That guy who had a baby in 1967 is about to become a grandfather:

The International Olympic Committee has yet to secure two more international sponsors, leading to a $30-million shortfall so far in the money Vancouver organizers had expected to receive from them.

And the recession has scared off potential suppliers, said John McLaughlin, the Vancouver committee’s chief financial officer.

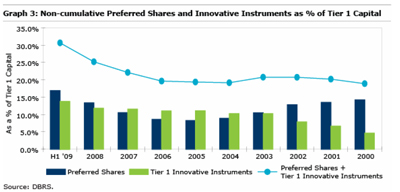

TCA issued about $1.6-billion in equity to fund a major purchase and had its credit rating affirmed by DBRS.

S&P had a mass downgrade of US Banks today:

Standard & Poor’s reduced its credit ratings or revised its outlook on 22 U.S. banks, including Wells Fargo & Co., PNC Financial Services Group and KeyCorp, citing tighter regulation and increased market volatility.

“Financial institutions are now shedding balance-sheet risk and altering funding profiles and strategies for the marketplace’s new reality,” S&P credit analyst Rodrigo Quintanilla said in a statement today. “Such a transition period justifies lower ratings as industry players implement changes.”

…

S&P lowered Carolina First Bank, Citizens Republic Bancorp Inc., Huntington Bancshares Inc., Synovus Financial Corp. and Whitney Holding Corp. to “junk” ratings. High-yield, high- risk, or junk, debt is rated below BBB- by S&P.

…

Capital One Financial Corp., BB&T Corp., Regions Financial Corp., U.S. Bancorp and were also among the lenders downgraded today.

Meanwhile, the stronger brethren repaid some funds:

JPMorgan Chase & Co. and three of the nation’s largest banks repaid $44.7 billion to the U.S. Treasury’s bailout fund in a step toward ridding themselves of government restrictions on lending and pay.

JPMorgan repaid $25 billion, Morgan Stanley gave back $10 billion, Minneapolis-based U.S. Bancorp refunded $6.6 billion and Winston-Salem, North Carolina-based BB&T Corp. paid $3.1 billion, the companies said today in separate statements.

Interesting that BB&T is on both lists!

Comrade Obama laid out his financial regulation plans today:

The central bank would get responsibility to oversee all systemically risky financial firms, a move that aims to eliminate gaps in oversight that contributed to the collapse of Bear Stearns Cos. and Lehman Brothers Holdings Inc. last year. The Fed would monitor not only banks but large financial companies, such as insurers or hedge funds, whose interconnections in the financial industry mean their failure would endanger the system.

“These firms should not be able to escape oversight of their risky activities by manipulating their legal structure,” the White Paper said. Through higher capital requirements and stronger regulatory scrutiny “our proposals would compel these firms to internalize the costs they could impose on society in the event of failure.”

So, since the Fed designed and supervised a system of bank regulation without a sufficient moat to protect it from EVIL HEDGE FUNDS, the solution is to regulate hedge funds. Goodbye Connecticut, hello Dubai!

And the chief purpose of any Central Bank, lender of last resort, is going to be politicized:

The Fed, while gaining a bigger role as the systemic regulator, would have some of its emergency lending power curbed. The plan calls for the Treasury secretary to approve in writing any emergency funding.

Oh, well, at leastRep. Scott Garrett is keeping his head:

President Barack Obama’s proposal to expand financial capital requirements to non-banking firms that trade in the $592 trillion over-the-counter derivatives market is misguided, said U.S. Representative Scott Garrett.

…

“It is unclear how applying the regulatory system that so woefully failed the banking sector to the rest of the U.S. economy could possibly be helpful,” Garrett, the ranking Republican on a subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises, said in an e-mail. The subcommittee is part of the House Financial Services Committee, which will have to turn the Obama proposal into legislation.

I’ve said all along: it’s clear that derivatives were a source of fear – and, in the case of AIG’s counterparties, a definite destabilizing force. This may be addressed simply by altering the existing capitalization rules … those exposed to loss (or those buying insurance and exposed to loss if the insurer fails) should obtain collateral. If the counterparty won’t put up the collateral (AIG, MBIA, et al.), then the required collateral is a straight deduction from the regulated entities’ capital. So what’s the problem? Increasing the scope of regulation is simply a make-work project.

The market was off a bit today, although damage to FixedResets was minimal. Volume continues high.

PerpetualDiscounts closed with a yield of 6.32%, equivalent to 8.85% interest at the standard equivalency factor of 1.4x. Long Corporates continued their yield decline to about 6.3%, sending the Perpetual-Discount Interest-Equivalent Spread to 255bp, as PDs continue to lag the extraordinary strength in bonds.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-1.1867 % |

1,288.9 |

| FixedFloater |

7.02 % |

5.49 % |

35,884 |

16.31 |

1 |

0.3236 % |

2,150.2 |

| Floater |

2.96 % |

3.34 % |

81,718 |

18.90 |

3 |

-1.1867 % |

1,610.3 |

| OpRet |

4.97 % |

3.77 % |

137,273 |

0.92 |

14 |

0.0452 % |

2,194.3 |

| SplitShare |

5.80 % |

6.08 % |

56,200 |

4.23 |

3 |

0.1829 % |

1,880.3 |

| Interest-Bearing |

5.98 % |

7.26 % |

23,032 |

0.52 |

1 |

0.1996 % |

1,995.2 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.2766 % |

1,735.8 |

| Perpetual-Discount |

6.33 % |

6.32 % |

167,404 |

13.37 |

71 |

-0.2766 % |

1,598.7 |

| FixedReset |

5.67 % |

4.81 % |

538,878 |

4.35 |

39 |

-0.0741 % |

2,012.9 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| HSB.PR.C |

Perpetual-Discount |

-2.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.62

Evaluated at bid price : 19.62

Bid-YTW : 6.53 % |

| BAM.PR.B |

Floater |

-2.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 11.76

Evaluated at bid price : 11.76

Bid-YTW : 3.34 % |

| CIU.PR.A |

Perpetual-Discount |

-1.92 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 18.39

Evaluated at bid price : 18.39

Bid-YTW : 6.32 % |

| PWF.PR.M |

FixedReset |

-1.55 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-02

Maturity Price : 25.00

Evaluated at bid price : 26.00

Bid-YTW : 5.26 % |

| BAM.PR.M |

Perpetual-Discount |

-1.51 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 15.66

Evaluated at bid price : 15.66

Bid-YTW : 7.63 % |

| HSB.PR.D |

Perpetual-Discount |

-1.41 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.52

Evaluated at bid price : 19.52

Bid-YTW : 6.44 % |

| PWF.PR.L |

Perpetual-Discount |

-1.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.38

Evaluated at bid price : 19.38

Bid-YTW : 6.70 % |

| BAM.PR.K |

Floater |

-1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 11.71

Evaluated at bid price : 11.71

Bid-YTW : 3.36 % |

| RY.PR.A |

Perpetual-Discount |

-1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 18.35

Evaluated at bid price : 18.35

Bid-YTW : 6.14 % |

| BNS.PR.K |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.65

Evaluated at bid price : 19.65

Bid-YTW : 6.21 % |

| CGI.PR.B |

SplitShare |

1.00 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2014-03-14

Maturity Price : 25.00

Evaluated at bid price : 25.16

Bid-YTW : 4.53 % |

| TD.PR.Y |

FixedReset |

1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 25.02

Evaluated at bid price : 25.07

Bid-YTW : 4.62 % |

| POW.PR.D |

Perpetual-Discount |

1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.60

Evaluated at bid price : 19.60

Bid-YTW : 6.51 % |

| BAM.PR.I |

OpRet |

1.44 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-12-30

Maturity Price : 25.00

Evaluated at bid price : 24.65

Bid-YTW : 5.84 % |

| MFC.PR.B |

Perpetual-Discount |

1.79 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 18.75

Evaluated at bid price : 18.75

Bid-YTW : 6.25 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| MFC.PR.E |

FixedReset |

79,046 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-19

Maturity Price : 25.00

Evaluated at bid price : 25.33

Bid-YTW : 5.41 % |

| HSB.PR.D |

Perpetual-Discount |

56,370 |

Desjardins crossed 50,000 at 19.70.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.52

Evaluated at bid price : 19.52

Bid-YTW : 6.44 % |

| SLF.PR.B |

Perpetual-Discount |

54,350 |

Desjardins crossed 50,000 at 18.27.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 18.30

Evaluated at bid price : 18.30

Bid-YTW : 6.59 % |

| RY.PR.E |

Perpetual-Discount |

50,272 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 18.30

Evaluated at bid price : 18.30

Bid-YTW : 6.23 % |

| TD.PR.S |

FixedReset |

49,965 |

Nesbitt bought two blocks from RBC: 15,500 at 25.05 and 19,900 at 25.03.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 24.88

Evaluated at bid price : 24.93

Bid-YTW : 4.54 % |

| TD.PR.O |

Perpetual-Discount |

47,960 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-17

Maturity Price : 19.90

Evaluated at bid price : 19.90

Bid-YTW : 6.20 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. |