The Bank of Canada has released the Financial System Review: June 2010.

The entire section on the the banking sector is well worth reading, but I will highlight only:

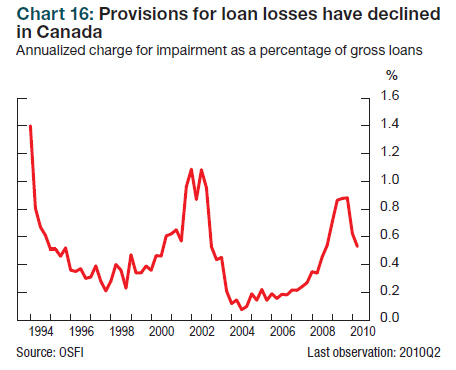

While Canadian banks continue to experience elevated loan losses, loss rates have declined materially in recent quarters (Chart 16).

footnote: We follow the convention of using the income statement expense, Provision for Credit Losses, as the measure of loan losses.

Following the reviews of the financial and economic environment are the reports:

- The Bank of Canada’s Extraordinary Liquidity Policies and Moral Hazard

- The Impact of the Financial Crisis on Cross-Border Funding

- The Role of Securities Lending in Market Liquidity

- Securitized Products, Disclosure, and the Reduction of Systemic Risk

- The Bank of Canada’s Analytic Framework for Assessing the Vulnerability of the Household Sector

Quite frankly, I find the reasoning in the Moral Hazard article to be a little opaque:

In an abnormal situation, where a large systemic event creates a widespread shortage of liquidity that disrupts a wide range of institutions and markets, distorting asset prices more generally, the Bank is most effective when it provides liquidity to a variety of institutions. Moral hazard is minimized by limiting such interventions to the shortest time period possible—specifically, to periods when the liquidity premium is significantly distorted across the system, leaving market participants fully exposed to risks associated with idiosyncratic shocks and small systemic shocks.

The idea that the BoC can determine when asset prices are distorted and when they are not smacks of hubris. Additionally, if the BoC is serious about minimizing moral hazard, its lending will always be at a penalty rate that ensures the borrowers are financing at a negative carry. Institutions with liquidity problems – all of them – should be offered a choice: finance your assets at the Bank at rates that will hurt you, or sell them at prices that will ruin you.

This was not done: the bank auctioned off credit at rates that made arbitrage profitable. The only excuse for doing so would be that the falling price of financial assets was having an effect on the real economy; but this was not the case in Canada.

Additionally:

Finally, the Bank supports the development, implementation, and ongoing functioning of the core infrastructure for generating liquidity in the Canadian financial system. This includes promoting greater use of central clearing counterparties for core funding markets, such as repos, as well as other mechanisms that help market participants to self insure against idiosyncratic liquidity shocks.

Do we have any engineers here? How many think that moving to a system subject to single-point failure is a step forward? Central clearing increases moral hazard by making the identity of your counterparties less important.

Contingent capital got a mention:

The prudential supervisor could also implement a scheme for converting subordinated debt into equity, contingent on a credit-risk event that depletes capital by an unacceptable amount.

footnote: See J. Dickson, “Protecting banks is best done by market discipline,” U.K. Financial Times, “Comment,” 8 April 2010.

The fact that the best reference the BoC can come up with is Dickson’s childish essay leads me to believe that the rot is spreading. I’m not sure whether it’s political capture (of the BoC by the Department/Minister of Finance) or regulatory capture (of the BoC by the banks), but either way is a sad thing; a sad thing that will ultimately cost us a lot of money.

The authors did not mention Carney’s notion to ban the bond. They’re going to get their knuckles rapped!

Finally, unable to defend the Bank’s actions during the crisis, the authors take refuge in an attempt to create a tautology where none exists:

It is impossible to eliminate all moral hazard, because

effective extraordinary intervention means that liquidity will be provided at a yield below what would prevail without the intervention.

…

Since liquidity premiums rise in a crisis because of the shortage of liquidity, the Bank provides liquidity at premiums below those prevailing in the market.

Very disappointing, and makes no allowance for the idea that in the absence of intervention some banks (hello, CM & BMO!) will have to borrow above the already elevated market rate.

The paper on securitization suffers greatly from the absence of Mark Zelmer, who, it will be recalled, wrote the single most sensible statement during the entire crisis:

In the end though, investors need to accept responsibility for managing credit risk in their portfolios. While complex instruments such as structured products enhance the benefits to be gained from relying on credit ratings, investors should not lose sight of the fact that one can delegate tasks but not accountability. Suggestions such as rating structured products on a different rating scale could be helpful, in that this may encourage investors to think twice before investing in such complex instruments. Nevertheless, investors still need to understand the products they invest in, so that they can critically review the credit opinions provided by the rating agencies.

Instead, the authors of this particular paper (as was the case with the authors of the December 2009 Review) drink the regulatory Kool-aid and insist that everybody is at fault except the guys who actually buy the stuff.

Much has been said about what went wrong with securitized products and what should be done to put securitization markets on a stable footing. The way forward includes several elements: (i) a better alignment of economic interests in the securitization process; (ii) appropriate prudential regulation and accounting standards; (iii) simplified and standardized structures based on high-quality real-economy assets; and (iv) greater standardization of documentation and increased transparency and disclosure to facilitate investors’ efforts to understand and manage the risks inherent in securitized products. Enhanced disclosure is only one necessary element of a comprehensive policy and industry response to the recent financial crisis.

Yes! After all, investing is simple. Let’s make sure that every bank teller in Canada can confidently recommend whatever is in the bank’s inventory, without ever having to know anything! Only in such a manner will bank profits be sufficient to hire lots of ex-regulators!

The way to eliminate the market’s systemic risk due to idiotic investing is to eliminate idiots from the market. This will be best done by publishing composite performance numbers as part of an advisor’s registration. In the case of banks, it is best accomplished by ensuring that traders actually trade, and surcharging risk-weighted assets if they become aged.

Mistakes are made by the best of us, and sometimes investments don’t turn out well even though no identifiable mistakes were made. But that only hurts you. Concentration kills you.