Ellen Roseman of the Toronto Star has been kind enough to publish some remarks I made about a preferred share portfolio.

The situation is probably common enough to be republished here … although after the last week of phenomenal returns, the querant is probably feeling a little better:

Since June, the preferred shares in my portfolio are down in market value by $165,000$ on an original purchase price of about $300,000.

I am approaching retirement and whenever I talk to my financial adviser at RBC Dominion Securities, he reassures me that I will continue to receive all interest payments AND the full amount of my original purchases when the preferred shares mature or are called.

If preferreds are less volatile, why are the original values down by a whopping 50 per cent?!!!!!!!!!

I own a mix of Perpetuals and Retractables but I am no financial wizard. I have spoken to a new financial adviser at the the National Bank and he implies that I am indeed in trouble with the preferreds, especially the Perpetuals. He is implying that I will have to sell at least some at a loss.

Here is the descriptive list of my holdings in preferreds as supplied to me by my broker.

These assets are down -45.8% to date!!!! My broker insists that I will continue to collect full interest payments until the Preferreds are called or redeemed, AND, when they are called, it will be at the full purchase price, which is fixed at $25 per unit.

The only impediment to this process is, of course, if any company issuing said Preferreds would go bankrupt.

I would like to know from your expert in preferred shares the following:

1) Is my broker’s contention that I will receive full interest payments and full unit value a correct interpretation?

2) Is there any chance that these assets could return to full original value when and if the markets recover?

3) Do I have any options with these preferreds, other than selling at a loss? Am I helplessly locked into these positions?

4) Was this a misguided tactic (to save on taxes) by putting 40 per cent of a 64-year-old client’s assets into preferreds and call it “fixed income”?

5) And lastly, should any client pay fees, under these circumstances, to a broker just to sit and wait for bonds and preferreds to mature?

Ellen, thank you sincerely for helping me on this matter. An independent analysis will assist me immeasurably to finally take the right road to recovery. Naturally I will wish you a happy and healthy 2009!

BAM split corp. series c–pfd2L

Bank of Montreal non cum.class B series 13, 4.50% pfd1

Bank of N.S. non-cum series 14, 4.50% pfd 1

BNS non-cum series 15, 4.50% pfd 1

BNS non-cum series 16 , 5.25% pfd 1

BNS non-cum, series 22, 5.00% pfd 1

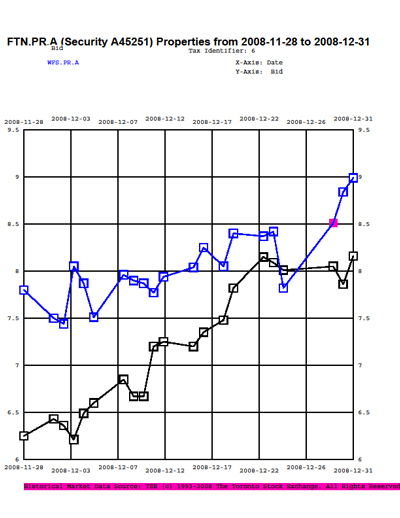

BCE fix/ float cum. Red series AC 4.6% BBP P2 Neg.

Brookfield Asset Mgmt. Class A series 18, 4.75% pfd 2L

Brookfield Properties 5.00% Class AAA series J bb+p3h

Brookfield Properties 5.20% Class AAA series K BB+P3H

CIBC 4.50% non-cum class A Pref. series 32 pfd1

Dundee Corp 5.00% cum, ser 1 P3

Epcor Power Equity 4.85% cum redeem pref. series 1 pfd 3H

George Weston Ltd. 5.20% cum- pref, series 4 pfd3

Great West Lifeco NON-CUM SERIES H 4.85% pfd1L

Great West Lifeco Inc. 4.5% non cum 1st pref. series 1 pfd 1L

HSBC Bank Canada 5.10% non-cum Red. c1 1 prefd. series c

Laurentien Bank non cum class A series 10 5.25% pfd3

National Bank series non cum 16 4.85% pfd1

Power Financial non cum series L 1st pref 5.10% pfd 1

Royal Bank non cum 1st Pref 4.70 series AB pfd1

Sun Life Financial 4.45% class A non cum. series 3 pfd 1

TD Bank non cum. class A Series P 5.25% pfd1

I trust these are the details that you need. My meeting with a new prospective broker is slated for Jan. 14.

… and my response was …

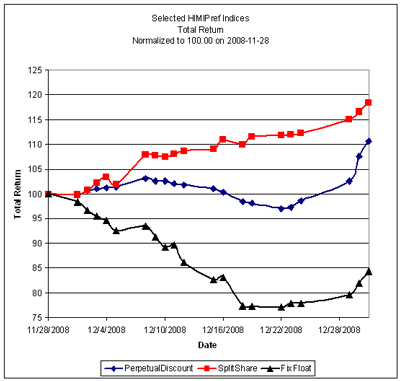

Well, I can tell you that this has been the worst year for preferreds since at least 1993 (when my records start).

In fact, of the 12 worst months since Dec. 31, 1993, six have been this year.

PerpetualDiscount issues (the most common type of preferred) are down 26.24% in the year to Dec. 24, 2008, and that’s total return (which includes dividends).

Since the beginning of the current bear market on Mar. 31, 2007, total return has been -35.83%.

The index tracking ETF (stock symbol CPD) ended 2007 with a Net Asset Value of $17.95. It has paid distributions in 2008 of about 84 cents and now has a Net Asset Value (at the close on 12/24) of $12.92.

CPD has its problems (see http://www.prefblog.com/?p=3478) but is the best publicly available snapshot of the investment-grade preferred share universe as a whole.

I’ve been receiving queries like this for the past year – interestingly, most of these have been from brokers asking me what to tell their clients.

In the case of, for instance, bank perpetuals, I tell them to tell their clients: “Hey – you bought the things for a (say) $1.15 p.a. dividend; they continue to pay a $1.15 p.a. dividend, there is no current indication they will ever fail to pay a $1.15 p.a. dividend … shut up and clip your coupons.”

Weights of the issues in the portfolio are not given. All subsequent analysis assumes equal-weighting.

The portfolio contains the following types of preferreds (see http://www.prefletter.com/whatPrefLetter.php):

Fixed-Reset: 1

FixedFloater: 1

Operating-Retractible: 3

Perpetual Discount: 17

SplitShare: 1

This is heavy on the PerpetualDiscounts (which represent about half the issues tracked by my analytics), which have underperformed this year. It’s light on Operating Retractibles & SplitShares, which have done better.

Preferred Share dividends may be halted at any time at the discretion of the company. A dividend halt is generally a last-ditch effort to save the company and there is no immediate danger of a halt in any of the issues held.

The credit ratings (which were supplied by the broker) are an attempt to estimate the chance of a future halt in dividends, or other inability to meet the terms of the prospectus. The breakdown is:

Pfd-1/Pfd-1 (low): 14

Pfd-2 (low): 3

Pfd-3 (high)/ Pfd-3/Pfd-3 (low): 6

This isn’t bad. There are more Pfd-3 issues than I like (I recommend no more than 10% of the portfolio in these lower-grade credits, with no more than 5% in a single name).

But there are also more Pfd-1/Pfd-1(low) names than I would normally expect. See http://www.prefblog.com/?p=211 for more about credit ratings.

With four names in the Brookfield group, the exposure there is a little high. I would recommend an exposure of no more than 10% of portfolio value in this name.

There is no information given about performance, other than the vague “-45.8% to date!!!!”

My dad’s house is up around 3,000% from his purchase price, while mine is up only about 50%, but that means nothing – we purchased at different times, that’s all.

To address the specific questions:

1) As mentioned above, there is no immediate fear of a dividend halt on any of these issues – although lightning can strike anywhere at any time. If the shares are redeemed, consent of the shareholders would be required to do this at any price other than par.

2) The OperatingRetractible & SplitShare issues have retraction dates, at which time you may force the company to return the principal, or to give you common stock with a value (probably) in excess of the principal. It depends on the terms of the prospectus, but for these issues you may reasonably expect to receive par value on the retraction date.

As far as the PerpetualDiscounts are concerned, it depends on what you mean by “recover”. They each pay $X of dividends per annum. If the issuers can issue replacement shares paying less than $X, it will be in their interest to call the shares at par and issue new ones that are cheaper for them. We might arrive at this situation tomorrow. It might happen next year. It might never happen. I certainly can’t predict the future levels of interest rates with any confidence!

3) None of the shares have an immediate retraction option.

4) Complex! It is not clear what is meant by “put” – is the portfolio advisory or discretionary? What instructions were given to the broker? What are the client objectives and risk tolerance, and what does the Know Your Client form show? What performance benchmarks were specified?

As far as the 40% of assets are concerned, what form does the other 60% take? My rule of thumb is that no more than 50% of the total fixed income portion of a portfolio should be in preferred shares.

As far as calling them “fixed income” is concerned, I’m not sure what else one might call them.

5) It depends on how much the fees are and what services are offered. I suspect that the broker is simply buying the occasional new issue and taking his 3% (issuer-paid) commission, in which case the continuing fees are nil.

My own fund (see http://www.himivest.com/malachite/MAPFMain.php) charges a fee of 1% p.a. on the first half-million, and has expenses on top of that of 0.50%.

It is down substantially both this year and last – but has handsomely outperformed its benchmark since inception due to active management. I suspect my performance – after fees and expenses – exceeds that of the reader’s portfolio, but the portfolio return is not specified here.

Besides the fund, I offer two services which may be considered helpful: a monthly newsletter (http://www.prefletter.com) and portfolio review. I’ll review this portfolio, with specific buy/sell/hold recommendations taylored to client investment objectives, for $1,000.

Sincerely,

HYMAS INVESTMENT MANAGEMENT INC.

James Hymas

President

There was one interesting snippet in the query that hadn’t been in the extract I saw: I have spoken to a new financial adviser at the the National Bank and he implies that I am indeed in trouble with the preferreds, especially the Perpetuals. He is implying that I will have to sell at least some at a loss.

Well, of course that’s what the new guy said. It’s plain from the tone of the query that that’s what the client wanted to hear and by some kind of amazing coincidence, that’s what he was told.

But my question is: on what grounds does the client believe the new guy is better than the old one? Does either advisor publish an audited track record?