them and investment recommendations and advice provided to them.

Unless OSC staff have reason to believe that regulatory action against a firm may be warranted, clients who are contacted by OSC staff will be informed that they are being contacted in the normal course of a compliance review of the firm, and that the call to them should not be interpreted as a sign of any misconduct by the firm. Clients will also be informed that they are not required to speak with OSC staff should they choose not to, and that their participation in the compliance review process is entirely voluntary.

The Globe has a very interesting piece on housing affordability:

Where things get weird is in how they calculate the average house price. What they’ve done is set the price at $144,600 in 1990, which is simply the average resale price at the time as calculated by the Canadian Real Estate Association (CREA). From that point, the Bank of Canada estimates the change in the average house price by averaging out gains as reported by Statistics Canada’s New House Price index (NHPI), and by Royal Lepage (i.e. CREA).

The issue here is that the NHPI is a quality-adjusted index, which means it seeks to measure the change in a comparable dwelling over time. This is a very important concept when it comes to tracking true inflation over time as you need an apples-to-apples comparison.

…

We know that the average size of new dwellings has risen in Canada, with the average new house being just under 2,000 square feet, according to data from the Canadian Home Builders Association. This is up markedly since the 1970s when the average house size in Canada was under 1,100 square feet. So as a society, we’ve changed our expectations for what constitutes a “normal sized” house. The problem is that as we’ve demanded larger and larger homes with better amenities and have been willing to stretch the household budget further to get those, the NHPI has been busy factoring out these changes.The end result is that by pegging 50 per cent of the growth in house prices to the NHPI, the average house price used in the Bank of Canada affordability index has significantly underperformed other measures of house price appreciation. The chart above illustrates the change in value of the average house used in the Bank of Canada affordability index. If you believe that the average house in Canada is $260,000, I can see how you’d think that there was no problem with affordability in Canada.

The full piece is well-worth reading and is a good companion to the recent RBC quarterly report on the topic.

Henry Paulson has joined the fray on new US MMF rules:

Former Treasury Secretary Henry Paulson is backing U.S. Securities and Exchange Commission Chairman Mary Schapiro’s effort to impose new rules on money- market funds.

In a letter that the SEC published May 30 on its website, Paulson highlights excerpts of his 2010 book, “On the Brink,” which provides his account of the financial crisis. Paulson’s letter covered the period between Sept. 16 and Sept. 19, 2008 when Bank of New York Mellon Corp., BlackRock Inc. (BLK) and Northern Trust Corp. (NTRS) reported requests for “billions in redemptions” from their money funds. Such requests exacerbated a credit crisis that began earlier that month, he wrote.

…

Schapiro initially proposed requiring money-market firms float their $1 net asset value along with mandating more capital and preventing customers from withdrawing all of their funds for 30 days. The so-called holdback provision has been particularly controversial in the industry and Schapiro is said to be open to replacing it with a fee that would be imposed on customers who take out their money during a liquidity crisis.Money-market firms have also fought the effort to move the industry to a floating net asset value. Paulson’s letter highlights a passage in his book that supports the floating value.

How is one to square the circle? MMFs invest in risky assets – corporate paper. No amount of rules will eliminate the credit risk. Only capital will do that – all MMFs must have either a second class of securities that will take the first loss following a credit event or a credible guarantee from their sponsors … nothing else will do. All together folks … MMFs ARE BANKS IN FUNDS’ CLOTHING! They should be regulated as such! And – importantly – since they are banks, they should hold more capital against holdings of bank paper – any bank paper, from any bank – than should be the case for non-bank paper!

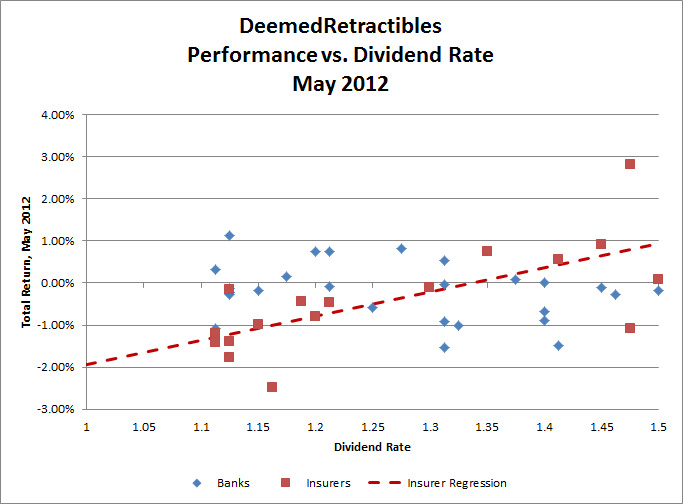

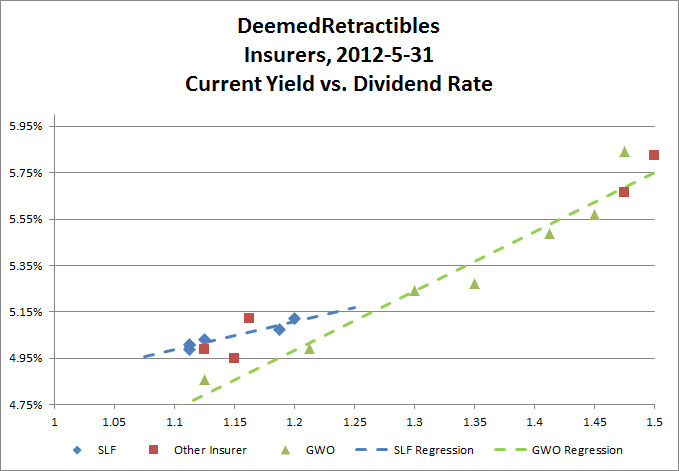

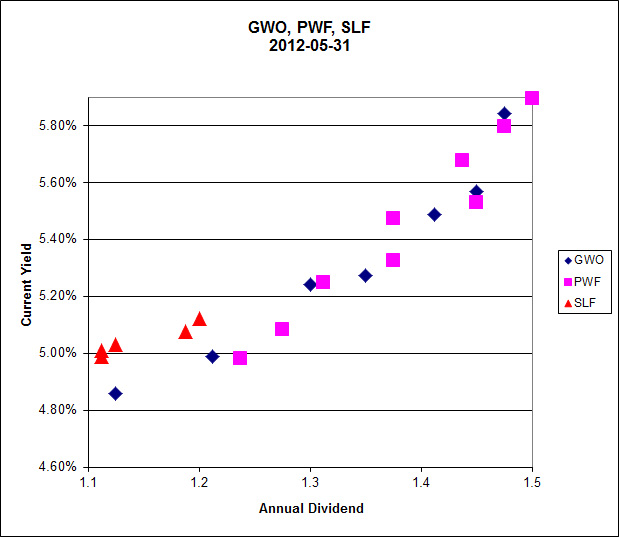

It was a rotten day for the Canadian preferred share market, with PerpetualPremiums off 16bp, FixedResets down 26bp and DeemedRetractibles losing 41bp. To make things more interesting, Floaters got whacked for 431bp, so it is not enough to speak glibly about ‘rising interest rates’! A very lengthy list of losers in the Performance Highlights table was comprised almost entirely of insurance issues. Volume was below average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -4.3077 % | 2,331.9 |

| FixedFloater | 4.49 % | 3.87 % | 29,476 | 17.58 | 1 | 0.1420 % | 3,511.4 |

| Floater | 3.10 % | 3.12 % | 77,012 | 19.37 | 3 | -4.3077 % | 2,517.8 |

| OpRet | 4.81 % | 2.55 % | 38,967 | 1.04 | 5 | 0.0155 % | 2,498.8 |

| SplitShare | 5.28 % | -5.32 % | 50,745 | 0.54 | 4 | 0.6061 % | 2,713.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0155 % | 2,285.0 |

| Perpetual-Premium | 5.46 % | 3.31 % | 78,569 | 0.60 | 26 | -0.1590 % | 2,223.4 |

| Perpetual-Discount | 5.04 % | 5.07 % | 137,290 | 15.30 | 7 | -0.2184 % | 2,441.7 |

| FixedReset | 5.08 % | 3.25 % | 191,552 | 7.90 | 70 | -0.2570 % | 2,378.2 |

| Deemed-Retractible | 5.04 % | 3.92 % | 155,934 | 3.17 | 45 | -0.4091 % | 2,294.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.K | Floater | -4.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 17.00 Evaluated at bid price : 17.00 Bid-YTW : 3.12 % |

| BAM.PR.B | Floater | -4.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 3.12 % |

| BAM.PR.C | Floater | -3.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 16.86 Evaluated at bid price : 16.86 Bid-YTW : 3.14 % |

| BAM.PF.A | FixedReset | -2.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 22.92 Evaluated at bid price : 24.51 Bid-YTW : 4.22 % |

| SLF.PR.D | Deemed-Retractible | -2.68 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.45 Bid-YTW : 6.44 % |

| MFC.PR.F | FixedReset | -2.57 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.54 Bid-YTW : 4.00 % |

| SLF.PR.C | Deemed-Retractible | -2.50 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.45 Bid-YTW : 6.44 % |

| SLF.PR.E | Deemed-Retractible | -2.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.60 Bid-YTW : 6.40 % |

| SLF.PR.B | Deemed-Retractible | -1.89 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.89 Bid-YTW : 5.95 % |

| MFC.PR.B | Deemed-Retractible | -1.63 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.35 Bid-YTW : 6.13 % |

| MFC.PR.G | FixedReset | -1.56 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.60 Bid-YTW : 4.41 % |

| SLF.PR.A | Deemed-Retractible | -1.55 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.90 Bid-YTW : 5.89 % |

| POW.PR.A | Perpetual-Premium | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 24.89 Evaluated at bid price : 25.12 Bid-YTW : 5.65 % |

| MFC.PR.C | Deemed-Retractible | -1.25 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.07 Bid-YTW : 6.13 % |

| MFC.PR.D | FixedReset | -1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-19 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 4.13 % |

| PWF.PR.L | Perpetual-Premium | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 24.48 Evaluated at bid price : 24.76 Bid-YTW : 5.20 % |

| SLF.PR.H | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.31 Bid-YTW : 3.90 % |

| SLF.PR.G | FixedReset | -1.09 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.50 Bid-YTW : 3.34 % |

| IAG.PR.E | Deemed-Retractible | -1.08 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-12-31 Maturity Price : 25.25 Evaluated at bid price : 25.70 Bid-YTW : 5.52 % |

| SLF.PR.F | FixedReset | -1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.82 Bid-YTW : 4.15 % |

| BAM.PR.R | FixedReset | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 23.59 Evaluated at bid price : 26.20 Bid-YTW : 3.49 % |

| BNA.PR.E | SplitShare | 1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.80 Bid-YTW : 5.04 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| IAG.PR.G | FixedReset | 97,915 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.10 Bid-YTW : 4.12 % |

| BNS.PR.Z | FixedReset | 78,166 | TD sold 10,000 to Scotia at 25.00 and crossed 40,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.96 Bid-YTW : 3.04 % |

| ELF.PR.H | Perpetual-Premium | 65,698 | Scotia bought 11,900 from anonymous at 25.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 24.68 Evaluated at bid price : 25.08 Bid-YTW : 5.56 % |

| SLF.PR.A | Deemed-Retractible | 52,793 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.90 Bid-YTW : 5.89 % |

| ENB.PR.D | FixedReset | 43,087 | Desjardins crossed 40,000 at 25.25. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 23.19 Evaluated at bid price : 25.22 Bid-YTW : 3.44 % |

| ENB.PR.H | FixedReset | 42,965 | Scotia crossed 28,700 at 25.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-04 Maturity Price : 23.13 Evaluated at bid price : 25.10 Bid-YTW : 3.33 % |

| There were 24 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.O | OpRet | Quote: 25.95 – 26.88 Spot Rate : 0.9300 Average : 0.5744 YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 26.32 – 26.99 Spot Rate : 0.6700 Average : 0.4400 YTW SCENARIO |

| POW.PR.A | Perpetual-Premium | Quote: 25.12 – 25.70 Spot Rate : 0.5800 Average : 0.3632 YTW SCENARIO |

| BAM.PF.A | FixedReset | Quote: 24.51 – 25.00 Spot Rate : 0.4900 Average : 0.2928 YTW SCENARIO |

| TCA.PR.X | Perpetual-Premium | Quote: 51.80 – 52.50 Spot Rate : 0.7000 Average : 0.5387 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 23.54 – 23.99 Spot Rate : 0.4500 Average : 0.3145 YTW SCENARIO |