Econbrowser‘s James Hamilton writes a good piece on Greece:

I suspect that the key fear has to do with the consequences of a default or restructuring of the debt itself. Willem Buiter estimates that French and German banks have € 110 billion exposure to Greek debt, and total exposure to a potential domino effect could be huge. The WSJ today has further breakdowns, and Dow Jones reports that JP Morgan’s holdings of non-U.S. government bonds increased by $36.5 billion in 2009, while Citigroup’s increased by almost $40 B.

…

And, as was the case in the 2008 difficulties, one can either view this primarily as a liquidity problem, for which we simply need the central banks to step in boldly to arrest the jitters, or as a solvency problem, in which case the policy decision is how to allocate the unavoidable capital losses among bank owners, bank creditors, and the government so as to minimize collateral damage to innocent bystanders. The fundamentals facing Greece suggest there is an overwhelming solvency component to the current problems. And the policy response so far seems to be choosing to allocate 100% of losses to the European and U.S. taxpayers.

Chatter about the potential disintegration of the Euro is starting to be heard from respected sources:

“You have the great problem of a potential disintegration of the euro,” former Federal Reserve Chairman Paul Volcker, 82, said yesterday in London. “The essential element of discipline in economic policy and in fiscal policy that was hoped for” has “so far not been rewarded in some countries.”

That story, by the way, leads off with an anecdote about dairy products:

Romano Prodi recalls how he persuaded Germany to allow debt-swamped Italy into the euro: support our membership and we’ll buy your milk, he said.

When Prodi toured Germany’s agricultural heartland after becoming Italian leader in 1996, he pitched “a big milk pipeline from Bavaria,” pointing to a three-year, 40 percent plunge in the Italian lira that was hurting dairy sales.

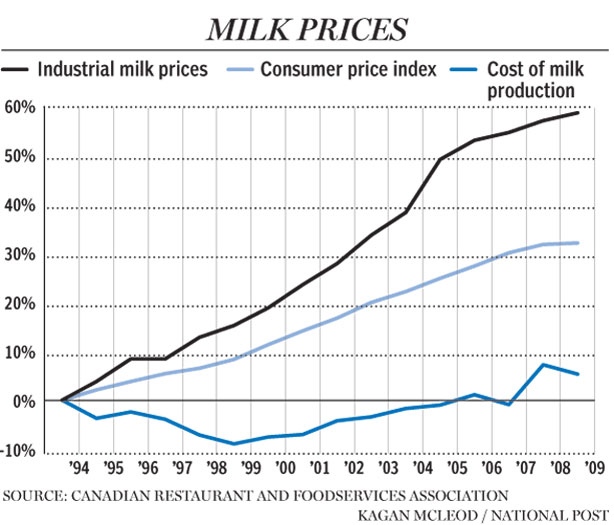

See? That’s the source of the problem! Here in smug Canada, we know how to do it properly … charge single mums and their kids extortionate prices for dairy products, so quota owners may continue to enjoy a bucolic lifestyle.

OSFI’s Mark White gave a speech reviewing the P&C industry.

A little more detail has emerged regarding the futures sale suspected to be the proximate cause of last week’s bungee jump.

Comrade Peace Prize’s administration has made it clear that it regards Swap pricing to be a public utility and that the role of government is to ensure that incompetent portfolio managers may continue to earn a good living:

Removing the Derivatives Trading Requirement to Protect Wall Street Profits. Under the current bill, standard derivatives would have to be traded on exchanges or other electronic trading platforms. Expect amendments to eliminate this trading requirement. Why? Because not everyone likes transparency. Today, the big derivatives dealers make big profits by charging end-users extra spreads and hidden fees, and they don’t want that to change.

This administration has learned nothing from TRACE. As soon as you get transparency, liquidity disappears. An ultimately, you will create more bungee jumps. On a positive note, however, it appears that regulatory capture is becoming an issue, albeit in a different field:

Obama said the federal government also shares some of the blame [for the Gulf of Mexico underwater oil blowout]. He faulted the Minerals Management Service for having too close a relationship with the industry it regulates. BP got an exclusion from a National Environmental Policy Act review by the agency for its damaged well in the Gulf.

“It seems as if permits were too often issued based on little more than assurances of safety from the oil companies,” Obama said. “That cannot and will not happen anymore.”

He ordered Interior Secretary Ken Salazar to “conduct a top-to-bottom reform” of the agency, including a review of its procedures for assessing the environmental impact of an offshore drilling plans.

Salazar said in a statement that will be “an important part of the ongoing comprehensive and thorough investigation of this incident.”

Obama previously announced plans to split the service’s responsibilities, which now include both enforcing rig safety rules and joining with companies such as BP and Exxon Mobil Corp. to develop oil and gas reserves while collecting royalties.

Volume on the Canadian preferred share market was way down today, reaching normal levels, as PerpetualDiscounts gained 4bp and FixedResets lost 8bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.62 % | 2.77 % | 42,832 | 20.86 | 1 | 0.0000 % | 2,112.6 |

| FixedFloater | 5.13 % | 3.19 % | 40,557 | 20.11 | 1 | -0.1413 % | 3,120.2 |

| Floater | 2.14 % | 2.46 % | 105,392 | 21.13 | 3 | -1.2710 % | 2,267.6 |

| OpRet | 4.91 % | 4.15 % | 94,607 | 1.76 | 11 | -0.1349 % | 2,300.6 |

| SplitShare | 6.41 % | 6.40 % | 120,294 | 3.53 | 2 | 0.4661 % | 2,130.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1349 % | 2,103.7 |

| Perpetual-Premium | 5.53 % | 4.77 % | 24,187 | 15.82 | 1 | 0.0000 % | 1,824.2 |

| Perpetual-Discount | 6.31 % | 6.38 % | 212,539 | 13.36 | 77 | 0.0360 % | 1,692.5 |

| FixedReset | 5.51 % | 4.27 % | 513,929 | 3.58 | 44 | -0.0775 % | 2,147.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.K | Floater | -2.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 16.10 Evaluated at bid price : 16.10 Bid-YTW : 2.46 % |

| MFC.PR.E | FixedReset | -2.13 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 5.15 % |

| BAM.PR.B | Floater | -1.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 16.04 Evaluated at bid price : 16.04 Bid-YTW : 2.47 % |

| MFC.PR.D | FixedReset | -1.43 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 26.80 Bid-YTW : 5.01 % |

| ELF.PR.F | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 18.50 Evaluated at bid price : 18.50 Bid-YTW : 7.27 % |

| MFC.PR.A | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 25.24 Bid-YTW : 4.05 % |

| PWF.PR.K | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 19.00 Evaluated at bid price : 19.00 Bid-YTW : 6.59 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.D | Perpetual-Discount | 58,915 | RBC crossed blocks of 17,000 and 15,000, both at 17.35. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 17.33 Evaluated at bid price : 17.33 Bid-YTW : 6.53 % |

| BNS.PR.Y | FixedReset | 39,150 | Desjardins crossed 24,000 at 24.16. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 23.96 Evaluated at bid price : 24.00 Bid-YTW : 3.83 % |

| BNS.PR.K | Perpetual-Discount | 19,480 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 19.61 Evaluated at bid price : 19.61 Bid-YTW : 6.19 % |

| BAM.PR.B | Floater | 19,345 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 16.04 Evaluated at bid price : 16.04 Bid-YTW : 2.47 % |

| TRP.PR.A | FixedReset | 18,646 | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 4.45 % |

| TRP.PR.B | FixedReset | 18,495 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-05-14 Maturity Price : 24.58 Evaluated at bid price : 24.63 Bid-YTW : 4.01 % |

| There were 27 other index-included issues trading in excess of 10,000 shares. | |||