There is growing support for the idea that Commercial Banking is different from Investment Banking (the “utility banking” and “casino banking” of the Turner Review) and should not be housed under the same roof – and this from one of the conglomerators:

what he would tell Obama if given the chance, [Bank of America Corp. Chief Executive Officer Kenneth] Lewis said it would be that “commercial banks are the fabric of any community in which they operate and we probably need to separate the commercial banks from the investment banking activities.”

The remarks may reopen the debate on whether the U.S. should reinstitute laws put in place after the Great Depression designed to insulate lenders from the risks of investment banking. Bank of America, the biggest U.S. bank by assets, bought Merrill Lynch & Co. in January, helping the largest U.S. brokerage avoid the financial collapse that drove Bear Stearns Cos. out of business.

Mr. Lewis later clarified his remarks:

“I was talking about the rhetoric, not physically separating the two,” Lewis said in an interview with Bloomberg Television. “We have an investment bank, we have a commercial bank as well that is the fabric of every community in which it operates.”

…

Lewis’s earlier comments caused credit-default swaps on Merrill Lynch to climb 85 basis points, or 0.85 percentage point, to 550 basis points as of 1:48 p.m. in New York, according to broker Phoenix Partners group. The swaps earlier touched 595 basis points, according to Credit Derivatives Research LLC. Contracts on Bank of America rose 10 basis points to 375 basis points, Phoenix prices show. An increase typically signals weakened investor confidence.

How much credence can be put into this restatement is something I cannot determine. Was it a genuine clarification of an off-hand remark taken out of context? Or was it the result of pressure from the board, his newly acquired investment bankers and the market? Time will tell!

Glass-Steagall went too far in enforcing a strict separation of the two functions. I have no problems with the commercial banks underwriting issues for their clients, or in selling them. I do, however, feel that the Basel Capital rules should be revised to offer a choice to the regulated entities regarding which regime they wish to be subject to, and to allow crossing the line – but on a more expensive basis.

Bank of America should have a regulated competitive advantage over Merrill Lynch in the “hold and arbitrage business”; Merrill Lynch should have a competitive advantage over Bank of America in the “Originate and Distribute” business.

Decent volume in the preferred share market today, but not much price action. That’s what we like, eh? Nice … calm … markets.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1041 % | 867.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1041 % | 1,403.0 |

| Floater | 4.56 % | 5.51 % | 66,707 | 14.65 | 3 | -0.1041 % | 1,083.8 |

| OpRet | 5.24 % | 4.85 % | 130,797 | 3.88 | 15 | 0.2041 % | 2,068.1 |

| SplitShare | 6.73 % | 9.08 % | 49,017 | 4.81 | 6 | 0.5726 % | 1,655.3 |

| Interest-Bearing | 6.17 % | 9.38 % | 34,411 | 0.74 | 1 | -0.2020 % | 1,933.6 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0265 % | 1,504.6 |

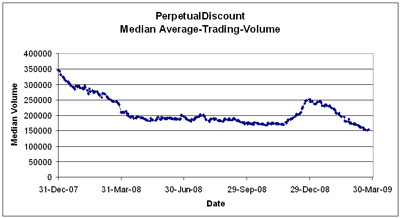

| Perpetual-Discount | 7.21 % | 7.40 % | 155,161 | 12.15 | 71 | -0.0265 % | 1,385.7 |

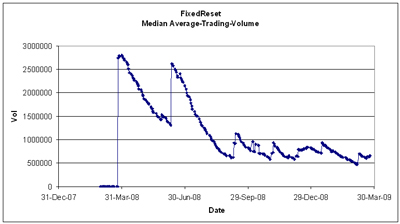

| FixedReset | 6.15 % | 5.87 % | 600,009 | 13.68 | 32 | 0.0081 % | 1,810.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CM.PR.J | Perpetual-Discount | -2.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 15.00 Evaluated at bid price : 15.00 Bid-YTW : 7.51 % |

| BAM.PR.M | Perpetual-Discount | -2.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 13.13 Evaluated at bid price : 13.13 Bid-YTW : 9.13 % |

| LFE.PR.A | SplitShare | -1.98 % | Asset coverage of 1.1-:1 as of March 13 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.20 Bid-YTW : 15.63 % |

| CM.PR.K | FixedReset | -1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 21.58 Evaluated at bid price : 21.58 Bid-YTW : 5.00 % |

| BAM.PR.B | Floater | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 7.96 Evaluated at bid price : 7.96 Bid-YTW : 5.51 % |

| HSB.PR.C | Perpetual-Discount | -1.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 17.35 Evaluated at bid price : 17.35 Bid-YTW : 7.41 % |

| TD.PR.R | Perpetual-Discount | -1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.77 % |

| PWF.PR.M | FixedReset | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 24.55 Evaluated at bid price : 24.60 Bid-YTW : 5.47 % |

| BNS.PR.R | FixedReset | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 21.33 Evaluated at bid price : 21.33 Bid-YTW : 4.71 % |

| ENB.PR.A | Perpetual-Discount | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 22.66 Evaluated at bid price : 22.90 Bid-YTW : 6.07 % |

| PWF.PR.G | Perpetual-Discount | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 19.16 Evaluated at bid price : 19.16 Bid-YTW : 7.88 % |

| PWF.PR.I | Perpetual-Discount | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 20.65 Evaluated at bid price : 20.65 Bid-YTW : 7.42 % |

| NA.PR.K | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 20.77 Evaluated at bid price : 20.77 Bid-YTW : 7.17 % |

| TD.PR.S | FixedReset | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 21.06 Evaluated at bid price : 21.06 Bid-YTW : 4.46 % |

| POW.PR.C | Perpetual-Discount | -1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 18.61 Evaluated at bid price : 18.61 Bid-YTW : 7.83 % |

| BNS.PR.Q | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 21.36 Evaluated at bid price : 21.66 Bid-YTW : 4.42 % |

| BAM.PR.N | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 13.22 Evaluated at bid price : 13.22 Bid-YTW : 9.07 % |

| SLF.PR.D | Perpetual-Discount | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 14.36 Evaluated at bid price : 14.36 Bid-YTW : 7.81 % |

| NA.PR.N | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 22.92 Evaluated at bid price : 22.99 Bid-YTW : 4.55 % |

| BMO.PR.M | FixedReset | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 22.43 Evaluated at bid price : 22.50 Bid-YTW : 4.18 % |

| TD.PR.O | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 6.63 % |

| DFN.PR.A | SplitShare | 1.13 % | Asset coverage of 1.5+:1 as of March 13 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.35 Bid-YTW : 9.08 % |

| HSB.PR.D | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 16.60 Evaluated at bid price : 16.60 Bid-YTW : 7.59 % |

| W.PR.H | Perpetual-Discount | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 19.55 Evaluated at bid price : 19.55 Bid-YTW : 7.21 % |

| GWO.PR.J | FixedReset | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 24.80 Evaluated at bid price : 24.85 Bid-YTW : 5.15 % |

| BNA.PR.C | SplitShare | 1.45 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 11.17 Bid-YTW : 15.74 % |

| CM.PR.A | OpRet | 1.48 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-11-30 Maturity Price : 25.25 Evaluated at bid price : 25.38 Bid-YTW : 3.76 % |

| SLF.PR.A | Perpetual-Discount | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 15.15 Evaluated at bid price : 15.15 Bid-YTW : 7.91 % |

| PWF.PR.K | Perpetual-Discount | 1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 15.40 Evaluated at bid price : 15.40 Bid-YTW : 8.23 % |

| GWO.PR.H | Perpetual-Discount | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 7.55 % |

| RY.PR.W | Perpetual-Discount | 2.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 18.91 Evaluated at bid price : 18.91 Bid-YTW : 6.58 % |

| SLF.PR.B | Perpetual-Discount | 2.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 15.23 Evaluated at bid price : 15.23 Bid-YTW : 7.95 % |

| SBN.PR.A | SplitShare | 2.97 % | Asset coverage of 1.6+:1 as of March 19 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.66 Bid-YTW : 8.33 % |

| BMO.PR.H | Perpetual-Discount | 3.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 19.86 Evaluated at bid price : 19.86 Bid-YTW : 6.77 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CIU.PR.B | FixedReset | 182,555 | New issue settled today. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.61 Bid-YTW : 6.20 % |

| PWF.PR.K | Perpetual-Discount | 60,402 | Desjardins crossed 43,400 at 15.24. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 15.40 Evaluated at bid price : 15.40 Bid-YTW : 8.23 % |

| RY.PR.L | FixedReset | 53,415 | Nesbitt bought 40,000 from National at 23.81. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 23.79 Evaluated at bid price : 23.83 Bid-YTW : 4.99 % |

| CM.PR.L | FixedReset | 49,542 | National bought 40,000 from Nesbitt at 25.04. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 25.06 Evaluated at bid price : 25.11 Bid-YTW : 6.25 % |

| TD.PR.I | FixedReset | 38,473 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-27 Maturity Price : 24.97 Evaluated at bid price : 25.02 Bid-YTW : 6.05 % |

| TD.PR.M | OpRet | 36,506 | Desjardins crossed 10,000 at 25.87 and bought 20,000 from National at 25.86. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 4.22 % |

| There were 34 other index-included issues trading in excess of 10,000 shares. | |||