Faced with criticism of their conduct and market disdain for their chances going forward, European politicians are taking decisive action – prohibit criticism!

The European Commission said yesterday it will investigate trades in sovereign credit-default swaps in the wake of the Greek crisis, which has pushed the euro lower and prompted officials to warn hedge funds they shouldn’t try to profit from the woes of the region’s nations.

… with further details:

Banks and regulators across Europe were summoned by the European Commission to discuss regulation of the market for sovereign credit-default swaps in the wake of the Greek debt crisis.

The European Union’s executive agency will hold a meeting in Brussels “shortly,” Chantal Hughes, a commission spokeswoman, said in an e-mailed statement today. The talks, which will take place as soon as March 5, will cover CDS pricing and links to the sovereign bond market, according to three people familiar with the discussions.

Remember the little boy who shouted that the Emperor had no clothes? The soldiers slaughtered him, his family, and anybody who heard the treacherous remark. Later, the Emperor’s wardrobe expenses caused taxes to rise so high that a famine resulted and the Empire collapsed. But that’s show-biz.

There’s more jostling in the Brookfield / General Growth deal, with Ackman’s role being criticized:

General Growth Properties Inc’s

unsecured creditors and suitor Simon Property Group on Tuesday criticized William Ackman’s role in the mall owner’s restructuring plan, alleging conflicts of interest given his position as a director and largest shareholder. Ackman has backed a reorganization plan that calls for his Pershing Square Capital Management hedge fund to offer Brookfield Asset Management

certain protections in return for the Canadian firm financing General Growth’s stand-alone exit from bankruptcy.

…

The official committee of General Growth’s unsecured creditors said in a court filing that the agreement between Pershing Square and Brookfield effectively restricts General Growth from considering alternative transactions because it puts the company into “an obvious conflict of interest situation.”“The Debtors must choose between the best interests of the estates and the economic interests of one of their most active and vocal directors,” it added, referring to Ackman.

Simon, a General Growth creditor, also questioned the arrangement between Brookfield and Ackman’s Pershing Square in a separate filing Tuesday.

RBC CEO Gord Nixon spoke at the annual meeting:

“Political rhetoric is distorting the cause of this recent crisis and potentially distorting the cure,” he told shareholders at the bank’s annual meeting in Toronto Wednesday. “This crisis was not caused by Wall Street, executive compensation, nor proprietary trading, although they all played a part. The root cause of the crisis was the failure of the U.S. residential mortgage market,” he said, adding that “the basic requirement to qualify for a large mortgage in the United States was a pulse.”

I would say ‘triggered’ rather than ’caused’. The recession is bringing to light a lot of bad practices: General Motors, Chrysler, Greece …

“The bulk of the losses during the crisis arguably resulted from lending practices and excessive concentration related, primarily, to U.S. residential real estate and over-extended consumers, not those activities addressed by the proposed reforms,” he said.

Glad to hear someone talking about concentration. Bad investments can hurt you, but over-concentration can kill you … as, for instance, many Canadian ABCP players found out. He says Basel III is fraying ’round the edges:

“While a few months ago it appeared as if there was a high degree of co-operation among the Financial Stability Board countries, we are now experiencing a divide with different countries trying to initiate rules that best suit their jurisdictions,” he said. “The unified response that was necessary and commendable during the darkest days of the crisis now risks being replaced by regulatory and legislative one-upmanship, as various governments pursue local agendas.”

…

And, while he said he agrees that it’s important for banks to be conservatively capitalized, he said that “the current Basel III proposals, as they’re referred to, are so complex and onerous that we run the risk of no agreement being reached.”

I was quoted in the Advisor.ca budget wish-list:

James Hymas, president, Hymas Investment Management Inc.

• A clear-cut plan for a balanced budget through the cycle.

• I want to see statements of planned spending cuts and tax increases that will not just eliminate the deficit (a childish half-measure), but ensure – insofar as such things can be ensured – that surpluses built up in relatively good times will pay for this recession and put us in a good position to cope with the next one.

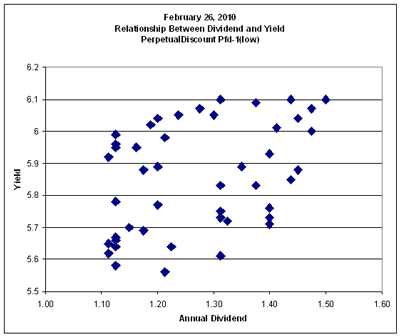

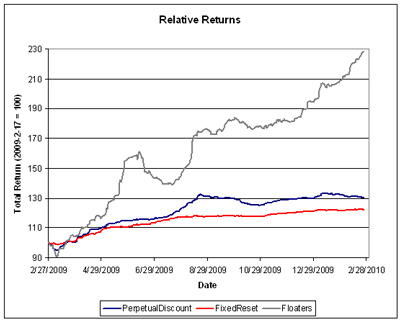

Volume dropped to more normal levels on a steady day in the Canadian preferred share market, with PerpetualDiscounts gaining 5bp and FixedResets gaining 9bp … taking the YTW on the latter class down to 3.52%.

PerpetualDiscounts now yield 5.89%, equivalent to 8.25% interest at the standard equivalency factor of 1.4x. Long Corporates are now yielding about 5.8%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) now stands at 245bp, a sharp, bond-driven widening from the 235bp recorded at month-end.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

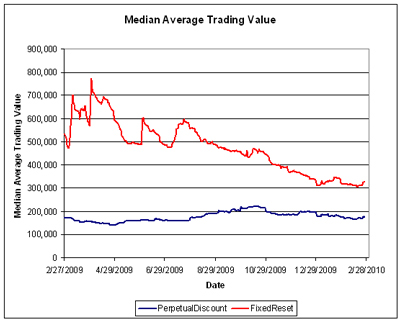

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.77 % | 2.92 % | 40,679 | 20.50 | 1 | -0.4876 % | 1,997.0 |

| FixedFloater | 5.34 % | 3.45 % | 40,599 | 19.64 | 1 | -1.2136 % | 2,958.5 |

| Floater | 1.92 % | 1.65 % | 49,074 | 23.45 | 4 | 0.6990 % | 2,396.7 |

| OpRet | 4.88 % | 1.59 % | 102,078 | 0.24 | 13 | -0.0089 % | 2,310.8 |

| SplitShare | 6.39 % | 6.53 % | 129,500 | 3.72 | 2 | 0.3985 % | 2,134.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0089 % | 2,113.0 |

| Perpetual-Premium | 5.87 % | 5.81 % | 132,078 | 6.90 | 7 | -0.0791 % | 1,895.9 |

| Perpetual-Discount | 5.86 % | 5.89 % | 180,302 | 14.05 | 70 | 0.0514 % | 1,802.9 |

| FixedReset | 5.40 % | 3.52 % | 320,307 | 3.73 | 42 | 0.0898 % | 2,193.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.G | FixedFloater | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 25.00 Evaluated at bid price : 20.35 Bid-YTW : 3.45 % |

| RY.PR.I | FixedReset | -1.14 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.07 Bid-YTW : 3.86 % |

| BAM.PR.K | Floater | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 2.27 % |

| TRI.PR.B | Floater | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 23.25 Evaluated at bid price : 23.55 Bid-YTW : 1.65 % |

| BAM.PR.O | OpRet | 1.91 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 3.81 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.A | Perpetual-Discount | 76,680 | Scotia crossed 48,700 at 19.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 19.80 Evaluated at bid price : 19.80 Bid-YTW : 6.01 % |

| CM.PR.G | Perpetual-Discount | 67,265 | RBC crossed 53,900 at 23.05. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 22.94 Evaluated at bid price : 23.15 Bid-YTW : 5.90 % |

| BAM.PR.P | FixedReset | 63,090 | Nesbitt crossed 50,000 at 27.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.19 Bid-YTW : 5.19 % |

| BMO.PR.P | FixedReset | 59,828 | Desjardins crossed 43,300 at 27.05. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 27.02 Bid-YTW : 3.66 % |

| CM.PR.I | Perpetual-Discount | 50,068 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 20.23 Evaluated at bid price : 20.23 Bid-YTW : 5.89 % |

| GWO.PR.G | Perpetual-Discount | 34,133 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-03 Maturity Price : 21.46 Evaluated at bid price : 21.46 Bid-YTW : 6.07 % |

| There were 31 other index-included issues trading in excess of 10,000 shares. | |||