Treasury is going to avoid voting its shares in companies that received TARP funds:

On many resolutions offered by investors — from demanding pro- environment policies to allowing domestic partner benefits to reining in executive bonuses — the Treasury plans to ask that its ballots be counted in the same proportion as the votes of other stockholders so it won’t impact the results.

An investment manager could probably go to jail for that! But Dealbreaker, bless its heart, sees the truth:

As Kenny Lewis can attest to, when it comes to the stuff that really matters, backroom waterboarding is a far more compelling tool than shareholder votes.

The Lewis affair was discussed on April 24: Lewis’ BofA was basically forced by Treasury to buy Merrill, despite “staggering deterioration” of Merrill’s balance sheet.

Looks like there will be increased regulatory control over oil & gas speculation. There is, naturally, considerable doubt as to whether speculation is harmful.

California’s having a little difficulty getting its IOUs accepted:

A group of the biggest U.S. banks said they would stop accepting California’s IOUs on Friday, adding pressure on the state to close its $26.3 billion annual budget gap.

…

Amid the budget deadlock, Fitch Ratings on Monday dropped California’s bond rating to BBB, down from A minus, the latest in a series of ratings downgrades for the state.The group of banks included Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and J.P. Morgan Chase & Co., among others. The banks had previously committed to accepting state IOUs as payment. California plans to issue more than $3 billion of IOUs in July.

BIS has released a working paper by Naohiko Baba and Frank Packer titled From turmoil to crisis: dislocations in the FX swap market before and after the failure of Lehman Brothers:

This paper investigates dislocations in the foreign exchange (FX) swap market between the US dollar and three major European currencies. After the failure of Lehman Brothers in September 2008, deviations from covered interest parity (CIP) were negatively associated with the creditworthiness of US financial institutions (as well as that of European institutions), consistent with the deepening of a dollar liquidity problem into a global phenomenon. US dollar term funding auctions by the ECB, SNB, and BoE, as well as the US Federal Reserve commitment to provide unlimited dollar swap lines are found to have ameliorated the FX swap market dislocations.

The Ontario Securities Commission has released its 2009 Annual Report. To my mind, the most interesting sentence was:

The OSC, Quebec’s Autorité des marchés financiers and the Investment Industry Regulatory Organization of Canada (IIROC) are reviewing complaints received in connection with the organization, sale or distribution of non-bank sponsored ABCP products.

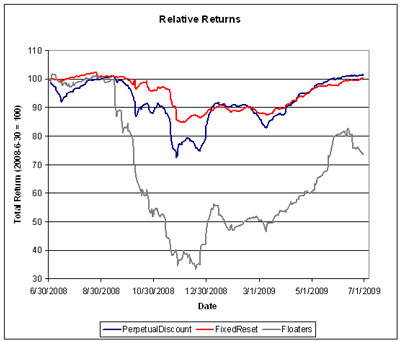

Not much price action today, but the PerpetualDiscount and FixedReset sectors both posted gains, with yields on FixedResets continuing what seems like an inexorable march downwards.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1648 % | 1,175.8 |

| FixedFloater | 7.08 % | 5.46 % | 37,415 | 16.37 | 1 | 0.0651 % | 2,130.7 |

| Floater | 3.24 % | 3.75 % | 80,252 | 17.99 | 3 | 0.1648 % | 1,468.9 |

| OpRet | 4.97 % | -4.67 % | 125,348 | 0.09 | 15 | 0.1123 % | 2,218.6 |

| SplitShare | 5.73 % | 6.35 % | 70,025 | 4.18 | 3 | 0.2412 % | 1,902.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1123 % | 2,028.7 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0817 % | 1,752.9 |

| Perpetual-Discount | 6.31 % | 6.34 % | 160,984 | 13.43 | 71 | 0.0817 % | 1,614.4 |

| FixedReset | 5.58 % | 4.34 % | 478,925 | 4.30 | 40 | 0.1380 % | 2,056.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.O | OpRet | -1.20 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 23.87 Bid-YTW : 6.37 % |

| BAM.PR.M | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 15.57 Evaluated at bid price : 15.57 Bid-YTW : 7.71 % |

| PWF.PR.G | Perpetual-Discount | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 22.81 Evaluated at bid price : 23.10 Bid-YTW : 6.51 % |

| POW.PR.D | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 19.41 Evaluated at bid price : 19.41 Bid-YTW : 6.48 % |

| BAM.PR.B | Floater | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 10.55 Evaluated at bid price : 10.55 Bid-YTW : 3.75 % |

| MFC.PR.A | OpRet | 1.67 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 3.73 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.P | FixedReset | 88,977 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 23.28 Evaluated at bid price : 25.50 Bid-YTW : 4.82 % |

| RY.PR.Y | FixedReset | 83,191 | National Bank crossed 20,000 at 27.21. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 27.21 Bid-YTW : 4.55 % |

| MFC.PR.E | FixedReset | 82,463 | RBC crossed 10,000 at 25.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 5.31 % |

| TD.PR.A | FixedReset | 69,261 | Nesbitt crossed 50,000 at 25.16. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 25.05 Evaluated at bid price : 25.10 Bid-YTW : 4.51 % |

| BAM.PR.I | OpRet | 56,838 | RBC crossed 50,000 at 25.00. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 24.95 Bid-YTW : 5.61 % |

| CM.PR.I | Perpetual-Discount | 56,480 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-07 Maturity Price : 18.06 Evaluated at bid price : 18.06 Bid-YTW : 6.53 % |

| There were 52 other index-included issues trading in excess of 10,000 shares. | |||