There’s some criticism of the European stress tests:

Regulators have told lenders the tests may assume a loss of about 17 percent on Greek government debt, 3 percent on Spanish bonds and none on German debt, said two people briefed on the talks who declined to be identified because the details are private.

“This isn’t a stress test,” said Jaap Meijer, a London- based analyst at Evolution Securities Ltd. It’s “merely the current valuation of government bonds.”

Credit markets are pricing in losses of about 60 percent on Greek bonds should the government default, more than three times the level said to be assumed by CEBS. Derivatives known as recovery swaps are trading at rates that imply investors would get back about 40 percent in a Greek default or restructuring.

“I wonder how much these stress tests are reverse- engineered to inspire confidence in the market” and banks, said Bruce Packard, an analyst at Seymour Pierce Ltd. in London.

Reverse engineering? Surely not! That’s done by evil bonus-seeking bankers underwriting sub-prime, not by Holy Regulators!

American banks are hoping to generate investor opposition to fair value accounting:

The American Bankers Association opposes the Financial Accounting Standards Board’s plan to apply fair-value rules to all financial instruments, including loans, rather than just to securities. The group says the rule could make strong banks appear undercapitalized.

The association’s website, noting that FASB’s stated mission is to serve investors, provides a sample letter for people writing to the board and suggests they focus on why the proposal isn’t “useful for investors.”

The ABA has devoted a whole page to the campaign.

State Street reached for yield – and suffered:

State Street Corp., the third-largest U.S. custody bank, reported second-quarter earnings that missed analysts’ estimates because of a $251 million after-tax charge related to its securities lending business.

…

State Street recorded the charge, which reduced earnings by 50 cents a share, to replenish funds that managed money on behalf of securities lenders. The funds invest cash deposited as collateral by securities borrowers. The injection allows State Street to lift redemption restrictions placed on clients in the fall of 2008 after the funds suffered losses.

Pensions & Investments has some interesting background:

It could be argued that the U.S. pension fund sector had historically engaged proportionately more in leveraged finance — by lending securities to raise cash collateral that can be reinvested for returns — than securities lending over recent years and that pension funds only very recently adopted a profile more in line with the U.S. mutual fund sector. That profile has maturity and liquidity more in line with the underlying loan transaction, that is, short term.

The mean return of the total return to lendable securities in a portfolio generated by the U.S. pension fund sector is almost double than that of the U.S. mutual fund sector over the three-year period under consideration. What should really worry the pension fund sector now is that the difference is at its historic low. The pension fund sector has reined in reinvestment guidelines and reduced its return expectations to reduce risk.

AIG writ small!

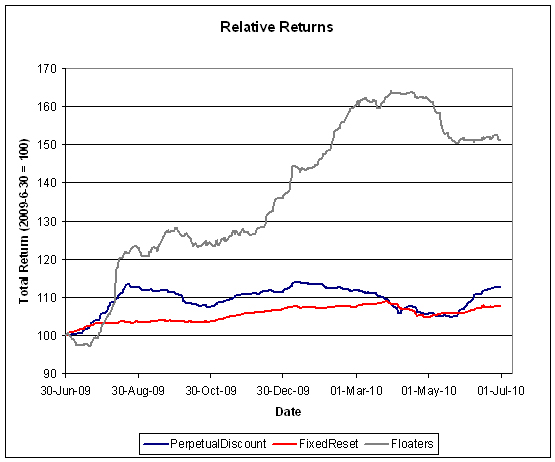

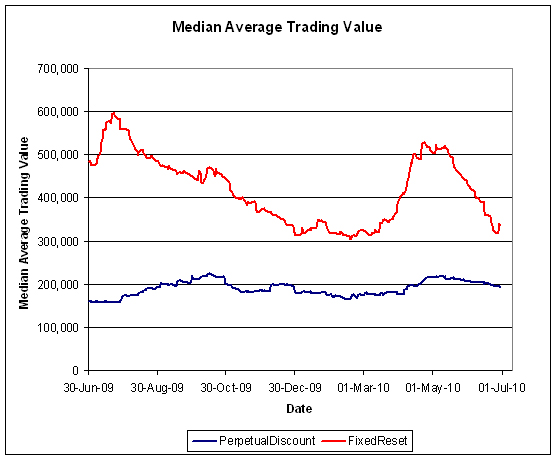

It was a good day in the Canadian preferred share market, with PerpetualDiscounts up 16bp and FixedResets gaining 3bp. Volume was moderate.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.83 % | 2.94 % | 23,320 | 20.28 | 1 | 0.0000 % | 2,048.5 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1860 % | 3,099.6 |

| Floater | 2.32 % | 1.98 % | 45,470 | 22.44 | 4 | 0.1860 % | 2,209.2 |

| OpRet | 4.88 % | 1.08 % | 80,223 | 0.08 | 11 | 0.0849 % | 2,341.7 |

| SplitShare | 6.39 % | 6.32 % | 87,945 | 3.45 | 2 | 0.0882 % | 2,171.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0849 % | 2,141.2 |

| Perpetual-Premium | 5.97 % | 5.61 % | 117,537 | 1.85 | 4 | 0.0497 % | 1,919.3 |

| Perpetual-Discount | 5.92 % | 5.96 % | 180,568 | 13.97 | 73 | 0.1553 % | 1,826.3 |

| FixedReset | 5.36 % | 3.74 % | 317,257 | 3.49 | 47 | 0.0271 % | 2,203.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.H | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 23.22 Evaluated at bid price : 23.49 Bid-YTW : 6.12 % |

| HSB.PR.C | Perpetual-Discount | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 21.45 Evaluated at bid price : 21.45 Bid-YTW : 6.00 % |

| GWO.PR.H | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 20.55 Evaluated at bid price : 20.55 Bid-YTW : 5.95 % |

| W.PR.J | Perpetual-Discount | 1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 23.25 Evaluated at bid price : 23.55 Bid-YTW : 5.96 % |

| W.PR.H | Perpetual-Discount | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 22.60 Evaluated at bid price : 23.18 Bid-YTW : 5.94 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.N | Perpetual-Discount | 106,516 | Desjardins crossed 100,000 at 22.70. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 22.56 Evaluated at bid price : 22.70 Bid-YTW : 5.79 % |

| IAG.PR.C | FixedReset | 106,016 | RBC crossed 50,000 at 26.80; Nesbitt crossed 50,000 at 26.81. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.81 Bid-YTW : 4.07 % |

| TRP.PR.C | FixedReset | 87,830 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 23.15 Evaluated at bid price : 25.07 Bid-YTW : 3.91 % |

| PWF.PR.J | OpRet | 75,950 | Nesbitt crossed 60,000 at 25.51. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-08-07 Maturity Price : 25.50 Evaluated at bid price : 25.50 Bid-YTW : 1.08 % |

| RY.PR.N | FixedReset | 64,593 | RBC crossed 55,000 at 27.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 27.37 Bid-YTW : 3.71 % |

| SLF.PR.G | FixedReset | 58,000 | Nesbitt crossed 44,200 at 25.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-07-08 Maturity Price : 25.12 Evaluated at bid price : 25.17 Bid-YTW : 3.93 % |

| There were 31 other index-included issues trading in excess of 10,000 shares. | |||