I use the term “McDonald CoCo” to describe a hybrid security that is initially debt-like coverts into equity when the issuer’s common equity price declines below a preset floor. The conversion is performed at the equity trigger price.

I will note immodestly that, were there any justice in the world, they would be called Hymas CoCos, since I published first, but there ain’t no justice and McDonald has the union card.

Anyway, Andrew G Haldane, Executive Director of the Bank of England, has published remarks based on a speech given at the American Economic Association, Denver, Colorado, 9 January 2011:

For large and complex banks, the number of risk categories has exploded. To illustrate, consider the position of a large, representative bank using an advanced internal set of models to calibrate capital. Its number of risk buckets has increased from around seven under Basel I to, on a conservative estimate, over 200,000 under Basel II. To determine the regulatory capital ratio of this bank, the number of calculations has risen from single figures to over 200 million. The quant and the computer have displaced the clerk and the envelope.

At one level, this is technical progress; it is the appliance of science to risk management. But there are costs. Given such complexity, it has become increasingly difficult for regulators and market participants to vouch for the accuracy of reported capital ratios. They are no longer easily verifiable or transparent. They are as much an article of faith as fact, as much art as science. This weakens both Pillars II and III. For what the market cannot observe, it is unlikely to be able to exercise discipline over. And what the regulator cannot verify, it is unlikely to be able to exercise supervision over. Banks themselves have recently begun to voice just such concerns.

… and complexity is Bad:

This evidence only provides a glimpse at the potential model error problem viewed from three different angles. Yet it suggests that model error-based confidence intervals around reported capital ratios might run to several percentage points. For a bank, that is the difference between life and death. The shift to advanced models for calibrating economic capital has not arrested this trend. More likely, it has intensified it. The quest for precision may have come at the expense of robustness.

Hayek titled his 1974 Nobel address “The Pretence of Knowledge”. In it, he highlighted the pitfalls of seeking precisely measurable answers to questions about the dynamics of complex systems. Subsequent research on complex systems has confirmed Hayek’s hunch. Policy predicated on over-precision risks catastrophic error. Complexity in risk models may have perpetuated Hayek’s pretence in the minds of risk managers and regulators.

Like, for instance, in the run-up to the height of the crisis:

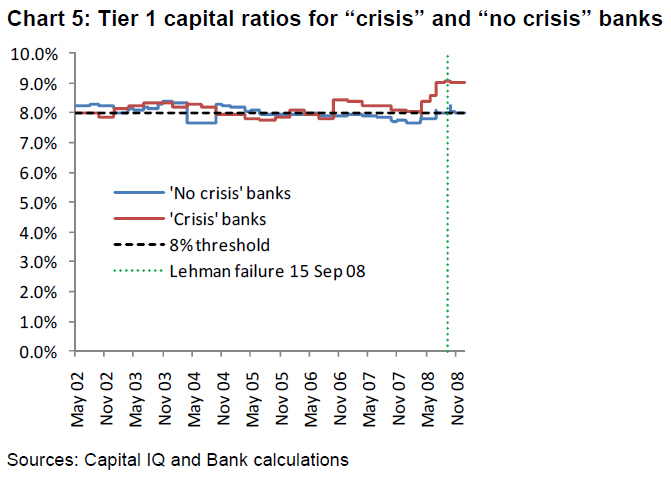

To see that, consider the experience of a panel of 33 large international banks during the crisis. This panel conveniently partitions itself into banks subject to government intervention in the form of capital or guarantees (“crisis banks”)

and those free from such intervention (“no crisis banks”).Chart 5 plots the reported Tier 1 capital ratio of these two sets of banks in the run-up to the Lehman Brothers crisis in September 2008. Two observations are striking. First, the reported capital ratios of the two sets of banks are largely indistinguishable. If anything, the crisis banks looked slightly stronger pre-crisis on regulatory solvency measures. Second, regulatory capital ratios offer, on average, little if any advance warning of impending problems. These conclusions are essentially unchanged using the Basel III definitions of capital.

Got any better ideas?

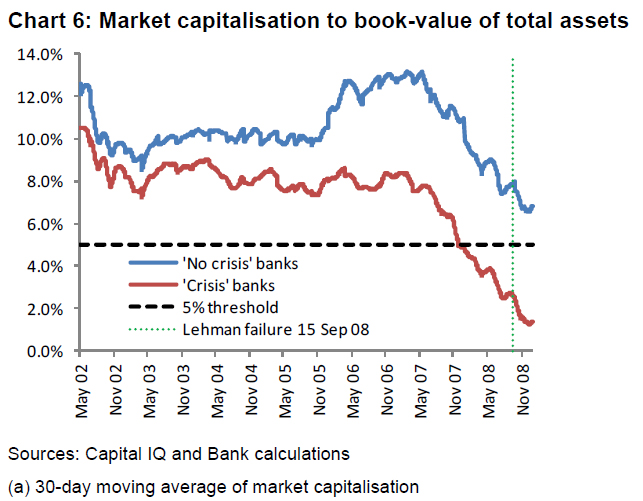

What could be done to strengthen the framework? As a thought experiment, consider dropping risk models and instead relying on the market. Market-based metrics of bank solvency could be based around the market rather than book value of capital. The market prices of banks are known to offer useful supplementary information to that collected by supervisors when assessing bank health.8 And there is also evidence they can offer reliable advance warnings of bank distress

To bring these thoughts to life, consider three possible alternative bank solvency ratios based on market rather than accounting measures of capital:

- Market-based capital ratio: the ratio of a bank’s market capitalisation to its total assets.

- Market-based leverage ratio: the ratio of a bank’s market capitalisation to its total debt.

- Tobin’s Q: the ratio of the market value of a bank’s equity to its book value.

The first two are essentially market-based variants of regulatory capital measures, the third a well-known corporate valuation metric. How do they fare against the first principles of complex, adaptive systems?

Having set the stage, he starts talking about CoCos:

Alongside equity, banks would be required to issue a set of contingent convertible instruments – so-called “CoCos”. These instruments have attracted quite a bit of attention recently among academics, policymakers and bankers, though there remains uncertainty about their design. In particular, consider CoCos with the following possible design

characteristics.

- Triggers are based on market-based measures of solvency, as in Charts 6–8.

- These triggers are graduated, stretching up banks’ capital structure.

- On triggering, these claims convert from debt into equity.

Although novel in some respects, CoCos with these characteristics would be simple to understand. They would be easy to monitor in real time by regulators and investors. And they would alter potentially quite radically incentives, and thus market dynamics, ahead of banking stress becoming too acute.

He points out:

CoCos buttress market discipline and help lift the authorities from the horns of the timeconsistency dilemma. They augment regulatory discretion at the point of distress with contractual rules well ahead of distress. Capital replenishment is contractual and automatic; it is written and priced ex-ante and delivered without temptation ex-post. Because intervention would be prompt, transparent and rule-based, the scope for regulatory discretion would be constrained. For that reason, the time-consistency problem ought to be reduced, perhaps materially. A contractual belt is added to the resolution braces.

These are the most important things. As investors, we want as much certainty as possible. Contractual conversion with a preset trigger and conversion factor removes the layer of regulatory uncertainty that bedevils most other approaches.

He highlights one concern that has been of interest to the Fed, and which seems to be the thing that industry professionals focus on when I discuss this with them:

If such a structure is for the best in most states of the world, why does it not already exist? At least two legitimate concerns have been raised. First, might market-based triggers invite speculative attack by short-sellers? The concern is that CoCo holders may be able to shortsell a bank’s equity to force conversion, then using the proceeds of a CoCo conversion to cover their short position.

There are several practical ways in which the contract design of CoCos could lean against these speculative incentives. Perhaps the simplest would be to base the conversion trigger on a weighted average of equity prices over some prior interval – say, 30 days. That would require short-sellers to fund their short positions for a longer period, at a commensurately greater cost. It would also create uncertainty about whether conversion would indeed occur, given the risk of prices bouncing back and the short-seller suffering a loss. Both would act as a speculative disincentive.

A second potential firewall against speculative attack could come from imposing restrictions on the ability of short-sellers to cover their positions with the proceeds of conversion.

I like the first solution and am particularly gratified that he chose essentially the same VWAP measurement period that I chose as a basis for discussion.

I don’t like the second firewall. Stock is stock is stock. Everybody knows you can’t cheat an honest man, right? Well, you can’t manipulate a healthy stock, either. Not on the scale of a 30-day VWAP, you can’t.

A related concern is that CoCos alter the seniority structure of banks’ capital, as holders of CoCos potentially suffer a loss ahead of equity-holders. But provided the price at which CoCos convert to equity is close to the market price, conversion does not transfer value between existing equity-holders and CoCo investors. And provided conversion is into equity it need not imply investor loss. If a market move really is unjustified, prices will correct over time towards fundamentals. The holder of a converted CoCo will then garner the upside.

I don’t understand this bit. As long as the trigger/conversion price is set well below the market price at CoCo issue time (I suggested that “half” was a good figure), then CoCos will retain significant first-loss protection.