The SEC has announced that it:

today issued a report cautioning credit rating agencies about deceptive ratings conduct and the importance of sufficient internal controls over the policies, procedures, and methodologies the firms use to determine credit ratings.

The SEC’s Report of Investigation stems from an Enforcement Division inquiry into whether Moody’s Investors Service, Inc. (MIS) — the credit rating business segment of Moody’s Corporation — violated the registration provisions or the antifraud provisions of the federal securities laws.

…

According to the Report, an MIS analyst discovered in early 2007 that a computer coding error had upwardly impacted by 1.5 to 3.5 notches the model output used to determine MIS credit ratings for certain constant proportion debt obligation notes. Nevertheless, shortly thereafter during a meeting in Europe, an MIS rating committee voted against taking responsive rating action, in part because of concerns that doing so would negatively impact MIS’s business reputation.MIS applied in June 2007 to be registered with the Commission as an NRSRO. The Report notes that the European rating committee’s self-serving consideration of non-credit related factors in support of the decision to maintain the credit ratings constituted conduct that was contrary to the MIS procedures used to determine credit ratings as described in the MIS application to the SEC.

Was this a Very Bad Thing by Moody’s? Yes.

Does Moody’s deserve to lose some credibility over this? Yes.

Should this be any of the SEC’s business? Ummm … that part’s not so clear. However, I eagerly anticipate an immense volume of paper out of the brokerages once their salesmen analysts start making the same kind of disclosure … on stuff they actually made a buy/sell recommendation about.

JP Morgan is closing their energy prop desk:

JPMorgan Chase & Co., the second- largest U.S. lender by assets, told traders who bet on commodities for the firm’s account that their unit will be closed as the company begins to shut down all its proprietary trading, according to a person briefed on the matter.

The bank eventually will end all proprietary trading to comply with new curbs on investment banks, said the person, who asked not to be identified because JPMorgan’s decision isn’t public. The New York-based bank will shut proprietary trading in fixed-income and equities later, the person said.

At the very least, the exercise will give us some data on the importance of dealer risk capital to the market – although how you can sort out prop strategies from regular market making remains something of a mystery to me. Maybe they just change the name.

The FDIC has released its 2Q10 Quarterly Banking Profile, with headlines:

- Quarterly Earnings Are Highest in Almost Three Years

- Reduced Loan-Loss Provisions Boost Net Income

- Margins Improve at a Majority of Banks

- Noninterest Income Is Lower

- Charge-Offs Fall for First Time Since 2006

- Noncurrent Loans Post First Decline in More than Four Years

- Reserves Fall as Large Banks Reduce Loan-Loss Provisions

- Rising Securities Values Contribute to Equity Capital Growth

- Loan Balances Continue to Decline

- Banks Reduce Nondeposit Funding

- No New Charters Were Added During the Quarter

EWT LLP writes a highly informative comment letter on market microstructure:

Based upon our vantage point on that day, taken in combination with our years of experience in various markets throughout the world and their handling of unexpected volatility and erroneous transactions,1 we respectfully offer our observations on both these events and some related recommendations. In so doing, we have focused on the following four key areas:

- Inaccurate NBBO feeds. Market center trading system problems (e.g., severely lagged and discontinuous market data) revealed single points-offailure in the market infrastructure. In particular, as illustrated below, the poor performance of National Best Bid or Offer (“NBBO”) feeds was a significant contributor to the aberrant events of that day. In our view, these feeds could be improved significantly through investment in available technology.

- Inconsistent and Ambiguous Market Center Practices. While they may be well-intentioned, certain inconsistent market center practices (e.g., Liquidity Replenishment Points or “LRPs”) and ambiguous rules regarding potentially erroneous transactions fragmented and curtailed liquidity provision on May 6 by increasing uncertainty under extreme market conditions. Replacing these practices and rules with uniform, industry-wide rules establishing limits on upward and downward price movement in a given period of time (i.e., a limitup/limit-down approach) and consistent rules for canceling erroneous transactions would accomplish the same objectives with fewer unintended consequences.

- Market Orders. “Market” and “stop” orders likely steepened the market decline on May 6 by intensifying selling pressure. A limit-up/limit-down approach would address this issue by providing a de facto collar on market orders. In the absence of a limit-up/limit-down approach, we recommend that customer market orders be collared or converted to limit orders by their brokers prior to submission to a trading center and that broker-dealers be required to specify a limit price on all orders.

- Concentrations of Liquidity Risk. Reliance on a small subset of firms or systems to provide or control liquidity as a result of exchange-specific incentive programs left the National Market System vulnerable on May 6 to failures by single firms or systems. To address these issues, the Commission should set uniform standards for market making, and require that all exchange-based market maker incentive programs be non-exclusionary and open to all who qualify.

I’m still upset about police actions during the G-20 meeting. So are some others, but there are few who really couldn’t care less, one way or another:

The largest mass arrest of Canadians in history and the Grits primary concern is that the cops were overwhelmed.

…

At a wintry moment in the history of Canadian civil rights, the Liberal Party is AWOL.

We are poorly served by our politicians of all stripes. Still, with the pseudo-opposition being led by Torture Boy, I suppose we should be grateful nothing worse than vindictive time-wasting seems to have occurred. This time.

The Canadian preferred share market closed the month with another good day on elevated volume, with PerpetualDiscounts up 19bp and FixedResets winning 9bp.

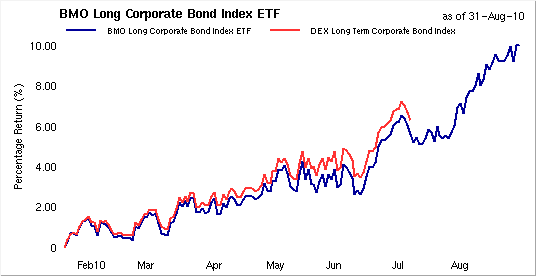

PerpetualDiscount now yield 5.69%, equivalent to 7.97% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.1% (!) 5.3%, so the pre-tax interest-equivalent spread is now about 285bp 265bp, a significant increase decrease from the 275bp reported on August 25 and the 275bp reported July 30. For another month, it’s simply a case of the preferred share market showing more inertia than the red-hot corporate bond market!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0933 % | 2,036.5 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0933 % | 3,085.0 |

| Floater | 2.57 % | 2.17 % | 34,665 | 21.91 | 4 | -0.0933 % | 2,198.9 |

| OpRet | 4.90 % | 3.67 % | 95,030 | 0.25 | 9 | 0.0258 % | 2,351.8 |

| SplitShare | 6.09 % | -24.87 % | 65,495 | 0.09 | 2 | 0.2316 % | 2,310.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0258 % | 2,150.5 |

| Perpetual-Premium | 5.76 % | 5.33 % | 94,668 | 5.62 | 7 | 0.2135 % | 1,969.7 |

| Perpetual-Discount | 5.70 % | 5.69 % | 188,664 | 14.17 | 71 | 0.1927 % | 1,907.1 |

| FixedReset | 5.27 % | 3.16 % | 270,638 | 3.35 | 47 | 0.0937 % | 2,253.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.C | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-31 Maturity Price : 18.12 Evaluated at bid price : 18.12 Bid-YTW : 6.23 % |

| CL.PR.B | Perpetual-Premium | 1.05 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-09-30 Maturity Price : 25.25 Evaluated at bid price : 25.76 Bid-YTW : -22.92 % |

| CM.PR.J | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-31 Maturity Price : 20.55 Evaluated at bid price : 20.55 Bid-YTW : 5.54 % |

| IAG.PR.C | FixedReset | 1.69 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.15 Bid-YTW : 3.38 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.W | Perpetual-Discount | 84,440 | Desjardins bought 19,100 from National at 22.63 and crossed 20,000 at the same price. RBC crossed 20,000 at 22.65. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-31 Maturity Price : 22.53 Evaluated at bid price : 22.72 Bid-YTW : 5.42 % |

| BNS.PR.R | FixedReset | 66,111 | RBC crossed 10,300 at 26.70; Desjardins crossed 16,000 at the same price. RBC bought 10,100 from CIBC at the same price again. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-25 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 3.07 % |

| TD.PR.S | FixedReset | 57,425 | Desjardins crossed two blocks o 25,000 each at 26.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.31 Bid-YTW : 3.21 % |

| RY.PR.Y | FixedReset | 49,555 | TD sold 25,000 to anonymous at 28.16. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 28.05 Bid-YTW : 3.11 % |

| TRP.PR.B | FixedReset | 46,940 | RBC crossed 24,300 at 24.88. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-31 Maturity Price : 24.83 Evaluated at bid price : 24.88 Bid-YTW : 3.50 % |

| MFC.PR.D | FixedReset | 46,209 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 26.46 Bid-YTW : 4.88 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

[…] spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the month at 265bp, a significant decline from the 275bp recorded at July month-end. Long corporate yields […]

[…] as the Seniority Spread) ended the month at 235bp, a significant decline from the 265bp reported at August month-end. Long corporate yields declined to 5.2% from 5.3% during the period while PerpetualDiscounts had a […]