Rumours swirled around Fannie and Freddie today, after a gloomy story in Barrons:

It is growing increasingly likely that the Treasury will recapitalize Fannie and Freddie in the months ahead on the taxpayer’s dime, availing itself of powers granted it under the new housing bill signed into law last month. Such a move almost certainly would wipe out existing holders of the agencies’ common stock, with preferred shareholders and even holders of the two entities’ $19 billion of subordinated debt also suffering losses.

Bloomberg’s rumours are more detailed:

Both Fannie and Freddie slid as much as 12 percent after Barron’s said government officials anticipate the companies will fail to raise the equity capital they need, prompting the U.S. Treasury to step in. Fannie is down 82 percent this year. Freddie has fallen 85 percent.

…

A rescue would include preferred stock with a seniority, dividend preference and convertibility right that would wipe out common stockholders, Barron’s reported, citing an unidentified source in the Bush administration. Treasury Secretary Henry Paulson, who received the authority he requested from Congress to help the companies, has said a bailout won’t be needed.

…

Standard & Poor’s cut Fannie and Freddie’s preferred stock and subordinated debt ratings by three levels last week to A- from AA-. S&P affirmed the companies’ AAA senior debt rating, reflecting perceived government support.

At the close, Accrued Interest made some good observations:

GSE securities of all types getting hit hard today. Interestingly, both the common and preferred shares are down ~20%. Sub debt some 200bps wider with poor liquidity.

…

The ultimate problem here is best described by Merrill Lynch’s Ken Bruce. You can dive into Freddie Mac or Fannie Mae’s balance sheet and make a good case that they don’t need new capital, at least under current forecasts for housing. You’d therefore conclude that if they were a truly private company, they’d best serve shareholders by trying to stick it out. But they aren’t a truly private company. As the perception of their capital strength wanes, policy makers are going to conclude that we are better off nationalizing the GSEs.

…

As for wiping out preferred shareholders… Remember that the big preferred shareholders are smaller banks. I don’t think it would make sense for the Administration to bolster one part of the banking system (Fannie and Freddie) at the expense of another part of the banking system (regional banks). And besides, I don’t think its necessary to protect tax-payers interests.

…

The trade is to be long senior Agency debt. There is just no way the Treasury allows anything to happen to senior debt holders. I don’t know who is playing in sub notes or preferred shares in here. No amount of investment analysis is going to help you figure what the Treasury’s next move is.

There was some discussion of the Fannie and Freddie prefs on August 8.

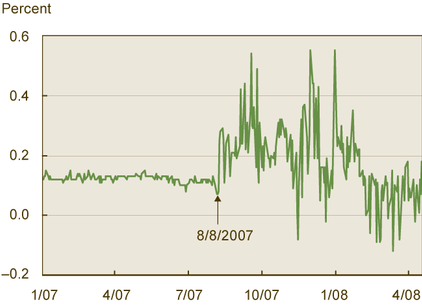

There was a great graph published by the Cleveland Fed in a discussion of the Student Loans Market:

Note: The spread is the three-month LIBOR rate minus the three-month financial commercial paper rate.

Sources: The Board of Governors of the Federal Reserve System; Financial Times.

The enormous volatility seems much more illustrative to me of the credit crunch than the more usual graphs of enormous spread increases:

Sunlife issues did very well today – it would appear that nobody noticed they went ex-Dividend today. PerpetualDiscounts had yet another up-day today, but the total return index is still a fraction under the June 30 value of 877.24. The fact that there has been a gain of almost exactly 8.75% since the July 16 nadir – with only one down-day in that period – should really rub it in about just how bad the first half of July was!

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 4.63% | 4.37% | 57,333 | 16.44 | 7 | -0.0803% | 1,106.2 |

| Floater | 4.07% | 4.10% | 46,155 | 17.15 | 3 | +0.1471% | 907.7 |

| Op. Retract | 4.98% | 4.45% | 112,445 | 3.06 | 17 | -0.0824% | 1,046.3 |

| Split-Share | 5.33% | 5.90% | 55,570 | 4.43 | 14 | -0.1441% | 1,040.5 |

| Interest Bearing | 6.18% | 6.51% | 48,553 | 5.26 | 2 | +0.1011% | 1,133.5 |

| Perpetual-Premium | 6.15% | 5.94% | 65,413 | 2.24 | 1 | +0.6337% | 994.0 |

| Perpetual-Discount | 6.07% | 6.12% | 197,523 | 13.55 | 70 | +0.2551% | 876.8 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BMO.PR.H | PerpetualDiscount | -1.1236% | Now with a pre-tax bid-YTW of 6.04% based on a bid of 22.00 and a limitMaturity. |

| BAM.PR.H | OpRet | -1.0000% | Now with a pre-tax bid-YTW of 6.35% based on a bid of 24.75 and a softMaturity 2012-3-30 at 25.00. Compare with BAM.PR.I (6.64% to 2013-12-30), BAM.PR.J (6.31% to 2018-3-30) and BAM.PR.O (7.33% to 2013-6-30). |

| SLF.PR.E | PerpetualDiscount | +1.0338% | Now with a pre-tax bid-YTW of 6.11% based on a bid of 18.41 and a limitMaturity. |

| IAG.PR.A | PerpetualDiscount | +1.1315% | Now with a pre-tax bid-YTW of 6.23% based on a bid of 18.77 and a limitMaturity. |

| SLF.PR.C | PerpetualDiscount | +1.1932% | Now with a pre-tax bid-YTW of 6.10% based on a bid of 18.22 and a limitMaturity. |

| ELF.PR.F | PerpetualDiscount | +1.2301% | Now with a pre-tax bid-YTW of 6.81% based on a bid of 19.75 and a limitMaturity. |

| MFC.PR.C | PerpetualDiscount | +1.3171% | Now with a pre-tax bid-YTW of 5.63% based on a bid of 20.00 and a limitMaturity. |

| SLF.PR.B | PerpetualDiscount | +1.3740% | Now with a pre-tax bid-YTW of 6.11% based on a bid of 19.62 and a limitMaturity. |

| ENB.PR.A | PerpetualDiscount | +1.7811% | Now with a pre-tax bid-YTW of 5.88% based on a bid of 23.43 and a limitMaturity. |

| CM.PR.P | PerpetualDiscount | +1.9277% | Now with a pre-tax bid-YTW of 6.58% based on a bid of 21.15 and a limitMaturity. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| SLF.PR.A | PerpetualDiscount | 81,620 | TD crossed 74,600 at 19.35. Now with a pre-tax bid-YTW of 6.12% based on a bid of 19.40 and a limitMaturity. |

| CM.PR.H | PerpetualDiscount | 34,460 | Now with a pre-tax bid-YTW of 6.61% based on a bid of 18.38 and a limitMaturity. |

| HSB.PR.D | PerpetualDiscount | 17,500 | Now with a pre-tax bid-YTW of 6.12% based on a bid of 20.78 and a limitMaturity. |

| BMO.PR.K | PerpetualDiscount | 16,750 | Now with a pre-tax bid-YTW of 6.08% based on a bid of 21.65 and a limitMaturity. |

| CM.PR.J | PerpetualDiscount | 15,850 | Now with a pre-tax bid-YTW of 6.48% based on a bid of 17.57 and a limitMaturity. |

There were seventeen other index-included $25-pv-equivalent issues trading over 10,000 shares today.