The fund underperformed in February as the extremely poor performance of the YLO preferreds reduced returns by slightly over 100bp.

The fund’s Net Asset Value per Unit as of the close February, 2012, was 10.6167.

| Returns to February, 2012 |

| Period |

MAPF |

Index |

CPD

according to

Claymore |

| One Month |

-0.62% |

-0.22% |

-0.12% |

| Three Months |

+6.25% |

+2.98% |

+2.93% |

| One Year |

+2.71% |

+6.77% |

+4.95% |

| Two Years (annualized) |

+11.26% |

+9.20% |

N/A |

| Three Years (annualized) |

+23.95% |

+15.03% |

+12.10% |

| Four Years (annualized) |

+17.40% |

+6.16% |

|

| Five Years (annualized) |

+14.49% |

+4.01% |

|

| Six Years (annualized) |

+13.15% |

+4.09% |

|

| Seven Years (annualized) |

+12.05% |

+4.07% |

|

| Eight Years (annualized) |

+11.69% |

+4.02% |

|

| Nine Years (annualized) |

+13.63% |

+4.65% |

|

| Ten Years (annualized) |

+12.30% |

+4.40% |

|

| The Index is the BMO-CM “50” |

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. |

| CPD Returns are for the NAV and are after all fees and expenses. |

| * CPD does not directly report its two-year returns. |

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.09%, +3.15% and +5.54%, respectively, according to Morningstar after all fees & expenses. Three year performance is +13.41%. |

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are +0.98%, +2.36% and +4.29% respectively, according to Morningstar. Three Year performnce is +9.40% |

| Figures for Manulife Preferred Income Fund (formerly AIC Preferred Income Fund) (which are after all fees and expenses) for 1-, 3- and 12-months are +0.09%, +2.88% & +5.20%, respectively |

| Figures for Horizons AlphaPro Preferred Share ETF (which are after all fees and expenses) for 1-, 3- and 12-months are +0.25%, +3.91% & +6.53%, respectively. |

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

The horrible performance of the YLO preferreds over the month (losses of between 60% (YLO.PR.A) and 76% (YLO.PR.D)) can be ascribed to the suspension of dividends on these issues, followed by sharp downgrades from DBRS and S&P. Unitholders and casual readers will know that these issues have been a nightmare for me since the renegotiation of their bank credit facilities in September. With the benefit of hindsight, it is easy to say I should have sold everything then – or at least stopped purchases after the credit downgrades in August – but … I didn’t. While I have been quite cognizant of the fact that credit quality of YLO has been deteriorating, I have also considered the decline to be more than fully reflected in the market price of these issues – and why sell for less than there estimated value?

One question that springs to mind is: just why, exactly, did the company suspend preferred dividends? This is a drastic measure to take and most companies maintain payouts until the very day they file for CCCA protection; in addition, YLO is both profitable and cash-flow positive. It is my belief that the board looked at the price their public securities – common, preferreds and bonds – were trading at and decided that since the public was of the view that bankruptcy was imminent they ‘might as well have the game as the name’.

| YLO Preferred Dividends Foregone |

| Issue |

Shares Out |

Dividend / Share |

Total

(Millions) |

| YLO.PR.A |

10,045,872 |

1.0625 |

$10.7 |

| YLO.PR.B |

6,062,128 |

1.25 |

$7.6 |

| YLO.PR.C |

8,120,900 |

1.6875 |

$13.7 |

| YLO.PR.D |

4,919,920 |

1.725 |

$8.5 |

| |

$40.5 |

Note that the calculation assumes that all issues remain outstanding, but the company can convert YLO.PR.A to common at the end of March, and YLO.PR.B to common at the end of June. The suspension of dividends means that such conversions will no longer have a cash-flow benefit, but conversions would halt the accrual of dividends, which are cumulative for all issues.

But one may say that a little over $10-million per quarter can now go towards paying down debt rather than paying out dividends – every little bit helps and, with luck, the relatively improved balance sheet will assist them to make a deal.

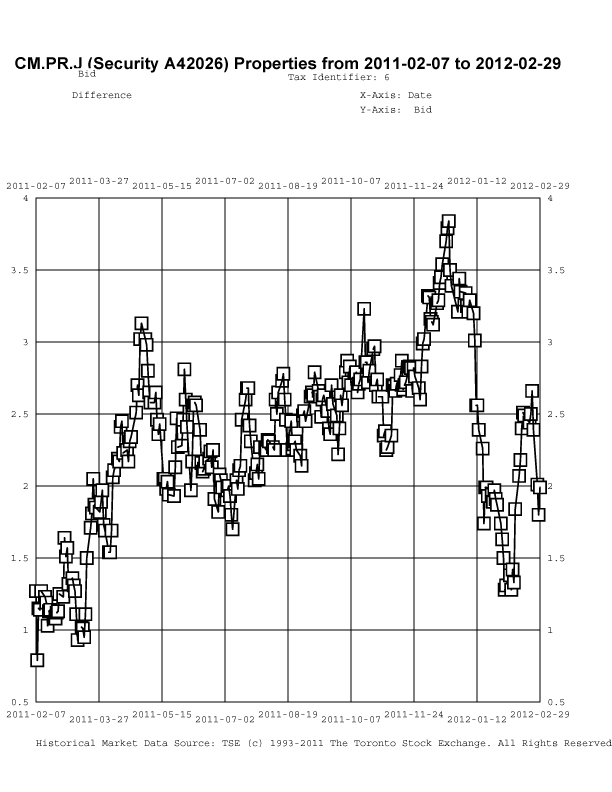

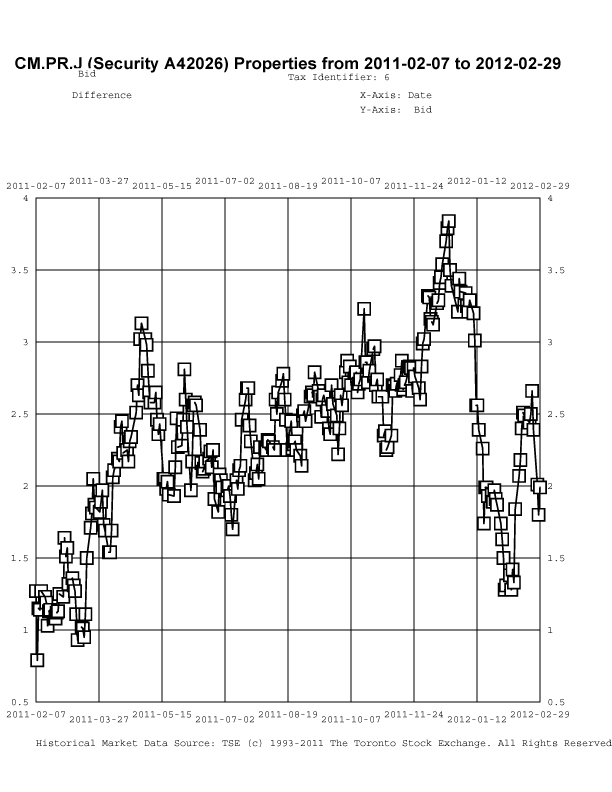

There was a large gyration in relative prices of bank and insurer DeemedRetractibles during the month, due to some long-awaited (by me, anyway!) issuance of Straight Perpetuals: GWO.PR.P, PWF.PR.R and POW.PR.G. The following chart shows the difference in bid price between CM.PR.J and GWO.PR.I, which pay the same annual dividend. No correction has been made for the difference in ex-Dividend dates:

Click for Big

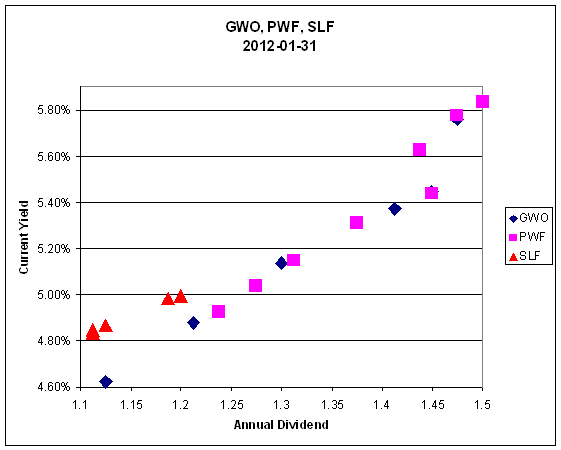

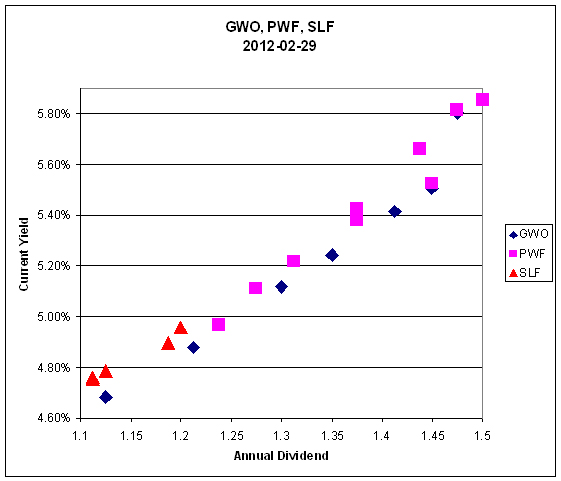

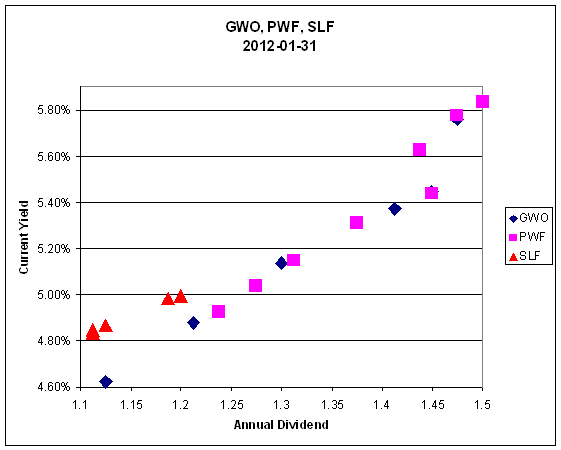

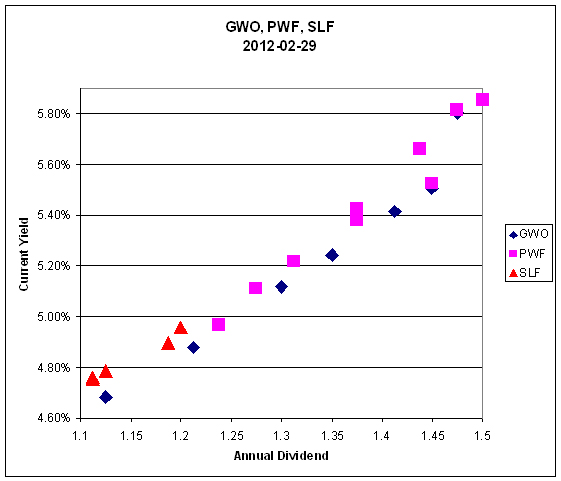

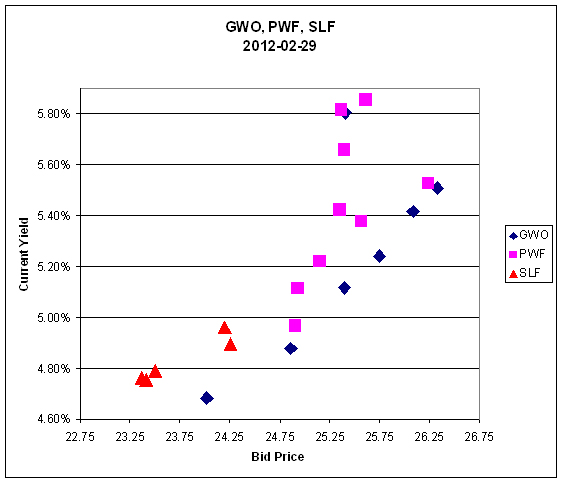

Click for BigSLF DeemedRetractibles performed quite well over the month and may be compared with PWF and GWO:

Click for Big

Click for Big Click for Big

Click for BigIt is quite apparent that the pricing difference between SLF and similar issues has narrowed – and also that the market continues to treat regulated issues (SLF, GWO) no differently from unregulated issues (PWF).

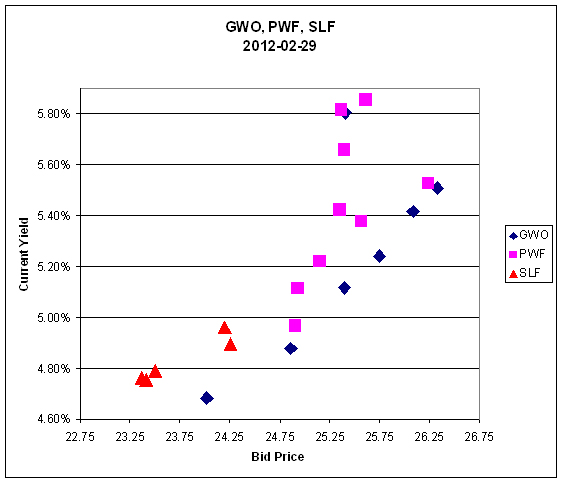

The extent of the remaining SLF exceptionalism is better illustrated by a chart showing the current yield against the bid price:

Click for Big

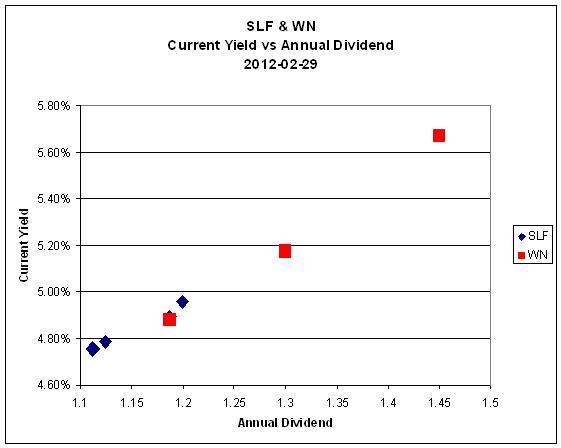

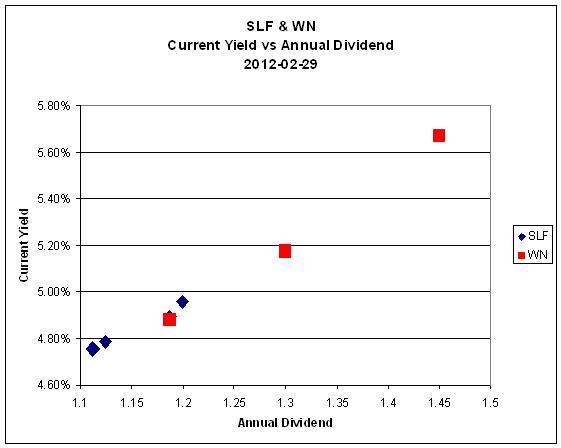

Click for BigAmazingly, SLF now trades comparably to WN, instead of cheaper!:

Click for Big

Click for BigIn order to rationalize the relationship between the Current Yields we are asked to believe:

- That the additional credit quality of SLF is worthless

- It is possible, of course, to argue that WN is actually a better credit than SLF, or that the scarcity value of a non-financial preferred outweighs the difference in credit. I have not yet heard these arguments being made

- The option value of the issuer’s call is worthless

- This can be phrased as ‘The potential capital gain for the SLF issues prior to a call, relative to that of the WN issues, is worthless’

- The potential of a regulatory inspired call for the SLF issues is worthless

- the SLF issues are currently Tier 1 Capital at the holding company level, but do not have an NVCC clause

Sometimes everything works … sometimes it’s 50-50 … sometimes nothing works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There were a lot of strongly motivated market participants during the Panic of 2007, generating a lot of noise! Unfortunately, the conditions of the Panic may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, without worrying about the level of monthly turnover.

There’s plenty of room for new money left in the fund. I have shown in recent issues of PrefLetter that market pricing for FixedResets is demonstrably stupid and I have lots of confidence – backed up by my bond portfolio management experience in the markets for Canadas and Treasuries, and equity trading on the NYSE & TSX – that there is enough demand for liquidity in any market to make the effort of providing it worthwhile (although the definition of “worthwhile” in terms of basis points of outperformance changes considerably from market to market!) I will continue to exert utmost efforts to outperform but it should be borne in mind that there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit |

| Month |

NAVPU |

Portfolio

Average

YTW |

Leverage

Divisor |

Securities

Average

YTW |

Capital

Gains

Multiplier |

Sustainable

Income

per

current

Unit |

| June, 2007 |

9.3114 |

5.16% |

1.03 |

5.01% |

1.3240 |

0.3524 |

| September |

9.1489 |

5.35% |

0.98 |

5.46% |

1.3240 |

0.3773 |

| December, 2007 |

9.0070 |

5.53% |

0.942 |

5.87% |

1.3240 |

0.3993 |

| March, 2008 |

8.8512 |

6.17% |

1.047 |

5.89% |

1.3240 |

0.3938 |

| June |

8.3419 |

6.034% |

0.952 |

6.338% |

1.3240 |

$0.3993 |

| September |

8.1886 |

7.108% |

0.969 |

7.335% |

1.3240 |

$0.4537 |

| December, 2008 |

8.0464 |

9.24% |

1.008 |

9.166% |

1.3240 |

$0.5571 |

| March 2009 |

$8.8317 |

8.60% |

0.995 |

8.802% |

1.3240 |

$0.5872 |

| June |

10.9846 |

7.05% |

0.999 |

7.057% |

1.3240 |

$0.5855 |

| September |

12.3462 |

6.03% |

0.998 |

6.042% |

1.3240 |

$0.5634 |

| December 2009 |

10.5662 |

5.74% |

0.981 |

5.851% |

1.1141 |

$0.5549 |

| March 2010 |

10.2497 |

6.03% |

0.992 |

6.079% |

1.1141 |

$0.5593 |

| June |

10.5770 |

5.96% |

0.996 |

5.984% |

1.1141 |

$0.5681 |

| September |

11.3901 |

5.43% |

0.980 |

5.540% |

1.1141 |

$0.5664 |

| December 2010 |

10.7659 |

5.37% |

0.993 |

5.408% |

1.0298 |

$0.5654 |

| March, 2011 |

11.0560 |

6.00% |

0.994 |

5.964% |

1.0298 |

$0.6403 |

| June |

11.1194 |

5.87% |

1.018 |

5.976% |

1.0298 |

$0.6453 |

| September |

10.2709 |

6.10%

Note |

1.001 |

6.106% |

1.0298 |

$0.6090 |

| December, 2011 |

10.0793 |

5.63%

Note |

1.031 |

5.805% |

1.0000 |

$0.5851 |

| February, 2012 |

10.6167 |

4.88%

Note |

0.999 |

4.875% |

1.0000 |

$0.5176 |

NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains.

Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00%

The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99

Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings.

The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested.

Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company (definition refined in May). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. |

| Yields for September, 2011, to January, 2012, were calculated by imposing a cap of 10% on the yields of YLO issues held, in order to avoid their extremely high calculated yields distorting the calculation and to reflect the uncertainty in the marketplace that these yields will be realized. Commencing February, 2012, yields on these issues have been set to zero. |

Significant positions were held in DeemedRetractible and FixedReset issues on February 29; all of the former and most of the latter currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31. This presents another complication in the calculation of sustainable yield. The fund also holds a position in SplitShare issues (mainly BNA.PR.C) which also have their yields calculated with the expectation of a maturity at par.

The decline in the calculated sustainable yield is due to a significant shortening of term in the year to date, together with the elimination of expected dividends from the YLO issues – the recent run-up in the prices of longer-term issues has made it prudent to increase the investment in shorter-term, better-credit, lower-yielding FixedResets, although the weighting in this asset class remains well below index levels.

I will no longer show calculations that assume the conversion of the entire portfolio into PerpetualDiscounts, as there are currently only seven such issues of investment grade, from only three issuer groups. Additionally, the fund has now eliminated its holdings of these issues.

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.