Financial 15 Split Corp. II has announced:

its regular monthly distribution of $0.04375 for each Preferred share ($0.525 annually). Distributions are payable December 10, 2008 to shareholders on record as at November 28, 2008. There will not be a distribution paid to Financial 15 II Class A Shares for November 28, 2008 as per the Prospectus which states no regular monthly dividends or other distributions will be paid on the Class A Shares in any month as long as the net asset value per unit is equal to or less than $15.00. The Net Asset Value as of November 14, 2008 was $14.06.

FFN.PR.A was last mentioned on PrefBlog when it implored unitholders NOT TO PANIC!!!!. There was a query regarding possible suspension of dividends on this thread; I concurred with the querant’s suggestion; both comments were posted *ahem* after the time-stamp of the press release. Well, it still hasn’t been posted on the fund’s website as of noon, that’s all I can say!

The monthly retraction feature for FFN.PR.A is supportive:

Holders retracting a Preferred Share will be entitled to receive an amount per Preferred Share equal to the lesser of (a) $10.00 and (b) 96% of the Net Asset Value per Unit determined as of the Retraction Date less the cost to the Company of the purchase of a Class A Share in the market for cancellation and less any related commissions and other costs (to a maximum of 1% of the Net Asset Value per Unit). Payment for any shares so retracted will be made within 15 days of the Retraction Date.

NAV on November 14 was $14.06. The capital units closed that day at $7.01; the preferreds closed at $7.00. Support was only mild as of that day’s prices (what on earth were the capital units doing, trading at a 75% premium to their NAV?) but today looks much better.

As I write this, FFN is quoted at 4.75-99 (still way above NAV!) and FFN.PR.A is quoted at $6.06-24. Using XFN as a proxy (not a particularly good proxy, since it’s all Canadian, and FFN is 1/3 American) … it closed at $18.60 on the 14th and is now trading at $17.12. That’s a loss on XFN of 8% in the period, so estimate the current NAV of FFN + FFN.PR.A units at $14.06 * 0.92 = 12.93.

Estimated Retraction Price:

R = 96% (NAV – C)

R = 96% (12.93 – 4.93) …. [cheating on the price a little bit!]

R = 96% (8.00)

R = $7.68.

So even with grossly over-valued capital units (although option players might have something to say about the value of the capital unitholders’ options) the monthly retraction is now looking extremely profitable.

Update, 2008-11-20: I have received the following communication from a very nervous Assiduous Reader:

I noticed your post on prefblog.com yesterday about FFN.PR.A. With coverage of the preferreds at 1.4:1 now and with today’s sharp declines in the price of Canadian financials, which make up the bulk of FFN’s assets, isn’t there a danger that it won’t pay dividends on the preferreds next month? Wouldn’t that also lead to a downward revision of

the NAV for the next monthly retraction?

Asset coverage of 1.4:1 is a lot. Maybe not when considering the long term, and maybe not when the underlying security is Consolidated Internet Mines & Telecom, Inc., but when the time scale is a matter of days and the underlying is blue-chip (well … as blue as they get, nowadays!) financials, it’s a lot. Asset coverage of 1.4:1 means the the underlying has to drop by 1 – (1/1.4) = 29% before the preferred shareholders become exposed to loss … and remember, that’s EXPOSED to loss, I’m talking about! At that point (asset coverage of 1:1), they basically own the portfolio of underlying equities.

My XFN proxy is now trading at 15.66, down a lot from the 17.12 I used above. That’s a loss of

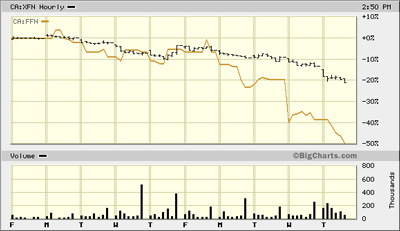

about 8.5%, so estimate the current NAV of FFN + FFN.PR.A units at $12.93 * 0.915 = 11.83. This is incredible. Look at the 10-day chart:

This is epic. I pointed out the epic nature of this crash on October 31 and now it’s even … um … more epic.

And you STILL have asset coverage of just under 1.2:1; the underlying can STILL go down ANOTHER 15%-odd; the capital unit-holders can lose even more money – before the preferred shareholders even have direct exposure. They haven’t lost anything at that point, not even on paper; but it takes all this before they can even become exposed.

So while the cushion is being eroded, there’s still a cushion.

As far as the preferred share dividends are concerned … well, the company can suspend them any time they like. That would be an enormous step and I consider it highly unlikely. Now that the capital unit dividends have been suspended, the company is cash-flow positive after expenses and dividends (assuming constancy of incoming dividends) and their assets are easy to sell if they need some money. I can remember only one case in which a split-shares’ preferred dividends were suspended … that was GT.PR.A a few years back. I suspect that they wanted to suspend dividends to the capital units when their NAV got low, but there was no mechanism in the prospectus regarding an NAV test – so they left one single dividend on the preferreds unpaid, restarted preferred payments and left capital units hanging out to dry … because capital unitholders, under the terms of GT.PR.A’s prospectus, could not receive dividends if the company was in default to the preferreds.

Your concerns about a dividend cut on the preferreds are … well, nothing’s impossible, but the probability is miniscule. And anyway, the dividends are cumulative. On windup of the company, the preferred shareholders would get their $10 principal and all unpaid dividends before the capital unitholders saw a single penny.

However, non-payment of preferred dividends would have no effect on NAV. The cash would remain in the company, but so would a liability for unpaid dividends. There could well be an effect on market price, however!

You seem extremely worried about the FFN.PR.A position you hold. Although your worries seem overblown to me, it’s your money, not mine! You may wish to consider reducing your position to the point where you can sleep again … but I earnestly suggest that if you do reduce, you give consideration to retraction rather than market sale, because selling into this market is a highly unpleasant experience.