There’s a draft bill in Congress that will kill the CDS market:

House of Representatives Agriculture Committee Chairman Collin Peterson of Minnesota circulated an updated draft bill yesterday that would ban credit-default swap trading unless investors owned the underlying bonds. The document, distributed by e-mail by the committee staff in Washington, would also force U.S. trading in the $684 trillion over-the-counter derivatives market to be processed by a clearinghouse.

Presumably, the requirement to own the underlying bonds would apply only to buyers. The industry response notes the obvious:

The standardization necessary to process a contract in a clearinghouse may harm the market and drive the trading overseas, Weber said.

“It’s a big deal because the OTC market has developed almost as an alternative to the exchange market with its clearinghouses,” he said. “It would be advantageous for places like London, Hong Kong or Singapore where OTC trading wouldn’t have that kind of restriction.”

Menzie Chinn of Econbrowser provides an an update on multipliers from a credible source:

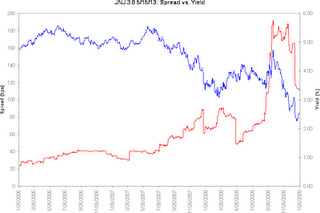

Accrued Interest points out that absolute yields on US corporates are nowhere near as interesting as the spreads imply:

… although, mind you, that’s a four year issue he’s talking about. He concludes:

So what does the corporate bond market offer? For those who want to just collect income, corporates are a much better choice than either Treasuries or Agency bonds. There are enough solid names to build a diversified portfolio. But this trade is all about the income collection, or the carry. It isn’t about making a great trade.

Or its about making the right credit call at the right time. Picking the beaten up name than can recover. But in that case, it isn’t an easy trade, its a gutsy call that could wind up with a big capital gain or else a large loss in bankruptcy.

I will suggest that fixed income investing in general is all about income collection. Those wishing to make a “great trade” should stick to a more appropriate asset class. I get a lot of calls asking for my ONE GREAT IDEA that will MAKE A FORTUNE!!!! Guys, guys, guys … that’s not what fixed-income is all about.

Treasury will write a global liquidity guarantee on a SIV, a move that has interesting implications. Clearly, there is huge demand for maturity transformation that is traditionally intermediated by banks, but in the glory days saw some intermediation by SIVs, among other vehicles. Clearly, these are unusual times and no conclusions for the future can be drawn; but it will be interesting to see how the eternal struggle between lenders wanting short-term and borrowers seeking long-term plays out over the next few years.

Vancouverites wondering about funding the Olympic Village will be unsurprised to hear that Fortress Investment Group really, really needs more cash. Hat tips: Zero Hedge and Dealbreaker, although I suspect they’re a little over-excited.

Treasuries got whacked today, with the long bond yield up 17bp to 3.59%. Mortgage paper is worse. Long Canadas did relatively well, yield up 8bp to 3.71%. Long Corporates have returned -2.05% month-to-date and now yield 7.6%.

However, PerpetualDiscounts – along with every other sector – was up today and now yield 6.88%, equivalent to 9.63% interest at the standard 1.4x equivalency factor, implying a pre-tax interest-equivalent spread of ~200bp.

Tomorrow will be an interesting day – there are no less than three new issues settling. The BNS 6.25%+446 will trade as BNS.PR.X; the TD 6.25%+438 will trade as TD.PR.G; and the NA 6.60%+479 will trade as NA.PR.P.

And who knows? If they trade nicely, maybe we’ll see some more!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.87 % | 7.66 % | 22,643 | 13.53 | 2 | -0.1070 % | 848.4 |

| FixedFloater | 7.42 % | 6.92 % | 161,135 | 13.92 | 8 | 0.6635 % | 1,394.4 |

| Floater | 5.34 % | 4.51 % | 32,048 | 16.39 | 4 | 0.4851 % | 985.3 |

| OpRet | 5.31 % | 4.91 % | 169,475 | 4.03 | 15 | 0.0139 % | 2,023.1 |

| SplitShare | 6.18 % | 9.17 % | 75,844 | 4.11 | 15 | 0.1742 % | 1,803.1 |

| Interest-Bearing | 7.09 % | 7.95 % | 36,181 | 0.88 | 2 | 0.1158 % | 1,996.6 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1204 % | 1,560.2 |

| Perpetual-Discount | 6.87 % | 6.88 % | 226,126 | 12.67 | 71 | 0.1204 % | 1,436.9 |

| FixedReset | 6.08 % | 5.35 % | 761,830 | 14.38 | 23 | 0.3718 % | 1,785.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ALB.PR.A | SplitShare | -2.16 % | Asset coverage of 1.1-:1 as of January 22 according to Scotia. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-02-28 Maturity Price : 25.00 Evaluated at bid price : 19.97 Bid-YTW : 16.56 % |

| BNA.PR.C | SplitShare | -1.90 % | Asset coverage of 1.8+:1 as of December 31, according to the company. The underlying BAM.A closed today at 19.88 compared to the year-end close of 18.55 and this improvement, together with what may be rather large profits on the retractions of BNA.PR.A and BNA.PR.B, will increase the coverage … at least a little, barring disaster tomorrow! YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 11.35 Bid-YTW : 15.50 % |

| WFS.PR.A | SplitShare | -1.61 % | Asset coverage of 1.1+:1 as of January 22 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-06-30 Maturity Price : 10.00 Evaluated at bid price : 8.56 Bid-YTW : 12.65 % |

| GWO.PR.F | Perpetual-Discount | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 21.75 Evaluated at bid price : 21.75 Bid-YTW : 6.88 % |

| MFC.PR.B | Perpetual-Discount | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 17.46 Evaluated at bid price : 17.46 Bid-YTW : 6.77 % |

| BMO.PR.K | Perpetual-Discount | -1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 19.51 Evaluated at bid price : 19.51 Bid-YTW : 6.88 % |

| IAG.PR.A | Perpetual-Discount | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 16.32 Evaluated at bid price : 16.32 Bid-YTW : 7.16 % |

| BNS.PR.J | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 19.79 Evaluated at bid price : 19.79 Bid-YTW : 6.69 % |

| PWF.PR.I | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 21.73 Evaluated at bid price : 22.00 Bid-YTW : 6.86 % |

| CU.PR.B | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 22.57 Evaluated at bid price : 22.77 Bid-YTW : 6.72 % |

| PWF.PR.G | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 21.73 Evaluated at bid price : 21.73 Bid-YTW : 6.84 % |

| TCA.PR.X | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 44.29 Evaluated at bid price : 45.51 Bid-YTW : 6.17 % |

| RY.PR.I | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 22.27 Evaluated at bid price : 22.31 Bid-YTW : 4.74 % |

| TD.PR.S | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 22.19 Evaluated at bid price : 22.25 Bid-YTW : 4.27 % |

| BMO.PR.N | FixedReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 25.35 Evaluated at bid price : 25.40 Bid-YTW : 5.91 % |

| BMO.PR.H | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 21.00 Evaluated at bid price : 21.00 Bid-YTW : 6.44 % |

| W.PR.H | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 19.11 Evaluated at bid price : 19.11 Bid-YTW : 7.28 % |

| FFN.PR.A | SplitShare | 1.46 % | Asset coverage of 1.1+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.62 Bid-YTW : 10.96 % |

| BNA.PR.A | SplitShare | 1.47 % | Asset coverage of 1.8+:1 as of December 31, according to the company. The underlying BAM.A closed today at 19.88 compared to the year-end close of 18.55 and this improvement, together with what may be rather large profits on the retractions of BNA.PR.A and BNA.PR.B, will increase the coverage … at least a little, barring disaster tomorrow! Oddly, this issue is now trading well over its estimated retraction price of $21.74. Didn’t always used to! YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2010-09-30 Maturity Price : 25.00 Evaluated at bid price : 24.15 Bid-YTW : 9.17 % |

| BCE.PR.Z | FixedFloater | 1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 25.00 Evaluated at bid price : 15.00 Bid-YTW : 7.30 % |

| BNS.PR.Q | FixedReset | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 4.62 % |

| RY.PR.L | FixedReset | 1.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 23.06 Evaluated at bid price : 23.10 Bid-YTW : 5.33 % |

| BCE.PR.G | FixedFloater | 1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 7.02 % |

| PPL.PR.A | SplitShare | 2.13 % | Asset coverage of 1.4+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.10 Bid-YTW : 7.72 % |

| ELF.PR.G | Perpetual-Discount | 2.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 14.60 Evaluated at bid price : 14.60 Bid-YTW : 8.24 % |

| BAM.PR.K | Floater | 2.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 7.85 Evaluated at bid price : 7.85 Bid-YTW : 6.78 % |

| DF.PR.A | SplitShare | 2.93 % | Asset coverage of 1.4-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.13 Bid-YTW : 7.15 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.R | FixedReset | 964,597 | New issue settled today. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 6.32 % |

| TD.PR.N | OpRet | 185,200 | Scotia crossed 182,900 at 25.65. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 4.03 % |

| BNS.PR.T | FixedReset | 54,782 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 6.10 % |

| SLF.PR.C | Perpetual-Discount | 50,475 | Desjardins crossed 25,300 at 15.40; Nesbitt crossed 15,000 at 15.41. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 15.36 Evaluated at bid price : 15.36 Bid-YTW : 7.36 % |

| RY.PR.P | FixedReset | 47,495 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 25.01 Evaluated at bid price : 25.06 Bid-YTW : 6.13 % |

| TD.PR.E | FixedReset | 43,462 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-29 Maturity Price : 25.03 Evaluated at bid price : 25.08 Bid-YTW : 6.25 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. | |||

Is the following news good news, bad news or no significant news for the holder of Bam prefs? I first thought it was good news but now think it is rather meaningless.

QUOTE

BAM Investments Corp. (TSX:BNB) today announced that it will redeem all of its previously issued exchangeable debentures on January 30, 2009. The debentures were issued in January 2007 and are exchangeable into 5,301,000 Class A Limited Voting Shares of Brookfield Asset Management Inc. by either the holder or the Company. The redemption price will be satisfied entirely by the delivery of that number of Class A Limited Voting Shares to the holders of the debentures.

The debentures have been valued based on the market price of the underlying Brookfield Class A Limited Voting Shares because of the exchange right, and therefore the redemption and associated delivery of shares will have no material impact on the net book value of the Company, which continues to own a net interest in 55.1 million Brookfield Class A Limited Voting Shares.

The redemption of the debentures results in the simplification of the Company’s corporate structure and a reduction in interest costs of approximately $1.5 million per annum.

END QUOTE

Here’s an interesting question about the calculation of Yield to Worst for convertible pref pairs.

Take for example,

BBD.PR.B floater paying about 75 cents now (Monthly); recent bid $9.90; current yield = 7.56%

BBD.PR.D fixed (until Aug 1 2012) paying $1.316 (Quarterly); recent bid price $14.45; current yield = 9.11%

(I ignore accrued dividends for simplicity).

These two isses are interconvertible Aug 1, 2012 when the fixed dividend resets to the 5-year Canada rate. Obviously, in this market that won’t necessarily be at the $25 par they can be redeemed at. However, the interconversion privilege should ensure they trade at/near the SAME PRICE just before interconversion.

I want to make the case that the YTW for BBD.PR.B is actually much higher than YTW for the .D pref. If we assume BBD.PR.D is properly priced, then the .B price needs to rise from $9.90 to $14.45 in 3.5 years. This particular price difference is almost exactly equal to 3.5 years of dividend on the .D pref, so the market seems to be assuming zero payout from the floater for the next three years (i.e. zero prime rate).

I submit YTW should be calculated for interconvertible pairs by assuming the lower yielding issue will, in addition to dividends, rise in price to match the other member of the pair at the next interconversion date. In this case, BBD.PR.B has a YTW of 17.4% (vs 9.1% for PR.D, which, like discount prefs is assumed to maintain the same price). Even with zero dividend, BBD.PR.B has YTW of 11% — which is still way better than Pr.D.

This take on YTW may be unconventional (which is probably why BBD.PR.B is so out of whack with PR.D — a 1.9 to 8.3% return difference between prefs of the same issuer does not usually last too long!), but I believe it is more accurate and meaningful than simply using current yield. It is really no different than computing YTW for soft retractibles based on investor conversion options, except we replace the $25/95% maturity price with the higher current price of the pair.

There are many of these types of fixed/floating pairs around, so I don’t know if the huge BBD spread is a unique or a common situation. Perhaps as the thought leader in this field, you could help us pref investors in the trenches wrap our minds around this more realistic approach. There is a HUGE pricing inefficiency here.

Louis,

According to the BAM Investments Annual Report, In January 2007 the company issued debentures exchangeable into 5.3 million Class A shares of Brookfield for proceeds of $193.2 million. The debentures are carried at fair value and changes in fair values are recorded in Net Income during the period in which the change occurs. The company pays interest that is equivalent to dividends paid on Class A shares of Brookfield plus a specified amount. The debentures are secured by 5.3 million Class A shares of Brookfield.

I have no idea why these were issued (tax? some kind of receive-dividends-pay-interest arbitrage? Perhaps they were issued to an incompetent investment manager for use in the “bond” part of the portfolio?) but in the absence of other information will conclude that there are no implications for BAM itself.

Prefhound

Good catch, sir, good catch! I have indeed noticed that nobody appears to be willing to take a view on prime; and that the “floating rate premium” usually seen now appears to be devoted entirely to the banks’ fixed reset issues … but I hadn’t noticed the BBD situation.

It is, of course, thoroughly ludicrous that such a spread exists, but I cannot agree that one should calculate YTW “by assuming the lower yielding issue will, in addition to dividends, rise in price to match the other member of the pair at the next interconversion date”. This is a suitable method for comparing the two issues, but it doesn’t say anything about how either issue should be compared to a third issue.

I don’t know if the huge BBD spread is a unique or a common situation.

With BCE issues the effect is reversed … or, at least, it has been recently.

Thanks for pointing that out, prefhound … my next preferred share article will be on Floaters, and this incongruity with FixFloat pairs will definitely make it into at least one of the tables!

“This is a suitable method for comparing the two issues, but it doesn’t say anything about how either issue should be compared to a third issue.”

To this point, discount pref BBD.PR.C (such a third issue) has a yield of 8.5%, which is 60 bp lower than BBD.PR.D. The reason for this seems to be that PR.D is expected, at current 5-year Canada rates, to reset at a lower dividend in 2012 than is currently paid.

Thus, one could make an argument that PR.D should yield 8.5% with its new dividend in 2012, and that the price of PR.D (and hence PR.B by coupling) should be lower then than it is now (as we are amortizing the “excess” dividend over 3 years).

However, even in this scenario, BBD.PR.B will still have a YTW 8 points better than PR.D — might not be 17%/9% but could be 10%/2% or something like that.

I am intrigued by the arbitrage potential here, but my last BBD.PR.B/D arb took 8 months to work out and I don’t feel like waiting 3.5 years to make 25%!

I like this remark…. “Guys, guys, guys … that’s not what fixed-income is all about.” Too true, it’s certainly not why I took a dive headlong into prefs about a year ago – I liked (and still do) prefs as an attractive, tax efficent fixed income alternative BUT I also thought I liked them as a quasi-cash alternative in a given inflationary environment. Now I’m not so sure.

I’ve had a bit of a rough ride on my learning curve – I had expected that high quality prefs would perform in a predictable manner, but instead have taken capital shrinkage in a world of falling interest rates.

I follow your blog and monthly letter but I haven’t heard you express an outlook for prefs in the medium term. I’m not looking to speculate on prefs, but I am trying to weigh any potential cap gain opportunities that may be building during 2009 and I do have concern that bank prefs may have hit something of a wall considering the new issues being rolled out.

prefhound: one could make an argument that PR.D should yield 8.5% with its new dividend in 2012, and that the price of PR.D (and hence PR.B by coupling) should be lower then than it is now (as we are amortizing the “excess” dividend over 3 years).

That is, more or less, the argument I would make – except that there should be some kind of price premium (yield discount) on the B/D, since the floating rate protection against future high rates should be worth something … or, who knows, maybe the potential for capital gains on the C should future rates be LOW is worth more!

joe clarke: have taken capital shrinkage in a world of falling interest rates.

Trouble is, you see, we are not in a world of falling interest rates. Government yields are falling certainly, but corporate rates and individual rates have – by and large – increased.

To speak of “rates” as a homogeneous block is imprecise and will lead to errors, confusion and losses. You can’t even speak of “government rates”, even when specifying the particular government, since there’s no reason why long Canadas and short Canadas have to move in tandem.

follow your blog and monthly letter but I haven’t heard you express an outlook for prefs in the medium term.

And you won’t! See my post on market timing.