TransCanada Corporation has announced:

that it has notified the registered shareholder of its Cumulative Redeemable First Preferred Shares, Series 1 (Series 1 Shares) of the Conversion Privilege and Dividend Rate Notice.

Beginning on December 1, 2014 and ending on December 16, 2014, holders of the Series 1 Shares will have the right to choose one of the following options with regard to their shares:

1.To retain any or all of their Series 1 Shares and continue to receive a fixed quarterly dividend; or

2.To convert, on a one-for-one basis, any or all of their Series 1 Shares into Cumulative Redeemable First Preferred Shares, Series 2 (Series 2 Shares) of TransCanada and receive a floating quarterly dividend.

Holders of the Series 1 Shares and the Series 2 Shares will have the opportunity to convert their shares again on December 31, 2019, and every five years thereafter as long as the shares remain outstanding.

Effective December 1, 2014, the Annual Fixed Dividend Rate for the Series 1 shares was set for the next five year period at 3.266 per cent.

Effective December 1, 2014, the Floating Quarterly Dividend for the Series 2 Shares was set for the first Quarterly Floating Rate Period (being the period from and including December 31, 2014, to but excluding March 31, 2015) at 2.815 per cent. The Floating Quarterly Dividend Rate will be reset every quarter.

The Series 1 Shares are issued in “book entry only” form and, as such, the sole registered holder of the Series 1 Shares is the Canadian Depositary for Securities Limited (CDS). All rights of beneficial holders of Series 1 Shares must be exercised through CDS or the CDS participant through which the Series 1 Shares are held. The deadline for the registered shareholder to provide notice of exercise of the right to convert Series 1 Shares into Series 2 Shares is 5 p.m. (ET) on December 16, 2014. Any notices received after this deadline will not be valid. As such, holders of Series 1 Shares who wish to exercise their right to convert their shares should contact their broker or other intermediary for more information and it is recommended that this be done well in advance of the deadline in order to provide the broker or other intermediary with time to complete the necessary steps.

For more information on the terms of, and risks associated with an investment in, the Series 1 Shares and the Series 2 Shares, please see the Corporation’s prospectus supplement dated September 22, 2009 which can be found under the Corporation’s profile on SEDAR at www.sedar.com.

TRP.PR.A is a FixedReset, 4.60%+192, which closed 2009-9-30 after being announced 2009-9-22.

From 4.60% coupon to 3.266% is a big hit – a 29% reduction. And it’s a big issue – $550-million par value. I anticipate a lot of highly unhappy brokerage customers who may, as has been speculated previously, be overselling the issue so they don’t have to see any reduced dividends.

The new rate of 3.266% implies that the GOC-5 rate at time of measurement was 1.346%, which sounds about right according to what I saw yesterday (the BoC says yesterday’s close was 1.38%), but it is most interesting to note that CBID says today’s close 1.45%. Conspiracy theories regarding manipulation of the GOC-5 rate on a day when three issues reset may be recorded in the comments.

Prices for the TRP issues are very strange: consider that TRP.PR.A, bid at 21.15, is priced lower than TRP.PR.C, which is a FixedReset, 4.40%+154, resetting 2016-1-30, bid at 21.77. One can only suppose that the market expects some dramatic changes in the five year Canada yield over the next year! Implied Volatility analysis – which assumes, among many other things, that GOC-5 will not change, ever – suggests that TRP.PR.A is now $1.44 cheap while TRP.PR.C is $1.73 expensive (both relative only to other TRP FixedResets, not to anything else). Well … place yer bets, gennelmen, place yer bets!

So, the perennial question was most recently asked by Assiduous Reader janbjarne and will be highlighted because of the flattering introduction:

Thank you for the very informative Prefblog and PrefLetter.

Your comments on how underpriced TRP.PR.A appears are interesting. Any thoughts on the pending conversion? A few months ago I thought that converting to the floater was a no-brainer. Now I am not so sure as both the TD.PR.Y/Z and the DC.PR.B/D pairs are trading at the same price.

Well, I’m not sure either! If you want absolute certainty, ask a stockbroker! Just don’t be so rude as to remind him of his prediction later!

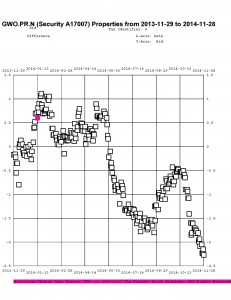

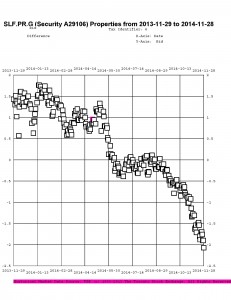

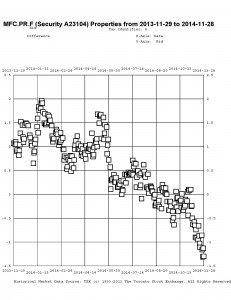

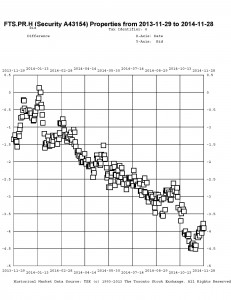

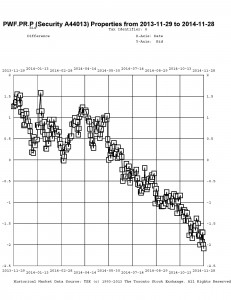

We can make an informed guess, though, using the Pair Equivalency Calculator which is explained in the article Preferred Pairs. We can examine all the currently trading FixedReset / FloatingReset pairs and determine the break-even average three-month bill rate for each pair:

Click for Big

Click for BigThere’s a fair bit of scatter, but the average for investment grade is 1.70% … that is, for each member of each pair to have an identical total return over the period until the next Exchange Date, the average bill rate until that date must be X, and the average of the Xs calculated for each pair is 1.70%, implying (assuming a steady increase in yields) a rate on the end date of 2.55%.

If we then reverse the calculation, the predicted price for the TRP FloatingReset is, given a bid of 21.15 for TRP.PR.A and an average bill rate of 1.70%, equal to 21.53: that is to say, we predict an immediate profit of $0.38 to result from conversion.

Even if we say that the average bill rate will be 1.54%, the lowest of the estimates, the predicted price of the FloatingReset should be 21.36, a profit of $0.21 … no great shakes, but it does indicate that the expectations of at least not losing are reasonably well-founded.

It should be remembered, though, that things can change dramatically in the course of even just a few weeks. The DC.PR.B / DC.PR.D conversion was a missed opportunity, because the break-even rate observed in the market changed dramatically between the date at which the estimate was made and the date the newly issued FloatingReset commenced trading..

Instructions are required by the company by December 16. I suggest holders first check with their broker to see what their broker’s deadline is (it’s usually a day or two earlier) and wait until the last minute before repeating the calculation and making up their mind. But at this point, it looks as if conversion to FloatingReset is the better bet.