Frankly, I thought this was over since even Naked Capitalism no longer considers this an issue. But I see that there is a new post at Mish’s Global Economic Trend Analysis that is keeping the flame alive.

I was going to ignore it, when I saw that it has attracted no less than 124 comments, but I can’t bear discussing the matter any further in the daily commentary. So here it is, a post dedicated to this issue, which will be updated if, as and when necessary (hopefully never).

The story so far:

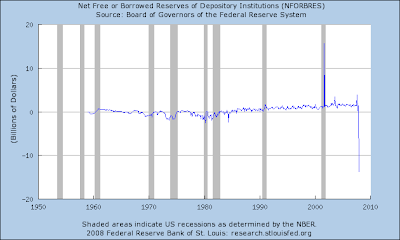

Naked Capitalism is very concerned about a precipituous decline in non-borrowed reserves at the Fed, but I’m not convinced there’s a story here. In the current H3 release, it is disclosed that, of $41,475-million in reserves, only $199-million are non-borrowed. Usually, non-borrowed reserves will be roughly equal to total reserves – implying that net free reserves is about zero. The chart tells the story:

So … what are reserves? The Fed has the answer:

- Reserve requirements, a tool of monetary policy, are computed as percentages of deposits that banks must hold as vault cash or on deposit at a Federal Reserve Bank.

- Reserve requirements represent a cost to the banking system. Bank reserves, meanwhile, are used in the day-to-day implementation of monetary policy by the Federal Reserve.

- As of December 2006, the reserve requirement was 10% on transaction deposits, and there were zero reserves required for time deposits.

There are two things to note here: first, Canada does not have a fractional reserve requirement and second, banks get ZERO interest on their reserves:

The Fed has long advocated the payment of interest on the reserves that banks maintain at Federal Reserve Banks. Such a step would have to be approved by Congress, which traditionally has been opposed because of the revenue loss that would result to the U.S. Treasury. Each year the Treasury receives the Fed’s revenue that is in excess of its expenses. The payment of interest on reserves would, of course, be an additional expense to the Fed.

Thus, all banks will attempt to keep their reserves as close to their requirements as possible. If they have any excess in the system, they will either try to lend them on the Fed Funds market – at the infamous Fed Funds Rate – or withdraw them, to invest the money in … basically anything. Even a one-week T-bill, even now, pays more than ZERO.

Now, along comes the Term Auction Facility. Its value of $40,000-million is – surely not fortuitously! – roughly equal to the total US bank reserve requirement … and it’s available cheap – 3.123%, as pointed out by Naked Capitalism.

If these borrowed term funds were to be left at the Fed – on top of the reserve balances that had been held there previously – then the banks would be borrowing at 3.123% and lending at ZERO. It is my understanding that this sort of negative margin on loans is not considered the road to riches at banking school. But an American stockbroker heard about this, got all excited and appears to have stampeded Naked Capitalism into unnecessary worry.

I discussed the effect of the TAF on bank reserves – and hysterical reactions thereof – on January 29. Naked Capitalism is now republishing a UBS research note that, frankly, I don’t understand at all:

What if the Fed’s rate cuts aren’t motivated by the desire to stave off recession, rather they’re to prevent a major banking crisis. Not one of escalating subprime losses or monoline downgrades, but actually a sheer lack of cash. The Fed’s not telling anyone what it’s up to because it doesn’t want to cause panic, but the evidence is actually there in its own data…

Ok, so things might not be quite as bad as that, but the situation isn’t far off. That’s because of the TAF. ….a savvy bank can put down lesser quality paper that it can’t generally do very much with (and certainly no one else really wants it), raise funds through the TAF, then use those funds to put down as reserves, and then conveniently gets paid a modest rate of interest against those reserves (which acts as a partial offset against the TAF). While there’s a small net cost to the banks, the real loser here is the Fed, what it gets stuck with is an ever growing pile of collateral.

Now consider this – that collateral is actually what’s backing the entire US banking system by way of its conversion to dollars and then the flow of those same dollars back to the Fed….

All this changes the complex of the US banking system somewhat. From the gold standard to the subprime standard perhaps?

In the first place, there is no interest paid on reserve balances. In the second place, the monetary effect of the TAF was neutralized by the Fed’s sale of T-Bills. I note Caroline Baum’s column and say: one may take a view on the advisability of the TAF, one may take a view on capital adequacy, and one may take a view on inter-bank lending; but any hullaballoo over “negative non-borrowed reserves” is hysterical nonsense:

The writer of the e-mail directs his readers to the most recent H.3 report, which shows total reserves ($41.6 billion) less TAF credit ($50 billion) less discount window borrowings ($390 million) equals non-borrowed reserves (minus $8.8 billion). The negative number is really an accounting quirk: If banks borrow more than they need, non-borrowed reserves are a negative number.

This gentleman is overlooking the fact that the Fed is “a monopoly provider of reserves,” said Jim Glassman, senior U.S. economist at JPMorgan Chase & Co. “This is a non-starter. There is no such thing as a banking system short of reserves. The Fed has absolute control over the supply.”

[Update: See also Felix Salmon at Why Non-borrowed Reserves Don’t Matter]

As mentioned above, Mr. Shedlock has now posted another treatise under the title Borrowed Reserves and Tin-Foil Hats. In this post he makes a vast array of points regarding stress on the US banking system – none of them relevant to his previous thesis that the reported Negative Non-Borrowed Reserves was in and of itself an indicator of carnage to come in the sector – on which I will comment as best I can:

Banks participating in the Term Auction Facility (TAF) have to put up collateral for the amounts they borrow.

…

Clearly, the Fed does not hand out reserves willy-nilly. It lends them, but only if banks have sufficient collateral. Furthermore lending is not “printing”. Thus Glassman, the senior U.S. economist at JPMorgan Chase & Co. really needs an education here.

It is indeed true that the Fed is not currently handing out under- or badly-collateralized reserves, but this is not always the case – I have previously highlighted a paper by Anna J. Schwartz, which argued that the discount window be eliminated due to fears that it might be used to prop up insolvent institutions. Additionally, Mish’s point that the current loans are well-collateralized seems to run counter to his purported thesis.

And, in fact, lending is printing – a colloquialism, to be sure, but the Fed does not have to print dollar bills to inflate the currency. All they have to do is say ‘Hey, presto! You’ve got $50-billion on deposit with us’ to achieve that goal. It is for this reason that when the TAF was implemented, it was simultaneously neutralized in monetary terms by their sale of bills … they deposited $50-billion in various accounts as TAF loans, they withdrew $50-billion from various accounts as payment for the bills. Monetary effect zero.

The Fed does not have “control” over supply of reserves because it does not have control over assets held and loans made by member banks. If Glassman’s thinking is representative of bank thinking in general, it’s no wonder banks balance sheets are so $#@%’d up.

“Assets held and loans made by member banks” represent the demand for reserves. The Fed controls the supply of reserves by virtue of their ability to loan anybody anything on any collateral.

A shortage of reserves comes into play when banks no longer have sufficient collateral to exchange for temporary reserves. Banks that do not have sufficient collateral, do not get loans from the discount window or the TAF. Period. End of Story. The Fed does NOT simply “print money” and hand it out to capital impaired banks. Bankruptcies result.

Fair enough, although as stated above the Fed does indeed have the ability to print money and hand it out to capital impaired banks to avert bankruptcy. Again, I fail to see the relevance to the “negative non-borrowed reserves” issue.

If Citigroup could have borrowed reserves from the Fed at 3-4% wouldn’t it had done so instead of raising $7.5 billion from Abu Dhabi at an interest rates of 11%? See Petrodollars Return Home and Abu Dhabi Deal Raises Questions About Citigroup’s Health for more on Abu Dhabi.

Citigroup went back to the well a second time under even more onerous terms as discussed in Cost of Capital “Ratchets Up” at Citigroup and Merrill.

Umm … the Citigroup / Abu Dhabi deal propped up Citigroup’s capital. They raised Tier One Capital through their deal with Abu Dhabi, not reserves. One would naturally expect a higher rate to be paid on Tier One Capital – to the extent that one can compare rates of expected return on equity vs. debt.

Read this again and again until it sinks in:

Over a third of the nation’s community banks have commercial real estate concentrations exceeding 300 percent of their capital, and almost 30 percent have construction and development loans exceeding 100 percent of capital.There will be more criticized assets; increases to loan loss reserves; and more problem banks. And yes, there will be an increase in bank failures.

No objections here! I can’t help but wonder, though, whether Mish is confounding loan loss reserves with fractional reserves … and wonder what relevance this has with the specific point regarding “negative non-borrowed reserves”.

Why Will Banks Fail?

- Banks will fail because they do not have sufficient reserves.

- Banks cannot borrow those reserves because they do not have sufficient collateral.

- The Fed’s collateral requirements do not permit printing money and handing that money over to failing banks.

- The Fed will not change those requirements and start printing money because of the “checkmate” scenario discussed below.

Well … let’s see:

- Lack of reserves is indeed one trigger that could lead to bank failure

- The banks certainly could borrow these reserves, if the Fed (or anybody else) felt like lending them the money on any collateral they wished. It should be noted that Overnight Fed Funds are explicitly uncollateralized … the problem is getting somebody to lend them to you on such a basis! See also a post on knzn.

- The Fed’s current collateral requirements do not permit “printing money and handing that money over to failing banks”, but there is no reason why this cannot change

- Whether or not they may change their collateral requirements in the future is a matter of conjecture and opinion

- Not a single one of these points is relevant to the topic at hand of “negative non-borrowed reserves”!

Bank reserves are net borrowed. This comes at a time when commercial real estate is about to plunge and bank balance sheets are loaded to the gills with them.

This also comes at a time when social attitudes towards debt are going to impair Bernanke’s ability to inflate. For more on social attitudes, please see 60 Minutes Legitimizes Walking Away, Changing Social Attitudes About Debt, and a Crash Course For Bernanke.

Finally, banks will not be going deeper to the “TAF well” as long as the rules state “All advances must be fully collateralized.” Once collateral runs out, it’s the end of the line.

If the Fed is not concerned about this situation, they soon will be.

Of course there are those who believe the Fed will break the rules and eliminate all collateral requirements. So far anyway, they have not done so. Let’s assume however, when push comes to shove, the Fed acting under duress does just what Glassman says, and provides permanent capital for free.

Finally … a mention of Bank Reserves and “net borrowed” in the same sentence! Unfortunately for Mish, this is criticism of the TAF, not criticism of Negative Non-Borrowed Reserves, which are simply a mathematical result of the TAF.

I will note that Glassman said nothing whatsoever about the Fed providing permanent capital (by which I mean Tier 1 Capital …. I’m not sure what Mish means!) for free. Glassman was not asked about permanent capital – he was asked about reserves.

***************************************************

All in all, Mish’s post reveals more ignorance than analysis. But he certainly seems to have struck a chord with his readers – many of whom are, presumably, clients.

Update: The story has been picked up by the WSJ:

A number of people on Wall Street have noticed a recent plunge in non-borrowed reserves in the banking system and wondered it is a sign of distress in the banking system or of unusually stringent monetary policy. They dropped from $42 billion last November to negative $2 billion at the end of January.

It’s probably a false alarm, though. The drop is purely technical, a function of how the Fed has chosen to classify the money lent through its new Term Auction Facility.

…

As it happens, in the last week of January TAF credit reached $50 billion. The amount of bank reserves the same week was only $48 billion. So, by definition, nonborrowed reserves, the difference, fell to negative $2 billion.

Update, 2008-4-29: The Fed has seen fit to comment:

The H.3 statistical release indicates that nonborrowed reserves of depository institutions have declined substantially since mid-December to a level that is now negative. This development reflects the provision of a large volume of reserves through the Term Auction Facility (TAF) and has no adverse implications for the availability of reserves to the banking system.

By definition, nonborrowed reserves are equal to total reserves minus borrowed reserves. Borrowed reserves are equal to credit extended through the Federal Reserve’s regular discount window programs as well as credit extended through the TAF. To maintain a level of total reserves consistent with the Federal Open Market Committee’s target federal funds rate, increases in borrowed reserves must generally be met by a commensurate decrease in nonborrowed reserves, which is accomplished through a reduction in the Federal Reserve’s holdings of securities and other assets. The negative level of nonborrowed reserves is an arithmetic result of the fact that TAF borrowings are larger than total reserves.

Remember … you read it first on PrefBlog!