The Bank of Canada has released the December 2010 Financial System Review which includes reports on:

- The Countercyclical Bank Capital Buffer: Insights for Canada

- Strengthening the Infrastructure of Over-the-Counter Derivatives Markets

- Central Counterparties and Systemic Risk

- Contingent Capital and Bail-In Debt: Tools for Bank Resolution

The Bank identifies:

Four major interconnected sources of risk emanate from the external macrofinancial environment: (i) sovereign debt concerns in several countries; (ii) financial fragility associated with the weak global economic recovery; (iii) global imbalances; and (iv) the potential for excessive risk-taking behaviour arising from a prolonged period of exceptionally low interest rates in major advanced economies. The main domestic source of risk arises from the increasingly stretched financial position of Canadian households, which leaves them more vulnerable to adverse events

They identify a central contradiction in monetary policy:

While stimulative monetary policy is needed to support the global economic recovery, experience suggests that a long period of very low interest rates may be associated with excessive credit creation and undue risk-taking as investors seek higher returns, leading to the underpricing of risk and unsustainable increases in asset prices.

One wonders if they are sending a signal by picking on the insurers:

Institutional investors with liabilities having a duration exceeding that of their assets, such as life insurance companies and defined benefit pension plans, are particularly affected by a sustained period of low interest rates. In this environment, the combination of upward pressure on the actuarial value of contractual liabilities and reduced yields on assets is likely to put pressure on the balance sheets of these entities, and potentially encourage risk-taking behaviour as these institutions strive to achieve the minimum returns they have guaranteed to policyholders and beneficiaries.

… and then return to the theme:

In Canada, household credit has continued to expand rapidly during the recession and the early stages of the recovery. While this expansion—in contrast with the experience in previous downturns and in other advanced economies—is in part a testament to the resilience of Canada’s financial system, it is also an important source of risk. The proportion of households with stretched financial positions that leave them vulnerable to an adverse shock has grown significantly in recent years, as the growth rate of debt has outpaced that of disposable income. The risk is that a shock to economic conditions could be transmitted to the broader financial system through a deterioration in the credit quality of loans to households. This would prompt a tightening of credit conditions that could trigger a mutually reinforcing deterioration of real activity and financial stability.

So there’s an inherent contradiction here. In bad times, interest rates are lowered so that people will borrow more and spend it. But now they’re worried that the borrowers won’t be able to pay it back, in sufficient numbers to cause problems of its own.

Clearly, monetary policy is too blunt a tool to do much. The bank wants to encourage borrowing and spending, sure, but it wants to encourage productive borrowing and spending – and the Wrong Type of People are exploiting monetary policy and blowing their loan proceeds on houses, beer and prostitutes instead of on productive equipement.

This becomes a political issue. Accellerated Depreciation is being tried in the US:

Tax cuts intended for businesses are a relatively small part of the $858 billion tax bill scheduled for a final vote in the Senate as early as Tuesday.

The Joint Committee on Taxation estimated that about $75 billion of the tax breaks in the plan were aimed at businesses, including $13 billion for a two-year extension of the coveted research and development credit, which helps cover the cost of wages for employees involved in research. The proposal also commits $22 billion for accelerated depreciation, which in 2011 would allow businesses to write off 100 percent of their capital expenditures immediately instead of over several years.

Many economists are skeptical of the tax breaks’ potential to stoke the economy in any meaningful way. Businesses are sitting on more than a trillion in cash, but are reluctant to invest because of lagging demand, a problem that tax incentives are not devised to address.

“The research and development credit is a good thing, with a limited effect, and the accelerated depreciation will get people to move forward with investment that they probably would have done anyway,” said David Wyss, chief economist at Standard & Poor’s. “But when you look at the amount of money involved, you’re not getting a lot of bang for your buck.”

The BoC cheerfully concludes:

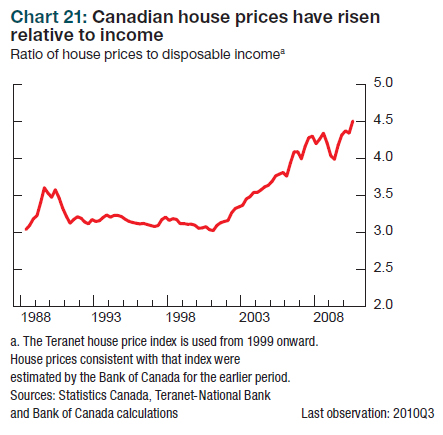

The probability of an adverse labour market shock materializing is judged to have edged higher in recent months, owing to the downward revision in the October Monetary Policy Report to the outlook for the global and Canadian economies. The Bank has conducted a partial stress-testing simulation to estimate the impact on household balance sheets of a hypothetical labour market shock that would increase the unemployment rate by 3 percentage points. The results suggest that the associated rise in financial stress among households would double the proportion of loans that are in arrears three months or more. Owing to the declining affordability of housing and the increasingly stretched financial positions of households, the probability of a negative shock to property prices has risen as well.

The Bank judges that, overall, the risk of a system-wide disturbance arising from financial stress in the household sector is elevated and has edged higher since June. This vulnerability is unlikely to decline quickly, given projections of subdued growth in income.

The section on the macro-financial environment has a few interesting things to say:

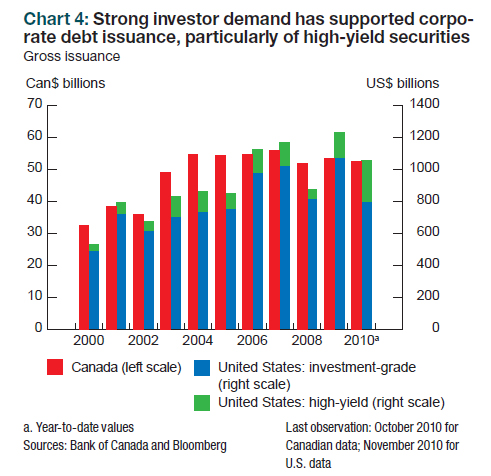

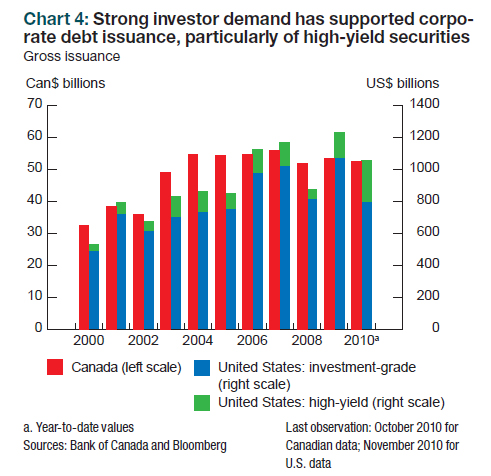

The current environment has supported elevated corporate bond issuance across the credit spectrum (Chart 4). In particular, issuance of U.S.-dollar high-yield debt has reached a historic high. The search for yield has also supported increased issuance of securities with longer maturities, especially in the most recent period.(1) Owing partly to the relative strength of Canada’s banking, corporate and government sectors, demand by foreign investors for Canadian debt securities remains robust.(2) A number of Canadian issuers, including some banks and provincial governments, have taken advantage of this strong international demand for Canadian debt products by accessing markets outside Canada.

1 For instance, 45 per cent of total corporate debt issued in the Canadian market in the third quarter had a maturity of 5 to 10 years, and 9 per cent a maturity of 30 years or more, compared with averages of 32 per cent and 3 per cent, respectively, since 1999.

2 Statistics Canada data show that, in the 12-month period ending in September 2010, nonresident investors purchased $105 billion in bonds in Canadian markets, compared with $43 billion over the same period in 2009.

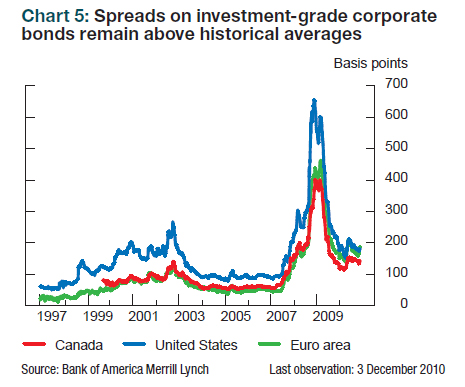

Click for Big

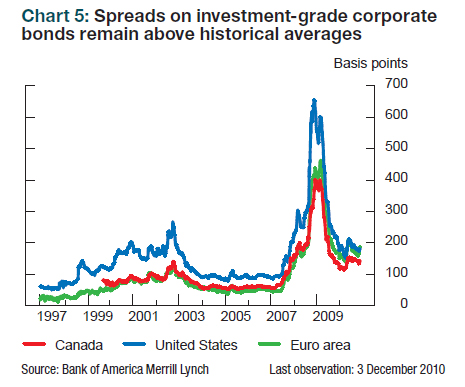

Click for BigNot surprisingly, given the strength of demand, credit spreads have tightened further in Canada and in other key developed markets, although they generally remain above historical averages (Chart 5).(3) Assuming a 40 per cent recovery rate, the current spreads on North American indexes for corporate credit default swaps (CDS) imply a default rate for the next five years of 1.50 per cent per year for investment-grade issuers and 5.25 per cent per year for high-yield issuers. Based on historical data, these implied default rates, although well below the peaks reached in previous recessions, are higher than the average realized default rates.(4) Overall, this suggests that current pricing in corporate bond markets is consistent with expectations of a modest economic recovery in industrialized economies.

3 While corporate spreads in Canada and the euro area are above their levels from the early 2000s, U.S. spreads are somewhat lower, particularly for high-yield investors.

4 Default rates for high-yield issuers have peaked at about 12 per cent during every recession since 1990, and the average default rate since the 1980s has been 4.5 per cent. Moody’s reports that, for the period from 1989 to 2009, the average cumulative default rate over a five year window was 0.9 per cent for Canadian investment-grade issuers and 1 per cent for U.S. investment-grade issuers.

Click for Big

Click for BigIn contrast to the term extension for corporate issuers:

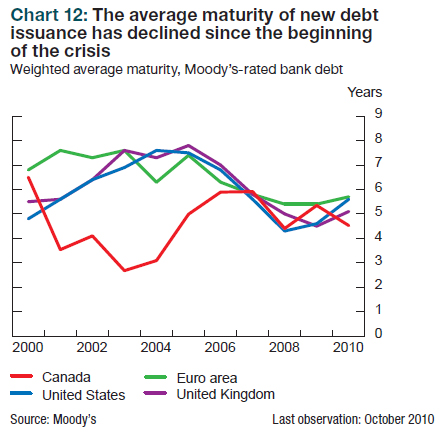

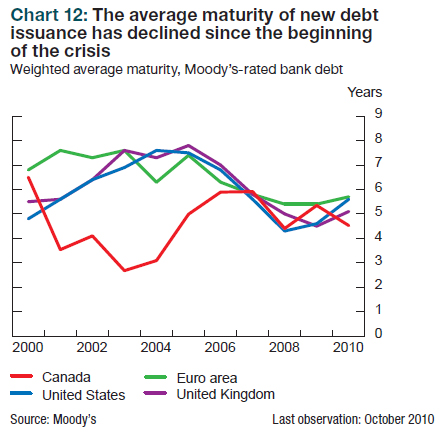

International banks continue to increase liquid assets and search for stable, longer-term funding, but progress has been slow. Many institutions still rely on wholesale funding, and the average maturity of new issuances has declined since the beginning of the crisis (Chart 12). Some small banks that have traditionally relied on retail deposits to finance their operations are facing stronger competition, given that the banking sector as a whole is seeking to improve the stability of its liquidity position by reducing its reliance on wholesale sources of funds.

Click for big

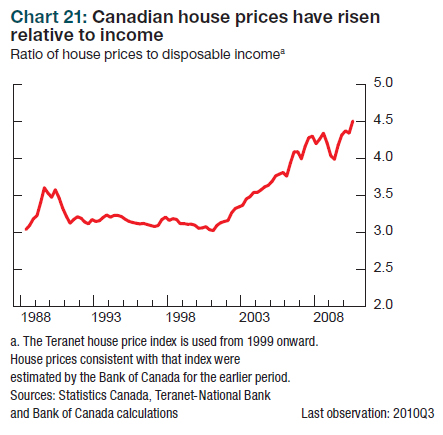

Click for bigI’m including the next chart just because it’s cool:

Click for Big

Click for BigIs monetary policy pushing on a string?

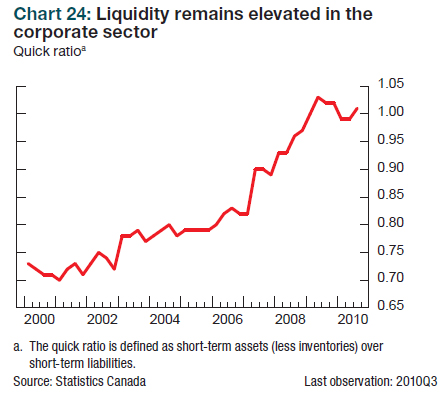

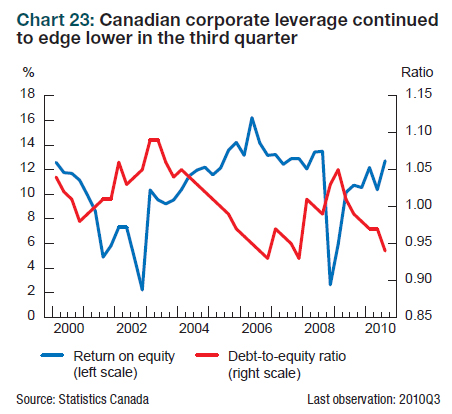

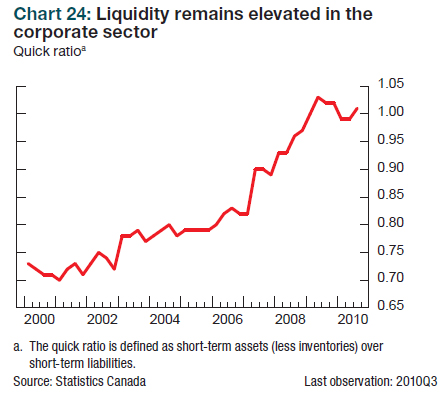

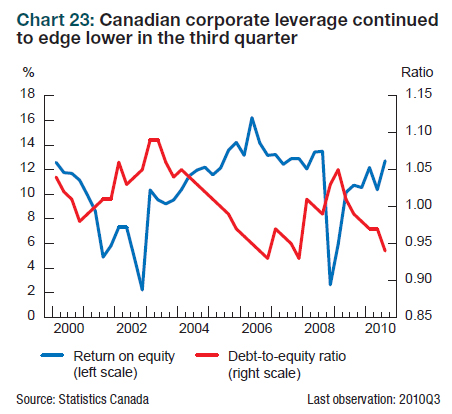

New information received since June indicates that the aggregate financial position of the Canadian non-financial corporate sector remains robust despite the recent slowdown in economic growth. The corporate sector appears well placed to withstand the financial consequences of adverse shocks. Corporate leverage declined in the third quarter of 2010, reaching the lowest ratio observed since the end of the financial crisis (Chart 23). Canadian corporate leverage, measured at market value, remains significantly below that of the United States, the United Kingdom and the euro area. Moreover, liquidity in the Canadian non-financial corporate sector—as measured by the ratio of short-term assets (less inventories) to short-term liabilities—remains elevated (Chart 24).

Click for Big

Click for Big  Click for Big

Click for BigThe individual reports are important enough that I’ll deal with them separately … some time.