David Dodge made an interesting speech in London, England. Of most immediate interest was his hawkish monetary stance:

I want to be absolutely clear on one point: The actions that we took to provide liquidity to support the smooth operation of financial markets did not in any way signal a change in our monetary policy. In fact, it was a step in maintaining our monetary policy stance by keeping our target for the overnight rate at 4 1/2 per cent, which we judged appropriate for keeping inflation on target over the medium term.

… but the theme of the speech was transparency:

In this complex process, transparency about the underlying credit was often lost. Because the originators of the loans intended to securitize them rather than leaving them on their balance sheets, they lacked the incentives to carefully assess the creditworthiness of the borrower. And investors often lacked the ability, or did not make the effort, to see through the complexity of the instrument. Thus, investors were unaware of the creditworthiness of the root asset and the potential difficulties with the liquidity of the instrument itself. Compounding the problems was the fact that the models upon which these structured products were valued assumed that they could be readily traded in a liquid market.

So far so good – especially the bit about liquidity. Liquidity killed portfolio insurance in 1987, but people never learn!

Moreover, the complexity and lack of transparency in many of the structured products added to the market dislocations. It was extremely difficult for investors to peel back the layers of these securities and derivatives to determine, with confidence, both the creditworthiness of the assets backing a particular security and the market value of the security itself. Even supposedly sophisticated investors became extremely uncertain and that, in turn, led to fear.

So far, so good. But now he skates over to an unrelated point:

In my view, there is a clear case for transparency more generally in the operation of all financial markets. In most countries there are fairly clear rules requiring transparency in the operation of mutual funds, so investors can tell what they are purchasing. Hedge funds, by their nature, are less transparent. But there is also, I believe, a clear case for increased transparency, at least with respect to their objectives, operating procedures, and governance.

…

Let me now say just a few words about the importance of transparency in government-sponsored institutions, whether domestic or international. I will begin with a few words about sovereign wealth funds, which control increasingly large amounts of money and are significant global financial forces. Some of these funds, such as the public pension funds in Canada, already adhere to very high standards of transparency. But in other cases, there is often insufficient transparency in the operation of these funds. Too often, the objectives behind these funds are not clearly defined, and this can lead to misconceptions about their motives, particularly those that have their origins in foreign exchange reserves. As is the case with private pools of capital, high standards of transparency for reporting and governance, as well as objectives, would be helpful for these public pools of capital.

So he begins with the idea that maybe it would be a good idea if PMs had some vague idea about what they’re buying … and ends with a desire to poke his nose into sovereign wealth funds? Mark my words … something’s up. We’re not being set up for the Bank of Canada to form the nucleus of a national securities regulator, are we? And not even Harper & Flaherty would politicize the Bank of Canada by influencing Dodge to help advance a political agenda?

Be afraid. Be very afraid.

The recession probability continues to be debated – with some amusing 1998 headlines:

- Market Watch: Bracing For Mortgage Losses

- Despite Late Rally, Dow Ends A Bad Week Lower

- Shift To Capital Markets From Banks Brings Tumult

- Crisis Goes Beyond The Balance Sheet

- Banks Tighten Some Loan Terms

- Commercial-Mortgage Issuers Are Locked In A Deep Freeze

- Recession Fears Dominate

- Market Turmoil Hits Luxury Home Sales

- Heavy Spenders Take A Break

- Decade of Moral Hazard

- Emerging-Market Investors Get Full-Fledged Drubbing

… which goes to show two things:

- Plus ça change, plus c’est la même chose

- You can always count on newspapers and markets to get extremely excited about things.

The laissez-faire approach of the Bank of England has been compared to the more activist approach of the Fed:

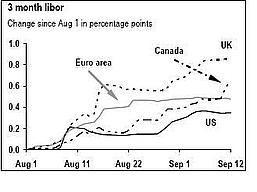

The change in LIBOR is going to hurt bank profits, but the BoE is hanging tough:

“The provision of such liquidity support undermines the efficient pricing of risk by providing ex-post insurance for risky behavior,” King said today in written testimony to the U.K. Parliament’s Treasury Committee. “That encourages excessive risk-taking, and sows the seeds of a future financial crisis.”

Brad Setser has discussed Bernanke’s assertion that a savings glut will continue to keep interest rates low. He largely agrees, but puts more weight on official flows.

US Equities were flattish:

Analysts expect third-quarter earnings at S&P 500 companies to grow by 3.7 percent, down from an average estimate of 5.2 percent at the start of August, according to data compiled by Bloomberg. Growth at that rate would snap a streak of 20 straight quarters above 10 percent.

… but Canadian equities looked forward to higher oil prices.

Treasuries were off slightly and Canadas were downright boring.

Volume was fairly light in the preferred market, but Scotia pulled off a good sized cross. I was surprised to see that BAM.PR.M / BAM.PR.N did not exhibit ridiculous behavior on their ex-date … wow! Normal behavior from this pair!

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.91% | 4.86% | 1,595,114 | 15.58 | 1 | +0.0000% | 1,043.7 |

| Fixed-Floater | 4.84% | 4.75% | 104,999 | 15.85 | 8 | +0.2000% | 1,033.6 |

| Floater | 4.47% | 3.26% | 87,276 | 10.83 | 4 | -0.0315% | 1,047.3 |

| Op. Retract | 4.83% | 3.80% | 76,378 | 3.02 | 15 | +0.1078% | 1,030.0 |

| Split-Share | 5.12% | 4.70% | 98,760 | 3.68 | 15 | -0.1132% | 1,048.6 |

| Interest Bearing | 6.29% | 6.85% | 64,386 | 4.54 | 3 | -0.2381% | 1,031.6 |

| Perpetual-Premium | 5.47% | 4.99% | 90,660 | 5.72 | 24 | -0.0017% | 1,032.3 |

| Perpetual-Discount | 5.05% | 5.08% | 258,060 | 15.36 | 38 | +0.0679% | 985.8 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| LFE.PR.A | SplitShare | -1.1184% | About time this thing lost some money – it yields well below the SplitShare index average. Now with a pre-tax bid-YTW of 3.99% based on a bid of 10.61 and a hardMaturity 2012-12-1 at 10.00. |

| RY.PR.B | PerpetualDiscount | +1.0829% | Now with a pre-tax bid-YTW of 4.87% based on a bid of 24.27 and a limitMaturity. |

| HSB.PR.D | PerpetualPremium | +1.1219% | Now with a pre-tax bid-YTW of 4.89% based on a bid of 25.15 and a call 2015-1-30 at 25.00. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| BMO.PR.J | PerpetualDiscount | 160,325 | Scotia crossed 150,000 at 22.85. Now with a pre-tax bid-YTW of 4.97% based on a bid of 22.80 and a limitMaturity. |

| MFC.PR.A | OpRet | 58,255 | Now with a pre-tax bid-YTW of 3.73% based on a bid of 25.66 and a softMaturity 2015-12-18 at 25.00. |

| CM.PR.H | PerpetualDiscount | 23,000 | Now with a pre-tax bid-YTW of 5.08% based on a bid of 23.90 and a limitMaturity. |

| RY.PR.G | PerpetualDiscount | 21,725 | Now with a pre-tax bid-YTW of 4.94% based on a bid of 22.95 and a limitMaturity. |

| CM.PR.I | PerpetualDiscount | 20,100 | Now with a pre-tax bid-YTW of 4.99% based on a bid of 23.84 and a limitMaturity. |

There were eight other $25-equivalent index-included issues trading over 10,000 shares today.